Not much has changed technically since we first looked at Enterprise Group Inc. (E:TSX.V) in June a couple of months ago. However, its technical condition has continued to improve steadily as it has moved towards completion of the bullish Ascending Triangle shown on its latest one-year chart, and its 200-day moving average has continued to catch up with the price.

The chart shows the picture of stock in a steady uptrend that has stopped for a rest from its February highs to allow its moving averages to catch up. Meanwhile, the fundamental circumstances of the company are improving dramatically with it swinging from loss to profit due in particular to the uniquely attractive and compelling services offered by its wholly owned subsidiary Evolution Power Projects Inc., which we will look at briefly lower down the page.

On the one-year chart, we can immediately see how Enterprise Group is continuing to march higher in a steady uptrend and only paused to consolidate when the broad market tanked in the Spring. It has been marking time for more than six months now since early February, which has allowed it to “recharge its batteries” for the next upleg that will probably be triggered by the next release of results which is expected soon, probably within the next several weeks.

Technically an upside breakout soon is suggested by the increasing bunching of the price and its bullishly aligned moving averages and the closing up of the bullish Ascending Triangle.

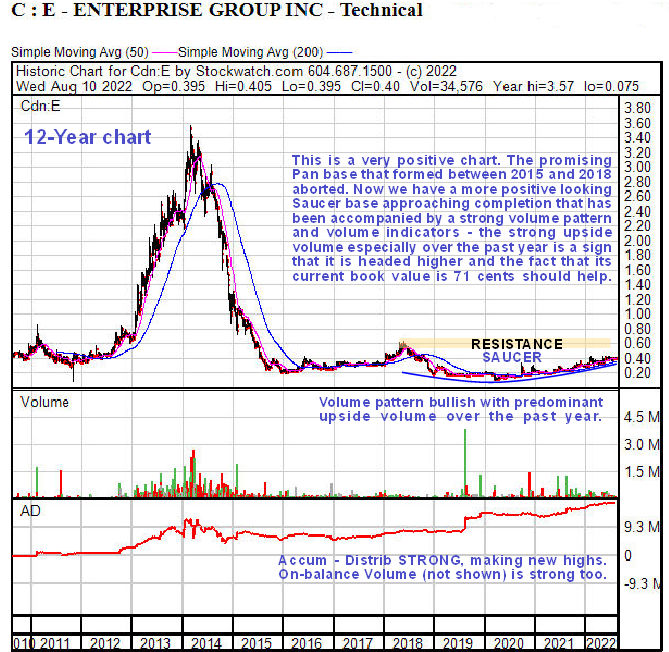

The 12-year chart, of course, looks much the same as when we first looked at it and is interesting because it shows that the price is slowly being shepherded towards a major breakout by a giant Saucer base pattern, and it is worth noting that with 47 million shares in issue, the price is not being held in restraint due to stock dilution and thus it could really take off once it succeeds in breaking out of this giant base.

The President of the company is understood to own 12 million shares, meaning that there are this many less shares in the float.

Now we come to the big reason that the company is doing so well fundamentally, not covered in the first article on it, which explains why the prospects for its stock are so bright.

One of the biggest headaches for oil and gas explorers in the northern wastes of Canada and elsewhere is trucking in vast quantities of diesel fuel, often over vast distances, to power on-site generators. This is becoming increasingly expensive and is definitely not “green” as the on-site generators create a lot of pollution and noise.

Enter Evolution Power Projects Inc. with its powerful generators that use Natural Gas. At a time when diesel has become much more expensive with possible problems of availability in the future, this has massive advantages for oil and gas explorers, for it is no longer necessary to truck in thousands of liters of diesel per day, as just one Evolution Power Projects’ unit has the ability to replace up to 15 diesel generators and in addition, the Natural Gas to power the Evolution Power Projects’ unit is often produced on-site as a consequence of the drilling, resulting in even greater savings.

Rentals of the units are apparently rocketing as the idea catches on, and the massive turnaround in the fortunes of Enterprise Group, largely it is thought as a result of the ballooning rentals of the Evolution Power Projects’ Natural Gas power generating units, is evident when we compare the Enterprise Group loss in 2021 to its sizeable earnings during the 1st quarter of this year.

Other positive factors that we should take into consideration include the fact that even at liquidation prices, the company’s assets, which are appraised twice a year, are worth CA$0.72 a share, which is much more than the current share price.

Also, a big LNG (Liquified Natural Gas) port facility is being built off the coast of British Columbia that should come in really handy for a considerable number of Enterprise Group’s customers.

It looks likely then that the improvement in Enterprise Groups' earnings will continue and become evident with the next set of results due to be posted soon, that are expected to generate an upside breakout, and we, therefore, stay long, and this is a good point to buy or add to positions.

Enterprise Group website.

Evolution Power Projects Inc. website

Enterprise Group Inc. closed at CA$0.395, $0.314 on August 10, 2022. The stock is rather thinly traded on the US OTC market, but volumes are expected to improve as the price breaks higher and advances.

Want to be the first to know about interesting Alternative Energy investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Enterprise Group Inc. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Enterprise Group Inc., a company mentioned in this article.