The Australian Securities Exchange (ASX)-listed provider of drone countermeasures, DroneShield Ltd. (DRO:ASX; DRSHF:OTC), recently received a US$500,000 contract from a U.S. government agency (which must remain confidential) for its anti-drone tech — and the company says it has already delivered the goods.

It is the second order by the high-profile U.S. agency and at least one analyst says this could mark the turning point in the company’s business model.

Sydney, Australia-based Peloton Capital Analyst Darren Odell says DroneShield is at “an inflection point” as it books sales with increasing frequency.

Odell has a Buy recommendation on Peloton with a 12-month target price of A$0.30, which would be about a 58% increase over the A$0.19 closing price in early August. He notes, however, that his target excludes 'material Middle East contracts' which have the potential to provide 'significant upside.'

So far this year the company, which listed on the ASX in 2016, has fulfilled orders from the U.S. Department of Defense, Department of Homeland Security, as well as federal and state level law enforcement agencies in the U.S. and other countries.

Odell expects 2022 revenue to be in the range of A$20-30 million (A$20-30M), mostly derived from the "five eyes" countries — Australia, Canada, New Zealand, United Kingdom and the U.S.

Another roughly A$230M remains in the sales pipeline, with about A$125M of that possibly going on the books this year, depending on how things go.

Year-to-date sales are around A$5M. Odell expects sales to rise exponentially in 2023 to at least A$170M.

In an April 8 research report, Odell wrote: “Its U.S. operations (through a wholly owned subsidiary based in Virginia near the Pentagon) are ramping-up following investment in its direct sales force, UK/Europe (impacted by COVID) is close to closure of deals through DRO’s long-standing partnerships (and) they are well positioned in their home market, Australia. Not surprisingly, governments worldwide, have become increasingly concerned about the growing risks from drones.”

CEO Oleg Vornik says despite being a relatively small company — DroneShield has a sub-US$80M market cap — DroneShield’s technology is high-margin and easily scalable to meet demand. There is currently about A$14M in inventory on hand.

Odell has a Buy recommendation on Peloton with a 12-month target price of A$0.30, which would be about a 58% increase over the A$0.19 closing price in early August.

He notes, however, that his target excludes "material Middle East contracts" which have the potential to provide "significant upside."

Meanwhile, Technical Analyst Clive Maund wrote in a May 8 post that DroneShield at A$0.25 was a “good point to buy or add to existing positions.”

Catalysts to Come

DroneShield has relationships with some big names.

It has worked with Oregon-based Teledyne FLIR. which makes advanced sensors and infrared technology, as well as French multinational Thales Group, which has roots in the aerospace industry and as a defence contractor.

"Thales is small in U.S. but it's very large in Europe and Australia. So we've been doing work them across defense, airport security and other things. We work with virtually all of the large defense firms to some extent," Vornik said.

Given that it has passed the trial phase, Vornik expects different U.S. government agencies to bulk up on its orders but suggests that considerable growth is also likely to come from high-profile events.

Earlier this year DroneShield teamed with law enforcement officials in Davos to keep drones from wreaking havoc at the World Economic Forum. And it played a similar role two months ago at IRONMAN Texas 2022, a noteworthy stop on the triathlon circuit.

The Olympics will be held in France in 2024 and Vornik expects to see DroneShield equipment deployed to help protect athletes and spectators alike. It's part of DroneShield's larger strategy of becoming an essential aspect of event security at stadiums and other venues to mitigate threats from things as benign as unlawful advertising to more serious problems like explosives and toxic gases carried by drones.

"Coming out of COVID, stadiums have been a slow market, but there is concern about stadiums being targets of terrorist attacks and drones, and disrupting games. There have been cases of people flying team flags right across the field in the middle of an active game. And that's an issue for stadium security or the people filming games, possibly even infringing upon broadcasting rights," Vornik told Streetwise Reports.

Other paths for growth include prisons where drones are increasingly used to deliver weapons, drugs, and other contraband to inmates, and at airports where small drones pose a considerable risk to commercial aircraft.

More than 40 Engineers

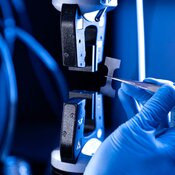

DroneShield, through its 40 or so engineers on staff, combines the power of radio frequency technology, with unique sensors, radar, and artificial intelligence software to provide a range of electronic warfare technology — with a focus on the estimated US$10B counter-drone market.

The company recently gained profile when the U.S. military said it had used DroneShield tech as a key part of its arsenal to bring down more than 30,000 drones along the border with Mexico. The drones are used by both drug traffickers and human smugglers to monitor law enforcement activity on the U.S. side of the border wall.

In Ukraine, DroneShield technology is being used to help protect Ukrainian soldiers from Russian reconnaissance drones that can pinpoint positions and direct an artillery strike.

The technology works by pointing a proprietary device such as the DroneGun Tactical — which looks like a futuristic weapon that one might find in Grand Theft Auto — at the drone and severing the connection between the drone and its remote control. The DroneShield operator then seizes control of the drone so that it can be safely landed and properly investigated by law enforcement.

That works well for line-of-sight drones up to about 3 kilometers (2.2 miles) away but DroneShield can also provide a sensor and radar array employing artificial intelligence to detect drones at night and jam their radio frequencies.

The company’s most basic drone countermeasure will set you back about US$50,000, while the high-end equipment can exceed US$1.5M. Sales to private individuals remains prohibited.

Grant Granted

DroneShield recently received a A$1.9M research and development grant from the Australian government for its R&D work in 2021. It is the largest grant the company has received to date (the company received another A$500,000 grant earlier this year). It's basically an incentive for the company to do its R&D in Australia.

The company says the A$1.9M will be reflected in the cash receipts for the 2022 third quarter.

DroneShield also won the award for outstanding international success in the field of information technology (IT), digital technologies, software, hardware, or digital services at Australia’s 59th Annual Export Awards.

DroneShield has no debt and around A$5.5 million in the treasury. Of the roughly 460 million shares outstanding, more than half of its issued shares are free-floating.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Brian Sylvester wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Peloton Capital Pty Ltd., DroneShield Ltd., April 27, 2022

Peloton does and seeks to do business with companies covered in research. As a result, investors should be aware that the firm may have a conflict of interest which it seeks to manage and disclose.

Peloton and its directors, officers and employees or clients may have or had interests in the financial products referred to in this report and may make purchases or sales in those the financial products as principal or agent at any time and may affect transactions which may not be consistent with the opinions, conclusions or recommendations set out in this report. Peloton and its Associates may earn brokerage, fees or other benefits from financial products referred to in this report. Furthermore, Peloton may have or have had a relationship with or may provide or has provided, capital markets and/or other financial services to the relevant issuer or holder of those financial products.

Specific Disclosure: Peloton Capital raised $17m for DroneShield (DRO), announced September 2020, for which it earned fees.

Specific Disclosure: The analyst does hold securities in DRO.

Specific Disclosure: The report has been reviewed by DRO for factual accuracy.

Specific Disclosure: As of 27th April 2022, Peloton Capital held nominal DRO shares and 15m call options. This position may change at any time and without notice, including on the day that this report has been released. Peloton and its employees may from time-to-time own shares in DRO and trade them in ways different from those discussed in research. Peloton Capital may arrange the buying and selling securities on behalf of clients.