The debt market has been perilously close to locking up in recent months which would quickly lead to the entire financial system freezing and banks slamming their doors and ATMs not working, etc. This is the reason for the heavy selloff across markets that has also affected commodities and driven the dollar higher.

So Friday’s announcement that the European Central Bank (ECB) is to engage in “unlimited bond buying” to stabilize the debt market was a major positive development for markets because other Central Banks, including and especially the Fed, are expected to follow suit which will get markets “off the hook” over the short to medium-term.

However, this action will only buy time because the debt monster is now so big that the quantities of money required to feed it are gargantuan and because this requirement has grown exponentially it has now gone vertical, which means that we are at the end of the end of the endgame, so after this final spectacular blowoff that will lead to hyperinflation, credit markets will fly apart anyway as this latest fiat experiment comes crashing down into a smoldering heap of ruins. It’s at this point that they will roll out their new digital money system, which will involve a Chinese-style social credit score system and digital passport, etc., and if you don’t obey their rules, such as being fully “vaccinated” you will be shut out of it.

This will be the means by which they force compliance with their system so that they can achieve their population reduction and control objectives. With money creation now rising vertically to feed the beast and stop the system from locking up, we may be only months away from this happening, and it should be kept in mind that this is not accidental—it is all happening by design.

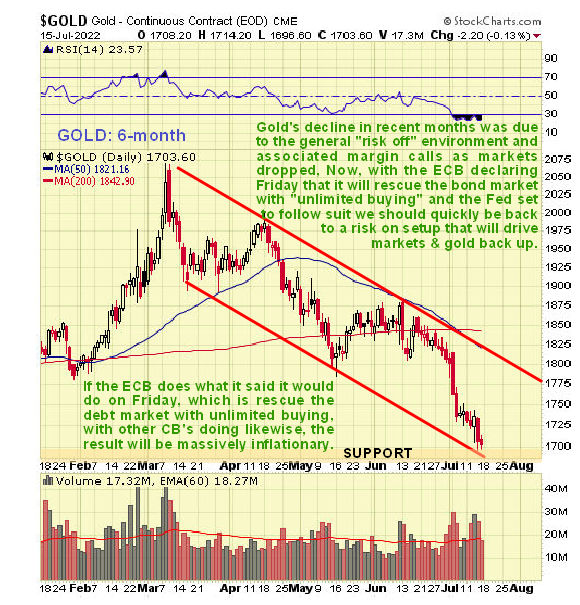

Given how inflation has been ballooning in the recent past it is surprising how much gold has fallen in recent weeks as we can see on its latest six-month chart, but this has been largely due to the prevailing risk-off environment and associated margin calls.

However, the ECB's Friday announcement should result in a swift reversal in sentiment leading to a rally, and as we can see on the chart, it is well placed to rally, having arrived at the lower boundary of its intermediate downtrend channel in an oversold state.

Gold’s three-year chart makes two important points clear. One is that, because gold’s recent downtrend has brought it down to strong support approaching the lower boundary of the large rectangular trading range that has formed since the August 2020 peak, there is a higher likelihood of it reversing to the upside here.

The other is that, because it has not broken down from this trading range, it is not in a bear market, and if we move towards hyperinflation this large range could turn out to be a consolidation pattern in an ongoing bull market. Additionally, we can see that it is heavily oversold on its MACD indicator, so this is a good point for it to turn higher.

On gold’s long-term 15-year chart we can see that the rectangular trading range that has formed from mid-2020 could be either a consolidation pattern or a top. What happened in Friday's chart promises a rally from support at the lower boundary of the range at least to the top of it.

However, the support at the bottom of this range must hold, if it later fails as a result of a general market crash occasioned by a severe credit crisis, then gold would probably plunge along with everything else, however, the risk of this has been reduced for now by imminent renewed Central Bank intervention. If the Central Banks now pump in the direction of hyperinflation then gold should fly off the top of this chart.

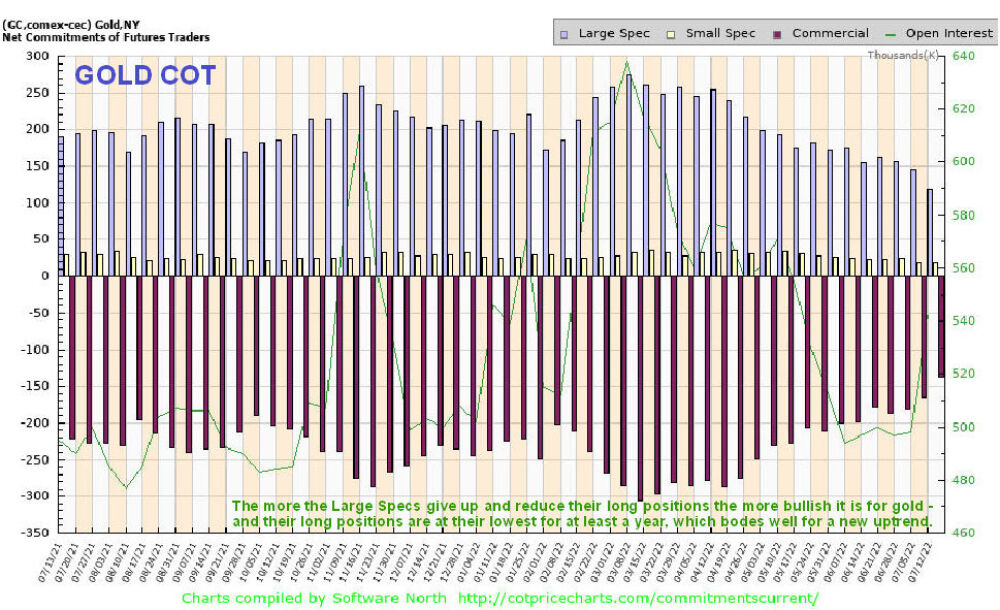

Gold’s latest COT chart is most encouraging as it shows that the normally wrong large Specs have reduced their long positions to the lowest levels for at least a year, which makes a reversal into an uptrend all the more likely, and here we should note that have not been net short gold for many years…

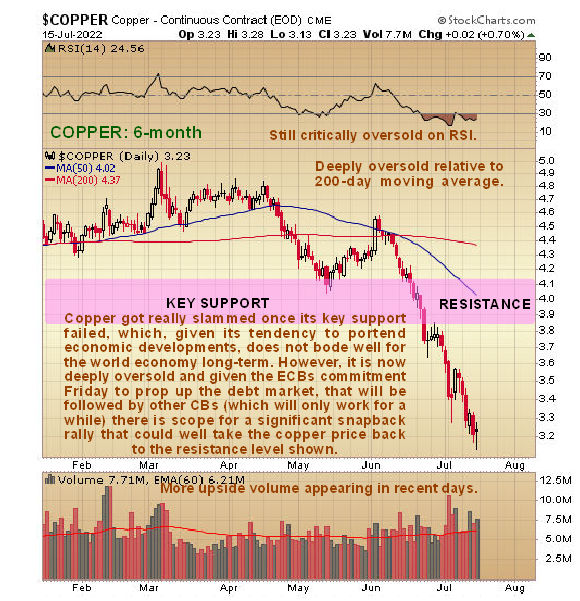

It is worth us taking a sideways look at copper here because copper is often an advanced indicator for the economy, hence its nickname Dr. Copper, and these days it is something of a barometer for the Chinese economy because China uses so much of it.

As we can see on its latest six-month chart, copper has really been “taken to the woodshed” in recent weeks, suffering a nasty drop after the failure of a key support level. This implies economic contraction ahead.

However, it has dropped so far so fast that it is now extremely oversold—it is at its third most oversold point in the past 20 years—on a sharp plunge late in 2011 it got a little more oversold and it got considerably more oversold on just one occasion, at the end of a severe plunge late in 2008 induced by the general market crash at that time. It is critically oversold on its RSI indicator and deeply oversold relative to its 200-day moving average so taking all these factors into account it is certainly entitled to a bounce.

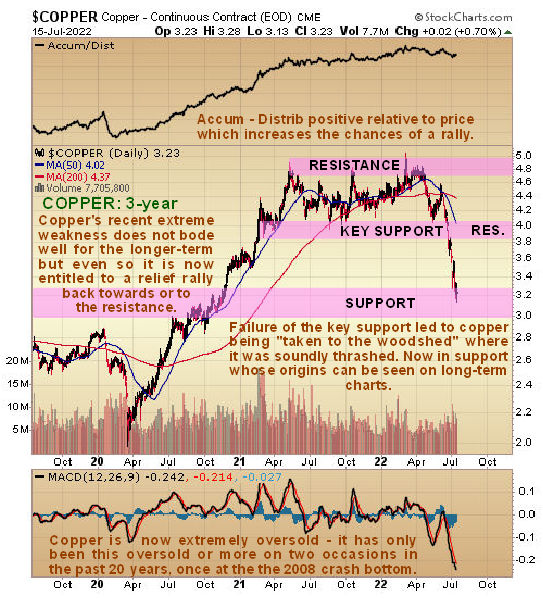

On copper’s three-year chart we can see the reason technically that copper has dropped so steeply in recent months—it broke down from the large trading range that it had been stuck in for about a year from mid-2021, and of course, the support at the lower boundary of this range is now a resistance level.

Its hugely oversold condition coupled with the fact that it is now in a zone of quite strong support arising from trading late in 2018 and early in 2019 together with the probable shift back to risk on conditions makes a snapback recovery rally likely which would probably take it back up to resistance at the underside of the trading range.

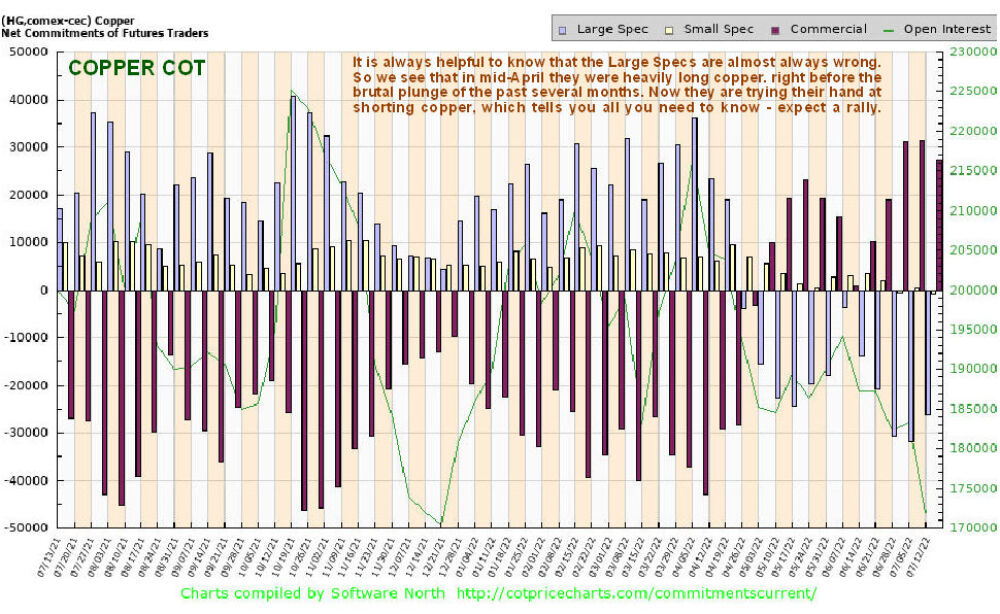

Another important factor that increases the chances of a recovery rally in copper is the fact that the normally wrong Large Specs, having gotten it spectacularly wrong being long copper back in the Spring, have now switched to being heavily short, suggesting a rally soon, as can be seen on the latest COT chart for copper.

This of course begs the question “If the Large Specs keep losing money, how do they keep going?”—the answer is that they don’t, but as they fall they are replaced by more like them, kind of like British soldiers marching in lines towards machine guns at the Battle of the Somme.

The risk-off environment that has triggered big declines in metals prices in recent months has also contributed to a flight to safety into the dollar along with Emerging Markets struggling to service their dollar debts. So now we will take a quick look at the latest charts for the dollar index.

On the 6-month chart for the dollar index, we can see that the further falls in gold and silver this month were partly or wholly due to strong gains in the index this month. However, we can also see that a bearish “shooting star” candle formed in the dollar index Thursday, suggesting an imminent reversal which was followed the next day—Friday—by another bearish candle that completed a “bearish engulfing pattern” about the time of the ECB announcement.

The candles in the dollar index late last week suggest that it is reversing into a decline.

Thus it is most interesting to observe on the long-term nine-year chart for the dollar index that it has been accelerating higher in a parabolic slingshot move which, since it has gone vertical, suggests it is making a blowoff top right now.

If it breaks down from this parabolic uptrend shortly it could drop hard—hardly surprising considering how much money the Fed is likely to create to save the debt market—and clearly, if it does, it will be very good news indeed for Precious Metals prices and base metal prices as well.

Originally posted on CliveMaund.com on July `17, 2022.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers, and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports.

As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.