Against a backdrop of staggeringly dilutive financings for junior exploration companies — or in many cases, no takers for financings whatsoever — Wealth Minerals Ltd. (WML:TSX.V; WMLLF:OTCQB) has raised $3,037,500 at reasonable terms and without paying a finder’s fee.

“We already had enough cash to fund our (planned) drill program), but there was interest (in a placement),” Wealth Minerals’ Strategic Advisor Tim McCutcheon told Streetwise Reports. “Wealth Minerals has spent years getting to this point and it doesn’t hurt that we’re in (the) lithium (business).”

The financing sees Wealth issue 12,150,000 units, with each unit comprised of one common share at CA$0.25 and one-half of one common share purchase warrant. Each whole warrant gives the holder as much as two years to acquire one share of Wealth at CA$0.40 apiece, a 21% premium to the closing price on June 28.

“We already had enough cash to fund our (planned) drill program), but there was interest (in a placement).”

— Wealth Minerals Strategic Advisor Tim McCutcheon

The two-year exercise period on the warrants starts from the date they were issued, and both the shares and the warrants must be held for at least four months, plus a day, before they can be exercised.

What’s more, CA$2 million of the cash raised comes from Rui Feng’s Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE), a silver producer with multiple mines in China.

Silvercorp also owns almost 30% of New Pacific Metals Corp. (NUAG:TSX.V; NUPMF:OTCQX).

Feng, a well-known entrepreneur in mining circles, is chairman of both companies.

Drilling Underway at Ollague

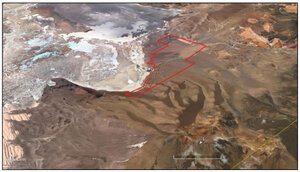

Wealth recently started drilling the Ollagüe basin, part of a salar in northern Chile, not far from the border with Bolivia. The drill program consists of 1,500 meters of diamond drilling that will test anomalies outlined in an earlier geophysical survey.

The company plans to publish a National Instrument 43-101 compliant resource on the 8,000-hectare Ollagüe Project once the drilling and lab work wrap up, likely toward the end of the summer.

Before drilling started, Wealth Minerals acquired 1,600 more hectares in the same salar from Lithium Chile Inc. in exchange for 2 million shares.

Lithium Chile drilled the basin in 2018, and some intercepts returned lithium grades as high as 480 lithium milligrams per liter (480 Li mg/l), while some surface samples taken earlier by the company returned lithium grades as high as 1,140 Li mg/l.

Wealth had previously conducted a coincident loop Transient Electromagnetic or TEM survey on the Ollagüe Project that identified what the company calls “highly conductive zones”, which are thought to represent potential lithium-bearing brines at depth. The drill program is testing that premise.

Insight Into Recent Financing

McCutcheon also provided some insight into how the financing came together, despite having more than enough cash to carry out its drill program and publish an initial resource estimate.

He told Streetwise Reports that German businessman and member of Wealth’s advisory board, Jürgen Geissinger, requested to take part in a placement in Wealth Minerals while the share price hovers around CA$0.30 per share.

Meanwhile, Silvercorp management approached Wealth Minerals CEO Hendrik Van Alphen about an investment in the junior at the recent Prospectors & Developers Association of Canada (PDAC) conference in Toronto.

Geissinger is also the former CEO of Schaeffler AG, a German-based supplier of bearings and precision equipment for the automotive industry and other sectors. Under his tenure, Schaeffler AG grew sales to EUR14 billion, a four-fold increase.

“We thank these two subscribers for their participation in this placement and look forward to delivering value to their investment," Van Alphen said in a release.

Van Alphen is a long-time mining executive, serving in different C-suite roles for companies such as Pacific Rim, Corriente Resources, as well as founding Cardero Resources. All told, Van Alphen has been part of public company financings totaling more than CA$1 billion.

McCutcheon says the money from the recent financing will be used for exploration and general corporate purposes.

Reuters reports that Director David Lies owns 18.23 million shares or 6.8%, while Van Alphen owns 4.93 million shares or 1.84%. Buffalo, N.Y.-based Sandhill Investment Management and Elkridge, Md.-based Paladin Advisory Group, LLC are also shareholders.

Wealth Minerals has about 268 million shares outstanding and trades in a 52-week range of CA$0.70 and CA$0.21.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Brian Sylvester wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Wealth Minerals Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.