It took quite a bit of time before Gold Terra Resource Corp. (YGT:TSX.V; YGTFF:OTC; TXO:FRANKFURT) released the first results of their much anticipated deeper drilling of the Campbell Shear, but on June 27, 2022 holes 029 and 037 were finally announced.

The results weren’t spectacular, but CEO Gerald Panneton indicated that despite the low grades the intercepts confirmed the hitting of the Campbell Shear mineralized zone, and that was the most important. Of course they would have loved to hit high grade gold right away, but when looking at the adjacent Con Mine deposit which was also part of the Campbell Shear, mineralization was also very variable, so it could have been anything from hitting nothing to high grade intercepts. The current result is somewhere in between, and seems to confirm the company is on the right exploration path.

Fifteen holes have been completed now, and more assays are expected to be returned from the labs regularly from now on.

After announcing a series of mostly strong results on the Yellorex and Mispickel targets, Gold Terra was looking to at least equally impress the investor community with good results on the Campbell Shear at depth. As the Campbell Shear is a very large, tilted structure, as is visualized in this 3D image, provided by the company (Campbell Shear in yellow, the Con Mine deposit in red), chances to hit mineralized areas at depth seem high:

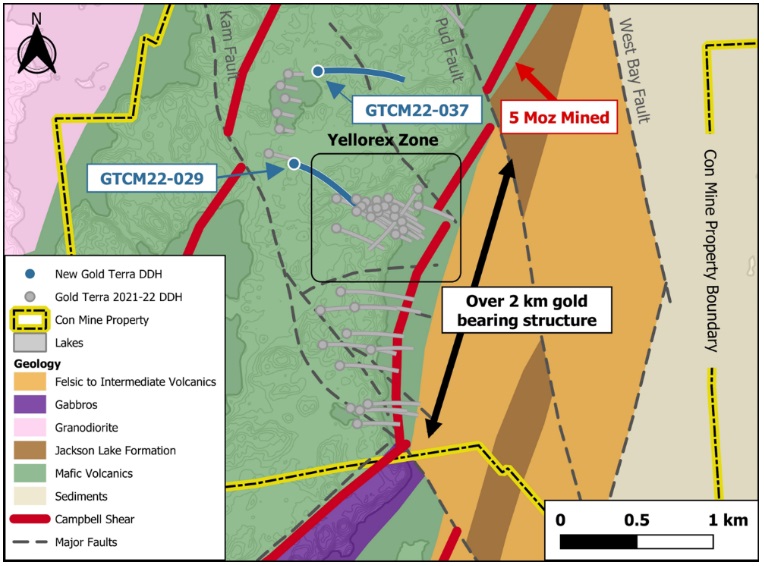

After completing 15 drill holes (holes 027-041) for 8,391m, the assays of the first two deep holes (029 and 037, for 2,833m of drilling) came back from the labs. Assays for hole 041 are pending. The locations of these holes can be seen in the map below:

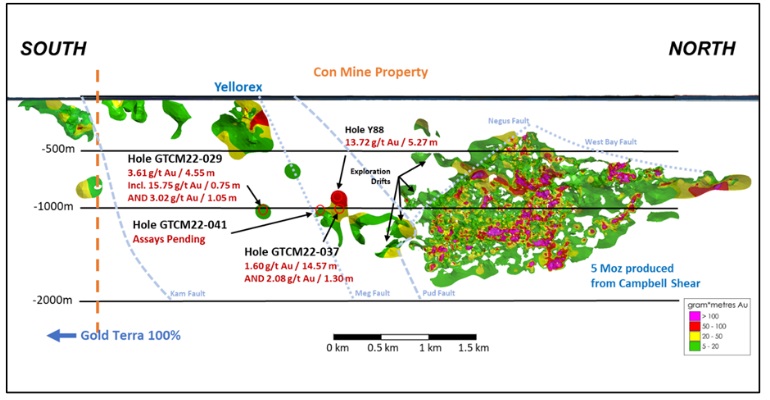

Hole GTCM22-037 returned 14.57m @ 1.6g/t Au from 1263m, including 6.5m @ 1.97g/t Au and 4.5m @ 2g/t Au. Hole GTCM22-029 intersected 1m @ 3g/t Au from 1308m. Real depth is well below 1,000m now, and the company is looking to go even deeper soon. These are not stellar first drill results, but when looking at the long section below, it can be seen that most of the Con Mine deposit was visualized green, meaning mineralization with gram*metres Au of 5 to 20.

The high-grade zones with g*m of over 100 certainly would have more appeal to investors, and provide the most economic mineralized pockets, but don’t build the entire resource. Hole 037 hit just that, a low grade g*m of 23 so just in the yellow colored category.

CEO Gerald Panneton was pleased with the hitting of the Campbell Shear zone: “Our drilling program is getting positive results on the Campbell shear at depth, and confirming gold mineralization in the area of historical holes Y-88 and Y-86. At the past producing Con Mine (5.0 Moz @ 15 g/t Au), it was typical to go from low-grade gold (approx. 1-3 g/t Au) to high--grade in the span of 10 metres. For example, we have observed visible gold, and the Campbell shear is present and well altered and mineralized, south of the Pud fault.”

I discussed this a bit further with him, and he stressed the typical pinching and swelling, like any other shear zone. Typical alteration, shearing and sulphides were encountered, sometimes even visual gold, all of it indicating the Campbell Shear itself, and this is exactly what they are looking for. Getting high grades at this early stage is considered by him as a bonus. I was also wondering about historic holes Y86 and Y-96A were all about, as they were mentioned in the news release:

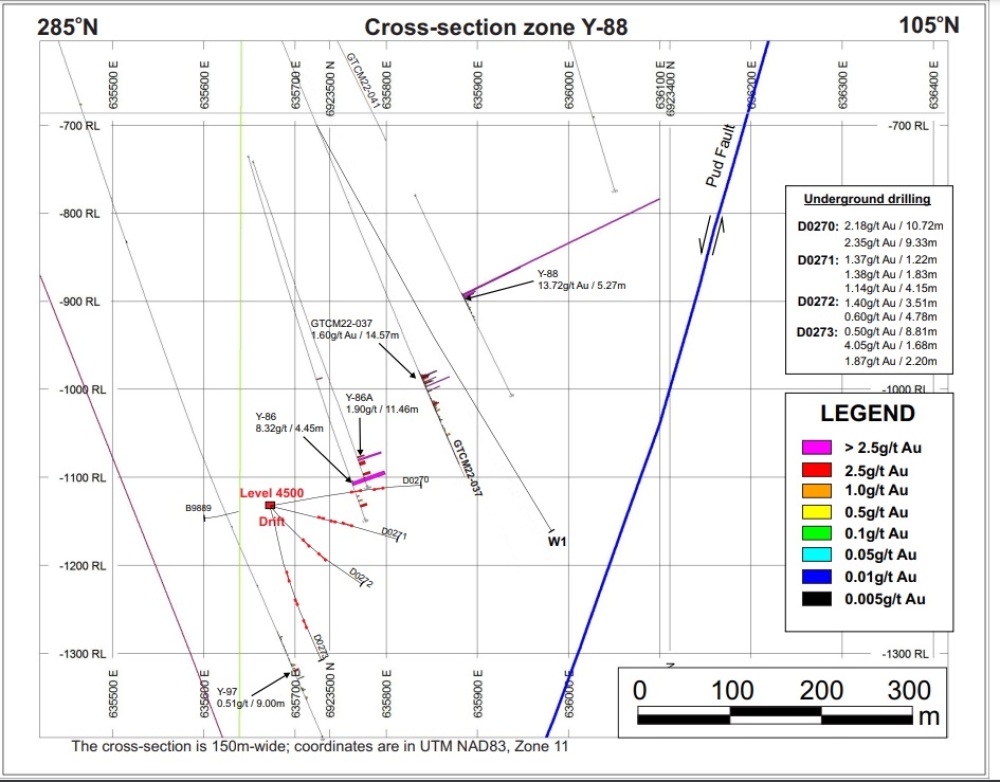

“Hole GTCM22-037 is a deep hole drilled below historical holes Y-88 (13.72 g/t Au over 5.27 metres)* and above Y-86 and Y-96A (8.32 g/t Au over 4.45 metres and 18.11 g/t Au over 0.83 metres respectively).”

Panneton provided me with a section, showing the holes Y88, Y86, Y86-A and Y97:

Also of interest were the D-holes, drilled back in the 1990’s at depth from the 4500 exploration drift, although all at lower grade, except for the surface hole Y-86 with 8.32 g/t Au over 4.45m. The underground program was shortly halted in the late 1990’s by Miramar after weak results. As mineralization seems to be lower grade the further away from Y88, I was wondering if this section is oriented east-west, and if 037 was drilled in order to better determine the limits of the high-grade zone indicated by Y-88, more or less infill-drilling between Y-88 and Y-86A.

CEO Panneton answered: “The plan for hole 37 was to repeat the Campbell Shear mineralization between hole Y86 and Y88, and eventually move updip from these very good intersection towards surface.”

The drilling at the Campbell Shear is well underway for quite a while now with 2 rigs aiming for about 35,000m this year. These two rigs at the Campbell Shear target are drilling south of the former high-grade Con Mine, with one big drill rig targeting the Campbell Shear at a depth of approximately 1000 metres below surface and at a 200-metre spacing. Management is also using hole 037 to set up directional drilling on 50-metre spacing. A second drill rig is allocated to test the Campbell shear north of Yellorex zone which was not part of the agreement with Newmont (September 2020).

As a reminder, management is intending to drill up to about 40,000m this year, with the objective of delineating at least a 1.0Moz high grade gold resource at the Campbell Shear at the end of 2022, and eventually a minimum of 1.5Moz high-grade gold the year after. As I have estimated the Yellorex mineralized envelope at over 600koz Au, I am curious if they will be able to delineate at least another 400koz high grade gold at the Campbell Shear.

Conclusion

Although the first results from deep drilling at the Campbell Shear weren’t spectacular, they did indicate the continuation of the Campbell Shear as an extension of the Con Mine mineralization. As such this was a delight to CEO Gerald Panneton, and he is eager to hit high grade mineralization by using wedges or directional drilling at a much closer spacing (25-50m) then used previously.

According to him, the Campbell Shear has lenses that are 200m in strike length and have good vertical continuity, despite some very high grade, less continuous distribution of mineralization. The company expects no different by drilling this zone south of the Con Mine. As a big drill program is underway, we can expect many more results this year, and I’m curious if Gold Terra can find high grade gold at depth.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence and talk to their own licensed investment advisors prior to making any investment decisions.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra Resource Corp., a company mentioned in this article.