When I first began writing about markets back in 1987, I decided that I would try my utmost to avoid political commentary on the basis that free markets devoid of political interference and interventions carried little if any need for anything verging on a subjective analysis of either Liberal or Conservative party policies.

Stock and bonds went up and they went down and only in the case of isolated political bungling (Nixon-Watergate/Reagan-Iran Contra/Clinton-Lewinsky/Ted Kennedy-Chappaquiddick) or assassination (JFK/Lord Mountbatten) did political events create upheaval in the North American markets.

Then, with globalization, I was forced to monitor European and Asian political developments and because many of my junior mining deals were operating in Latin America, subtle shifts in the political winds in that continent forced me to keep an eye open for military coups and regime changes, all designed to keep the “commies” out and the “business guys” in.

“When I think about the biggest, most important economic policy this government if re-elected, would move forward, you’ll forgive me if I don’t think about monetary policy."

— Canadian Prime Minister Justin Trudeau

Alas, here in 2022, after nearly thirteen years of nonsensical interference in markets by a non-government entity called the Federal Reserve Board, fundamental analysts trained in the art of dissecting balance sheets and income statements are fully replaced by behavioral psychologists whose job is purely to assess and decipher the mutterings and ramblings of the Fed Chairman and his band of merry governors in order to determine the future “value” of stock prices.

The problem with depending upon the interpretation of the monetary policymakers as opposed to the operating performance of companies is that all they are paid to assess is the future direction of stock prices as opposed to the future value of companies.

Sadly, at the moment that the Fed changes its mandate, there is no one left qualified to assess value, and investors are left hanging over the edge of the Cliff of Hopium, praying that these overpaid market strategists can translate Fed gibberish into actionable research ideas.

As we are seeing in spades, as the first half of 2022 comes to a dismal end, how the Law of Unintended Consequences has turned a “buy-the-dip” Fed lovefest into a “sell-the-rip” free-for-all, I watch with morbid delight as the 30% that have never experienced a bear market get savagely mauled at every turn.

As I wrote about in an earlier email alert, 2022 has now been witness to the worst starting six months in the recorded history of the NASDAQ and the second-worst start for the S&P 500 in fifty years.

Astonishingly, despite that, investors are carrying near-record weightings of equities over cash and bonds with every “guest commentator” on CNBC trotting out their list of stocks to buy proclaiming with greater and greater fervor that “the bear market is ending!” when the history of bear market bottoms (such as 1974 and 1982) would reveal that at real bear market bottoms, recommending a stock would invite a punch in the head.

In other words, this bear market in stocks will likely end with CNBC interviewers asking a bond broker questions on “capital preservation” when in fact if they still have an audience, they are actually seeking out an expert in “capital Recovery.”

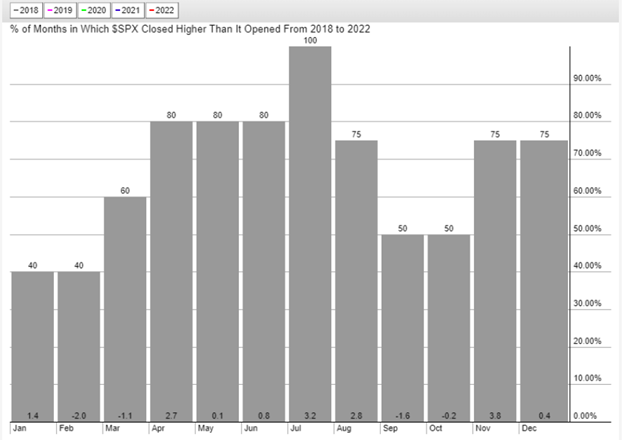

That said, July is historically the best-performing month of the calendar year for S&P 500 and I fully expect that any day now a tradable summer rally will arrive.

In fact, the way stocks gapped down on today’s opening on this the last trading day for the quarter and first half reeked of reporting period “window dressing” sprinkled with ample doses of capitulation.

I added to Teck Resources Ltd. (TECK:TSX; TECK:NYSE) under $30 after watching it trade over $45 a mere twenty days ago.

That is what happens when redemptions begin to grip the hearts and minds of these 30-something money managers who were raised on a steady diet of “The Fed’s Got Our Backs” complacency, hubris, and naiveté exacerbated by massive applications of leverage and woeful misunderstanding and mismanagement of risk.

As you can see, July usually is a strong month in which to take trading positions with an exit ramp in mid-to-late August but what makes this particularly tricky is this entire dialogue over the Fed “pivot” which will, at least in the minds of the entire trading world, send stocks screaming higher.

Why?

It is because the investment industry is anchored in the memory of what happens when Fed liquidity (“tinder”) meets animal spirits (“blowtorch”) after six months of drought.

The question no one is asking as I did back in March is “What if the Fed does not pivot?” or better still, “What if the Fed does pivot and all bond yields save U.S. Treasuries (controlled by the Fed), spike higher (fearing inflation) taking stocks down?”

Bill Fleckenstein calls that “the Fed losing the bond market” and it is a brilliant analysis brought forth in a wonderful contrarian manner as only someone over the age of sixty (and very seasoned) can deliver.

The late Richard Russell always stressed capital preservation over heroics whenever his Proprietary Trend Indicator (“PTI”) turned negative which is the camp in which I currently reside and yet despite that as a guiding principle, I had my biggest loss in years when the oil trade got away from me in March.

When the primary trend is down, one is better off using put options where despite short-term errors in entry levels, the predominant downtrend inevitably rescues you.

When taking long positions, the only time one can make any time of move is from deeply oversold positions where the RSI (“relative strength index”) is sub-30.

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) has been a rockstar since the June 15th announcement of 51.9 meters (51.9m) of 5.4 grams per tonne gold (5.4 g/t Au) (including 9.9m of 17.7 g/t Au) at Fondaway and has since tacked on 64.16% in a market that has seen new lows in the TSX Venture Exchange as well as new reaction lows in the Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.Arca) at $32.00.

Only Getchell Gold, MAX Resource Corp. (MAX:TSX.V; MXROF:OTCBB), and Gold Resource Corp. (GORO:NYSE.American) are ahead on a year-to-date basis with the other three portfolio holdings negative.

Since virtually everyone of my junior mining newsletter gurus is now bearish (or at least “cautious”), I am taking the position that stellar drill results are the only potential driver for valuation increases so while I have a few proxy positions in copper and uranium, it is 10-20 bagger potential for which I am gunning and it should be no surprise that the three winners carry just that type of potential.

The disappointment is Norseman Silver Ltd. (NOC:TSX.V) whose Taquentren Project is a copper-silver prospect located in Argentina under the supervision of Navidad discoverer Daniel Bussandri.

These are the kind of markets that are typical of both summer markets and bear markets as volumes are reduced along with valuations while people return to the normalcy of a post-pandemic world.

Just as inflation rates spiked due to government stimulus (“rescue”) checks starting in 2021, recent data suggests that inputs are starting to abate such that these rapidly-decelerating economies may just allow for a pause in the aggressiveness of the central bank inflation fight measures.

If we get that pause, you do not want to be short so look for “bad news” on the economic front to trigger “good news” on the monetary policy front and subsequent market rebound.

Lastly, with Canadian housing now finally starting to correct, I eagerly await the revelation of massive defaults in the secondary mortgage lending arena.

There has been a huge amount of shenanigans in lending procedures so with housing in Canada many times more overvalued than was U.S. housing in 2006, I see weakness on the horizon for the Canadian currency despite its historical correlation with energy prices.

In fact, if oil starts to correct, I see a quick plunge to a 60 handle as the quagmire of overleveraged real estate speculators is revealed.

Hail the return of the Northern Peso!

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance.

With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector.

Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures

1) 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Market Vectors Junior Gold Miners ETF, Getchell Gold Corp. and Norseman Silver Ltd., companies mentioned in this article.

Charts provided by the author.