Kainantu Resources Ltd. (KRL:TSX.V; 6J0:FSE), the gold- and copper-focused exploration company sitting next to K92 Mining Inc. (KNT:TSX.V) and seeking epithermal gold and porphyry copper-gold deposits along a proven copper-gold belt in Papua New Guinea, recently reported positive results from an airborne geophysical survey the company conducted earlier this year.

On July 7, newsletter writer Bob Moriarty, after not writing about a mining a junior mining stock since early June, published an opinion piece on KRL Resources in which he discussed the intrinsic value of the company's assets.

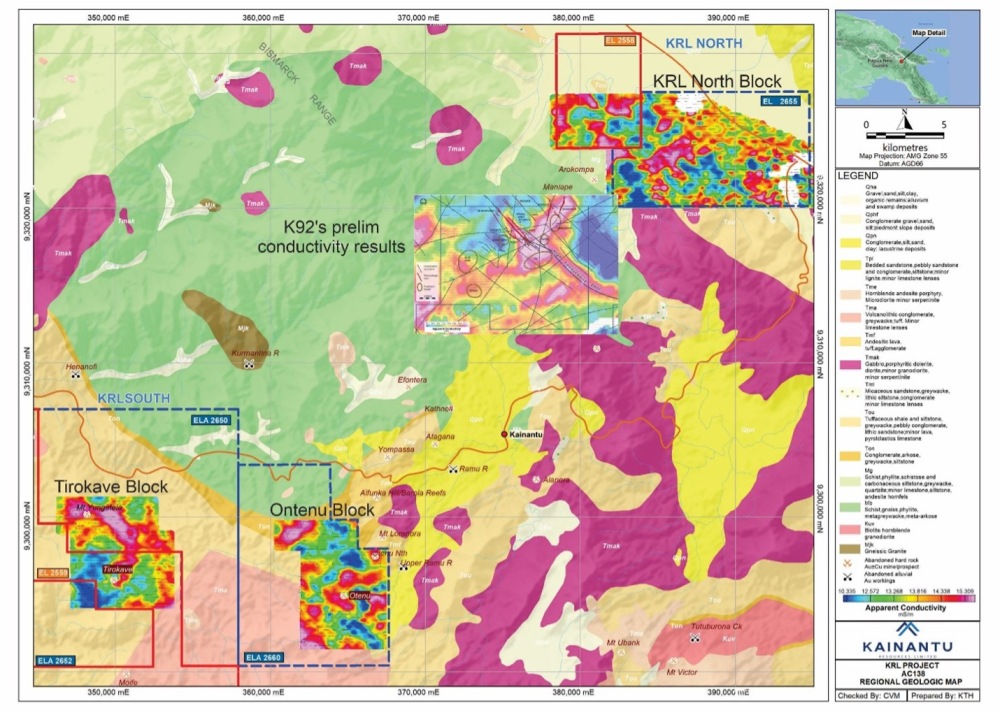

Meanwhile, the geophysical survey outlined highly conductive and magnetically significant anomalies throughout KRL's land package that indicate the potential for high-grade epithermal and porphyry mineralization.

When comparing the electromagnetic conductors to those reported earlier at K92 Mining’s high-grade Kora North property, they appear to extend northeast into the corner of the KRL North Project.

Continuity of high-grade mineralization is a geological theory the company has sought to prove since KRL went public 18 months ago in 2020 after cherry-picking claims that essentially surround K92’s prolific Kainantu copper-gold mine — the donut around the hole, if you will.

KRL earlier hinted at its findings in a March 10 release: “Overall, the 2021 field work and analysis confirms the company’s view as to the prospective nature of KRL North the project and the likely extension of high-grade mineralization from the adjacent K92 project in the Bilimoia Mineral Field.”

The junior explorer's geologists continue to gain a greater understanding of the structural similarities and possible trend between the project and the Bilimoia Mineral Field, where two significant vein systems have been outlined at Maniape and Arakompa. Those are roughly 2 and 4 kilometers outside of the southeast corner of KRL North (see image at left).

The airborne survey by Toronto-based Expert Geophysics was a joint effort between miners in the region, including K92 and KRL, with K92 supporting KRL’s participation. The total area covered was 186 sq. kilometers and from more than 1,000 line-kilometers.

The survey was the largest airborne geophysics program completed in Papua New Guinea in more than 20 years.

K92 Data Analysis Left Blank

“K92 has left their data analysis blank for about 100 meters around KRL area. All things point to positive data results from KRL North as the transfer structure and mining deposit model even from K92 show an extension onto KRL North,” wrote Jerry Huang, principal of Toronto-based merchant bank and market advisor Jemini Capital, in an email to Streetwise Reports.

It’s noteworthy because K92’s Kainantu copper-gold mine has a resource of more than 5 million gold-equivalent ounces (5 Moz Au eq, across all National Instrument 43-101 resource categories), and it produced 104 Koz gold in 2021 at all-in sustaining costs of around $856/oz — well below the industry average.

K92 is Toronto-based Cormark Securities’ top pick of the junior producers with a target price of CA$13. It’s at about CA$9 now, a steady climb up from CA$1 when trading started in late May 2016 — an 800% increase.

K92 has demonstrated the potential of the Kainantu region and is one of the TSX’s best recent exploration success stories.

Everyone needs a role model. KRL has one next door.

Geophysics Tells a Story

In addition to KRL North, KRL’s airborne geophysics program was flown over key areas on KRL South, like the East Avaninofi and Yaoro Ridge prospects.

The survey identified two large magnetic anomalies in “highly permeable structural environments” southwest and southeast of KRL North. Salthouse says these both demonstrate the potential to be mineral-hosting porphyry deposits.

At KRL South, strong magnetic signatures indicate a possible offshoot in the center of the Tirokave ring feature. In fact, Salthouse says the finding supports the mapping and sampling of skarn mineralization.

The geophysical survey also identified a new prospect at Mt. Yungateia, north of the East Avaninofi prospect, that has strong conductivity and magnetic signatures heading toward Tebeo Ridge.

KRL looked into potential drilling companies to test these different targets, and Salthouse suggests that the all-in drilling costs should be in the range of $130 to $150 per meter, well below the industry average in other areas as global inflation continues to drive up exploration costs.

A 'Long-Term Portfolio Approach'

Salthouse says he takes a “long-term, portfolio approach” of identifying and developing exploration projects in Papua New Guinea. KRL's May River copper-gold project and the recently announced Kili Teke acquisition fit nicely into his long-term view.

KRL management has a track record of not only discovering, but also developing and mining significant projects such as the 3-Moz Au-eq Toka Tindung mine in Indonesia.

Mining in the Kainantu region was not always looked upon favorably by many locals. Salthouse and the KRL team spent about 18 months building trust by consulting with local communities and establishing a rapport necessary for building long-term access. Salthouse says the work augmented the solid reputation KRL management has with the MRA, the mining agency in Papua New Guinea.

Salthouse developed an understanding of social license issues as an executive with different companies, including OceanaGold Corp. (OGC:TSX; OGC:ASX), Archipelago Resources Plc (AR:LSE), and REA Holdings Plc.

He developed KRL from the ground up in conjunction with the successful PNG-based EPC business, Asia Pacific Energy Ventures Pte Ltd.

Salthouse hand-picked the Kainantu Resources team, most of whom have successfully worked together in developing regions of the Asia-Pacific.

This includes Nick Franey, formerly a senior geologist at OceanaGold, who was recently appointed KRL’s chief geologist. Chairman and Director Marcus Engelbrecht was also once Acting CEO for OceanaGold in addition to being CFO for BHP Billiton Ltd.'s (BHP:NYSE; BHPLF:OTCPK) Diamonds and Specialty Products division.

KRL Acquires Kili Teke

Kainantu Resources recently picked up the Kili Teke copper-gold porphyry project in Papua New Guinea from South African gold producer, Harmony Gold Mining Co. (HMY:NYSE; HAR:JSE). The initial acquisition cost for KRL was CA$500,000, with another CA$500,000 to be paid next year, plus shares and a 1.5% production royalty.

KRL also split compensation payments across a number of feasibility milestones, with payments contingent upon positive economic and geological outcomes.

Kili Teke is about 40 kilometers along strike from the giant Porgera mine, usually among the top 10 gold-producing mines in the world. It produced more than 16 Moz Au between 1990 and 2009.

Harmony spent over $25 million to date, including drilling roughly 36,000 meters over 54 holes on Kili Teke and the definition of an inferred resource of 237 million tonnes, which contains 800,000 tonnes of copper (at a grade of 0.34%), 1.8 Moz Au (at a grade 0.24 g/t Au), and 40,000 tonnes of molybdenum (168 ppm).

KRL will work toward a preliminary economic assessment at Kili Teke, but the junior has other options, too.

“There's quite high copper potential there. There is also potential to refocus the development toward a higher-grade gold resource drawing on the skarn ore body closer to surface," Salthouse explained.

He added that there is a good chance that Kili Teke could be "re-optimized" to generate material returns as "a gold-focused asset operating at the more junior end of the market."

Most of Salthouse's thoughts re-optimization stem from the extensive drill programs that Harmony conducted prior to the sale.

For example, hole KTDD013 at Kili Teke returned 542 meters containing 0.58% Cu, 0.41 g/t Au from 90 meters downhole, including 186 meters running 1.02% Cu, 0.72 g/t Au from 252 meters downhole.

One hole over, KTDD014, hit 509 meters grading 0.38% Cu, 0.2 g/t Au from 358 meters downhole, Including an internal interval of 144 meters at 0.53% Cu, 0.23 g/t Au from 610 meters downhole.

And hole KTDD015 intersected 466 meters grading 0.34% Cu, 0.25 g/t Au, including 290 meters at 0.44% Cu, 0.34 g/t Au from 129 meters downhole.

Everybody Wants a Raise

KRL completed a heavily oversubscribed private placement in January 2022, raising CA$2.77M. All good, right?

The company then released its FY21 annual reports (relating to the periods prior to the placement), which was covered in an article on Stockwatch that reported the company had only $650,000 in cash.

This led to confusion among investors and something of a run on the stock. This was further compounded by pressure on global financial markets. KRL's share price trended even lower throughout May after a 4-month hold came off shares issued in the January raise.

The share price has since found support at around $0.10.

Salthouse says the current price represents a "significant discount" when compared with the "assumed net asset value and upside potential" of the company's projects.

He ought to know. Salthouse owns 8% of KRL and says he will participate in next round of financing, which will likely be necessary before any drilling.

Director Geoff Lawrence owns roughly 20%, while a company named Tanuki Holdings Ltd. owns 8.09%. KRL management and founders already have invested in excess of CA$2 million since the company listed.

An equity research report on Kainantu by Vancouver-based Morningstar Research pegs KRL’s “fair value” at CA$0.25 — representing 177% upside to the CA$0.09 closing price on June 17.

German Mining Networks also released a research report in October 2021, which gave the company a 12-month price target of CA$0.45. The report cited a number of value drivers such as the junior explorer's experienced management, exposure to high-demand commodities in proven mining jurisdictions, and KRL's reputable in-country partner, Asia Pacific Energy Ventures,

KRL has about CA$1.6 million cash and trades in a 52-week range of CA$0.34 and CA$0.08, with around 60.7 million shares outstanding, about 25% of which is floating.

Originally published on June 26, 2022.

Disclosures

1) Brian Sylvester wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Kainantu Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Kainantu Resources Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kainantu Resources Ltd., a company mentioned in this article.