NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) has optioned the advanced exploration-stage Nutmeg Mountain Gold Project in Idaho from GoldMining Inc. (GOLD:TSX; GLDG:NYSE.American).

For about CA$9 million in shares and cash, NevGold gets a National Instrument 43-101-compliant resource of more than 1.1 million oz gold (all categories) and some leverage for its next raise in the form of a lead order totaling CA$1.25 million — a considerable advantage for a junior company given that the CA$1.25 million already committed will provide leverage in a future financing.

The deal is still subject to regulatory approval.

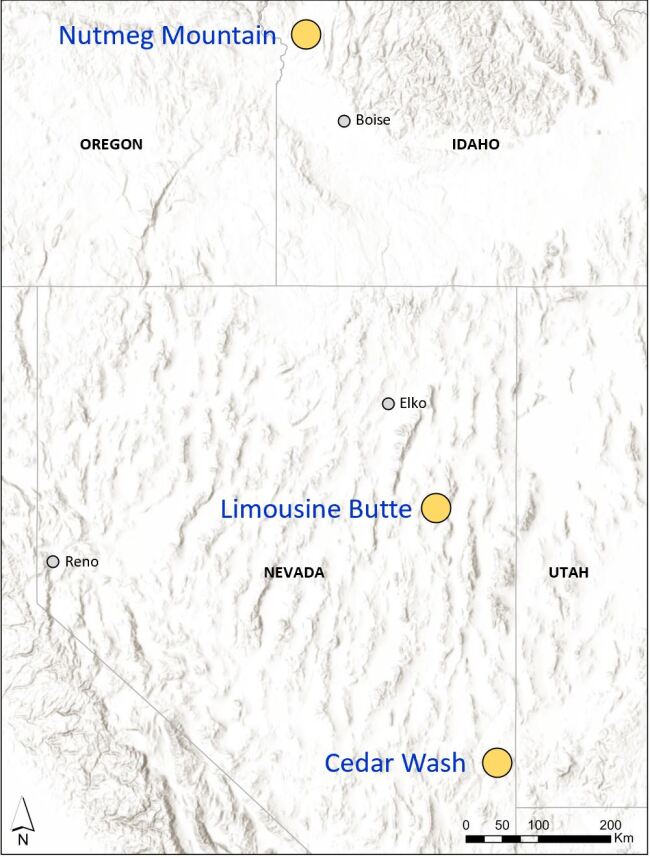

NevGold CEO Brandon Bonifacio says the transaction creates a lot of upside for NevGold, and like it has done at Limousine Butte in Nevada, the company’s focus will move toward extracting value for shareholders at Nutmeg Mountain.

“Our low-case scenario is 1.1 million ounces. But we think there's a lot more there,” Bonifacio told Streetwise Reports. “We're paying less than $10 per ounce in the ground when these ounces should trade at $60, $70, or even $80. It takes us one step closer to building one of the marquee gold resource development and exploration companies in the Western USA.”

GoldMining, meanwhile, comes out of the deal with about 10% of NevGold, some cash now, more cash later, and the right to a board seat.

“We are excited to have formed a partnership with NevGold,” GoldMining CEO Alastair Still said in a release. He added that he is encouraged by the “continued exploration success at Limousine Butte in Nevada, and the upside potential of the other assets in the NevGold portfolio.”

Technical Analyst Clive Maund wrote a post on NevGold following today's news and suggests there are some bullish signs in NAU trading.

He wrote: "There are several bullish factors to observe on this chart (at left). An important one is the persistent strong volume on the recent run-up following a gap breakout from the downtrend — this is certainly bullish, especially as the Accumulation line rose to new highs on this move and hasn’t dipped at all on the reaction of recent days which has occurred on dwindling volume."

Once NevGold completes its earn-in agreement with GoldMining, the junior will have four wholly owned gold projects, two with established gold resources.

The gold projects would include the following: Nutmeg Mountain in Idaho and Limousine Butte and Cedar Wash in Nevada. Limousine Butte has a historical resource totaling 292,000 oz (241 Koz in the Measured and Indicated category, and 51 Koz inferred) at an average grade of 0.77 g/t gold (using at cutoff grade 0.41 g/t gold). And they also have the high grade silver-gold-copper-lead-zinc project in British Columbia.

A Brief History of Nutmeg

GoldMining (formerly Brazil Resources) bought Nutmeg from Sailfish Royalty Corp. (FISH:TSX.V; OTC:SROYF) in March 2020 and immediately hired Global Mineral Resource Services (GMRS) to calculate a mineral resource estimate using the assay data from drill programs that were conducted between 1981 and 2012.

In the early 1980s the property was drilled by established names like Homestake and Freeport (now Freeport-McMoRan Inc. (FCX:NYSE)). The last diamond drill holes on the property, located in southwestern Idaho, about 80 kilometers northwest of Boise, were drilled in 2012 but most of the historical drillholes only went to an average depth of around 75 meters, so the full extent of the mineralized system was never tested.

Nutmeg Mountain contains an indicated resource of 43,470,000 tonnes grading of 0.65 gram per tonne gold (g/t Au) tonne for 910,000 oz Au. The inferred resource is 9,150,000 tonnes at 0.56 g/t Au for roughly 160,000 oz. Both the indicated and inferred resource calculations used a 0.3 gram cutoff.

GMRS modeled the resource in a constrained pit, as most of the deposit starts near the surface. Furthermore, GMRS recommended that GoldMining advance Nutmeg Mountain (then called Almaden) to a Preliminary Economic Assessment (PEA) in two phases.

The first phase would involve geophysics, alteration mapping, and diamond drilling to “identify high-grade feeder-style mineralization that could potentially underly existing lower-grade, near-surface mineralization.”

The second phase would consist of different metallurgical studies as part of an effort to complete an updated resource estimate and a PEA. GMRS estimated the total cost for both phases at about CA$4 million.

“The same geology in northern Nevada carries on in Idaho, and the state is starting to see some more modern exploration and development. We strongly believe the resource is a lot larger than currently stated and we are looking forward to our inaugural drill program this year,” Bonifacio told Streetwise Reports.

Previous drill programs have outlined four tabular mineralized zones in a low-sulphidation epithermal gold deposit: Main, North, Stinking Water, and Cove Creek. The Main Zone is in a graben.

North Zone mineralization was deposited on the eastern flank of the graben, about 600 meters north of the Main Zone. The Stinking Water Zone is 600 meters west of the North Zone and is thought to be a slumped landslide portion of that zone. The Cove Creek Zone is located approximately 600 m south of the Main Zone and is inferred to be a slumped landslide continuation of the Main Zone.

Once the Nutmeg deal closes, NevGold plans to re-analyze the exploration database and establish new drill targets in preparation for a 10,000-meter drill program to expand the resource outside the existing envelope, both laterally and at depth. The company is most interested in finding the higher-grade feeder system typically associated with low-sulphidation epithermal deposits.

Details of the Deal

NevGold will issue 4,444,444 common shares to GoldMining at a price of $0.675 per share — that’s about CA$3 million. The shares will give GoldMining a 10.6% interest in NevGold.

GoldMining will also make an initial $1M investment in NevGold by subscribing for 1,481,481 shares at CA$0.675 apiece, and of course, the CA$1.25 million lead order commitment that must happen by the end of November.

To fulfill its option agreement, NevGold must make a series of payments: January 2023, CA$1.5M; July 2023, CA$1.5M; January 2024, CA$3M. NevGold can choose to pay these amounts in cash or shares.

The junior also must spend at least CA$2.25M on exploration work, CA$1.5M of which must be spent before June 2023.

Once that’s all done, NevGold will be the proud owner of Nutmeg Mountain. But the company would have to pay GoldMining a further CA$7.5M if NevGold advances Nutmeg to a feasibility study.

Reuters reports that McEwen Mining Inc. (MUX:TSX; MUX:NYSE ) owns 9.93% of NevGold, while chairman Giulio Bonifacio owns 5.91% or 2.96 million shares. Brandon Bonifacio owns 5.34% or 2.7 million shares.

Fully diluted, the junior has about 50 million shares outstanding, with about 18 million shares in the free float. Since launching about a year ago, NevGold has traded in a range of CA$0.34 and CA$0.84.

Sign up for our FREE newsletter

Disclosures:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: NevGold Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp., a company mentioned in this article.