Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) announced that it has started another 5,000-meter diamond drilling campaign at its Wicheeda rare earth element (REE) deposit in British Columbia.

The company hopes to produce as much as 10 percent of the world’s light REEs to help it compete with China, which has about 85% of the world’s REE processing capacity. And the company said it is testing a new extraction process that could increase its output.

“A big, non-China, rare earth metals project that comes online in a jurisdiction like Canada would be gold dust for investors,” wrote Stuart Fieldhouse, who follows the mining sector for The Armchair Trader. “We are already facing massive demand for rare earth metals from the automotive sector, and that is just likely to increase over time.”

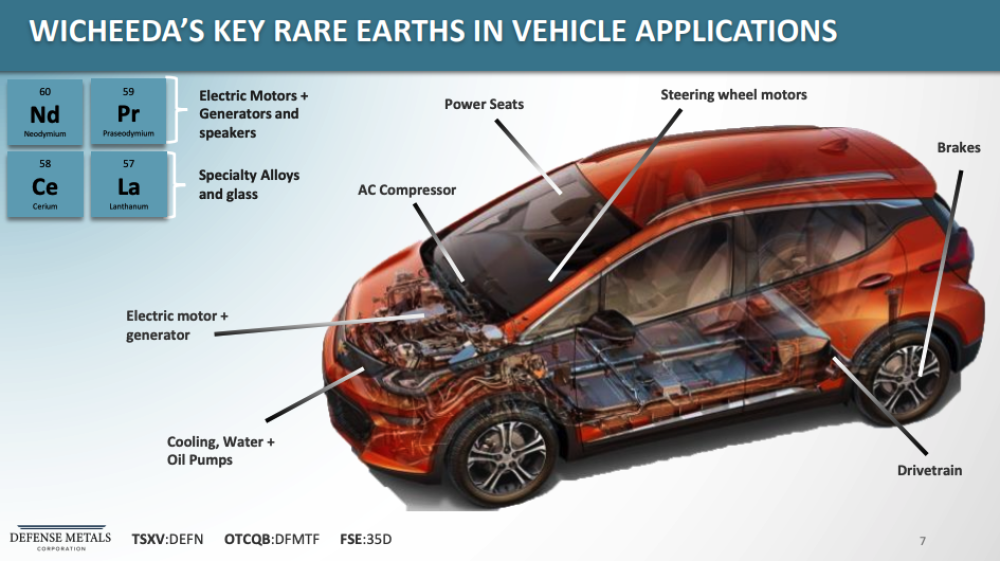

The new economy is demanding more REEs, which are used in purifying water, MRIs, fertilizers, weapons research, wind turbines, and permanent magnet motors for electric vehicles.

The new economy is demanding more REEs, which are used in purifying water, MRIs, fertilizers, weapons research, wind turbines, and permanent magnet motors for electric vehicles.

Based on the results of the company’s 2021 drilling for the minerals at Wicheeda, analysts are bullish on the project’s prospects.

“In our view, the Wicheeda Rare Earth Project is shaping up nicely, and progress-to-date bodes well for a compelling preliminary feasibility study,” Noble Capital Markets natural resources analyst Mark Reichman said in a research report on April 28. “Based on outstanding results from the Fall 2021 program along with planned drilling, the potential to expand and upgrade the resource is significant. We anticipate interest in offtake agreements and/or strategic partnerships to grow as the company advances toward a PFS.”

New Rare Earth Elements Extraction Process on Horizon

The new drilling program is using existing drill pads prepared in 2021 in the northern area of the Wicheeda deposit, which returned some of the highest-grade intercepts. Two holes there returned 3.79% total rare earth oxides (TREO) over 150 meters, including 4.77% TREO over 60 meters extending 80 meters beyond the current mineral resource and 40 meters beyond the constraining pit shell, the company said.

This interval included 12 meters averaging 8.06%, Defense Metals said, and contained the highest combined neodymium-praseodymium (NdPr) oxide value to date at Wicheeda of 1.41% NdPr oxide at 10% TREO.

“A big, non-China, rare earth metals project that comes online in a jurisdiction like Canada would be gold dust for investors.”

—Stuart Fieldhouse of The Armchair Trader

Drilling in the north will be followed by exploration drilling west of Wicheeda, where holes drilled in 2009 revealed visual indications of potential REE mineralization.

Defense Metals is now testing an acid bake extraction process for REEs that it said could potentially lower capital and operating costs. It uses concentrated sulfuric acid at high temperatures to convert the REEs to water-soluble sulfates, which then dissolve during a water leach, the company said. The REEs are then recovered using a precipitation process.

Acid baking would allow for a more than 95% recovery rate for REEs, as opposed to less than 90% with the alternative caustic cracking process, Defense Metals President and Director Luisa Moreno told Streetwise Reports. Testing for the new process will likely be finished by the last quarter of this year.

“The process requires less equipment and involves fewer steps and circuits,” Reichman of Noble Capital Markets wrote on June 1. “Most of the world’s rare earth elements are produced using the acid-bake process.”

Our Way of Life Depends on It, Company Says

The 2021 preliminary economic assessment (PEA) for Wicheeda demonstrated an after-tax net present value of CA$512 million for the site. Its 43-101 technical report showed a 5 million tonne indicated resource at 2.95% TREO and a 29.5 million tonne inferred resource averaging 1.83% TREO from 4,000 meters of drilling.

The U.S. government has realized the importance of REEs. It announced a $35 million Defense Department grant in February to MP Materials Corp. (MP:NYSE) to separate and process REEs at its California facility. The company has also agreed to invest another $700 million to create more than 350 jobs in the permanent magnet sector by 2024.

“Our way of life depends on advanced materials,” Moreno told Forbes. “From the car we drive to the buildings that house us.”

Defense metals has a market cap of CA$41.26 million with 183.4 million shares outstanding, 180.5 million of them floating. It trades on a 52-week range of CA$0.36 and CA$0.20.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Defense Metals Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp., a company mentioned in this article.