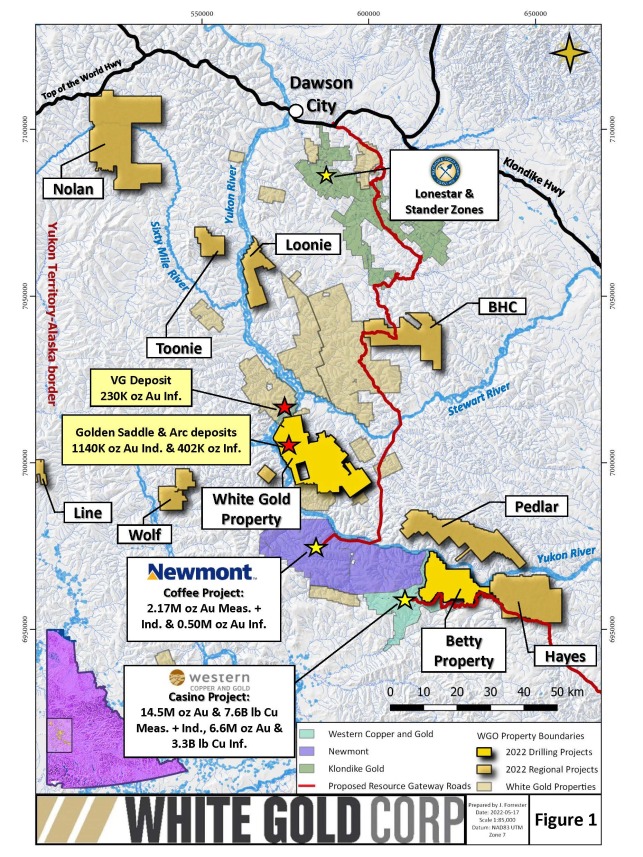

Yukon gold explorer White Gold Corp. (WGO:TSX.V; WHGOF:OTCQX; 29W:FRA) has announced plans for exploring its 350,000-hectare land package in the White Gold district of the Yukon in 2022.

The company will undertake a fully funded CA$6 million 7,500-meter drilling program in the emerging gold camp that once produced more than 20 Moz of placer gold as the source of the historical Klondike gold rush.

The district is already home to several large deposits: Newmont Corp.’s Coffee, White Gold’s Golden Saddle, and Western Copper and Gold Corp.'s Casino projects. Two of them, Coffee and Golden Saddle, were initially discovered by White Gold co-founder and Chief Technical Adviser Shawn Ryan.

With that great location, White Gold’s methodical approach to exploration, and its experienced management, the company is backed by majors Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE), which as of April 13 owned about 19.9% and 15.8% of the company, respectively.

With that great location, White Gold’s methodical approach to exploration, and its experienced management, the company is backed by majors Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE), which as of April 13 owned about 19.9% and 15.8% of the company, respectively.

Kinross said its “strategic investment” in White Gold gives it optionality in the “largely underdeveloped White Gold District and in the larger Yukon Territory.”

“White Gold maintains experienced management and exploration teams with a successful track record of major discoveries in the Yukon, and Kinross leverages its deep technical and operational expertise to add value in White Gold’s pursuit of a quality development opportunity,” Kinross said in a statement when contacted by Streetwise Reports.

Analysts have taken notice, as well. After the company released the results from soil grab samples in April showing significant copper, gold, and multi-element soil anomalies on its Hayes and Pilot properties, Stephen Soock of Stifel GMP said he was looking forward to results from the drilling there and further exploration by the company.

“We expect the stock to re-rate as it continues to progress along its exploration pipeline,” Soock wrote. “We maintain our BUY rating and target price of CA$2.70.”

Searching for the ‘Source’

According to White Gold, its exploration priorities for 2022 will include:

- Testing the extension of the Betty Ford target. Maiden diamond drilling there intersected 3.46 g/t Au over 50 meters and 1.17 g/t Au over 48 meters.

- The Mascot target. The company will start a maiden diamond drilling program there. Historical drilling found 2.62 g/t Au over 41.1 meters and 29.75 g/t Au over 3.1 meters.

- Testing the area between the Ryan’s Surprise and Ulli’s Ridge targets, and further testing the high-grade gold discovery at Ulli’s Ridge in 2021 where maiden diamond drilling intersected 6.94 g/t Au over 19.5 meters.

- Focused prospecting along a 6.5-kilometer-long gold and arsenic soil geochemical trend 2 kilometers west of Golden Saddle.

While those millions of ounces of historical placer gold were taken primarily from secondary deposits in riverbeds, the mythical “source” of hard rock gold in the Yukon has not been found.

“I called it Sasquatch hunting,” Ryan said in a video interview posted on White Gold’s website. “You’ve heard about the beast, but you’ve never seen it.”

That was the genesis of White Gold, Ryan said, looking for the “haystacks” where the “needles” of gold are, and chasing those targets. He said majors like Agnico and Kinross are looking for new districts and one is starting to emerge in the Yukon.

“We should be making a few more discoveries,” Ryan said.

‘Exploration Arm’ for the Majors

The company’s flagship Golden Saddle and Arc deposits and its VG deposit host a global resource of 1.8 Moz. Stifel GMP’s Soock said he expects Golden Saddle and Arc to be taken over by a major as they approach the combined 2 Moz mark, and that such a sale would be a major catalyst for the company.

“White Gold maintains experienced management and exploration teams with a successful track record of major discoveries in the Yukon, and Kinross leverages its deep technical and operational expertise to add value in White Gold’s pursuit of a quality development opportunity.”

—State from Kinross Gold Corp.

The majors really look to juniors like White Gold to be their “exploration arm” for the district, White Gold Chief Executive Officer and Director David D’Onofrio told Streetwise Reports.

“These kinds of companies, the biggest (mining) companies in the world, they do a tremendous amount of due diligence before they enter in an area,” D’Onofrio said of Agnico and Kinross. “This clearly checks all of their boxes. … We’re very fortunate to have guys like that supporting us. In addition to their financial support, they provide a lot of technical guidance and expertise.”

White Gold said it owns 40% of the mineral quartz claims in the Tier 1 mining jurisdiction, which is also highly regarded globally. An annual survey by the Fraser Institute ranked Yukon as a top 10 jurisdiction in both its Investment Attractiveness and Best Practices Mineral Potential indexes.

D’Onofrio said with the drilling program starting in the coming weeks, it’s a great time to get exposure to the company.

White Gold has 149.5 million shares outstanding a market cap of CA$74.05 million. It trades in a 52-week range of CA$0.85 and CA$0.45.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: White Gold Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with White Gold Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of White Gold Corp. and Agnico Eagle, companies mentioned in this article.