Joining us for a conversation is Carlos Espinosa, the CEO of Roo Gold Inc. (ROO:CSE). Mr. Espinosa, it's a pleasure to be speaking with you today to have you introduce us to Roo Gold, which is positioning itself as the new dominant player in New South Wales of Australia.

Maurice Jackson: Before we deep dive into company specifics, Mr. Espinosa, please introduce us to Roo Gold and the exciting opportunity the company presents to shareholders.

Carlos Espinosa: Roo Gold is a junior exploration Canadian company. We have a very attractive portfolio of assets in New South Wales in Australia. Our portfolio was built through acquisitions, and we now have 14 high-grade (10) potential gold and (four) silver concessions. Our most recent concession is located between two of our current properties. We also have four high-value silver concessions. Roo Gold is basically adding value to the area and building a district in New South Wales.

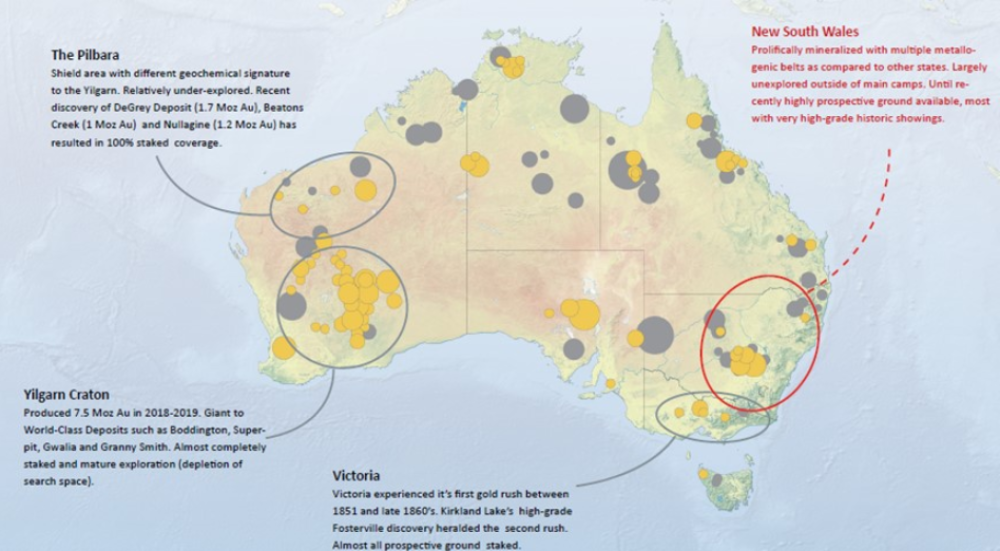

Maurice Jackson: Let's find out more. Mr. Espinosa, take us to Australia and share with us why Roo Gold is strategically focused on New South Wales. Please acquaint us with the region, potential mineral endowment, and mining jurisdiction.

Carlos Espinosa: Australia as a country because today it's one of the most friendly mining jurisdictions worldwide. They offer excellent infrastructure. They have a world political, economic, and regulatory environment that it's inviting the mining industry to work there. From the COVID perspective, you see minimum restrictions, and we see a low risk for operational interruptions.

Working in Australia is an asset under the current economic and geopolitical environment. Talking specifically about New South Wales, we see a huge opportunity because it's an underexplored area in the country. New South Wales is the second gold producer state in Australia but is still under-explored. Just to give you an idea of the current gold endowment, it exceeds a hundred million ounces of gold and 1 billion ounces of silver.

The province is offering a great opportunity with limited work historically. So, that's where we see the huge potential. Some small-scale production shows grades of up to 1,600 grams per ton of silver and over 130 grams per ton of gold. Again, this is just a small-scale production, but we see the potential in the future. And the portfolio we are building is in the same proximity as similar mines that are already in operation, which we see in the future has some strategic advantages for us.

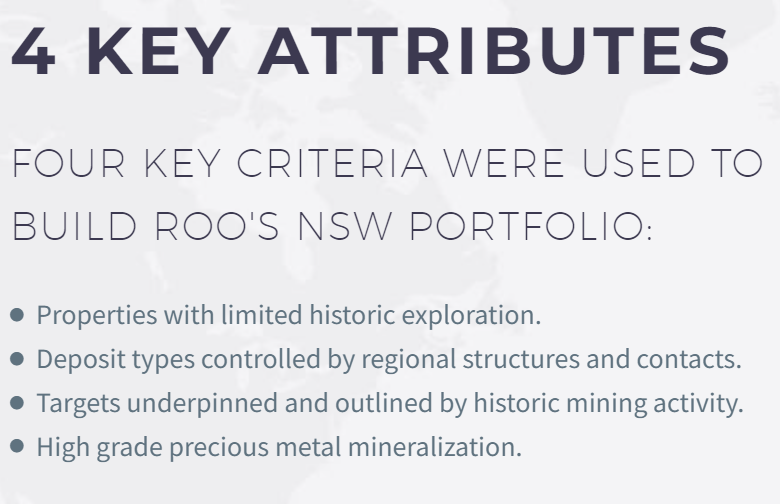

Maurice Jackson: Let's go visit your property bank, which consists of 14 high-value gold and silver projects. But before we do, please walk us through the four key attributes that Roo Gold used to select each of your projects respectively.

Carlos Espinosa: The first point, it's properties with limited historic exploration. And why is that? It's because we see the huge upside in this area, and we are acquiring a very competitive price, and we can flip it into something very, very valuable. The deposit types are controlled by regional structures and contacts that allow us to have access to those properties. And those targets are underpinned and outlined by historic mining activity. And we see, finally, high-grade precious metal mineralization in the area. So those are the four points we focused on.

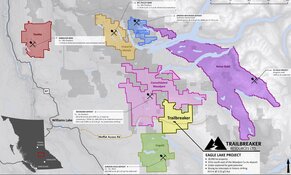

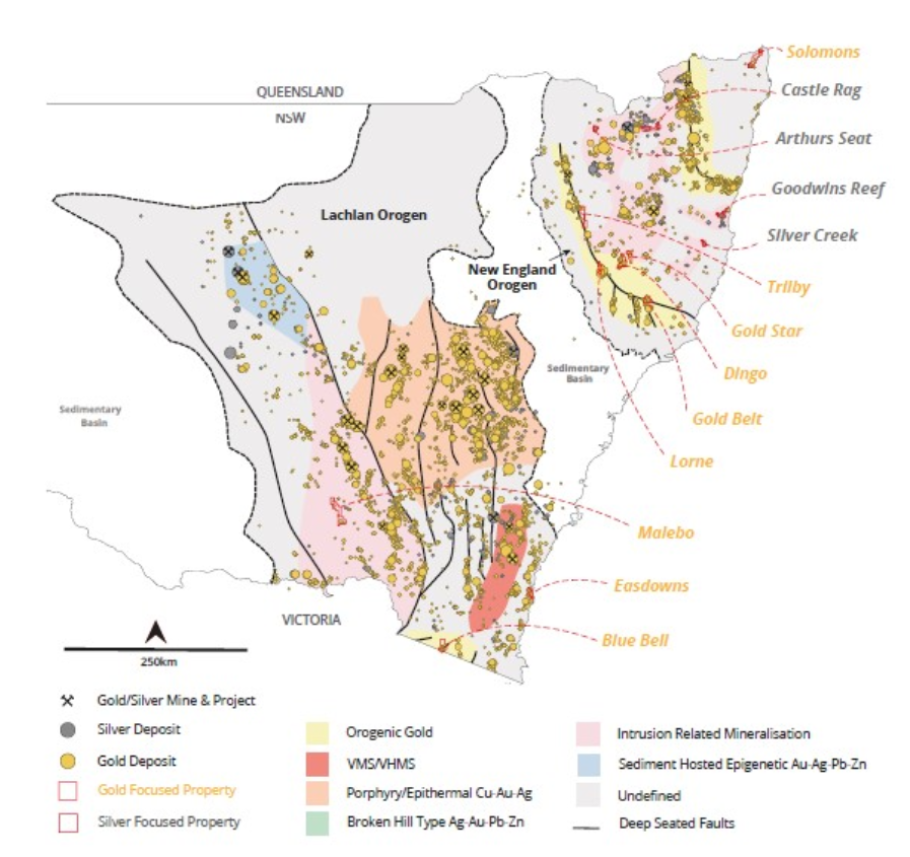

Maurice Jackson: I have a map before us highlighting your property portfolio, which consists of approximately 1,400 square kilometers and 137 historic gold mines. Beginning with your high-value goal projects, please introduce us to your projects and the opportunity before us, beginning with the projects that you're currently conducting exploration work on.

Carlos Espinosa: We have 10 properties covering a total of over 1,200 square kilometers. That includes 106 historic gold mines and prospects with a highly mineralized, with relatively unexplored work in New England Orogenic Terrane and the other mineralized Lachlan Orogenic Belt.

So mineralization is mostly an orogenic type associated with a large-scale structure making for very attractive and large targets. There are 12 strike kilometers of the significant gold mineralized region, the Peel-Manning Fault system. So just to give you one example of one of the RooGold properties, Lorne, it's 102 square kilometers, and we already have 28 historic gold mines and prospects, including the historic Golden Star mine, up to 500 meters of underground working with a historic Marquis of Lorne mine that reports grades up to 15 grams of gold. So that's the type of what we are doing down there.

Maurice Jackson: Moving on to silver, please introduce us to your high-value silver projects, and which ones are RooGold actively conducting exploration work on?

Carlos Espinosa: On the silver side, we have four properties covering a total of 272 square kilometers. Again, we have historical gold, silver mines, and prospects. We have, in this case, 31 historic silver mines that are relatively unexplored in the New England Orogenic Terrane. All the properties are largely unexplored since the early '90s. Little to no drilling and almost any exploration, but we see several styles of mineralization that are present, including intrusion-related vein stockwork targets and low sulfidation epithermal types.

Maurice Jackson: Well, Mr. Espinosa, I'm still smiling about the 15 grams of gold there.

Carlos Espinosa: So do I.

Maurice Jackson: Multi-layered question for you, sir; what is the next unanswered question for Roo Gold? When can we expect a response? What do you determine success, and what can we expect as far as news flow?

Carlos Espinosa: That's a good question, but it's a lot of work ahead of us. Roo Gold is still a relatively new company. We built this portfolio through acquisitions, and we are currently in the process of signing land access on every property. Currently have a couple of land access agreements in place with the Gold Belt and Goldstar properties. And we are continuing to work with the rest of those assets.

So we need to implement more land access for our remaining properties. We are still doing some chip samples, and we have already sent some samples to the lab. Following will be some geophysics and, eventually, planning for a drilling program on the high target areas we find. But it's still a lot of work ahead of us. So we will continue flowing the information to the market today. We were happy to share the information about the acquisition.

Probably in a couple of weeks or three weeks, we will have the first lab results for some of those chip samples. And in the meantime, we will try to continue signing agreements for the land access and getting more samples to allow us to better prepare our drilling program in the area.

Maurice Jackson: Leaving the project site, let's discuss some important topics germane to your projects. Do you own your projects 100%?

Carlos Espinosa: Absolutely. We are very happy about that. We don't have any royalties or any other commitments. So we are very, very proud of that.

Maurice Jackson: And just for the record, are you fully permitted?

Carlos Espinosa: I could say yes, with the exception that we are still in the process of getting the land access on some of the properties. So we are working on that part.

Maurice Jackson: And speaking of that access, how is infrastructure?

Carlos Espinosa: The infrastructure is really good. The challenge we have had in the last few months was the weather. We had a flood in the area that didn’t allow us to have access to the property where it's something that happens once in the last 60 or 70 years in Australia. That’s mother earth for you sometimes. But generally speaking, we have very good infrastructure. We don't have any issues, and we see an easy way to work there.

Maurice Jackson: Is the ultimate goal to build a mine or arbitrage?

Carlos Espinosa: Still too early to have a firm position on this. But if you ask me, I would love to build a mine. However, when we see the times, we need to sit down and analyze what is best for the company and our shareholders. But the initial idea is to work having a mindset of building a mine.

Maurice Jackson: We've discussed the good. Let's address the bad. What can go wrong, and what are your action plans to mitigate those possible wrongs?

Carlos Espinosa: The mining industry is a risky business. There are a lot of things that could go wrong. In our case, we can find nothing on our properties that we deem as a great concern. And the way we are going to try to minimize risk will be the acquisition of this huge land package. We are working on trying to identify which parts of all these properties have a higher potential for development.

In other words, we probably have several properties in the same area, but we have a larger portfolio than most of the junior companies in Canada. So, what we believe is we are diversifying the risk, putting several properties, and eventually, we need to decide either where we want to spend more time and money, where it's not worth spending that time and that money.

Maurice Jackson: Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Espinosa, please introduce us to your board of directors and management team, and what skill sets do they bring to Roo Gold?

Carlos Espinosa: Absolutely. On the board, we currently are a small team on the board members. It's myself, Michael Singer, and Michael Mulberry. We are planning to expand this board. We're probably going to add one or two more members very soon, but for now, it's the three of us.

Michael Singer is an executive with extensive financial management, capital market experience, and corporate governance experience, mainly in the pharmaceutical and medical cannabis industries. But he's bringing a lot of experience in corporate governance, which is helping us to start building the right foundation for the company and have a strong foundation for the future and the growth of the company.

On the other side, Michael Mulberry has over 30 years of experience working in the public and private mining companies in Canada and overseas. He brings experience, and his intellectual capital is an intangible asset that doesn’t reflect on the balance sheet.

In terms of management, I'm the CEO, and we have Alexandra Bonner. Alexandra is our VP of exploration. She's based in Australia. She's Australian with more than 15 years of corporation mining and corporate development. She works in precious and base metals. So she's bringing a lot of experience to the company. And it's very important to have someone like her down there because she's leading the plans for the development and executing the exploration programs.

Also, we have Mart Rampe, who is our land manager and technical advisor. He's helping us mainly with the negotiation on the land access with the locals. And we have strong advisors to the board and the management. We have a Dr. Chris Wilson, who is a geologist with over 30 years of experience. He had been working worldwide on several projects, from exploration to production. We have Dr. Quinton Hennigh, who, I mean, he doesn't need to have an introduction with over 25 years of experience. He leads team support exploration in Newcrest and Newmont and so on. So it's amazing to have him with us. And we also Kym Revington, he's our technical advisor based in Australia. He has over 20 years of experience in the mining industry as well. So he's adding a lot of value to the company.

Maurice Jackson: Well, it seems like your team has a lot of commercial and exploration success. And speaking of that word, success is a proven pedigree of success. I want to ask you about Carlos Espinosa. Who is he, and what makes him qualified for the task at hand?

Carlos Espinosa: I'm very excited and pleased to be here as a part of the team. I've been in the mining industry for over 12 years. I am the former CEO of Monarca Minerals, which is another Canadian company listed here on the TSX.V. And we used to have, or we had assets in Mexico, and it has products overseas. And also, I was on the board of Monarca. I was on the board of Silver X Mining. I worked with an Argentine mining company in the process, from being private to going public.

So, I had quite a good experience in the industry before that. I was working on the TSX and TSX Venture. In my last position there, I was the head of global mining. My role there was to recruit mining companies to go public in Canada.

Therefore, my time in the TSX gave me very good exposure to Canadian capital markets and a better understanding of the mining industry and how the Canadian capital markets merge in a very unique position worldwide. That is why Canada is leading in the mining industry and the mining capital markets.

Combined, I bring this experience with me to Roo Gold. Before that, I was more focused on international business development. I am originally from Mexico, and I have been doing international business for more than 25 years, probably. So I have a lot of experience also doing business overseas, learning about different cultures, and dealing with working in remote locations.

Maurice Jackson: Let's get into some numbers. Mr. Espinosa, please provide us with the capital structure for Roo Gold.

Carlos Espinosa: The share price has been under a very challenging market in the last few months. We are currently around $0.11 cents, and our outstanding shares are 59 million. We have 100 thousand options and 22 million warrants outstanding. On a fully diluted basis, we have 82 million shares, and the market cap is around 6.5 million. And currently, we have $1.5 million in cash.

Maurice Jackson: And full disclosure, I am a proud shareholder.

Carlos Espinosa: Oh, thank you very much. I'm happy to hear that.

Maurice Jackson: All right, sir. And how much debt do you have?

Carlos Espinosa: We don't really have debt. We have just deferred accounts payable on a normal operation but nothing to concern.

Maurice Jackson: All right. And what is your burn rate?

Carlos Espinosa: It is a tough question because we have some unique expenses, with the procurement of equipment and some other miscellaneous expenses, but we are around $50,000 to $60,000 in a month.

Maurice Jackson: What percentage of ownership does management have, and who are the major shareholders?

Carlos Espinosa: On the management and director, we have around 10% of the company. Probably 7% is for institutional investors, and the rest is between retail and friends and family.

Maurice Jackson: Are there any redundant assets on the books that we should know about?

Carlos Espinosa: No.

Maurice Jackson: Are there any changes to control fees, and if yes, what is the compensation?

Carlos Espinosa: We don't have any fees. So, I think that's great for the investors.

Maurice Jackson: Oh, that's very complimentary, sir. Is management charging a consultant fee for any services?

Carlos Espinosa: No. We have our salary or the fee just for the role we are hired for, but that's it. Nothing else.

Maurice Jackson: In closing, sir, what keeps you up at night that we don't know about?

Carlos Espinosa: Well, I think it's something that keeps awake a lot of people, which are the current market conditions, macroeconomics, and the geopolitical situation globally. Because it's hard to build mid-term or long-term plans when the market conditions are regularly changing. Every day and every night, I think about what we can do better or how we can avoid any risks. But I mean, it's not easy to answer because every morning you find something new on the news.

But it's what it is. At least I feel comfortable that we are in a very safe jurisdiction, and we have a great team. And we have in our hands a nice land package that we look forward to developing value for our shareholders.

Maurice Jackson: What would you like to say to shareholders?

Carlos Espinosa: Well, first of all, I would like to thank them for investing in Roo Gold. We are happy to have you with us. We have skin in the game, so we are together in this. And really, what I want to ask investors is to stay connected and please be patient because this part of the work we're doing today is not exciting, let's say, or doesn't show a lot of progress. But it's the foundation. basically, getting those permits for the land access will allow us to go and move faster to the following phases, and the news and the progress and the good news will come in the future.

To our shareholders, we are working for you, we're working with you, and just ask that you be a little patient. I want to thank you for choosing Roo Gold as part of your portfolio.

Maurice Jackson: Last question, what did I forget to ask?

Carlos Espinosa: I think it's a very good conversation, but probably what you forgot to ask is: What's going to happen next when we have our land access? And what we are planning to get chip samples?

We already had some, but it's going to be a large number of chip samples for different regions that allow us to have better information about our properties.

We're going to do some geophysics, identify those hot targets, and then begin to start drilling those targets; as I mentioned earlier in this conversation, it's an unexplored region. In the whole land package that we have, there are only 28 drill holes historically. So, it's a lot of work to do ahead, and that's where we are and going too. So, we are planning to move forward with the drilling program in the months ahead.

Maurice Jackson: Mr. Espinosa, for readers that want to learn more about Roo Gold, please share the contact details.

Carlos Espinosa: It's RooGoldinc.com.

Maurice Jackson: Mr. Espinosa, it's been a pleasure speaking with you today. Wishing you and Roo Gold the absolute best, sir.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will improve the world.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site and also to create content by interviewing experts in the sector. Proven and Probable LLC does accept stock options and cash as payment consolidation for sponsorship. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING, OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.”

All Rights Reserved.

Images provided by the author.

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Roo Gold Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Roo Gold Inc. is a sponsor of Proven and Probable. Proven and Probable disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.