The invasion of Ukraine and the economic fallout from the pandemic are pushing global crude oil and natural gas prices to levels not seen in eight years — the price of crude oil has risen to more than $100 a barrel.

For the last two years, Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTCMKTS) has been in the process of shifting its focus to green energy. But it still has oil and gas assets, and the company said it expects to see cashflow increase about 15% to 18% in the sector this year over last year.

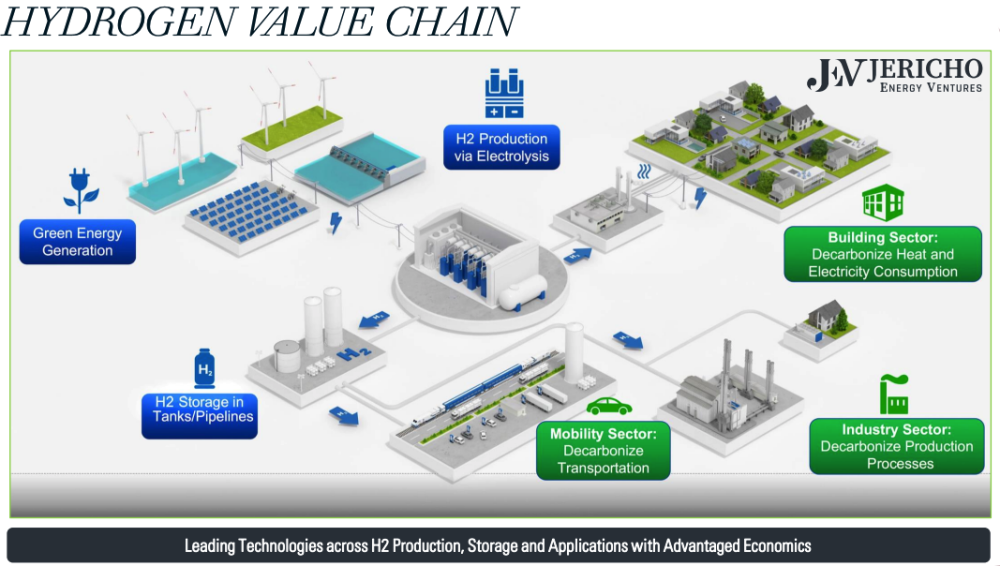

Those profits are going right back into Jericho's push toward hydrogen, Chief Executive Officer Brian Williamson told Streetwise Reports.

"Hydrogen is truly a clean energy, and most people don't understand why it is so clean and how easily it can be implemented. Project deliveries will make that more tangible to investors."

—Independent Investor PennyQueen

"It only creates cashflow to move us further down the hydrogen value chain to doing what we want to do with our company," Williamson said. "We like where we're positioned. … We never gave up on our oil assets, and we don’t envision a world where gas isn't a part of the future, at least in our lifetime. But we feel like we're perfectly positioned for this time in this day."

Independent investor PennyQueen agreed, saying she expects the transition to clean energy to take as long as 25 to 30 years.

"I expect the trajectory of hydrogen to become apparent to the world over the next two years, but I expect Jericho's price to move appreciably in the next 12 to 18 months as orders and deliveries build," PennyQueen told Streetwise Reports. "Hydrogen is truly a clean energy, and most people don't understand why it is so clean and how easily it can be implemented. Project deliveries will make that more tangible to investors."

The Journey to Green

But hydrocarbons are still responsible for about 85% of energy consumption globally, Jericho said.

Jericho began its transition to green energy in June 2020. In January 2021 it announced the acquisition of Hydrogen Technologies, which has developed a high-temperature Dynamic Combustion Chamber boiler with zero-emissions hydrogen to generate heat, hot water, steam, and combined heat and power. Last year, Jericho announced it would be collaborating with Rémy Cointreau’s Bruichladdich Distillery in Scotland to install the boiler to run its stills that produce Scotch and artisanal gin.

In July 2021, Jericho invested in H2U Technologies Inc., a company developing a "proprietary ultrahigh throughput, AI-driven, electrocatalyst discovery process for electrolyzer and fuel cell applications" with Southern California Gas Co.

Jericho also has invested in Supercritical Solutions Ltd., which is developing a new class of water electrolyzer that will allow low-cost hydrogen production. Jericho led the seed series funding round for SuperCritical and was joined by Chris Sacca's Lowercarbon Capital as co-investor.

The company said its oil and gas assets are primarily focused in the Hunton, Mississippi Lime, Woodford Shale, and the Anadarko Basin STACK Play formations in Oklahoma, where it holds about 52,000 net acres.

'Our Focus for the Future'

That oil and gas business was the bedrock of the company since it was formed in 2014. But with years of low prices, the sector was "beat up," Williamson said.

Williamson remembers being virtually alone at investor conferences. "Nobody cared anymore," he said. "People had moved on from oil and gas — people had had enough."

But the break during COVID-19 enabled the company to slow down and look at look at a new path. And it wasn’t that different from the path it was on. Jericho realized it could use its same expertise and strengths and apply them to green energy.

"We came to realize that we really liked the positioning of hydrogen, because it took advantage of everything we knew," Williamson said. "It gave us a chance to really make sure our research was right, and what we were trying to accomplish was achievable. … We are dead set on making hydrogen our focus for the future."

The sector is also a win for investors on more than one level, according to PennyQueen.

"Investing in clean tech is a way to feel good, knowing that you are directly influencing environmental change while increasing your capital," she said.

Jericho has 225 million shares outstanding and trades in a 52-week range of CA$0.98 and CA$0.36. Its market cap is CA$84.48 million.

Read what other experts are saying about:

| Want to be the first to know about interesting Clean Energy and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Jericho Energy Ventures. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures, a company mentioned in this article.