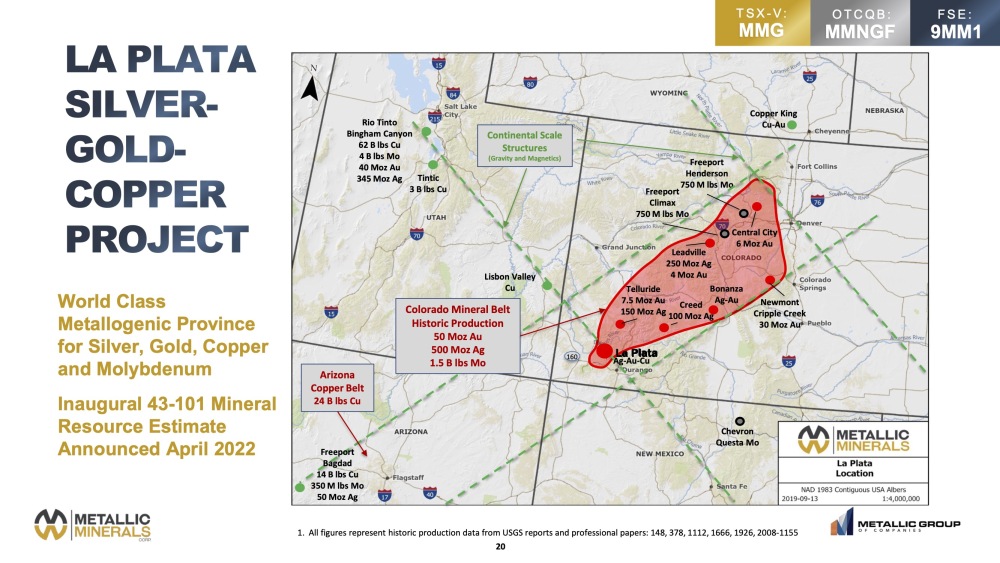

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB) La Plata copper-silver porphyry project in Colorado has its first resource estimate, and it will give copper-hungry companies seeking assets something to chew on as copper prices continue to hover around $4.50 per lb, down from their all-time highs in early March.

The National Instrument 43-101-compliant La Plata resource rings in at 889 million lb copper and 14.975 million ounces silver (Moz Ag) in a constrained model containing 115.7 million inferred tonnes at an average grade of 0.39% copper-equivalent (CuEq) (0.35% Cu and 4.02 grams per tonne silver (4.02 g/t Ag), using a 0.25% CuEq cutoff grade.

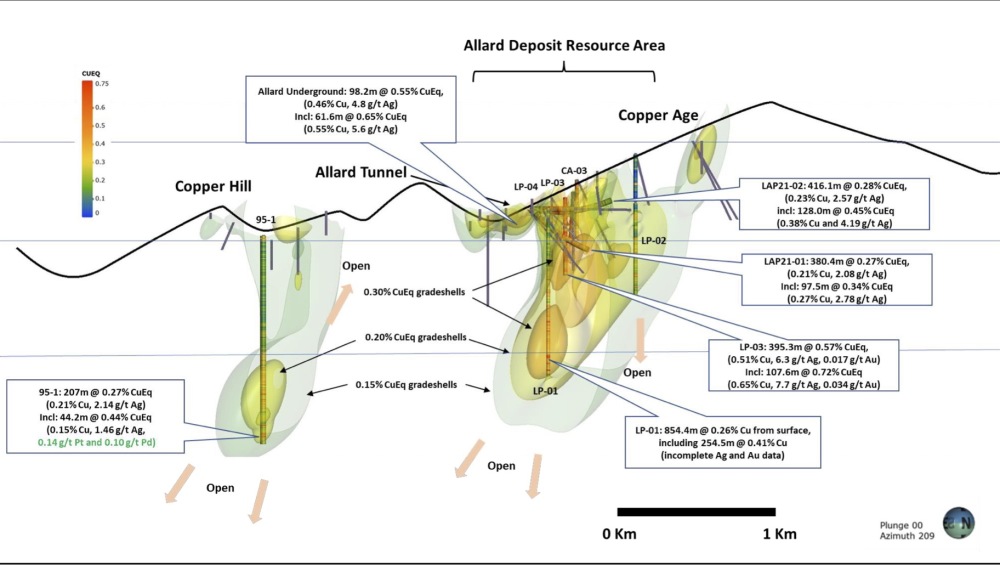

The resource focuses on the central Allard copper-silver porphyry deposit.

The mineralized zone that forms the resource is a single porphyry intrusive-hosted sulphide system that was drilled over an area measuring about 1 kilometer by 400 meters, with the spacing between holes typically varying between 50 and 100 meters (some spacing is 150 meters).

The deepest hole drilled ended in mineralization about 1 km below surface.

“It's a big system. And that central hole — and others in this area — basically started in mineralization and then ended in mineralization. What that tells us is we have got to keep drilling to understand how big it’s ultimately going to get,” Metallic Minerals Chief Executive Officer and Chairman Greg Johnson told Streetwise Reports.

Metallic Acquired La Plata at the Bottom of Metal Price Cycle

Metallic acquired La Plata (which translates to “the Silver” and was discovered by Spanish explorers in the 1700s) in an equity-based transaction in late 2019. The deal was for a total of 10 million Metallic “units” and $500,000 cash, once certain milestones are completed through 2023. Each unit consists of a share and a half purchase warrant that is subject to certain terms.

There is also a 2% NSR that can be bought down to 1.5% (neither amount is likely to impede any takeover bid as producers acquiring copper properties in the current copper price environment are paying much more for lesser assets, often in more volatile jurisdictions).

Before La Plata found its way into Metallic’s hands, Kennecott (Rio Tinto Plc's (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) U.S. exploration group), Exxon Mobil Corp. (XOM:NYSE) (when oil and gas companies still looked for base metals deposits) and Phelps Dodge (now Freeport-McMoRan Inc. (FCX:NYSE)), had drilled a combined 56 holes totalling almost 13,000 meters on the property.

Since acquiring the project in late 2019, Metallic has completed an additional 1,980 meters of core drilling, resampled historical drill core, and took underground samples from the Allard deposit. The junior also conducted airborne and ground-based geophysics and surface sampling across the broader property. The resource was calculated by SGS Geological Services using the recent and historical data.

The work Metallic has done at La Plata is really the only modern exploration undertaken on the property in about 50 years. Through focused confirmation drilling the company was able to develop a NI 43-101 resource estimate for the property in fairly short order.

Drill results along the Allard porphyry system have shown some impressive numbers. Hole LP-03 returned 395 meters grading 0.57% copper equivalent (CuEq) (0.51% Cu, 6.3 g/t Ag, 0.017 g/t Au), while hole LP-01 intersected 854 meters grading 0.26% Cu, including a higher-grade interval of 254 meters grading 0.41% Cu — both holes started and ended in mineralization.

Allard remains open to expansion at depth and along strike. And 16 more untested porphyry centers have been identified using advanced machine learning technology on the greater La Plata property area. Metallic is working with Goldspot Discoveries Inc. (SPOT:TSX.V), a Vancouver-based firm that uses geological and geophysical data, in tandem with artificial intelligence, to better “understand” metal deposits.

Johnson says some of those targets have similar or even stronger mineralization signatures than the Allard system itself.

Metallic plans more follow-up drilling and geophysical surveys in 2022, especially in the epithermal zones outside the porphyry core. Johnson believes those zones could hold precious metals mineralization, perhaps not dissimilar from their Keno Silver project in Yukon.

“We would anticipate adding value as we drill the system more to test its ultimate size extent and to bring in value for gold and other metals as well. In particular, there is good potential to bring in high-grade epithermal silver and gold systems that are nearby but aren't in this (resource) right now,” Johnson told Streetwise Reports.

A Two-Flagship Project Company?

With Metallic advancing its flagship Keno Silver property in Yukon, and now La Plata, it provides more options for shareholders, Johnson says.

“We are effectively a two-flagship company now,” Johnson explained. “Already we are seeing interest from producers based on the quality and ‘blue sky’ potential of the two assets.”

“Our belief is that La Plata is a really good project and adds value to what we were already being valued on for our half of the Keno Hill District. We'll be able to advance these (projects) in parallel, and down the road, the nice upside for shareholders is that we may determine that there are actually two company-makers here,” Johnson told Streetwise Reports.

At $25/oz silver and $4.50/lb. copper, it doesn’t take long to calculate that the current in the in-the-ground metal value of 15 Moz Ag and 900 Mlbs Cu is about $4.4 billion. Even at a 75% discount rate to current metals prices to account for the inferred grades, potential capex, and mining costs, etc., La Plata remains a potential billion-dollar asset in the making.

Even without the maiden resource at La Plata, Vancouver-based equity research firm Couloir Capital had a 12-month “fair value” target on Metallic of CA$0.68.

Renowned mining investor Eric Sprott owns 16% of Metallic, while San Antonio, Texas - based US Global Investors and Hungarian firm OTP Funds are also large shareholders. Management and insiders own about 19%.

Metallic has a current market cap of about $60.5 million and trades in a 52-week range of CA$0.66 and CA$0.42.

Sign up for our FREE newsletter

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Metallic Minerals Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metallic Minerals Corp., a company mentioned in this article.