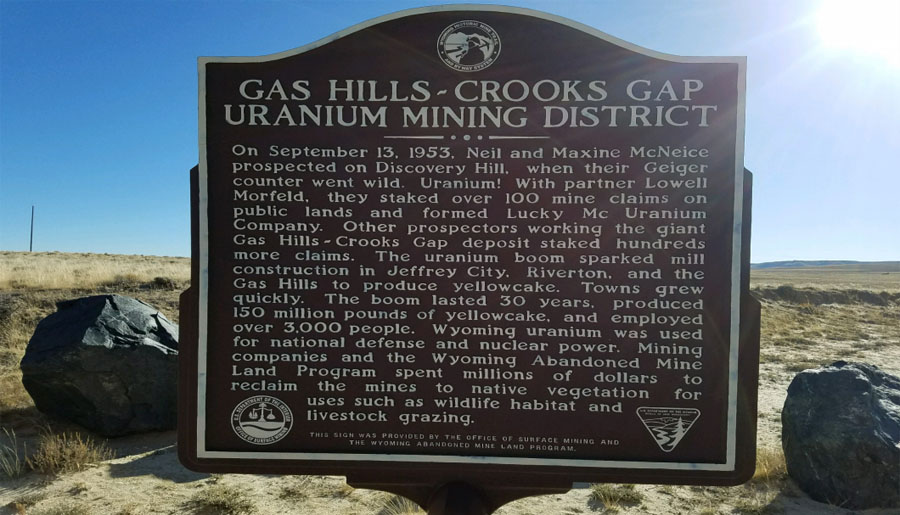

In a June 30 research note, analyst Mitch Vanderydt reported that Eight Capital increased its target price on Azarga Uranium Corp. (AZZ:TSX; AZZUF:OTCQB) to CA$0.50 per share from CA$0.45 after including the results of the Gas Hills preliminary economic assessment (PEA) into its model on the company. Azarga's share price today is about CA$0.29.

Vanderydt discussed how the PEA links Azarga's Gas Hills and Dewey Burdock in situ recovery (ISR) projects, treating the former as a satellite of the latter, and why this matters.

First, the PEA has uranium ISR feed mined at Gas Hills in Wyoming being trucked to Dewey Burdock in South Dakota for processing there. Doing this would double annual U3O8 production at Dewey Burdock, taking it to 2,000,000 pounds, Vanderydt noted.

Second, the PEA's "combining" Gas Hills and Dewey Burdock versus keeping Gas Hills an independent secondary project benefits Azarga, Vanderydt highlighted. Instead of Gas Hills getting discounted by investors, which usually happens with secondary projects, it should boost Azarga's stock price given its strong economics. Those Gas Hills economics, according to the PEA, include an after-tax net present value at an 8% discount of US$102.6 million (US$102.6M), or US$55 per U3O8 pound. Forecasted capex is only US$26M.

To process Gas Hills' feed, Dewey Burdock's plant would need enlarging, to the tune of US$15–20M, Vanderydt indicated.

That being the case, Azarga's plan and timeline are this. It would build Dewey Burdock once it receives a mine permit from South Dakota, the last permit it needs. Azarga could have it in hand as early as the end of this year, Eight Capital purports.

Receipt of this permit could "rerate the stock and possibly lead to Azarga being taken out by the operators of the neighboring ISR plants, namely Cameco, Energy Fuels, Peninsula Energy, Uranium 1 or URE," Vanderydt wrote.

Once Dewey Burdock construction is completed, Azarga would bring the project online, around late 2022-early 2023. Then, roughly three years after the operation start, Eight Capital estimates, the uranium miner would pursue getting the necessary permits amended to allow for a plant expansion.

"This would free up additional plant capacity for Gas Hills to be developed," Vanderydt wrote.

Eight Capital has a Buy rating on Azarga Uranium.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Azarga Uranium. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azarga Uranium, a company mentioned in this article.