Solar installations surged 46% the first quarter of this year, accounting for 58% of all electric capacity additions in the US. Installations are projected to climb further, aided by the Biden administration’s clean energy efforts and rising corporate investment in renewable energy.

However, supply-side headwinds for the industry remain. The costs for solar modules are climbing as the price of polysilicon surges to near-decade highs. Further, the EIA forecasts that a continued rise in costs could limit demand for new solar projects and delay up to 15% of new solar developments this year, both of which are worrying signs that the solar industry may be in for more volatility ahead.

Related ETF & Stocks: Invesco Solar ETF (TAN), First Solar (FSLR), Sunrun (RUN)

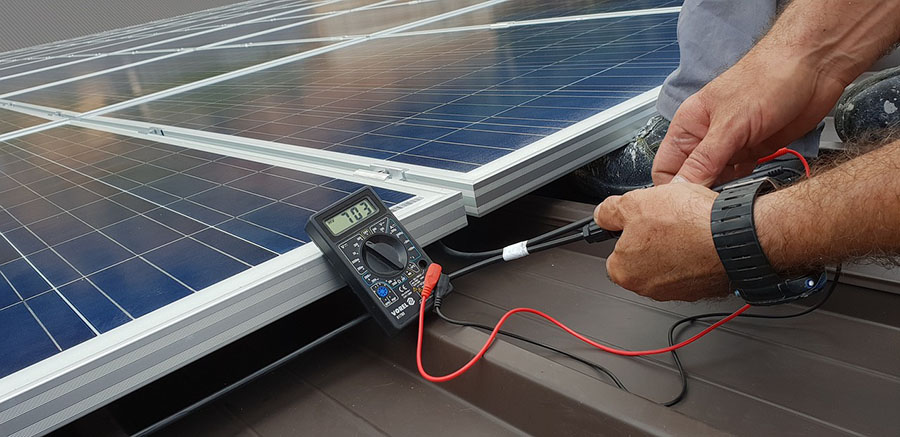

Solar Gets Off to a Hot Start

According to a report from energy research firm Wood Mackenzie and the Solar Energy Industries Association, solar installations surged 46% to more than 5 gigawatts (GW) in the first quarter of 2021. That figure is forecast to climb to 24.4 GW installed this year, which would be an increase of 24% compared to 2020.

The report states that the impressive installation data is due to strong demand from corporations striving to reduce their greenhouse gasses as well as companies trying to capitalize on lower costs. Further, Bloomberg recently projected that nearly 60% of all power installations through 2025 will be solar based.

Per Electrek, the 5 GW of new solar capacity accounted for 58% of all electric capacity additions in the first quarter. Utility-scale installations led the way with 3.6 GW of new capacity, while residential solar sales added 905 megawatts, an increase of 11% over the same period last year.

Overall, the US solar market has now added 100 GW of installed electric generating capacity, more than doubling the size of the solar industry over the last 3.5 years.

Further, CNBC notes that a long-standing federal tax credit has been key for solar companies to generate heightened levels of activity. Currently, owners of both commercial and residential solar can deduct 26% of the cost of the system from their taxes through 2022, according to Energy Sage. That number falls to 22% in 2023 and is reduced further to 10% in 2024 for just commercial use projects, as there is no federal tax credit for residential solar energy systems in 2024.

However, the Biden administration is pushing to extend that federal tax credit through the rest of the decade in an effort to drive further investment in clean energy. The aforementioned report from Wood Mackenzie notes that utility-scale solar would benefit the most from President Biden's clean energy proposals, highlighting the fact that nearly 75% of solar installations in the first quarter were utility-scale projects.

Headwinds Threaten Solar Industry's Profitability

Strong first quarter sales and clean energy initiatives from the Biden administration should further accelerate solar energy adoption. However, serious supply chain challenges that the industry will have to overcome remain.

According to a report from Reuters, global solar developers are beginning to slow down their installations due to the rising costs of production.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on June 17.

As MRP has noted, prices for polysilicon have been steadily climbing, creating a slew of supply chain issues across the solar industry. Those issues could continue to worsen, as a recent report from Bernreuter Research, highlighted in PV Magazine, found that polysilicon prices have surged 160% since the beginning of the year, from $11/kg to roughly $28.5/kg. Bloomberg recently reported that the current cost of polysilicon is at its highest level since 2012, which in turn has boosted the price of solar modules by 18%, after falling 90% over the last decade.

Rising costs could have a dramatic effect on production. Roth Capital writes as much as 15% of utility-scale solar projects could be delayed this year, while analysts at Solarzoom predict that if price pressures persist, state-owned power giants in China could push solar projects to next year. If that happens, Solarzoom projects the delays would contribute to the first year of negative growth in global solar installations in 17 years.

IHS Markit recently added a bearish note to their global solar installation projections, which are still forecast to grow 27% in 2021. However, the note states that additional increases in module costs could reduce their global solar installation projections to just 9% this year.

Additionally, Reuters was able to poll three panel makers in China, who stated they have raised their panels prices anywhere between 20-40% to offset the heightened cost of polysilicon. In the US, the second largest solar market behind China, solar developers are struggling to price projects for 2022, citing a lack of clarity on how long polysilicon prices will remain elevated. Currently, contract prices for solar projects in the US were up 15% in the first quarter compared with the same period in the previous year.

MRP has recently reported on a potential long-term remedy for the surge in polysilicon prices, in which perovskite solar cells are used as a replacement in the construction of solar panels. The Biden administration has dedicated $40 million to the research of perovskite materials, but the solar industry has yet to fully adopt the new method as research still develops while polysilicon prices continue to run wild.

To conclude, robust corporate investment in renewable energy, as well as the Biden administration's clean energy policy efforts, should drive global solar installations higher in 2021. However, that growth may be capped by skyrocketing polysilicon prices, causing headaches for solar developers across the globe and leading to project delays from heightened costs of production being passed on to consumers.

For Investors

After a strong year of growth last year, solar stocks have largely underperformed this year. First Solar (FSLR) is down nearly 22%, while Sunrun's stock (RUN) has fallen roughly 31% over that same period. Meanwhile, the Invesco Solar ETF (TAN) has fallen 22% year to date.

Last February, MRP closed its LONG Solar theme due to the sector's extended valuations. Between the theme's inception in May 2018 and its suspension in February 2021, the TAN returned +349%, vastly outperforming S&P 500's +44% gain, and more than quadrupling the First Trust Global Wind Energy ETF's (FAN) +76% rise over the same period.

As the sector continues to mature, MRP will be monitoring development and growth prospects across this industry, which has a lot of long-term promise but may continue to struggle with several short-term hurdles.

Originally published June 17, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.