In a June 18 research note, analyst Zegbeh Jallah reported that ROTH Capital Partners increased its price target on Clearside Biomedical Inc. (CLSD:NASDAQ) to $15 per share from $9 after the biopharma reported a set of trial data showing early efficacy. Its current price is about $4.91 per share.

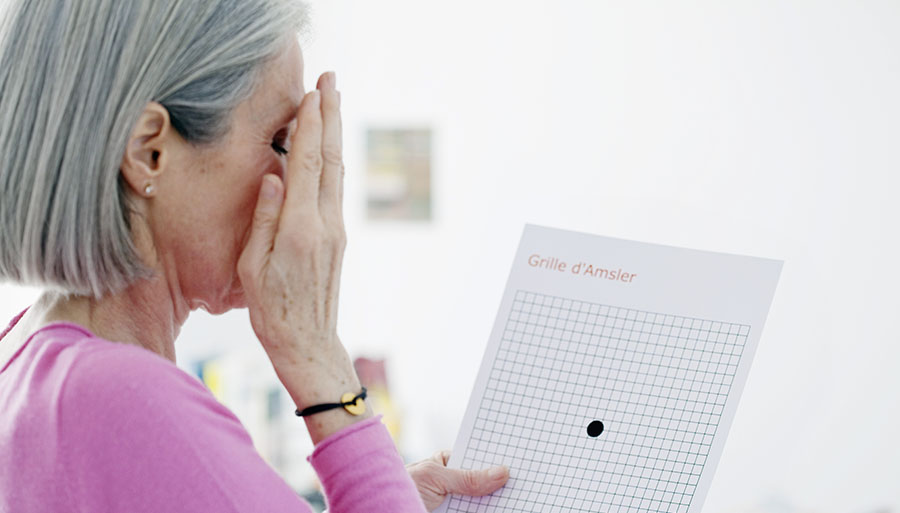

The safety and efficacy results that Clearside announced, Jallah noted, were from its Phase 1/2a dose escalation study of CLS-AX (axitinib) in pretreated wet age-related macular degeneration (wAMD) patients. Data were specifically for Cohort 1, the group that received 0.03 milligrams of the inhibitor of vascular endothelial growth factor (VEGF) receptors 1, 2 and 3. This was the lowest of the three tested doses, with the others being 0.1 and 0.3 milligrams. Cohort 1 received one dose of CLS-AX one month after receiving Eylea, an anti-VEGF therapy.

Jallah highlighted that this data set showed CLS-AX to be safe and efficacious. Cohort 1 experienced a mean improvement in best corrected visual acuity (BCVA) of +4.7 letters, and this was after they had lost -0.2 letters following the Eylea injection the month before their CLS-AX dose. Further, none of the patients required retreatment earlier than one month after receiving CLS-AX, and two patients went as long as three months without retreatment.

"While we expected clean safety given the low dose, increases in BCVA beyond that achieved with Eylea were a surprise," Jallah wrote. "With this encouraging start, we're adding CLS-AX to our model and increasing our price target."

Jallah pointed out that investors are looking for three months of durability, which 0.03 mg did not achieve in Cohort 1, but its falling short likely was due to the dose being so low, the analyst purported, indicating that preclinical studies support this hypothesis. Also, Jallah posited that Clearside likely could achieve longer duration and improved efficacy by keeping CLS-AX out of the vitreous humor and, instead, maintaining high concentrations of it in the retinal pigment epithelium–choroid–sclera (RCS). This compartmentalization would allow for the use of CLS-AX doses even higher than those tested in the study.

"Therefore, we look forward to the update from Cohort 2, expected by year-end," Jallah wrote.

ROTH has a Buy rating on Clearside Biomedical.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

Disclosures from ROTH Capital Partners, Clearside Biomedical Inc., Company Note, June 18, 2021

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Within the last twelve months, ROTH has received compensation for investment banking services from Clearside Biomedical, Inc.

ROTH makes a market in shares of Clearside Biomedical, Inc and as such, buys and sells from customers on a principal basis. Shares of Clearside Biomedical, Inc may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities.ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months.