The Gold Report: Barry and Ryan, in March, you attended the Prospectors & Developers Association of Canada (PDAC) convention, the largest mining gathering in the world. What is your main takeaway?

Barry Allan: Probably the biggest takeaway this year was while attendance was down marginally, the quality of the companies in attendance was very, very good. It wasn't this frenetic activity of a bunch of people running around looking for meetings, as there were better quality companies in attendance and making presentations. I guess it is characteristic, to be fair, of what we'd expect to see in a bear market, that the good always survive, that the good always continue to make discoveries and move assets farther down the track. I think that's exactly what PDAC was telling us this year.

TGR: You prepared a report for PDAC highlighting more than a dozen companies, not all of which are on your coverage list, that you believe have great potential. Would you discuss a few of these companies?

BA: What Ryan and I were attempting to do here was to profile some companies that were unique and caught our eye. Not all, as you say, were under coverage, but they were companies that we had some knowledge about and we found intriguing and interesting.

TGR: Which company would you like to start with?

Ryan Hanley: Red Eagle Mining Corp. (RD:TSX.V). I looked at its project a couple of years ago while I was in Colombia. We decided to point it out because it's one of the first major projects that has been able to actually get through the permitting phase in Colombia. There are a couple of reasons for this. One is that Red Eagle has done a good job on the community side and has its social license. It has communicated well with all of the stakeholders in the region. It also doesn't have the artisanal mining problems that some of the other players in the area do, at least not to the same extent, which has made the permitting process a little easier. In addition, Red Eagle's project is an underground operation; it's not looking at constructing a large-scale open pit.

"Red Eagle Mining Corp. is one of the first major projects that has been able to actually get through the permitting phase in Colombia."

Red Eagle now has everything in hand, including project finance, which I think is worthy of quite a bit of attention. It also is a pretty attractive deposit, a little bit over 5 grams/tonne (5 g/t) and a little over 400,000 ounces gold. There is quite a bit of exploration potential there as the deposit remains open down-dip and to the east, as well as offers a few satellite targets. We thought Red Eagle was one to definitely keep our eyes on because of how well it has been advanced, how it is fully funded and how it has exploration potential.

TGR: What is another company on your list?

RH: Rye Patch Gold Corp. (RPM:TSX.V; RPMGF:OTCQX), which is in Nevada. The main thing that caught my eye is it has a 3.4% net smelter royalty on Coeur Mining Inc.'s (CDM:TSX; CDE:NYSE) Rochester mine. Given where commodity prices are today, that has given Rye Patch about $4–5 million a year in revenue, which it can then use across its exploration projects. Rye Patch's main project, Lincoln Hill, is right next to the Rochester mine. It's scoped out as a small-scale operation, only about $30 million to build. It has an attractive internal rate of return because while it is low grade, it does have a low strip ratio, so the economics hold up in today's gold price environment.

"The economics of Rye Patch Gold Corp.'s Lincoln Hill project hold up in today's gold price environment."

Additionally, Rye Patch has several other exploration properties that are starting to look more interesting, including some in the Cortez Trend. Garden Gate Pass looks like it falls along strike of Barrick Gold Corp.'s (ABX:TSX; ABX:NYSE) recent Goldrush discovery, which is a little more than 8 million ounces (8 Moz) at 11.5 g/t. Being along strike of that makes Garden Gate Pass a pretty important exploration target, as is the Patty project, a joint venture with Rye Patch, Barrick and McEwen Mining Inc. (MUX:TSX; MUX:NYSE) in roughly the same area. Rye Patch is following all of these recent discoveries of high grade along the Cortez Trend, in addition to the project that it already has.

BA: We also profiled a company called Dalradian Resources Inc. (DNA:TSX), which is based in Ireland; it had caught our eye because of grade and good execution. This underground deposit is running in the 10 g/t area, looking like it has something north of 3 Moz gold in resources. It is test mining these high-grade, narrow-vein systems to prove up the grade. Dalradian is high grade, is approaching its mine development very smartly and doing what we think is a good quality job. So that caught our eye.

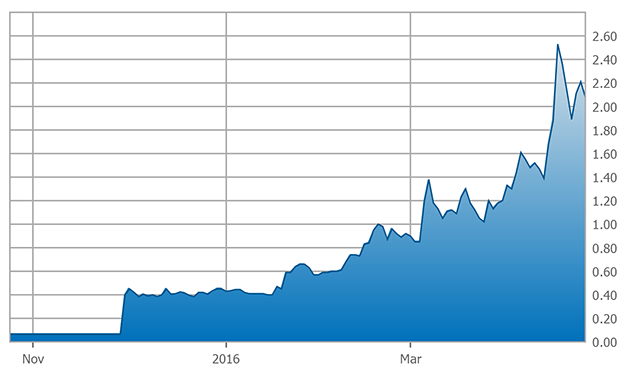

We selected LiTHIUM X Energy Corp. (LIX:TSX.V) out of interest in the lithium space and because of the people who were behind it, including Executive Chairman Paul Matysek. The company has assembled brine lithium properties in Argentina and has taken a fairly significant exploration bet on properties in the only producing area in Nevada. We saw some good people here getting a company organized and good sponsorship that would make sure the capital was there to advance the project further. It has, as time wore on, been certainly a darling of the marketplace and has shown some very spectacular equity returns. We would say it still is a bit speculative at this point, but it definitely has executed very well.

TGR: Do you think its Nevada location is giving it that extra push, given Tesla Motors Inc. (TSLA:NASDAQ) and its Gigafactory?

BA: That's certainly part of it. LiTHIUM X is not alone in trying to leverage the Clayton Valley for lithium production. What is more significant is the company expressed a clear intent that it was in the market to acquire such an asset, and it has subsequently executed on acquiring that. So what may have started off as an idea has quickly transformed into good exploration both in Nevada and Argentina. I think it's both of these together that has really taken the stock to where it is.

TGR: Since you released your PDAC report, two of the companies you profiled, Adventure Gold Inc. (AGE:TSX.V) and Probe Metals Inc. (PRB:TSX.V), have announced a merger.

BA: Those were two that we were fairly close to. We felt both Adventure and Probe were very good quality exploration plays run by very good quality people. We were not surprised that they have combined themselves into a common company. Their methodologies are very similar; one is more Quebec based than the other, but both are very good explorationists with good properties to go exploring and with cash. What Probe brought to the table was $20 million in cash, and Adventure brought good people and good properties.

TGR: Do you have any parting thoughts for our readers?

BA: Most of the equities we profiled in the PDAC report are much higher now than where they were in March. I think it's testimonial to the fact that the feeling in the mining industry is much better than it has been in a good long while, and that's getting expressed even at the junior level.

TGR: Barry and Ryan, thank you for your time.

Barry Allan is vice chair, mining group and senior mining analyst at Mackie Research Capital, and has been with the firm since 1997. He was named to Zack's Investment Research's Top 10 5-Star Analyst list in 2015, ranking No. 1 in North America for precious metals and No. 3 across every sector in North America. Allan has worked in the mining sector for over 30 years, serving as an exploration geologist before becoming a gold and precious metals mining analyst with CIBC, Gordon Capital, BZW and Prudential Bache. He holds Bachelor of Science degree in geology and a Master of Business Administration from Dalhousie University.

Ryan Hanley is a research analyst with Mackie Research Capital, covering the precious metals space, with a focus on junior and intermediate producers, and the mining services space, with a focus on mineral drillers. Hanley joined Mackie in 2010 and prior to becoming a research analyst in March 2012, he spent two years working as a research associate covering the precious metals sector. Hanley holds a Bachelor of Art from McMaster University in Hamilton, Ontario.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Red Eagle Mining Corp. and Rye Patch Gold Corp. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Barry Allan: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Ryan Hanley: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.