In a news release, British Columbia-based uranium explorer and developer Azarga Uranium Corp. (AZZ:TSX; AZZUF:OTCQB) announced "positive results of an independent Preliminary Economic Assessment (PEA) on its Gas Hills In-situ Recovery Uranium Project in Wyoming, U.S. following an increased mineral resource estimate announced by the company on March 30, 2021."

Azarga Uranium's President and CEO Blake Steele remarked, "We are extremely pleased with the results of our maiden in-situ recovery (ISR) PEA for the Gas Hills Project. The PEA demonstrates robust economics and expands the future production profile of the company into the state of Wyoming, which has a long history of successful ISR operations."

"The PEA results further validate our company's strategy of developing low-cost ISR projects as we continue to progress our flagship Dewey Burdock Project towards construction. With uranium markets in a structural deficit, Azarga Uranium is exceptionally well positioned to capitalize on the anticipated recovery in the uranium price through its two tier one development stage ISR uranium projects in the U.S.," Steele added.

The company advised that the base case valuation for the project outlined in the PEA estimates a pre-income tax internal rate of return (IRR) of 116% and a pre-income tax net present value (NPV) of US$120.9 million. On an after-tax basis, the PEA forecasts an IRR of 101% and a NPV of US$102.6 million. The firm noted that the NPV figures were calculated using a discount rate of 8%.

The firm stated that initial capital expenditures for the Gas Hills Project NI 43-101 compliant PEA are estimated at US$26.0 million and that cash flows generated from the project are expected to turn positive in the first year of production, two years after construction begins.

Azarga explained that according to the most recent PEA, the project is expected to produce 6.507 Mlb of U3O8 over seven years at a steady rate of around 1.0 Mlb/year with the base case PEA calculations incorporating average uranium prices of US$55/lb. Azarga indicated that the total pre-income tax cost of uranium production is estimated at US$28.20/lb before income taxes of US$3.82/lb of production.

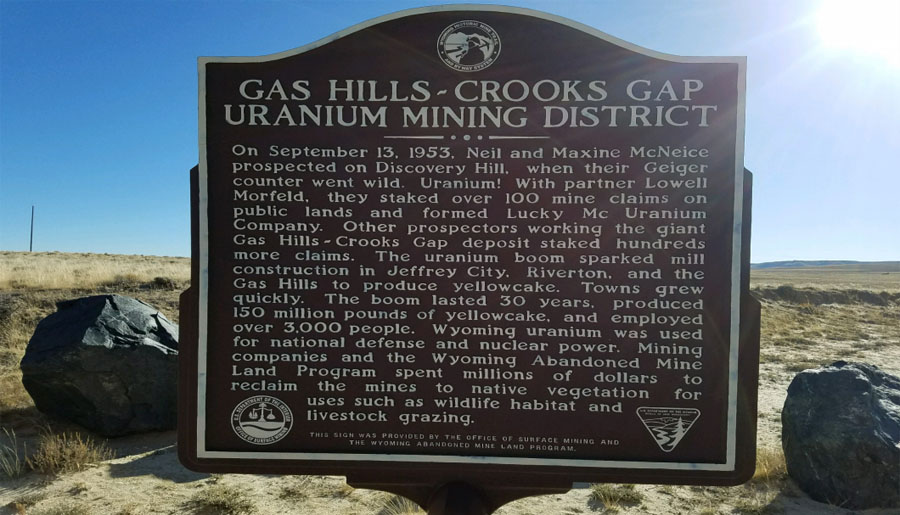

The company stated that several companies have explored, developed and produced uranium in the Gas Hills district and at the site it now controls. Five mills in the area in aggregate had processed greater than 100 Mlb of uranium, mostly from open-pit mining operations, though some underground and ISR methods were also employed to a lesser extent.

The firm advised that the Gas Hills Project PEA development plan calls for a central processing facility to be constructed at Azarga's Dewey Burdock Project. It is anticipated that construction will consist of wellfields in four separate resource areas that will be connected by pipelines to a single satellite plant location where ion exchange equipment will be utilized to extract uranium from the wellfield fluids. During the next stage, the firm indicated that "ion exchange resin will be shipped from the Gas Hills Project to the Dewey Burdock Project for uranium stripping and regeneration, with creation of a dried yellowcake product at Dewey Burdock."

Azarga Uranium is a U.S.-focused integrated uranium exploration and development company that controls 10 uranium projects and prospects in the states of Colorado, South Dakota, Utah and Wyoming. The company stated that it concentrates its activities primarily on in-situ recovery uranium projects. The firm indicated that presently its highest priority is its Dewey Burdock ISR uranium project in South Dakota for which it has already received required licenses and permits from the Nuclear Regulatory Commission and the Environmental Protection Agency. The company stated that it is now working on securing further major regulatory permit approvals needed for construction of the Dewey Burdock Project.

Read what other experts are saying about:

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Azarga Uranium. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azarga Uranium, a company mentioned in this article.