The heat I took last week over my "Back up the Truck" call was somewhat comedic in that every guru out there was urging "extreme caution." Meantime, what was I telling you that I was doing? I was buying every gold/silver share and call option that I could afford in the last two weeks of August.

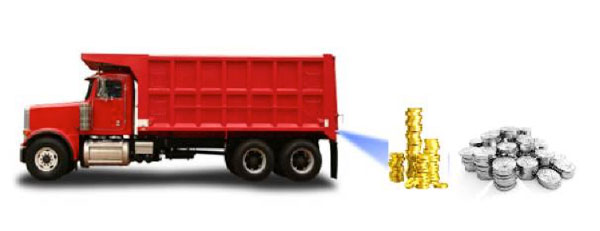

Here it is: This graphic was called "Back up the truck!" Gold was $1,315 when I created it and now it is $1,354. The blogosphere went berserk with comments like "Kiss of Death," and "Top Talk," and "Wrongway Corrigan," but a funny thing happened on the way to the pillory post—everything reversed to the upside and the miners and the metals have now completely worked off their oversold conditions and have reclaimed their respective 50-daily-moving-averages (which chart gurus LOVE to talk about). The blogosphere is now eerily quiet, and my inbox is strangely devoid of snarky emails. Go figure. . .

Back Up the Truck

The newsletter gurus were all slamming me for my total and unequivocal rejection of the art of "technical analysis" when it comes to gold and silver. "Let’s go to the charts!" opined one very popular guru as he told his listeners, "Don’t blame me!" if the U.S. employment report comes in "gold and silver hostile."

Well—it did come in hostile, because the algobots had to juice the S&P 500 up several dozen points in order to offset the massive selling in the futures. Gold and silver were seriously oversold based on a 26 RSI (relative strength index) for gold. With the RSI for the GDXJ at 31 (see the chart at the top of the story), I decided to go "ALL-IN" on Friday morning, right after the (lack of) jobs report came out, and it was NOT because of some technical "buy signal." It was because of this famous line from the pits of the old Chicago Board of Trade: "When they're yellin' you should be sellin', and when they're cryin', you should be buyin'!" Well, "THEY" were cryin’ big time last Friday. End of story.

You all know me well enough that after 40 years trying to decipher markets and the psychology driving them, I rarely back away from an important call, and when the opportunity arises, I usually LUNGE at it. I don't tiptoe at it for fear that I might lose "subscribers" (because I have none), and I don't try to hedge my comments with a multiple of "If this or that, then that or this" disclaimers. I simply email out missives with graphics like the one you see posted above.

If I'm right in my assessment of the global financial landscape, the intermediate trend for gold and silver has now kicked in and should draw gold toward that big downtrend line drawn off tops made in late 2011 and late 2013. However, back in Q1, when I penned the missive "Patiently Climbing Aboard the New Golden Bull" with gold slightly north of $1,100 and the HUI at 115, that overhead resistance was up at around $1,450. With the passage of time, today it is right at $1,400 and explains why the Cretins were pulling out all of the stops to cap the rallies back in July and August.

As for silver, between now and the end of the year I see the gold-to-silver-ratio under 60, and if I get $1,400 gold, I should get silver at $23.33. However, once we see the intermediate-term trend kick in with a breakout through that dastardly downtrend line at $1,400, gold should head in a beeline to the April 2014 breakdown level at $1,525, and the GTSR (gold-to-silver ratio) should be plunging, with silver outperforming gold and junior silver companies on fire.

With the 2016 boating season now winding down and with kiddies all back to school, I see the metals dominating the financial landscape and volatility escalating. The "long gold/short stocks" trade was the one I had on in late 2015, and it worked magically until this summer when the post-Brexit panic was contained by the global central banks. The stock markets have not been on a tear because they reacted to some technical "buy signal" and they didn't "stair-step" up the "Wall of Worry" to record highs on the S&P and Dow because of some "technical pattern." They moved to new highs because a directive was handed down from the U.S. Treasury (Working Group on Capital Markets) to 33 Liberty (NY Fed), ordering them to levitate stocks while the Bank of Japan, the Bank of England and the European Central Bank all followed along with similar orders.

For these reasons, I'll be doubly diligent in trying to detect another capping exercise up around $1,380, but I think the bullion bank behemoths will be too concerned with the deteriorating global macro environment to concern themselves with the gold market. So the dips should be bought in gold and silver and the miners, with the best timing tool seeming to be RSI. Forget about podcasts and "the charts," and just hold onto your positions and add with RSI under 35 and reduce when it is north of 70. It will save you money.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images courtesy of Michael Ballanger.