Caesar says these words as a large scabbard gets plunged into his innards, signifying in modern lore a phrase describing the ultimate betrayal by a friend. And looking at the behavior of the bullion banks as measured against the vast majority of gold "analysts" out there, I would think that many retail investors are soon going to be staring up into the eyes of their friendly financial advisor saying the very same thing. Et tu, Koolaid drinker?

On Dec. 4, 2015, the COT report revealed that Commercial traders in the Crimex Gold pit had reduced shorts over a six-week period from 166,000 net short on Oct. 15 to a paltry 2,911 contracts net short that day, making it the tiniest short position in over a decade and a half and an incredible BUY signal which I captured in a) the Dec. 4 email note and b) the GDX/GDXJ ETF's and NUGT/JNUG calls I bought over the next three days. The rest is history. An 82% rip in the HUI off the Jan. 19 regurgitation/capitulation lows and a 23% rip in gold YTD now turned the financial blogosphere into a large ravenous pack of salivating bulls all scrambling to claim the crown as the "Kings of Gold." The tires on the Gold Bandwagon are now as flat as an October hay-wagon's as TV celebrity after TV celebrity is only too happy to opine about their "call" on gold and all their (old and dated) reasons for owning it.

However, as you can see from the chart posted above, the Commercials traders have now done a complete 180-degree turn from the bullish short-covering of Dec. 4, an event I noted back in the third week of February when the aggregate net short position reported by the Commercials came in at 131,984. I decided then to refrain from any new longs and in fact telegraphed the fact that I would probably be looking at reductions and some hedges if that number continued to erode. On Feb. 26, the number came in at net short 163,149 to which I remarked. "This is a very bearish number," as price continued to rise from $1,235 to $1,265/oz and the bandwagon began to appear. As we moved into the pre-PDAC week, I published my report entitled "Quietly Climbing Aboard the New Golden Bull" but as much as I was (and am) thrilled at the arrival of the new multiyear bull market, I told everyone to exercise "CAUTION" due to the rapidly escalating shorts being feathered out by the bullion bank behemoths. Sure enough, on March 4, the Friday before PDAC, gold hit $1,280/oz the same day that aggregate Commercial shorts hit 171,431 as bullish commentary in the MSM hit fever pitch. Finally, two days after the end of the 2016 PDAC love fest, the Commercials lowered the boom, which was actually from the Tuesday trading session right in the MIDDLE of PDAC with the omnipotent delivery of that massive 195,372 net short position—19,537,200 ounces of synthetic, fantasy-world, never-to-be-delivered, not-required-to-be-accounted-for "gold."

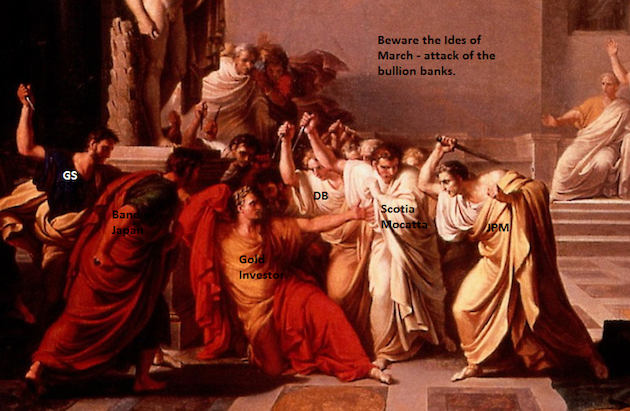

Needless to say, here we are on the exact day known all too well by Roman Emperors as "The Ides of March" and the Crimex futures have just printed $1,229, which marks it as a $57 smash since last Thursday evening and undoubtedly a well-cemented "short term top" and as much as I would like to be strutting around, football in hand, in the end zone, ready to do my "Oogie Shuffle" and do a "spike-the-ball-in-your-face" type move, I am instead sitting at my desk, nauseated by the abject criminality of this exercise. I'm also astounded how many "portfolio managers" being paid tens of millions of dollars in fees and bonuses every year were lured into this Arachnidan web by the momentum-creating antics of the bullion banks and their MSM brethren. Ladies and gentlemen, this was a complete and total set-up from the Get-Go and it was as if I was watching a beer bottle falling off a table in slow motion after a night of debauchery, too wasted to lunge for it and too laid back to care, as the Commercials played out Act III, Scene I of the assassination of the emperor with their usual deftness and sleight of hand.

We had four weeks to prepare for this event and some did and some did not, but what is for certain is that you absolutely MUST take advantage of any rebound/recoveries in the gold price and in the HUI by buying protection or by reducing exposure. It took six weeks back in October-November for the washing machine to go through the entire wash-rinse-spin cycle so that could easily take us to the month of May before any daylight is seen on the horizon. You can take to the bank the likelihood that Goldman Sachs will be mobilizing the heavy earth-moving equipment shortly in order to validate that "sub-$1,000" forecast from last week and of all the thieves in the building, they are the ones that have the magic pixie dust when it comes to sprinkling fear and loathing in ANY market and we should FULLY expect such.

So when you look at the picture at the top, and you see that poor besieged emperor lying on his back preparing to get hacked to pieces by members of a conspiracy most ignoble, think of the public mutual funds, pension funds, sovereign wealth funds, private investors and the average mainstream speculator in the same position, powerless, unarmed and up against the unregulated, SEC-sanctioned, sword-wielding bullion banks that can sell 5% of annual world production via the Crimex in a five-week window of infamy. At a net short position of over 195,000 contracts, the Commercials are fully armed for another big payday, so I trust we have all acted accordingly. If not, I will see your "et tu brute" and raise you three "caveat emptors"…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All images/charts courtesy of Michael Ballanger