Think you've made a lot of money from the U.S. oil and gas boom?

You ain't seen nothing yet. . .

By now, you've heard much about the shale boom. Drilling technologies have allowed us to extract oil and gas directly from the source rocks, or shale, and reversed a nearly 40-year decline in oil production.

In 2008, the United States produced 1.8 billion barrels of oil. In 2013, we produced 2.7 billion barrels, a 50% increase in five years.

One way or another, you've probably made money from this trend. The oil boom has helped keep the economy afloat. Oil stocks, as measured by the iShares U.S. Energy ETF (IYE), are up 47% over the past two years. They've helped power the broad market indexes to new highs.

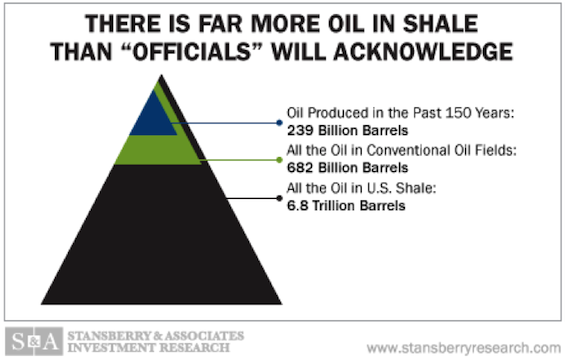

Many believe that there isn't enough oil in shale for the boom to last. . . But we've done the math. It's an estimate people aren't getting from the U.S. government.

And it shows what the skeptics are missing. . .

Conventional oilfields—the "gushers" you might see in the movies—are geologic anomalies. They have to be in just the right place to catch the oil. Oil doesn't form in an oilfield. It migrates to that field from the shale. And not much of that shale oil makes it into the fields.

On average, just 10% of the oil formed in the shale source seeps into conventional oilfields. In other words, around 90% of the oil either stays in the shale or leaks out to be lost.

According to the Energy Information Administration (EIA), from 1859 to 2013, the U.S. produced 209 billion barrels of oil from conventional oilfields. And there are an estimated 30 billion barrels of conventional oil in reserves (not yet produced). That means over the past 150 years, the total oil from conventional U.S. fields is about 239 billion barrels.

We can use that number and a little science to get an idea of how much oil shales hold.

As I said, we can recover about 239 billion barrels of oil from conventional oilfields. But that's only a small fraction—just 35%—of all the oil in there.

That means about 682 billion barrels of oil remain in those fields. That's a lot of oil. (For context, the U.S. consumes about seven billion barrels a year.)

And remember, that's still only around 10% of the total oil in the source shale. So the shale actually contains about 6.8 trillion barrels of oil. If we account for the volume of oil that migrated out, the shale still holds about 6.1 trillion barrels of oil.

The infographic above illustrates this point. The small (blue) triangle shows all the oil that we recovered from conventional oilfields (and all the reserves yet to be produced). That's oil held in normal oilfields, not shale. The next larger (green) triangle shows all the oil held in conventional oilfields.

The largest triangle shows all the oil in shale. As we said, if we take out the conventional oil, there are roughly 6.1 trillion barrels of oil remaining. If we can recover just 5% of that oil (we're getting 4% to 6% out of the Bakken today), we'll get about 300 billion barrels.

That's more oil than the U.S. produced in the history of the oil industry AND all the oil reserves we have today.

Some skeptics argue that our ability to tap into that oil is limited. Shale oil is trickier to extract than the oil from a conventional well. And productivity per shale well isn't as good as a conventional well. But we don't have to worry about the productivity of a single shale well. There's so much oil trapped in shale that we can drill many more shale wells than we could conventional wells.

U.S. shale oil can provide our energy needs for decades to come. And companies are continuing to find innovative ways to extract it.

The shale revolution is still in its infancy. It will continue to make many people very rich. . .

Matt Badiali

Daily Resource Hunter