All of a sudden, everyone's talking about financial repression—the capture and torture of domestic savers with below-inflation rates of interest, so that banking and government debt shrinks in real terms.

"Such policies," explains economic historian and author Carmen Reinhart for Bloomberg, "usually involve a strong connection between the government, the central bank and the financial sector." Check.

Given the post-war size of our debts, she goes on, "financial repression. . .with its dual aims of keeping interest rates low and creating or maintaining captive domestic audiences. . .will likely be with us for a long time." Check.

"[It's] equivalent to a tax on bondholders and, more generally, savers." Check.

Now if, like me, you already gave, then you might want to look for the exits—and you really don't need to look very far. Yet to date, this sudden burst of comment on financial repression can only counsel despair, despite the greatest liberty of capital movement in 100 years. More oddly still, the classic escape-route of buying gold—an escape route blocked worldwide when governments wore down their twentieth-century wartime debts—has scarcely been mentioned.

Take the Financial Times: It's published 15 stories on financial repression in the last month alone, yet only two mention gold. Google News counts 103 stories in English from the last two weeks globally, yet barely one-in-four dares mention gold, and half of those only because they mention the high classical gold standard ending 1914. Before then bondholders also got very low (but not negative) real rates of interest. They also got the full return of principal value on maturity.

"In [our] age of free capital movement, financial repression is still possible," reckons another historian (and a member of GMO's asset allocation team) Edward Chancellor in the FT, "because it is being simultaneously practised in the world's leading financial centres. Negative real interest rates are to be found not only in the US, but also in China, Europe, Canada and the UK."

But so what? No one's yet forcing U.S. citizens to keep their money inside the States, and no one's forcing them to choose a euro, Canadian or sterling savings account if they go elsewhere either. Which is lucky, with rates at 1%, 2% and 3% below inflation respectively. Yes, the finance industry is paying the price of getting bailed out, with the world's $30 trillion (T) in pension funds forced to hold ever-greater quantities of subzero-yielding debt. But outside the still-repressed East, private savings today enjoy unheard of freedom to go where they wish and do as they please. And even there, in India and China most notably, the freedom to buy gold—the universal financial escape—is similarly at a 100-year peak.

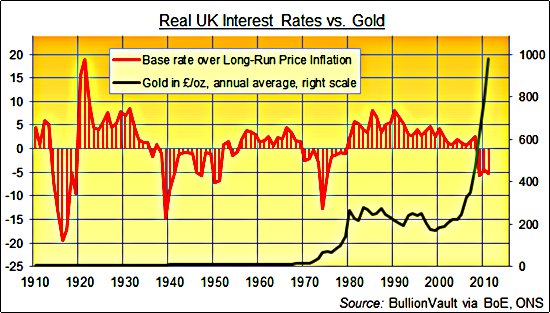

Witness the British experience with investment gold, for instance. Suspending the gold gtandard when war broke out in 1914, London banned domestic gold trading by private individuals throughout both world wars, pretty much all the time in between, and for more than three decades after Hitler put a hole in his head.

The cost to cash savers and gilt-holders? One hundred pounds lent to the British state in 1945 was worth £91 in real terms by 1980. Whereas £100 held in gold would have become £304 of inflation-adjusted real value. But unlike today, gold wouldn't have done you much good in the meantime, because it was nailed to currency values (not vice versa) by the false peg known as the dollar xxchange standard. And also unlike today, you would have been breaking the law for much of that time, simply by owning coins or gold bars.

A brief window opened in 1971, but it was closed four years later because savers used it too freely, sparking a foreign currency drain that brought down the shutters on foreign inflows of metal again. It took another four years for the UK's gold controls to be lifted entirely. By which point gold had already begun its big move. Real rates turned strongly positive 12 months later, and the urgency of buying gold to escape repression was gone.

Financial repression this ain't, in short, but nor would it be new if it was. Our current freedom to buy gold is very new, in contrast, along with the wealth of alternatives—both domestic and foreign—open to anyone daring to take control of their money instead of lending it to government or paying a pension fund manager to do the same.

Take note: Nothing is certain to repair the losses you suffer on other captive investments today. U.S. citizens, for example, suffering real interest rates 4.6% below inflation in January 1975, were allowed to buy gold for the first time in three decades. Bullion promptly dropped half its dollar price, shaking out all but the most pig-headed investors over the next 18 months before rising eight-fold by the start of 1980.

"In [our] mildly reflating world" however, advises Bill Gross of Pimco, "unless you want to earn an inflation-adjusted return of minus 2–3% as offered by treasury bills, then you must take risk in some form." And buying gold is just such a risk—a uniquely simple and obvious one, offering a stateless escape to a borderless market. But make no mistake: Swapping the credit and inflation risk of cash and bonds for physical gold means exposing yourself to price risk.

Volatility is certain as retained wealth worldwide thrashes free from the imaginary manacles of the financial press, and the traps laid for the unwary by the packaged financial industry.

Adrian Ash, BullionVault

Gold price chart, no delay | Buy gold online at live prices

Adrian Ash is head of research at BullionVault—the secure, low-cost gold and silver market for private investors online, where you can buy physical gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2012

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events—and must be verified elsewhere—should you choose to act on it.