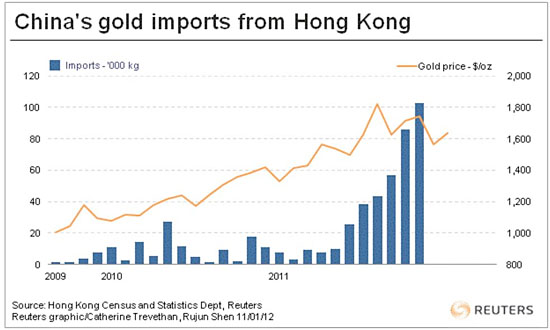

The chart above gives us a clear picture of just how China has changed from being an exporter of gold to an importer of considerable amounts of gold in a few short years. However, is this the full story?

The Hong Kong Statistics Department reported that China imported 102,779 kilograms (kg) of gold from Hong Kong in November, an increase from October's 86,299kg. This is usually a reliable source of information regarding transactions between the two parties. However, are we to assume that Hong Kong is the one and only supplier of gold to China? Do we really expect that the Chinese, who are intent on building up their gold reserves, would go to just one shop? We doubt that very much, hence the cloak of secrecy surrounding Beijing when it comes to such matters. China is not known for indicating its intentions in advance and to this day keeps its cards close to its chest. And why not—why would you want to drive up the price of a commodity that you desire to own?

It's a strategy that other sovereign states and large investors should take heed of; it would have served Gordon Brown well before he bumbled on with his gold auctions a decade ago. That single act alone cost the United Kingdom billions when compared with today's prices, but even back then, adopting a low-profile approach to gold sales would surely have served him better.

Now that the Chinese government allows and indeed encourages the people of China to own gold, and the wealth of the Chinese individual is on the increase, we envision a time when demand will outstrip the level of supply that Hong Kong can deliver. It's been reported that Beijing's technocrats, at the end of last month, shut all of the country's gold exchanges other than two of them in Shanghai. This tells us that despite the dramatic increase in imports as shown above and China's valiant efforts to mine gold, the demand is insatiable.

If this is the case, then other avenues of gold procurement and importation would be sought and may already be in place.

So, dear reader, the question is:

Who is supplying the additional, yet unrecorded, quantities of gold to the Chinese market? Is it a covert operation with Russia, South America, an African state or indeed any number of illustrious banks domiciled in the West? We can only suspect that there is someone out there being economical with the truth.

Your thoughts are, of course, most welcome.

Bob Kirtley, SK Options Trading

Regarding www.skoptionstrading.com. We currently have a number of open trades at the moment however, we do not update the charts until the trade is closed and the cash is back in our account.

Also many thanks to those of you who have already joined us and for the very kind words that you sent us regarding the service so far, we hope that we can continue to put a smile on your faces.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

Winners of the GoldDrivers Stock Picking Competition 2007

www.gold-prices.biz

Disclaimer: gold-prices.biz or SK Options Trading makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level or risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is not a guide nor guarantee of future success.