Markets are tough and this will continue. Just remember that these bad markets will not last forever, but unfortunate we have more pain to go through before a bottom. We can also expect a good bear market rally at some point as well. I will try to pin point that. This past Tuesday, the Canadian bank stocks broke down on the charts, except Royal Bank that managed to hold at it's July low. I show the chart here on CIBC where we have the March 2023 $65 Put option that has a good gain now. I suggested selling half our Bank of Nova Scotia March 2023 $80 Put where we have a 100% gain. The bank stocks are starting to price in a recession and a plunging real estate market. I expect they could test their 2020 Covid lows.

TD Bank had forecast that Canadian house prices would fall -19% by end of 2022. Now they are predicting another -11.2% in 2023. That works out to about a -28% drop, coming in line with my -30% or more prediction. TD's Sondhi expects home sales to drop -20% below pre pandemic levels. That will probably mean a drop in housing construction and lumber prices that have already fallen to pre pandemic levels. The housing in the US is a different story as it was not so highly leveraged as Canada, but US housing starts have fallen with a combination of a weaker market with labour and supply shortages. That said an economic slow down and recession will negatively affect US housing too.

Surprise, surprise surprise as Gomer Pyle would say. Well you should not be as I have been warning for a year. The September report is the seventh out of nine CPI readings this year to have topped expectations, according to Michael Brown, senior market analyst at Caxton. As I have been commenting numerous times, this inflation is entrenched and will be very tough to tame. Year-over-year CPI retreated to 8.2% last month from 8.3% in August, while the annualized increase in core CPI, which strips out volatile food and energy prices, rose to 6.6% from 6.3%. Both numbers came in higher than economists polled by the Wall Street Journal had expected. The 0.6% core versus a Wall Street forecast of 0.4% was the big shock. The increase in the core rate over the past year climbed to a new peak of 6.6% from 6.3%, marking the biggest gain in 40 years. Take note, it is the core (PCE) that the Fed focuses on.

Markets initially plunged Thursday on the bad inflation report and then rallied in one of the biggest reversals I have ever witnessed. S&P futures peaked +1.57% ahead of the CPI release, bottomed out -2.4% and the S&P 500 closed +2.6% with a round trip intraday range of 5.52%, according to Deutsche Bank. The reversal is impressive and I show a chart on the popular Spyder ETF that represents the S&P 500. What is noteworthy, the volume was not very impressive for such a move. This is a powerful reversal form a new low indicated by a strong engulfing bullish white candle. All the talk I heard was about this is peak inflation, the market has bottomed, blah blah blah. We could have a bear market rally and that is it. Bear markets bottom when everyone is bearish and calling for new lows, not bottoms and reversals. This alone convinces me this is no bottom but could be another bear trap a rally emerges.

Thursday could just be a one day wonder, but if we do get a bear rally, I marked in resistance levels that would relate to 3,700 and 3,900 on the S&P 500. Friday, markets bounced lower off the 3,700 area. I would be surprised if the market could move much above 3,900, all the problems facing the economy and markets have not improved and will probably get worse before they get better.

I commented and had a chart on lumber in May 2021 and called it a bubble top. As it turned out, I was within days of calling that top. Times then were too unpredictable to suggest a way to benefit from lumbers decline, but not today.

This is a monthly chart until end of September and the current lumber price has rallied a little to about US$500. With a recession and weak housing I expect we will see a drop to $300 and possibly lower. Lumber prices are back to pre pandemic levels but the lumber stocks are still at lofty levels and not pricing in a weaker market. They are great short candidates now.

U.S. housing starts in June were down to 1.6 million annualized units, their lowest level since September, 2021. In July, U.S. housing starts fell further, to 1.45 million annualized units, but rebounded in August to 1.58 million. Weaker numbers are in store with a Fed induced recession.

I think the best two to short are -

West Frazer Timber NY:WFG and Boise Cascade NY:BCC

Both companies are focused a lot on the lumber market with West Frazer effected more by Canada and the Canadian housing market than Boise.

The US Commerce Department said Thursday it will decrease the duty rate for most Canadian lumber producers to 8.59 per cent, compared with the current 17.91 per cent. The Commerce Department had made its intentions known in January to reduce tariffs, proposing a preliminary duty rate of 11.64 per cent, and has now reduced that amount further with the final rate of 8.59 per cent. This has probably been accounted for in the recent rally in lumber prices.

West Fraser has grown beyond the Company's original base in British Columbia and today, is one of the largest lumber and OSB manufacturers in the world.

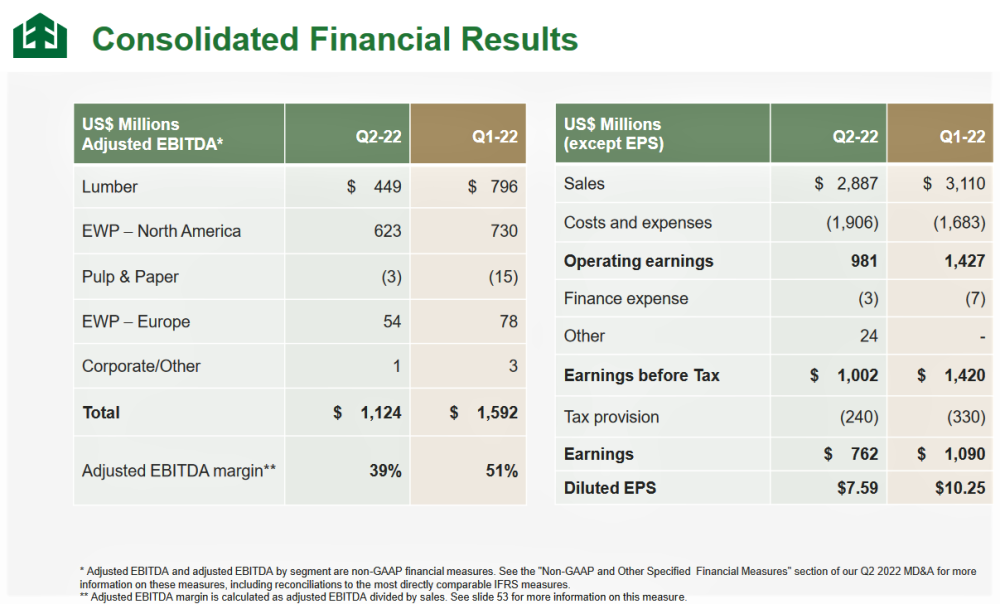

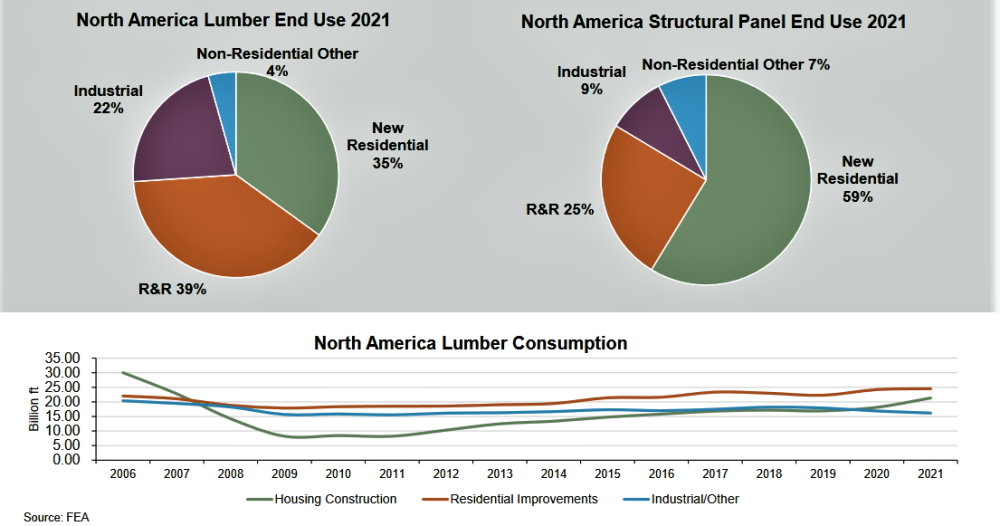

You can see from the slide above from West Frazer's Q2 presentation that C$ earnings are about 100% lumber and Engineered Wood Products (EWP) which is strands, fibers, veneers or particle boards bound together with strong adhesive. There was a substantial earnings decline from Q1 to Q2 and lumber prices have seen a further decline in Q3. West Frazer also shipped a lot more volume in Q2 over Q1 with lumber shipments up +17% as transportation constraints eased in Western Canada. OSB (board) shipments were also up 10%. This was shown on slide 6 of their presentation with slide 16 below showing huge dependence on housing.

It does not take a rocket scientist to know that a recession and rapidly rising interest rates will crush the housing markets. Credit Suisse says. “Our lower estimates reflect our expectation of a sharp slowing of housing turnover and a reduction in home improvement spending in 2023 based on this lower turnover,” wrote analyst Dan Oppenheim in a note to clients Friday.

West Frazer stock ran up in price because of the housing boom and high lumber prices caused by Covid-19 policies. Lumber prices have come down and the housing boom is ending as North America falls into a recession. The stock ran up about 120% from around C$60 in 2019 to the 2022 high C$132 and it is currently not reflecting lower lumber prices and a looming recession with a housing slow down. I expect the stock can easily drop to around $66 and with a bad recession could easily see prices back to around $40. I would sell the stock, short it and/or buy Put Options. I like the February 2023 $110 Put for about $14. There is little activity on these, but on the US side, the February 2023 US$70 Put around $5.00 has more trading.

Boise Cascade NY:BCC Recent Price $58.60

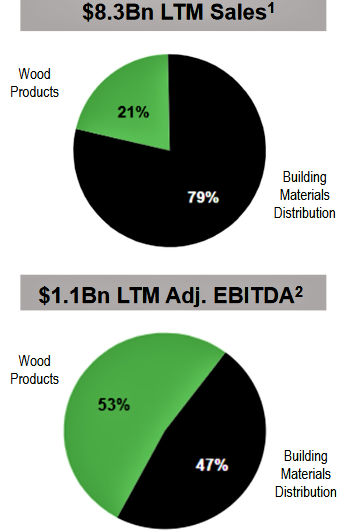

Boise is totally focused in the US and is why I prefer West Frazer more of a short because of the Canadian market exposure. Never the less, I expect Boise stock will take quite a hair cut in a poor housing market driven by high interest rates an a US recession. Boise also has a big focus on residential real estate and home improvements. They are one of the largest US wholesale building products distributors with 38 warehouse centers and 1 truss plant.

This partial slide on the right from their presentation is interesting because it shows that 79% of sales were from their Building Materials distribution segment but only accounted for 49% of profits. It is a clear sign that high lumber prices have driven high profits in their Wood Products Division. As I mentioned above, lumber prices have dropped further in Q3.

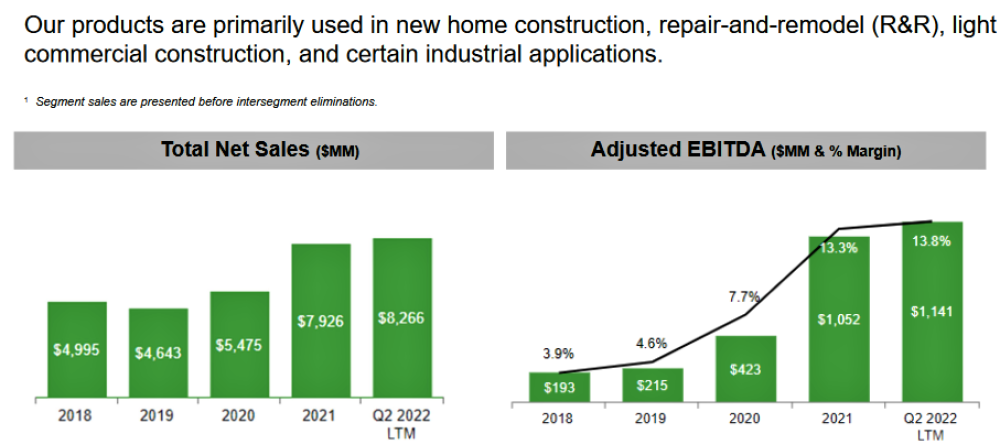

Currently Boise looks like a very solid company as shown in the slide below from their presentation and had strong sales and earnings growth since 2020. What I am saying is the good times are over so sales and profits have peaked and will soon decline.

Boise gives this warning in their Q2 finacials “As a manufacturer of certain commodity products, we have sales and profitability exposure to declines in commodity product prices and rising input costs. Our distribution business purchases and resells a broad mix of commodity products with periods of increasing prices providing the opportunity for higher sales and increased margins, while declining price environments expose us to declines in sales and profitability. We expect future commodity product pricing and commodity input costs to be volatile in response to economic uncertainties, industry operating rates, transportation constraints or disruptions, net import and export activity, inventory levels in various distribution channels, and seasonal demand patterns. EWP and general line products have historically experienced limited price volatility, but are also subject to price erosion as economic activity slows. “

Boise has a very similar chart to West Frazer just at a different price level. The percentage gain from 2019 and potential percentage drop are around the same.

For Put options, I like the January 2023 US$60 Put for around $6.00