AAZ on the TSX Venture | AZURF on the OTCQB | A0U2 on the Frankfurt

As many of you know, my Penny Queen portfolio is designed around making money while making the world better. To that end, I’ve been looking for resource plays that are clean-energy focused.

“In the end, Azincourt was the only company that matched all of my criteria, with its focus on clean energy, solid ESG principals, and cutting-edge technology.”

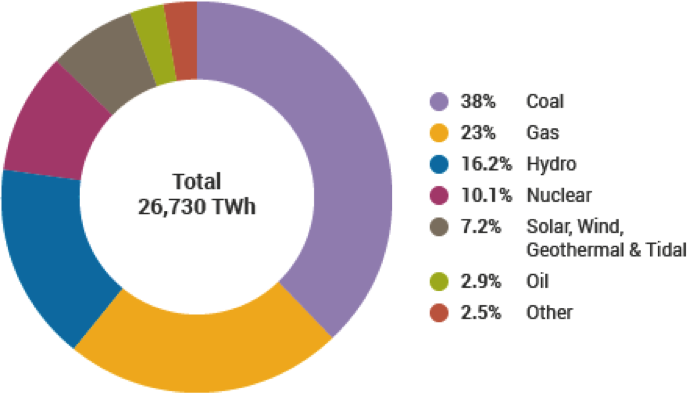

While uranium exploration may be controversial, I truly believe that, when done correctly, nuclear energy is one of the cleanest forms of energy. In fact, about 10% of the world’s power is currently (and safely) generated through nuclear fission. While radioactive waste and its disposal are not insignificant issues, they are miniscule compared to the amount of greenhouse gases emitted by fossil fuels.

After learning about the uranium shortage and the potentially parabolic move in prices, I narrowed my search to uranium producers and explorers.

After learning about the uranium shortage and the potentially parabolic move in prices, I narrowed my search to uranium producers and explorers.

Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) is a clean energy resource exploration and development company with two major uranium exploration projects in Saskatchewan, Canada, and a uranium and lithium project in Peru. It recently partnered with FOBI to use data analytics and artificial intelligence to make their operations more efficient and profitable.

In the end, Azincourt was the only company that matched all of my criteria, with its focus on clean energy, solid ESG principals, and cutting-edge technology.

Why Uranium Is a Great Opportunity

Before we get into why I think Azincourt is a great pick, I’d like to talk about why I think uranium is a great opportunity. Uranium is needed for nuclear fission and there are currently 445 working nuclear reactors worldwide. There are another 50 being built, 100 planned, and 300 proposed.

People love to talk about bull and bear markets, but the reality for commodities is that they are simply supply-and-demand markets, with a dash of human emotion thrown in. Uranium’s price history is as dramatic as the emotions nuclear energy provokes.For 2021, the uranium shortage is expected to be about 23.6 million pounds, which equates to about 13% of global demand.

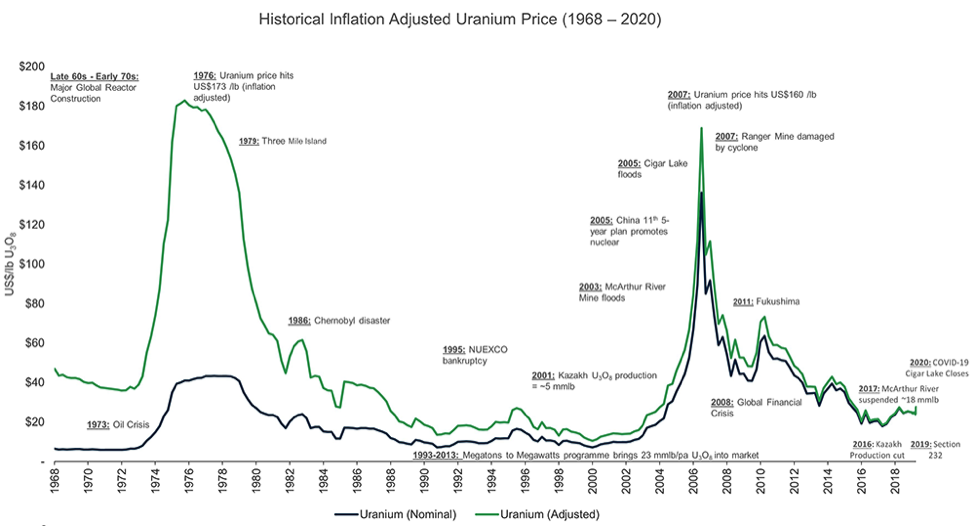

Demand for uranium began in earnest after World War II — with the first nuclear power being generated in 1948 — and continued through the early 70s. The image below from yellowcakeplc.com shows the inflation-adjusted uranium prices and the likely causes of the price movement.

“While uranium exploration may be controversial, I truly believe that, when done correctly, nuclear energy is one of the cleanest forms of energy.”

Demand, supply, and social issues are the driving factors. There was a major drop in uranium prices following the accidents at Three Mile Island, Chernobyl, and to a lesser extent Fukushima. Two things that had a clear effect were the demand caused by the oil crisis beginning in 1973 and the increased Chinese demand and production issues from 2001 to 2005.

Be sure to sign up to receive PennyQueen's next stock picks exclusively available for Streetwise Reports' Readers. Sign Up Now!

PennyQueen is an investor who focuses mostly on clean tech and does her own independent analysis. She has created a social media community of over 10,000 like-minded investors with whom she has shared her progress of taking a $329k nest egg and building it to over $6 million within a year.

I believe we are on track for a major move upward when considering the current supply deficit and the known increase in demand coming from the planned and proposed facilities. Those new facilities are more than the total current facilities in existence, and they do not account for any of the new safer, smaller reactor units that are being designed today. The social outlook on nuclear power is shifting in tandem with the growing realization that climate change is happening — and happening now.

According to the U.S. Energy Information Administration, in 2020 alone, the U.S. purchased 48.9 million pounds of uranium, with a weighted-average spot price of $28.70 per pound and Canada being the largest supplier (Uranium Marketing Annual Report - (eia.gov).

A Canaccord Genuity analyst has predicted the spot price to peak as high as $80 by the end of 2021. Combine this with the resource juggernaut, Sprott, creating a physical uranium trust and buying up as much physical uranium as they can, and you have conditions ripe for a major price move.

As of this writing, the spot price for uranium is $48.15. The last major price movement for uranium was a low of $7 per pound in 2001, running to a high of $137 per pound in 2007. In 2007, Paladin Energy’s shares moved from AU$.50 to AU$9.25.

Volatility is opportunity, and timing is queen.

Now that you understand why I chose to add uranium to my portfolio, I want to talk about why I chose Azincourt.

Why I Chose to Add Azincourt to My Portfolio

As my name suggests, I personally am not afraid of penny stocks. I find the penny sector to be an area where you can leverage research to achieve astounding returns. If I have the choice between a company sitting at $10, $1, or 10 cents, I’ll likely see more potential in the smaller share price. Azincourt is currently sitting at a share price of US$0.0724 with a market cap of US$34.5 million.

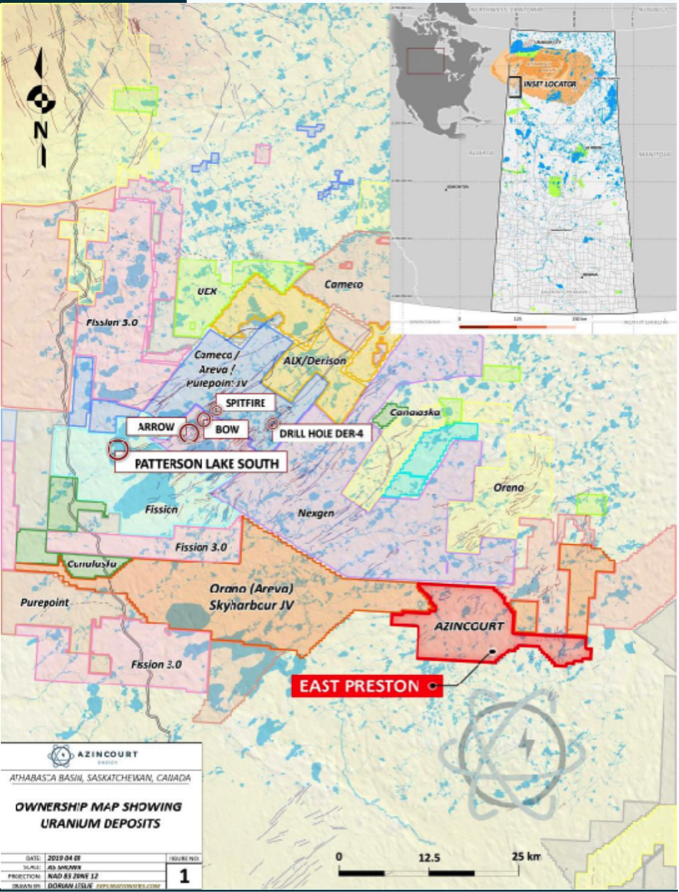

Their neighbors to the north in the uranium-rich Athabascan area of Saskatchewan, have market caps ranging from $30 million to $10.6 billion, the average market cap of $1.7 billion. Clearly, the larger companies have diversified holdings and operations, but I like to buy the cheapest house on the block, since it has the most upside.

The biggest potential gain would be a discovery in a uranium bull market. So, what are they doing to increase their chances?

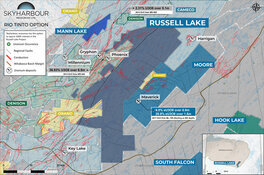

First off, they are looking in the Athabasca Basin, which has the highest-grade known concentration of uranium in the world, up to 100 times the world average.

Azincourt has a 70% interest in the 25,000-hectare Preston project and just announced reaching a deal to acquire up to a 75% interest in the 13,700-hectare Hatchet Lake Uranium Project

It has already spent over CA$3 million in exploration costs and has identified multiple high-priority drill targets.

In early September, it completed an airborne radiometric survey looking for Gamma radiation that is emitted from uranium deposits and updated its explorations plans accordingly.

In early September, it completed an airborne radiometric survey looking for Gamma radiation that is emitted from uranium deposits and updated its explorations plans accordingly.

Also, in September, they signed a one-year contract with FOBI to utilize data-analytics and artificial intelligence to aid them in efficiently locating drill targets. This is only one paragraph, but this may be the thing that changes all uranium exploration in the future. There is a lot of existing data about where uranium has been found, but it is not an exact science. Azincourt is making an investment that could provide them with an absolute edge on their competition.

At this point, 17 drill holes (4,178 meters) have been drilled in East Presnton. This winter alone, they will be drilling 30 holes (600-7000 meters), targeting areas of elevated uranium discovered in the 2020 to 2021 season.

I won’t write anything about a company unless I meet with the CEO and get a good feel for them as a person and understand the company from their point of view. A few weeks ago, I was able to speak with Alex Klenman. I was skeptical about the company until we had our conversation. Some of the biggest takeaways were just how well capitalized they are – they are currently sitting on CA$14M and have CA$22 potential funding from warrants.

The most exciting thing that came from the meeting was learning that they have a little more than 30% institutional ownership. That amount of institutional ownership is just about unheard of in a pre-discovery resource company. I take it as a very good sign when the so-called smart money is on board.

After talking with Alex, and hearing about the three major discoveries that have been made by their lead geologist and VP of Exploration, Trevor Perkins, I’m not surprised. His entire management team has the experience and knowledge to make this project successful.

Alex also talked a lot about corporate responsibility, their strong relationships with the local First Nations people, and his belief in the science behind good exploration. Last season, he made the tough decision to call off the drilling early to prevent damage to the environment by chancing the melting ice bridges. This season they are ready to move with aggressive plans in hand and all the resources they need.

Azincourt is in a target-rich environment, utilizing big data, and leveraging a veteran team, and – for these reasons – they are my pick in the uranium sector.

Links :

Azincourt Investor Deck November 2021

Plans for New Nuclear Reactors Worldwide - World Nuclear Association (world-nuclear.org)

Uranium Marketing Annual Report - (eia.gov)

Bloomberg article China planning 150 new nuclear plants

Warrior Trading article on Sprott’s Physical Uranium Trust

If you have not already, be sure to sign up to receive PennyQueen's next stock picks exclusively available for Streetwise Reports' Readers. Sign Up Now!

Disclosure:

1) The Penny Queen: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Azincourt Energy Corp. and FOBI. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Azincourt Energy. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this report. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This report is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy and Fobi, companies mentioned in this article.

Sign up to receive PennyQueen's next stock pick

Sign up to receive PennyQueen's next stock pick