In a May 20 research note, Intrynsyc Capital Corp. reported it initiated coverage on Kodiak Copper Corp. (KDK:TSX.V), a Vancouver-based junior explorer that is advancing its MPD copper-gold porphyry project in British Columbia's Quesnel Trough copper belt. Kodiak Copper also owns the Mohave project in Arizona, at which historical drilling has been done.

Intrynsyc presented its investment thesis on this mining company. The bank highlighted that Teck Resources saw fit to invest in Kodiak Copper and already captured a 9.9% share via a CA$8 million charity flow financing.

"Kodiak Copper offers exposure to high-grade copper-gold porphyry potential based on recent results [and], in addition, significant exploration upside as a developing porphyry copper story with additional porphyry centers yet to be tested," Intrynsyc wrote. "The company's current market cap of about CA$78 million indicates the significant upside."

Recent encouraging results are from 2019 and 2020 drilling at MPD, a combination of three properties, Man, Prime and Dillard. In 2019, Kodiak Copper discovered the Gate zone via hole MPD-19-003, which showed 102 meters (102m) of 0.53% copper and 0.16 grams per ton (0.16 g/t) gold. In 2020, hole MPD-20-004 returned 535m of 0.49% copper and 0.29 g/t gold, or 0.76% copper equivalent.

Drilling had been done between 1966 and 2014 by different operators, a total of 129 holes over 25,780 meters, but never below 200 meters and never as a single project. Those efforts, though, Intrynsyc noted, derisk the current campaign and give Kodiak Copper "a head start on exploration and a wealth of knowledge to refine ongoing targeting." The program Kodiak has underway, fully funded, is for 30,000 meters of drilling.

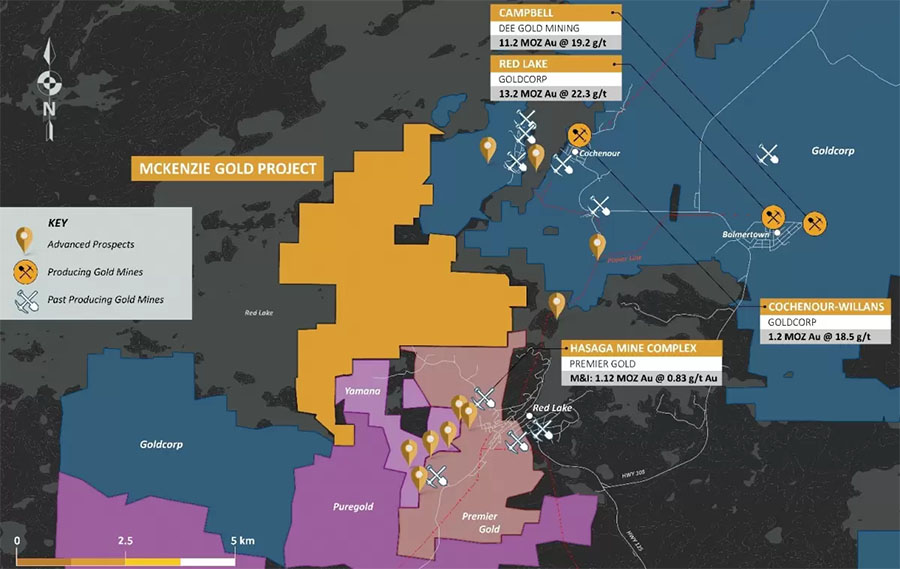

Also working in Kodiak Copper's favor, Intrynsyc noted, is MPD's location, in the alkalic copper-gold porphyry-rich Quesnel Trough, a tier one jurisdiction hosting several projects and mines, including Copper Mountain, Mount Milligan and New Afton. Also, MPD is close to infrastructure, affording it year-round and low-cost exploration.

Given the geology of the property and the belt, Intrynsyc purports that more porphyry centers exist on the property and, potentially, additional deposits, the latter in the untested porphyry centers of Man, Prime, Dillard and Dillard East.

"MPD screens as a rare opportunity underpinned by a combination of all the components an acquirer looks for in investment opportunities," Intrynsyc wrote.

The report noted that Kodiak is backed "by John Robins' Discovery Group, founded by Chairman Chris Taylor (President and CEO of Great Bear Resrouces), and led by Claudia Tornquist (former GM at RIO Tinto and former VP Business Development at Sandstorm Gold)."

The team backing Kodiak Copper, Intrynsyc pointed out, has "shown the ability to raise capital at higher prices (nondilutive) while protecting their tight share structure and attracting strategic investors such as Teck."

Intrynsyc concluded, "We consider Kodiak Copper an emerging player that is hitting its stride at the perfect time of the cycle. We believe the company is the next go-to story in the base metals sector and poised to build value via the drill bit."

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Intrynsyc Capital, Kodiak Copper Corp., May 20, 2021

Disclosure

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives.

This publication is intended only to convey information. It is not to be construed as an investment guide and may be construed as an offer or solicitation of an offer to buy securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor Intrynsyc Capital Corporation can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment solely on the basis of this publication, but should first consult your investment adviser, who can assess all relevant particulars of your proposed investment. The author and Intrynsyc Capital Corporation accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.