With copper one of the hottest metals on the planet, with no end in sight for its strength, investing in copper juniors makes a lot of sense. While arguments can be made for uranium, lithium, cobalt, nickel, silver, gold, etc., copper has the best long-term fundamentals. Copper assets in Canada and the U.S. are especially attractive given various difficulties/uncertainties around the world.

For instance, just two countries (Chile and Peru) supply ~40% of the world's mined copper. The world is learning that like Kazakhstan for uranium, the Democratic Republic of the Congo for cobalt and China for dominating the refining of many metals, it's unwise (geopolitically/security of supply) to have all of your eggs in one basket.

I recently spoke at length with the CEO of Braveheart Resources Inc. (BHT:TSX.V; RIINF:OTCQB), a company with near-term production potential, plus three promising projects, all in Canada. Ian Berzins, P.Eng. has assembled strong prospects and an excellent team. Please continue reading to learn more about the company.

Peter Epstein: Please give readers the latest snapshot of Braveheart Resources.

Ian Berzins: Braveheart is a junior miner with two past-producing, advanced exploration/development stage, Canadian mining projects focused on copper, with lesser payables including nickel, gold, silver, palladium, platinum and silver.

Both have significant infrastructure; roads, power, water and close proximity to mining communities. We also have a very high-grade gold project (142,000 oz @ 16.5 g/t). All three projects are in Canada.

We plan to restart the Bull River mine near Cranbrook, B.C. in the 4th quarter. Immediate cash flow is expected from processing surface stockpiles of run-of-mine ore. In parallel, the company plans to advance exploration at our Thierry project.

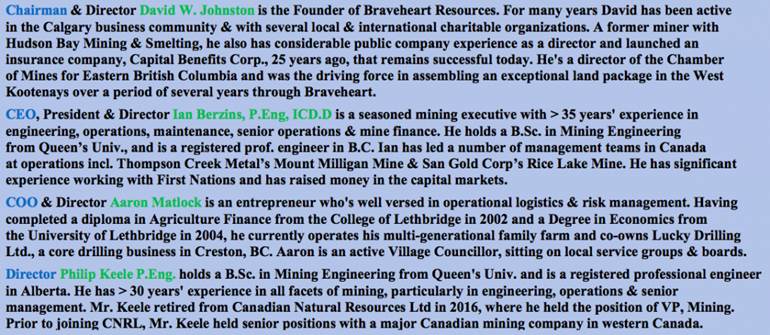

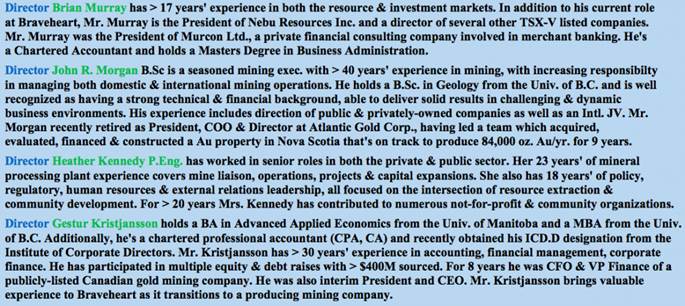

Peter Epstein: Please tell readers about Braveheart's key team members (management team, board).

Ian Berzins: Our management team and board have significant experience in engineering, geology, operations, project development, plus senior management experience including companies such as Canadian Natural Resources, Suncor Energy, Atlantic Gold, San Gold, Miramar Mining, Thompson Creek Metals, Grande Cache Coal and Fording Coal. The team has managed five operating gold mines and two copper mines in Canada.

Peter Epstein: Can you brag a bit about your team's history of successes?

Ian Berzins: In May 2018, Braveheart was a $4.0 million market cap company with an option to acquire a high-grade gold mine. Today the company has two significant near-term copper projects and a market cap of $20 million.

One director was involved with bringing Atlantic Gold to commercial production and a second director led the Mount Milligan copper and gold mine to commercial production.

Peter Epstein: Some investors are worried about Braveheart having to raise a lot of equity capital. Can you comment on your need to issue shares over the remainder of the year?

Ian Berzins: Braveheart needs to raise approximately $5.0 to $6.0 million to complete capital infrastructure upgrades. Proceeds will be raised through equity issues, conversion of warrants and/or placing a royalty on one of the properties. There are currently no royalties on any of our projects.

Peter Epstein: You have three projects. Which is your favorite, and why?

Ian Berzins: Bull River is our most advanced, our flagship project, with copper, gold and silver payables. It has a minimum 7-year mine life and is 95% built. Alpine is a high-grade gold mine at 16.5 g/t, one of the higher grades in all of B.C., which is known for high grades.

We envision Alpine providing supplemental feed to our Bull River operation. Thierry is the elephant, it could easily be the company maker. It's at least three years out, but could be 10x to 15x larger than Bull River. Our favorite opportunity? The first one to reach commercial production!

Peter Epstein: The Bull River Mine project is a past producer and is high grade at >2% copper, but it's a small resource. How much larger might it get?

Ian Berzins: We currently have ~6.5 to 7.0 years in our resource. But the mine is only 350 meters below surface, which is relatively shallow. It's very conceivable that the resource could extend to a depth of over 1,000 meters.

Last year we intersected structures 115 meters below our lowest workings. This material is not included in the current resource. Yes, the resource is expected to get a lot bigger, but it's too early to be more specific.

Peter Epstein: Can you explain, in layperson's terms, the value of your considerable tax losses?

Ian Berzins: The tax losses are associated with the individual projects. We have $150 milliom in tax losses at Bull River and $100 million at Thierry. Effectively, Braveheart will not be paying out cash taxes for the first 10 years of mining.

Peter Epstein: Is your team actively pursuing other properties/projects at this time?

Ian Berzins: We're always looking for acquisition opportunities. Typically we look in Canada at projects that have past production, are near existing infrastructure (roads, power and communities), a mineral resource in place, and are undervalued.

An experienced mining team who have built and managed mines can recognize value and the challenges that others might miss or oversimplify.

We're currently drilling at Bull River and expect to have encouraging results down dip. The resource could easily be expanded by 2x to 3x. Additionally, ore sorting and higher copper prices should allow us to lower the cut-off grade, effectively allowing us to mine lower grade material not included in the current resource.

Peter Epstein: A scoping study was done for Bull River in 2013. Is that scoping study of any use today? What would the after-tax net present value (NPV) and internal rate of return (IRR) look like at a copper price of $4.25/lb?

Ian Berzins: The scoping study gave management and the board sufficient confidence to continue with infrastructure upgrades. We're considering completing an updated preliminary economic assessment (PEA) as an expansion to the scoping study.

When we bought the project in 2019 the price of copper was US$2.75/lb, so clearly the economics have improved. I have to defer this question until a PEA or preliminary feasibility study (PFS) is completed.

Peter Epstein: Could the Bull River Mill be retrofitted to process higher value metals like gold?

Ian Berzins: Yes. In order to process gold from Alpine we would just need to add a gravity circuit at a cost of less than $250,000. That would be a relatively simple upgrade to the mill. The gravity circuit would capture ~80% of gravity-recoverable gold.

Peter Epstein: The Thierry Mine project has a PEA on it with an after-tax IRR of 19%. That's pretty good, but are there ways to improve the economics when the time comes for a PFS?

Ian Berzins: Yes. The Thierry project had an after-tax IRR of 19% and an NPV(6%) of C$260 million based on a US$3.40/lb copper price. However, at US$4.71/lb, the NPV more than doubles to C$547 million.

Economics could be improved by focusing on the near-surface open-pitable portion of the deposit at K1-1, and on the previously developed underground infrastructure, to reduce capital costs.

Peter Epstein: Braveheart has made good progress reducing its debt, but there's still some remaining. How much debt do you still have? Are the terms onerous?

Ian Berzins: We currently have C$5 million in debt with a senior secured creditor. The interest rate on the debt was recently reduced to 10%. In the past six months, we eliminated C$6.0 million of debt through conversion to common shares.

Peter Epstein: Why should readers consider buying shares of Braveheart Resources vs. one of the other 100+ copper-focused juniors?

Ian Berzins: Great question. There's been so much written about the bull market in copper lately that I feel it might not be necessary to point out that demand for copper is going to be very strong for decades to come. And, equally important (for the price of copper) is that global supply is increasingly uncertain.

Bullish price forecasts of $7-$8lb are exciting, but our projects would thrive at $4–$5/lb. In just the past month or two, both Peru and more recently Chile have had political outcomes that could slow or curtail significant quantities of copper production. These countries account for ~40% of mined copper, only the best projects will advance to production.

Having copper projects (and one gold project) in Canada will be extremely important going forward. We think we have very good copper assets in B.C. and Ontario. And, our gold project in B.C, has a blockbuster grade of 16.5 g/t.

Peter Epstein: Thank you Ian. Braveheart seems to be in the right place at the right time with the right team. I look forward to your progress this year and next.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Braveheart Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Braveheart Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Braveheart Resources was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.