I remain quite surprised at the massive rebound in commodity prices from COVID-19 lows last year. For instance, lumber is up >500% and iron ore, crude oil, soybeans, tin and copper are up 285%, 170%, 150%, 130% and 125%, respectively. Gold at $1,840/oz (up +25%) might seem unimpressive by comparison.

However, in August as gold roared past $2,000/oz, reaching at an all-time [nominal] high of $2,067/oz, there was real excitement in the air. Hundreds of gold junior stocks soared.

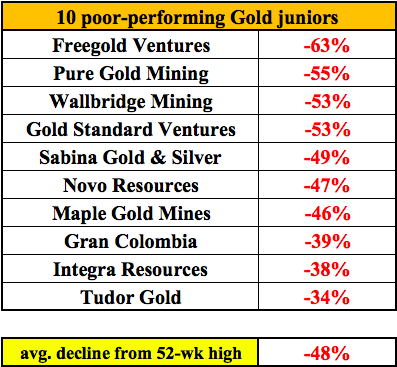

Today's gold price is 11% below its high tick, yet many high-quality gold juniors are down three to five times as much. In the chart below are 10 well-known gold juniors down an average of 48% from 52-week highs.

To be fair, some gold junior valuations might have traded too high last summer, but the sell-off appears to be overdone, leaving some really good opportunities. Readers should note that $1,840/oz is a spectacular price.

In the seven-years from 2013–2019, the average of year-end closing prices was $1,245/oz. Most PEAs, PFS/DFS reports done in that period used a long-term gold price assumption of $1,200–$1,350/oz.

Therefore, even without a higher gold price, juniors with gold properties in safe, prolific jurisdictions like Canada, near highly respected producers or world-class projects, offer very compelling risk-reward propositions. And, if the gold price fights its way back above $2,000/oz, all bets are off on how high some juniors might fly.

With that in mind, one such company with tremendous blue-sky potential, albeit with commensurate high risk, is Marvel Discovery Corp. (MARV:TSX.V; IMTFF:OTCQB). Last week it spun out some REE and battery metal assets, leaving it with four gold properties and a few others, including a nickel, cobalt, copper project in Quebec.

It has four gold properties spread across Newfoundland and the Red Lake/Atikokan areas. To learn more about the re-focused Marvel Discovery, I spoke at length with its CEO and large shareholder Karim Rayani, who continues to be an active buyer of shares in the open market.

Peter Epstein: Please give readers the very latest snapshot of Marvel Discovery Corp.

Karim Rayani: This is a great time to be looking at Marvel Discovery. Over the past several months the company has undergone a management reorganization and rebranding. We have acquired a number of gold assets that have tremendous potential and are adjacent to multimillion ounce discoveries in both Newfoundland and northwestern Ontario.

We think that discovery potential is high across our gold portfolio. We're adjacent to, or nearby, great producers like Agnico Eagle and Evolution Mining, and very well-respected juniors including New Found Gold, Great Bear Resources, Marathon Gold, Premier Gold Mines and Pure Gold Mining. Evolution is expanding in the district, having recently acquired Battle North Gold.

Peter Epstein: There's been a lot of excitement in Newfoundland lately. Can you talk about that, and about Marvel's properties in the province?

Karim Rayani: Newfoundland is one of the hottest areas for exploration these days. New Found Gold Corp. is achieving great exploration successes, its market cap has rocketed to C$1.4 billion. This has sparked a gold rush in the province. Marvel has been staking and acquiring new ground in key areas.

With our Victoria Lake and Slip gold properties, we're now one of the larger landholders around New Found Gold, Exploits Gold and Marathon Gold—host of the North Atlantic's largest gold deposit (aggressively drilling and looking to acquire more ground).

Victoria Lake shares structural settings with Marathon's world-class Valentine Lake project. Historical grab samples at Victoria Lake returned up to 15.5 to 24.9 g/t gold plus 18 to 140 g/t silver. Slip has similar structural settings as New Found Gold's Queensway project, and has historical surface samples as high as 44.5 g/t gold.

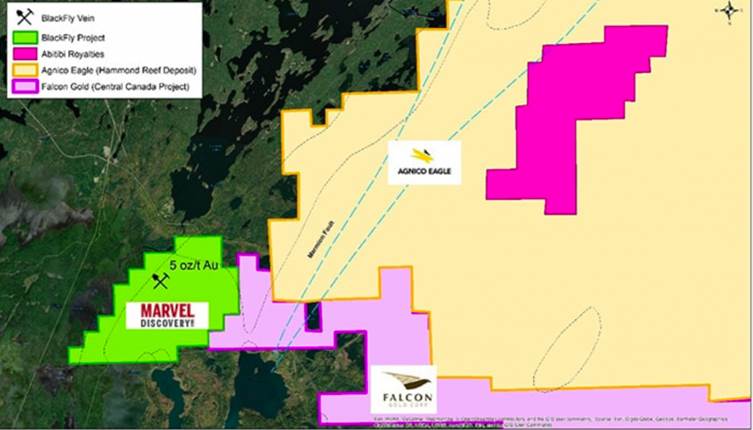

Peter Epstein: Please update us on the Blackfly Gold project.

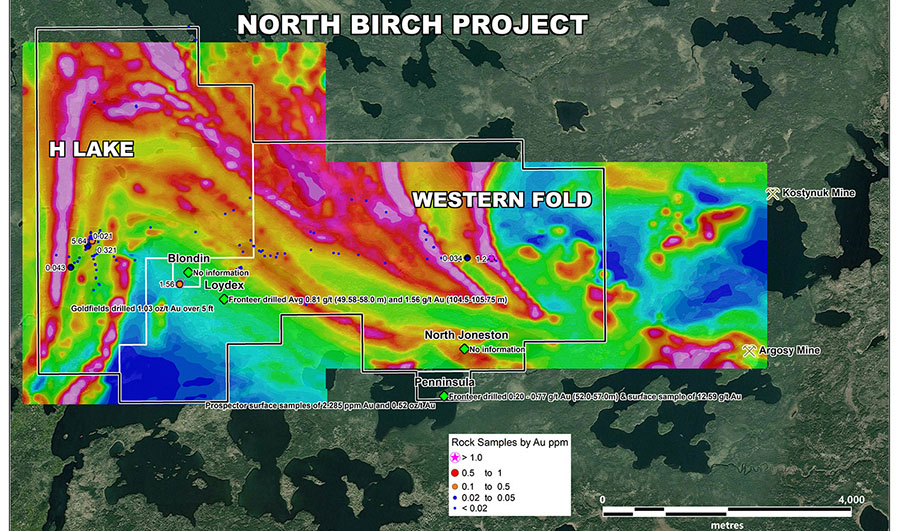

Karim Rayani: Yes, Blackfly is very exciting. It's in the up-and-coming Atikokan gold mining camp, ~13.6 km southwest along strike of Agnico Eagle's 5.6 million ounce Hammond Reef Gold project. This year's exploration program follows up on last year's compilation of historical info and high-resolution airborne magnetics/time-domain EM data collection. Prospecting, bedrock mapping and rock sampling are underway.

We recently received a work permit allowing for trenching, line cutting and drilling. Diamond drilling of 16 holes is planned for the summer. Historical intervals include 1.1 meters at 15 g/t gold and 2 meters at 11 g/t gold.

Geological mapping indicates alteration/mineralization for up to 5 km. Grab samples at the historical shaft area include 85.6 and 167 g/t gold. With the work we've done this year and last, we're zeroing in on high priority targets.

Peter Epstein: You recently spun out two properties into a new entity. Where does that leave Marvel Discovery in terms of ongoing involvement in the assets that were spun out?

Karim Rayani: Good question, thank you. We're very excited to have spun out the Pecors and Wicheeda projects into a new entity named Power One Resources. This leaves Marvel as a more focused entity. However, Marvel retained ~25%–30% of the new entity. The remainder will be distributed to shareholders as a special dividend.

We plan on implementing the arrangement on or about May 13, 2021. Holders of Marvel shares as of the close on May 7th will get a common share of Power One for every five shares held in Marvel. Power One will also issue 5 million Power One Shares to Marvel.

Moving forward, Marvel and Power One will be sister companies with common goals. In fact, we recently picked up additional ground contiguous with Power One's Wicheeda REE property. To the extent that Power One advances Wicheeda and Pecors in coming years, shareholders of Marvel will benefit as well. Equally important, Marvel will be in a position to help Power One expand if/when they are successful.

We recently acquired a 100% interest of a 5,352-hectare property east of Elliot Lake, Ontario, that's contiguous to Grid Metals Corp's and Canadian Palladium's East Bull Lake Intrusive (EBLI) palladium (Pd) projects.

The new property is also near New Age Metals' River Valley deposit, which hosts a 4 million troy ounce Pd Eq. resource. Our EBLI property hosts a possible extension of palladium-platinum mineralization onto our property.

The Pecors property that we spun off, west of the newly acquired Marvel Discovery ground, has been recognized as a large (25 km long x 6 km wide) magnetic anomaly. A regional magnetic feature between the Pecors anomaly, and the EBLI to the east, suggests these intrusive suites may be connected. This possible connector and the southeast extension of the Pecors anomaly is hosted within the Marvel Discovery claims.

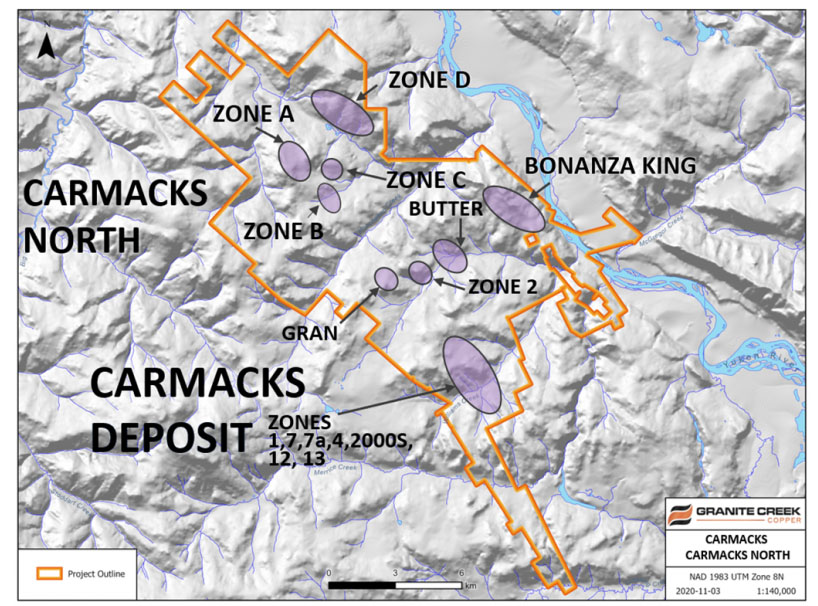

Peter Epstein: Can you tell us about your Camping Lake property in Red Lake?

Karim Rayani: In the Red Lake district we're earning into a 51% interest in the Camping Lake project. Camping Lake is within 20 km of Great Bear Resources' blockbuster Dixie Gold project. Historical exploration on the property was done by Kinross Gold, Laurentian Goldfields and Anglo Gold, incl. drilling and (rock, soil and lake sediment) samples.

Peter Epstein: Finally, how significant is your Duhamel battery metals project in Quebec?

Karim Rayani: Our 2,300-hectare Duhamel property is prospective for nickel, copper and cobalt. As a frame of reference, the best drill intercept we had was in 2000. A 3.0 meter interval graded 1.27% nickel, 0.33% copper and 0.12% cobalt. So, yes, we think Duhamel could be significant.

Those grades might not sound too sexy, but given that copper is at an all-time nominal high, and nickel and cobalt have significantly bounced off of last year's lows, that 3-meter intercept equates to ~5 g/t gold equivalent, and the mineralization is near surface.

Peter Epstein: Thank you, Karim. As always, a great update. I look forward to seeing progress on your gold prospects this year.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Marvel Discovery, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Marvel Discovery are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Marvel Discovery was an advertiser on [ER] and Peter Epstein owned shares and warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.