As copper is closing on to all-time highs, trading at US$4.42/lb Cu at the time of writing (peaking in 2011 at US$4.6285/lb Cu), Meridian Mining UK S (MNO:TSX.V) came out with its first set of assays from its 100% optioned Cabaçal VMS Copper-Gold Project in Brazil, from its ongoing field program, encompassing 10,000 meters of diamond drilling. The mix of verification and infill holes, aimed at targets in the Southern- and Eastern Copper Zone (SCZ/ECZ), returned good results, with highlights of 15.9m @ 4.0% CuEq and 48.6m @ 1.4% CuEq for CD-004 and CD-003, respectively. This is the first stage of confirmation of the historical BP Minerals/Rio Tinto drill results.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The initial focus areas were two-fold: management was targeting the SCZ through CD-001, CD-003 and CD-004 for high grade NW-SE trending alteration pipe hosting copper-gold-silver mineralization, and the ECZ through CD-002 for near surface sulphide mineralization, as suggested by historical drilling.

Since Meridian Mining has been mostly targeting to prove continuity of historical data by twinning or verification holes at the beginning of the program, it is interesting to see how the current drill results CD-001 to CD-004 match/relate to the historical holes.

- CD-001 was targeting to twin JUSPD 596, which intersected 15m @ 5.2% Cu, 2.66 g/t Au and 9.54 g/t Ag;

- CD-002 was targeting thick, shallow copper gold mineralization of the Eastern Copper Zone and designed to test adjacent to historical hole JUSPD 228, which returned 19.1m @ 0.4% Cu and 0.1 g/t Au, from 42.07m. It wasn't an exact twin hole, but a close, slightly up-dip hole located in a corridor that hasn't seen much drilling so far;

- CD-003 was targeted as an infill hole between historical hole JUSPD 596, and adjacent holes to the south that intersected broad packages of mineralization;

- CD-004 was drilled 20m south of historical workings, in the vicinity of historical drill hole JUSPD482, which intersected 13.4m @ 5.50% Cu, 1.31g/t Au and 24.72g/t Ag.

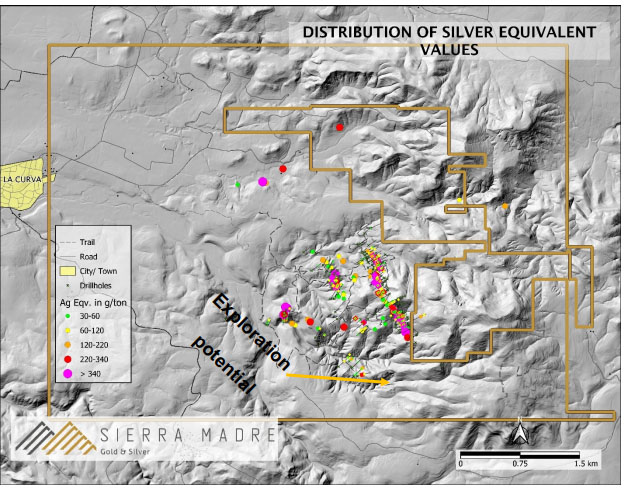

The drill collar locations are indicated on the map below:

As can be seen, most holes are drilled and at the edges of gold focused historical workings, that used a high 3g/t Au cut-off grade, where the bulk tonnages of Copper-Gold-Silver-Zinc mineralization remains intact. Also, it can be noticed that the map is littered with white dots outside the workings, indicating historical drill holes. It would be very interesting to see a 3D model that interpreted this data and would be a perfect guide for new drilling.

CEO Adrian McArthur had this to say about such a model and eventual timing:

"The company already has historical 3-D models compiled by the vendors and has conducted its own modelling using LeapFrog software during the due diligence process. This has given us an excellent base for planning. Rio Tinto has generously released its own historical data, providing just this month a further update of digital and scanned hardcopy files. The 3D modelling is a staged process to which the 80-20 rules apply. The initial scoping gives us the basis for planning; the work to move towards full NI 43-101 compliance involves rigorous compilation and cross checks which for a project of this scale are months in the making.

"Dislocations exist in the historical data and we have made adjustments to maps and collar positions based on new DGPS control points. part of a carefully documented and ongoing auditing process. Searches are constantly being made in the field to verify the positions of the historical collars (sometimes the actual collars themselves are still visible, and sometimes the drill pads, despite the passage of time). For NI 43-101 compliance we will verify the locations of as many holes as possible—a task made challenging coming out of the wet season when the grass is still knee to waist-high. We are continuing reviews for historical data sources that had not previously been digitally compiled (with access requested the historical archives of BP Minerals and archives of the National Mining Agency (ANM) in Brazil). The final 3D model will be a culmination of this work as part of the NI 43-101 update being targeted for the fourth quarter."

Holes CD-001 and CD-004 were drilled from the location of the historical drill pad of JUSPD 596, and as part of a fan (a fan means a series of holes drilled from a common platform on different trajectories, with holes directed in this case to the NW and NE). Holes CD-006 and CD-009 were drilled from that pad as well, and full assays are pending on these and five other completed holes as part of the on-going first round of drilling. Holes CD-003 and CD-004 still have partial intercepts pending for assays from the wider disseminated mineralized envelope, as assays initially focused on high-grade deeper sections.

The first phase of drilling results was delivered just after the free-trading date for the stock from the December financing. To my surprise nothing happened on that date, and during the day of this news release there was increased volume, but the share price appreciated in a healthy way as well. Executive Chairman Clark explained to me that the active equity management implemented at Meridian has led to a series of supportive long-term shareholders, who have a good understanding of the long-term growth potential of the Cabaçal asset.

Let's have a look at the results, which are infill and verification holes of historical drilling, stepping out from the historical mine workings. All intercepts are estimated to have a true width of 90% of intersection widths:

- CD-001 was drilled 75m southeast of the historical workings and returned 23.7m @ 0.8% CuEq from 128.00m (0.6% Cu, 0.3g/t Au, 0.7g/t Ag, 0.1% Zn), comprising stringer and breccia mineralization before the footwall was hit at 151.6m depth. Upper assays included:

- 14.5m @ 0.3% Cu from 50.50m;

- 0.9m @ 0.6% Cu, 0.1g/t Au & 5.0g/t Ag from 76.65m;

- 3.0m @ 0.2% Cu & 0.1g/t Au from 92.00m;

- 3.7m @ 0.3% Cu & 0.1g/t Au from 103.00m;

- 0.9m @ 0.9% Cu & 0.4 g/t Au from 108.32m;

With the lower zone returning:

- 11.4 m @ 0.9% Cu, 0.4 g/t Au, 1.2 g/t Ag and 0.2% Zn.

Since the historical hole JUSPD 596 returned 15m @ 5.2% Cu, 2.66g/t Au, and 9.54 g/t Ag, this differed considerably. Management commented on this in the news release:

"The hole deviated compared to the historical trajectory of JUSPD 596, accounting for some difference in the assay results. The combined data of all BHEM results in the area will be reviewed to provide targeting vectors towards zones of higher sulphide concentrations (surveys of CD-007-009 pending)."

It seems the high grade mineralization is confined to a relatively narrow zone, which can be easily missed by drilling. It could take additional holes before the high grade zone is pinpointed. Notwithstanding this, the bulk of the deposit will consist of lower grade mineralization so no harm done, the higher grade stringers and breccia will be the cherry on the cake, in my opinion, improving the already economic grades even further.

- CD-002 returned 22.7m @ 0.8% CuEq from 39.70m (0.5% Cu, 0.4g/t Au, 0.7g/t Ag & 0.1% Zn) including a higher grade zone of: 2.7m @ 2.8% CuEq from 59.74m (1.6% Cu, 1.7 g/t Au, 5.3g/t Ag & 0.4% Zn). This hole also deviated a bit from the trajectory of historical hole JUSPD 228, but resembled the historical hole much better, almost exactly, probably also caused by the more continuous lower grade zone. Something of interest was the further commentary provided in the news release:

"BHEM was undertaken on CD-002, although being a vertical hole is not optimally orientated to provide directional vectors to conductors. The survey detected a strong conductivity response modelled as a plate 30.0 x 30.0m plate, ~ 40m off-hole. The plate is nominally modelled to the SE but required additional survey constraint to verify with angled holes. Additional work will be conducted to test beneath and southeast of the sill to test for repeat mineralization."

This plate is shown as a blue rectangle in the drill collar map above, southeast to the location of CD-002. If follow-up drilling proves to be successful, this would mean a further 100-meter step-out. I wondered as a non-geologist why a vertical hole doesn't have an optimal orientation regarding providing directional vectors to conductors, as in my view you need at least two holes with some distance, barring faults, regardless of orientation, to derive any stratigraphic concepts of geology present. CEO McArthur answered that:

"The Eastern Copper Zone is known to comprise a broader disseminated envelop with more discrete higher-grade stringer to breccia mineralization. The presence of the conductor suggests that high concentrations of sulphide minerals are developed within this corridor. We will be doing some angled holes to verify the footprint of the mineralization and ensure that the drill density is sufficient to adequately characterize the higher-grade zones. This position plunges gentle below a post-mineralization sill, and the full extent of the body remains to be defined to the southeast."

- CD-003 returned 48.6m @ 1.4% CuEq from 120.00m (0.7% Cu, 1.0g/t Au, 2.0g/t Ag & 0.3% Zn), including a higher-grade zone of: 17.2m @ 3.2% CuEq from 151.40m (1.5% Cu, 2.5g/t Au, 4.7g/t Ag, & 0.4% Zn), with the full results looking like this:

- 48.6m @ 0.7% Cu, 1.0g/t Au, 2.0g/t Ag, & 0.3% Zn from 120.00m; including

- 17.2m @ 1.5% Cu, 2.5g/t Au, 5.0g/t Ag & 0.4% Zn from 151.40m;

- 2.0m @ 1.9% Cu, 13.1g/t Au, 7.5g/t Ag & 0.3% Zn from156.70m; and

- 4.4m @ 3.8% Cu, 3.5g/t Au, 12.7g/t Ag & 0.7% Zn from 161.27m.

A high grade gold result was intercepted at depth: 1m @ 24.7g/t Au, ranging from 156.7m to 157.7m depth. Assays are pending for the 77-120m interval, which could widen the mineralized envelope. As disseminated sulphides started from 52.4m, and the 52.4m-77m interval didn't return economic intercepts, it will be clear such sulphide intercepts don't automatically convert into mineralization. The same goes for CD-004, where these sulphides started at 46m depth.

- 48.6m @ 0.7% Cu, 1.0g/t Au, 2.0g/t Ag, & 0.3% Zn from 120.00m; including

- CD-004 returned 15.9m @ 4.0% CuEq1 from 148.55m (3.3% Cu, 0.7g/t Au, 15.7g/t Ag & 0.6% Zn), including a higher-grade zone of: 10.2m @ 5.9% CuEq from 151.97m (4.9% Cu, 1.0g/t Au, 23.9g/t Ag & 0.7% Zn).

Full results are:

- 6.5m @ 0.6% Cu, 0.2g/t Au, 3.0g/t Ag, & 0.1% Zn, from 114.90m; including

- 0.3m @ 11.5% Cu, 2.2g/t Au, 55.0g/t Ag, & 0.7% Zn from 119.40m;

- 15.9m @ 3.3% Cu, 0.7g/t Au, 15.7g/t Ag & 0.6% Zn from 148.55m; including

- 10.2m @ 4.9% Cu, 1.0g/t Au, 23.9g/t Ag & 0.7% Zn from 151.97m

- 6.5m @ 0.6% Cu, 0.2g/t Au, 3.0g/t Ag, & 0.1% Zn, from 114.90m; including

Assays are also pending for the 77-120 meter interval. The very high grade pXRF point readings were coming from this core, as 8% Cu was assayed from 156.6m to 157.6m. It is likely a replicating of continuity between zones as this was the exact same depth of the high-grade gold intercept of CD-003, drilled 25m south of CD-004.

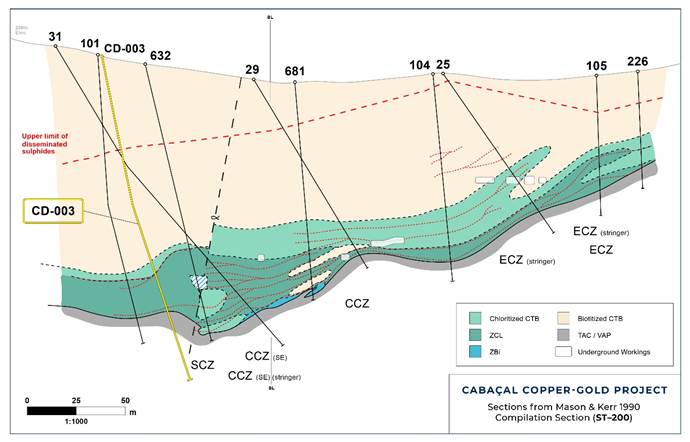

The results from CD-003 and CD-004 confirm the concept of a 15–17-meter-thick high grade breccia to stringer zone contained within lower grade, disseminated sulphide zones in the Southern Copper Zone, located right above the volcanic footwall (footwall is the underlying side of a mineralized zone, fyi on the other hand there is the hanging wall, the overhanging side of a mineralized zone). Cross-sections from the Mason and Kerr report from 1990 (below) illustrate this perfectly.

When asked about the controls established on geology and mineralization at Cabaçal, CEO McArthur answered that:

"The stratigraphic sequence at Cabaçal has been established from surface mapping, drill cores and underground exposures. A series of quartz-sericite-chlorite-biotite schists (CTB) with more siliceous zones (CHB), more chloritic zones (CTB/CL and ZCL) and interlayered cherts, occurs structurally above a thick sequence of quartz-sericite schists (TAC). The contact between the CTB and TAC formations is abrupt. Mineralization is mainly confined to the CTB/CHB formations with higher grade copper mineralization preferentially associated with ZCL (most intensely chloritic zones). The lower levels of the mine sequence are typically more gold rich. Mineralization has been divided into a number of spatial domains:

- The East Copper Zone: comprising elongate sulphide veins developed within chloritic CTB. Having lower gold grades, it was not targeted extensively for selective underground mining, but is not devoid of gold credits with respect to a bulk-mining open pit development scenario;

- The Central Copper Zone has variable gold-copper-silver mineralization including a component of the massive sulphides; and

- The Southern Copper zone includes stockwork Cu-Au mineralization and vein-stringer Au-Cu mineralization in the down-dip portion of the defined extent of the mineral system."

According to the 1990 Mason and Kerr study, the high grade in Meridian's current program and in historical results was interpreted as part of a major NW-SE trending alteration pipe of higher grade copper-gold-silver mineralization, now defined 100 meters out from the historical workings. As it seems grades are increasing at depth, I was wondering if management is targeting more, even higher grade copper at depths eligible for underground mining. CEO McArthur answered:

"Our drilling confirms the presence of the high-grade corridor noted by Mason and Kerr. The trend is open to the southeast and is one of a number of near mine targets, others notably including positions in the vicinity of the decline where high-grade trends were interpreted to project up-dip. Satellite targets further from the mine development includes a position 500m to the south where wide-spaced drilling shows a poorly tested thickening of the favorable ZCL target position (e.g., dark green zones on image above). The study concluded that there was strong potential for discovery of more mineralization around Cabaçal and in the belt as a whole which was described as a prime long-term target for VMS type mineralization, which in a Canadian context would see strong competition for ground holding."

As a reminder, the current drilling is part of a 60–70 hole drill program for 10,000 meters, of which 30 holes are twinning holes, in order to verify the 21.7 Mt historical resource estimate. Originally it was planned to do this with two drill rigs, but on the back of the positive initial results, the company is mobilizing a third rig now, which will be commencing drilling around before the end of April. Management is also buying more high-powered borehole EM equipment now, which will increase the radius of detection from about 50 meters to about 150 meters. Equipment is currently under construction and is expected to be deployed in the field by mid-June.

On a side note, CEO McArthur was particularly pleased with a ground-based EM survey, which modelled a bedrock conductor, which was already detected by a modern 2007 airborne survey, as such providing excellent confirmation. This conductor is part of a set of conductors neighboring the Cabaçal Mine, and these and other mine corridor conductors are shown on this map covering over 14km, called VTEM Plates visualized by yellow rectangles, see below:

Strong conductors are connected to high grade sulphides, and as such an obvious target. They are highlighted in yellow ovals. The current 10,000 meter drill program is expected to be completed by the end of Q3, 2021, and management is targeting a maiden NI 43-101 compliant resource estimate by Q4, 2021. However, management told me, should the drilling still be expanding the drill envelop at this point, they will not stop the drill program to simply produce a resource.

While busy working on verification of the historical data, the company also reviewed the metallurgical information when the mine was operational. The achieved results from the past were impressive, and Meridian is targeting as a consequence +90% recovery for copper, 90% recovery for gold, and +85% recovery for silver. These targeted recoveries are based on conventional flotation and gravity processes, so a very standard flow sheet. As there is no data available on zinc or lead recoveries, this will need to be tested as well. For a copper dominated mineralization, these are amazing recoveries for the precious metals, as usually for a copper concentrate precious metal recoveries are below 75–80%. According to McArthur, the reason for this is the bulk of the gold and silver is hosted either by the chalcopyrite or as coarse gold and silver (electrum) that was easily recovered by gravity.

Conclusion

As the first good drill results are coming in, the building blocks for the investment thesis for proving up and expanding the Cabaçal project into a real VMS system seem to be set in place nicely one by one by management. Although CD-001 deviated from the historical high grade results, it just indicated that verifying old results isn't a walk in the park, and this high grade part will probably take some more drilling to prove up. As these were just the first four holes, with six more coming up shortly, as part of a 70-hole program, there are many more interesting intercepts to expect, which will undoubtedly trace more mineralization.

It was good to see that the share price reacted nicely to the news release, which at the same time didn't cause excessive selling among the holders of December private placement paper, coming out of lock up on April 22, 2021. It shows me management did an excellent job by selecting quality holders, and manages expectations very well, and probably also lined up supportive buyers. For me this all embodies a very well-run junior, with a project that potentially just has scratched the surface. I am considering buying more soon.

I hope you will find this article interesting and useful and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor and has a long position in this stock. Meridian Mining is a sponsoring company. All facts are to be checked by the reader. For more information go to www.meridianmining.co and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.