In listening to and reading commentary on lithium (Li) prices, analysts, journalists and management teams are quick to point out a doubling in the lithium carbonate (LC) price (in China) from last year's multiyear lows. While that's certainly bullish news, prices should be viewed over a longer period than just nine months.

Benchmark Mineral Intelligence (BMI) recently tweeted the above chart. This indicative index of LC prices is well suited for analysis. If the dates at the bottom are too small, they begin in October 2006. This weighted-average LC index, which picks up prices from around the world, topped at ~$21,500 per metric tonne ($21.5k/Mt) in late 2017, before bottoming at ~$8k/Mt last summer.

Readers are reminded that before 2015–16, there was virtually no electric vehicle (EV) market to speak of. LC prices were ~$5k–6k/Mt in many of the years leading up to 2016 (see chart; price began a second, much larger spike in Q3/2015). Back then, global EV penetration had only reached ~0.6% (1 out of 167 of the world's passenger vehicles were electric).

Last year, it clocked in at a still modest 2.9%. In four years time, global EV penetration is expected to quadruple–quintuple to 12–15% (see chart below). Although 2025 is very interesting, look at Morgan Stanley's estimate for 2030 of 31.5% penetration! Note: Global EV penetration forecasts for 2030 range from 25% to 40%.

Earlier this year, top Li producer increased its demand forecast for 2025 to 1.4 million metric tonnes of lithium carbonate equivalent (LCE) per year. Based on my observations of the Li market since early 2016, there's no way the industry can deliver that much growth in the next four years.

Yes, Li prices will be stronger for longer

Given that 2020's LCE demand was ~375k Mt (estimates range from 350k to 400k Mt), even if every existing producer doubled their output, it would take 16 new 25k Mt LCE/year projects to reach 1.14 million Mt/year. Yet, there are fewer than 12 projects that propose to deliver equal to or greater than 25k Mt LCE/year in the next four to six years.

A key takeaway: Each and every project takes two to four years to ramp up to nameplate capacity, or longer if a project is developed in stages. For example, Millennial Lithium Corp. (ML:TSX.V; MLNLF:OTCQB) has a six-year ramp up to full battery-grade LC production. Galaxy Resources Ltd.'s (GXY:ASX; GALXF:OTCMKTS) high-grade Sal de Vida brine project in Argentina is coming online in three stages. Both projects are forecast to reach full capacity around 2028–2030.

Therefore, supply of 1.14 million Mt/year won't arrive by 2025. In any event, that daunting figure pales in comparison to the anticipated need in 2030. RK Equity's Rodney Hooper is forecasting demand of 2.9 million Mt/year. Earlier this month, UBS increased its demand level in 2030 to 4.4 million Mt.

I strongly believe that unconventionalprojects (i.e., not brine or hard rock) will get funded out of sheer necessity. Several direct lithium extraction (DLE) projects will get developed, such as Standard Lithium Ltd.'s (SLL:TSX.V; STLHF:OTCQX) innovative brine project in Arkansas. But, we need a lot more than a handful of DLE projects.

Sedimentary deposits, such as clay-hosted mineralized zones, offer the best examples of an alternative to hard rock or brine. Globally, there are five or six large, clay-hosted Li projects (at preliminary feasibility study (PFS)-stage or beyond) in the pipeline. Note: No DLE or clay-hosted Li project has ever reached commercial scale. A few western U.S. states and Mexican clay-hosted juniors have projects that are pre-preliminary economic assessment (PEA) stage.

All hands on deck: Even unconventional projects desperately needed

Where does that leave readers who want to invest in the battery metals space? I believe that one clay-hosted (sedimentary) Li junior offers a very compelling risk-reward proposition. It's high-risk like the DLE plays, but has equal or better upside potential.

For clay-hosted Li extraction to be viable, commercial successes at Bacanora Minerals Ltd.'s Sonora and Lithium Americas Corp.'s (LAC:TSX; LAC:NYSE) Thacker Pass projects will be critical. These two, both well-funded and slated to reach production in 2023 or 2024, will blaze a path forward for those who follow.

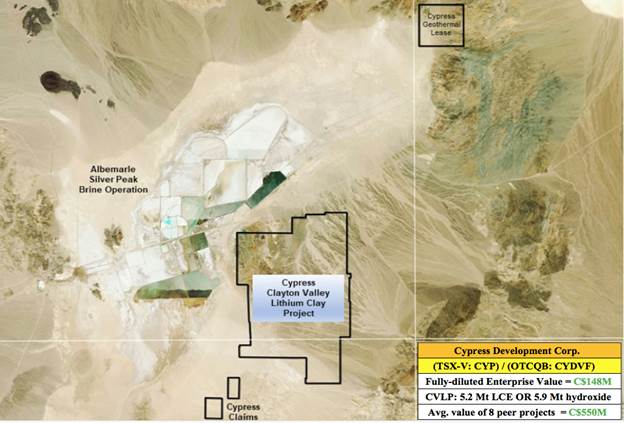

That's why I remain quite bullish on Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:FSE). By standing on the shoulders of trail-blazing first movers, it will learn from their mistakes, gaining the confidence of stakeholders. To be clear, Cypress is interesting in its own right, not just for riding on the coattails of Thacker Pass.

Like other sedimentary projects, Cypress has a giant Li resource (Measured and Indicated of 6.3 million Mt LC Or 7.1 million Mt Li hydroxide). The strip ratio is very low at 0.3:1.0, compared to an average of 5.6:1.0 among several other sedimentary peers.

More important, CEO Dr. Bill Willoughby, his technical team and third-party advisors believe they've found a better mousetrap (operating flow sheet).

As it stands, all clay-hosted Li projects, including Cypress's, plan to use sulfuric acid to liberate lithium out of host claystone into solution. However, Cypress is carefully studying the use of hydrochloric (instead of sulfuric) acid as its leaching agent. Admittedly, companies in Nevada and elsewhere have been trying to crack the clay-hosted Li code for decades.

What's different this time? Three things.

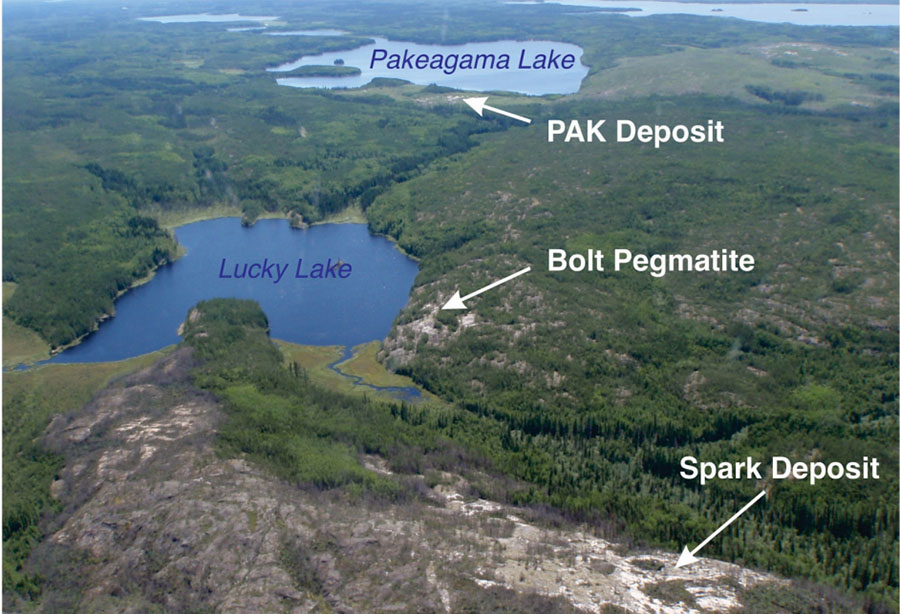

Cypress Development Corp., at PFS-stage, well positioned in Nevada

First, Cypress is greatly benefiting from expert geologic, engineering and metallurgical consultant groups, plus the considerable efforts of various Nevada state and federal agencies dating back to the 1970s.

Second, Li prices are double their long-term average and trending higher, introducing a much-needed margin for error.

Third, I count 30-plus publicly-listed original equipment manufacturers (OEMs) with market caps greater than CA$3 billion that are (collectively) relying on 1 million+ Mt LCE/year, by the middle of the decade.

If Cypress can operate with hydrochloric acid, it would eliminate the need to make, move and consume sulfuric acid, and there would be no need for a $102 million sulfuric acid plant. Preliminary thoughts are that this new flow sheet should generate better project economics, but it's impossible to quantify without further work.

Management believes that greater operating flexibility could potentially be achieved, allowing for the ability to produce (if warranted) more battery-grade hydroxide than is contemplated in the PFS.

A new flow sheet would make the project less logistically complex and more environmentally friendly. It would require a lot less water—although it would need more power. If Cypress could tap green-energy sources (wind/solar/geothermal), that would be really big news.

It's no exaggeration to suggest that Cypress could have (subject to a third-party BFS/DFS) the best clay-hosted sedimentary Li project in the world, due to its uniquely favorable combination of 1) geology, 2) proximity to sustainable sources of brine and/or geothermal fluids, 3) relatively modest use of water, and 4) very low strip ratio (0.3:1.0).

Thacker Pass clay-hosted Li project valued by analysts at ~CA$1.7 billion

Cypress is a few years behind LAC and Bacanora, but those companies will presumably pave the way forward for the company's eventual success. If Willoughby and his talented team can partner with an industry heavy-weight like Albemarle, then time (and technical/funding risk) to first production would be reduced.

The market is valuing Thacker Pass at ~CA$1.0 billion (CA$1.0B). Analysts are valuing it as high as CA$2.4B. If Thacker Pass is worth anywhere near the midpoint of ~CA$1.7B, then Cypress is arguably worth a lot more than its paltry (fully diluted) enterprise value of CA$132M.

Assuming that Cypress has a 75% chance of success, and discounting a potential CA$1.7B valuation by two-thirds (for Cypress being earlier stage on permitting and largely unfunded), that's still a prospective CA$438 million valuation.

Conclusion

I hope that readers can see that lithium demand will be strong to extremely strong over the next 10 years. If one agrees, one should consider buying shares in Cypress Development Corp.

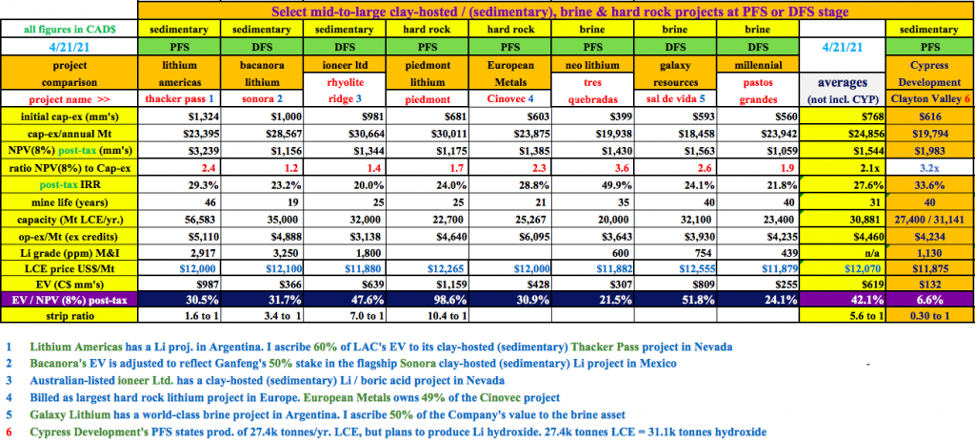

Not only is Cypress compelling as a "second" mover behind Thacker Pass and Sonora, it could have a superior flow sheet and possibly the strongest economics of any Li project on the planet, except Neo Lithium Corp.'s (NLC:TSX.V) Tres Quebradas project in Argentina. Please see the peer comparison chart above.

Cypress has the second best IRR (internal rate of return), second best EV (enterprise value)/capex ratio and lowest market valuation. And, its ratio of EV to after-tax NPV(8%), of just 6.6%, is 84% below the peer average (42.1%) for the same ratio of eight similar-stage Li peers.

Cashed up with ~CA$22M, the PFS behind them, a pilot plant being fired up next month, water rights being negotiated and a fully-funded BFS/DFS expected in 1Q/2022—this story has been meaningfully de-risked (albeit, still high risk).

As the (fewer than) 15 projects that could reach production by mid-decade begin to get tied up via off-take agreements, and as OEMs and Li producers acquire projects and/or Li juniors outright, Cypress will rise to the top of the list of investment vehicles well suited to play the unstoppable battery metals theme.

Earlier this week, Orocobre Ltd. (ORL:TSX; ORE:ASX) announced a AU$4 billion merger of equals with Galaxy Resources. Industry consolidation has barely begun. Obtaining security of battery metal supply will grow ever more urgent in coming years.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Cypress Development Corp. was a recent (not current) advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.