In the mining industry, location is often the key determinant of a project's success.

For precious metals, although gold and silver can be mined in various regions of the world, few could match the steady production and exploration potential of Mexico.

Since the arrival of Spanish Conquistadors in search of gold and silver some 500 years ago, Mexico has grown into one of the world's largest metal producers. Today, the Latin American nation is the largest producer of silver in the world and a top 10 global producer of gold.

According to the US Geological Survey (USGS), Mexico's silver production reached 5,600 tonnes in the past year, representing just over 20% of the global mined output. Gold production in 2020 was 111.4 tonnes, good for ninth place in the world.

While mining activities occur throughout Mexico, many of the notable gold and silver operations are found in Sonora and Zacatecas, with the former producing more than one-third of the country's gold, and the latter more than one-third of its silver. Collectively, these two states account for roughly 55% of Mexico's mining GDP.

Top gold-producing states in Mexico (Source INEGI)

Mining-Friendly Jurisdiction

In many countries, the regulatory framework surrounding mining remains one of the biggest hurdles in unlocking their resource potential. Mexico, on the other hand, possesses a favorable environment for those operating in the mining industry.

Given its long tradition, mining is essentially enshrined in Mexico's constitution, with mineral exploration having a preference over any other land use. Laws exist to provide a well-defined mining regime that operates under a concession system, whereby concessions are required for exploration or extraction.

Exploration concessions are granted for six years and are not renewable. However, production concessions are awarded for 50 years and are renewable for a similar time. This encourages active and efficient exploration activity geared toward development and mineral production. There are no limits to the number of mining concessions a company can hold.

The concessions in Mexico commonly have specified expenditure requirements, as well as provisions for conforming to established standards for health, safety and environmental protection.

Over the past decade, Mexico's environmental regulations have become increasingly stringent because of international agreements that it has ratified, including the North American Agreement on Environmental Cooperation (parallel to NAFTA), the United Nations Framework Convention on Climate Change and the Convention on Biological Diversity.

Nowadays, mining companies must obtain environmental impact permits from SEMARNAT (Spanish: Secretaria de Media Ambiente y Recursos Naturales) prior to any mining and exploration activities, and such activities are subsequently subject to several environmental permits from different offices with SEMARNAT.

All mining companies must meet environmental impact permitting regulations that include tailings and water remediation plans before being allowed to commence operations. This is especially important as ESG (environmental, social and governance) practices remain a key area of concern among mining investors.

As part of the comprehensive structural reforms passed by the Mexican government, new duties were approved for mining companies: 7.5% of a figure similar to EBITDA and 0.5% of gold and silver sales.

Moreover, the current administration under President Andrés Manuel López Obrador is very supportive of mining. Last year, López Obrador included the industry as part of his $2.5 billion economic package. The President has also been active in resolving the various issues across mines in Mexico.

Sierra Madre Occidental

Despite centuries of mining activity, the geological potential of Mexico remains strong, as the country's terrain is one of the most tectonically active and complex in the world. Orogenesis has pushed up mountain chains across Mexico.

A key feature of Mexico's geology is the Sierra Madre Occidental, a high plateau forming part of a chain of mountain ranges that runs from western Antarctica, up through South America, Central America, through Mexico, and into the western United States.

Sierra Madre Oriental mountain range

This high plateau is cut by deep river valleys and was formed through volcanic activity and sits atop a sedimentary basement composed of metamorphic rocks. The basement is part of the Older North American basement, which itself is underlain by a Precambrian basement and is intertwined with Paleozoic-era sedimentary layers.

The Sierra Madre Occidental extends from the northern part of Sonora state and south, where it meets the Trans-Mexican Volcanic Belt that covers central-southern Mexico. Gold and silver mineralization is commonly linked to the two belts of hydrothermal veins and gaps that stretch out underneath both sides of the Sierra Madre Occidental.

Geology in the mining state of Zacatecas, also part of the mountain range, comprises several marine beds of the Lower Cretaceous era and Upper Triassic greenstones, lava and sedimentary rocks. Mineralization occurs mainly in epithermal veins, which are prime targets for precious metals exploration.

Zacatecas is located within the Mexican Silver Belt, considered to be the world's largest silver region. The Fresnillo area in Zacatecas state has seen significant mining activity since the 1500s.

Two other mountain ranges, Sierra Madre Oriental and Sierra Madre del Sur, located to the northeast and south respectively, also form some of the nation's key metallogenic areas.

The nation's geological potential has attracted more than 250 private exploration companies to Mexico, with operations concentrated in the northern states of Sonora, Zacatecas and Chihuahua.

Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF)

Among those actively exploring the mineral-rich regions of Mexico, one miner that is on a fast track to achieving intermediate status is Canada's Magna Gold Corp. (MGR:TSX.V; MGLQF:OTCQB), which has been actively acquiring and developing quality precious metals properties in Mexico.

The company's flagship project is the past-producing San Francisco mine, located 150 km north of Hermosillo, Sonora's state capital. The 47,395-hectare property consists of two previously mined open pits (San Francisco and Chicharra)—which Magna plans to reopen soon—and associated heap leaching facilities located close to the San Francisco pit.

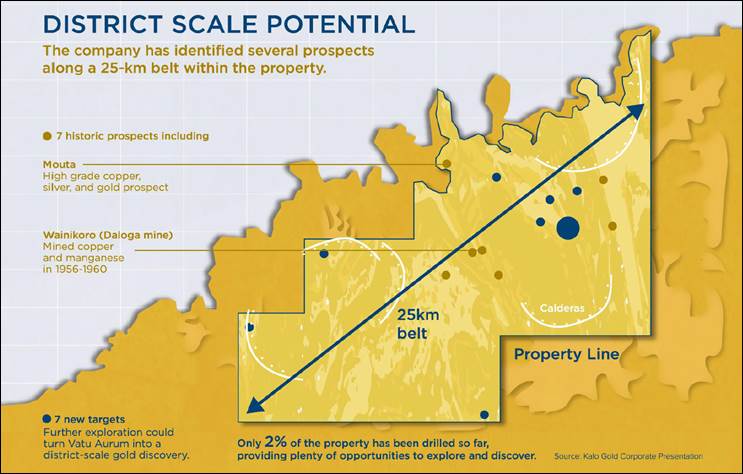

Resource potential along the San Francisco district

"We have a simple business model; it starts with growing organically. We only acquire properties in near-term production that were either mismanaged or forgotten in previous years," Magna President and CEO Arturo Bonillas said in a 2020 interview with Resource Stock Digest. He added the San Francisco mine was "such a perfect match" for this operating model.

The company is led by a management team that has decades of experience in the country, along with a track record of success. Bonillas himself is an industrial engineer with over 40 years of experience in the Mexican mining industry and extensive experience in all aspects of exploration, financing, building and operations.

Before joining Magna, Bonillas had a 10-year tenure as president of Timmins Gold Corp. (now Alio Gold), where he spearheaded that company's transition from one of exploration and development to a mid-tier gold producer.

Miguel Ángel Soto, Magna's vice president of exploration, also has over 40 years of experience in the Mexican mining industry, including 25 years in roles as senior executive geologist for several mining companies. He is widely recognized as one of the top mining professionals in the country, with extensive knowledge of all mining districts in Mexico.

As co-founder of Timmins Gold, Soto successfully increased the gold resources of the San Francisco mine from 611,000 to 2.4 million ounces, which eventually led to the sale of the project to Magna in May 2020. Now, he is looking to take the former mine back into the fold and advance it further.

San Francisco Mine

The San Francisco mine was previously developed and operated by Geomaque from 1995 through 2000. During that time, approximately 13.5 million tonnes of ore at a grade of 1.13 g/t gold were treated by heap leaching, and 300,834 oz of gold were recovered.

Mining operations ceased in 2001 because of low gold prices, although leaching and rinsing of the heap continued for approximately one year after this.

San Francisco open pit

In 2005, Timmins Gold acquired the mine and processing equipment, and began commercial operations in 2010. Since then, the mine has processed more than 1.2 million ounces of gold, producing over 100,000 oz of gold per year on average. This makes San Francisco one of the most successful mining operations in recent history in terms of economic performance and operational results.

Last year, the mine entered a period of residual leaching, during which it is expected to recover between 12,500 and 15,000 oz of gold, but that did not deter buyer interest.

Looking to re-establish San Francisco as a profitable mine, in spring 2020, Magna agreed to acquire the Sonora-based project for nearly 20% of the company's share capital, which could turn out to be a bargain considering how much gold prices have risen over the past 12 months.

Since the acquisition, Magna has already completed an updated pre-feasibility study (PFS) on the property, showing nearly 100 million tonnes of mineral resources (Measured and Indicated) with an average gold grade of 0.446 g/t.

"The numbers were great. The study shows that we have 1.5 million ounces of resources in the ground. We have close to 800,000 ounces of gold that we're going to extract from the mine over the next seven years, at a rate of 70,000 ounces per year," chief executive Arturo Bonillas elaborated on the PFS.

San Francisco – plan view of operations

Magna also intends to execute a mine operational improvement plan, including a full review and update to the mine design and production plan, metallurgy and processing, workforce management, and local and regional exploration. Based on Magna's review to date, the company believes it can re-commence mining operations in the near term.

Other Gold Projects

Aside from the past-producing San Francisco mine, Magna is also looking to develop several exploration-stage gold projects across Mexico.

One of those is the Mercedes project located within the Sierra Madre Occidental province, a historically productive, regionally extensive tertiary volcanic field that stretches from the U.S.-Mexico border to Central Mexico.

Mercedes project location map

Previous work at the La Lamosa area, one of the mineralized targets within the mining concessions, displays disseminated gold mineralization hosted within an andesitic and rhyodacitic volcanic complex intruded by a quartz-feldspar porphyry. The property exhibits textures and alteration consistent with high sulphidation epithermal mineralization, typical of important discoveries in the region.

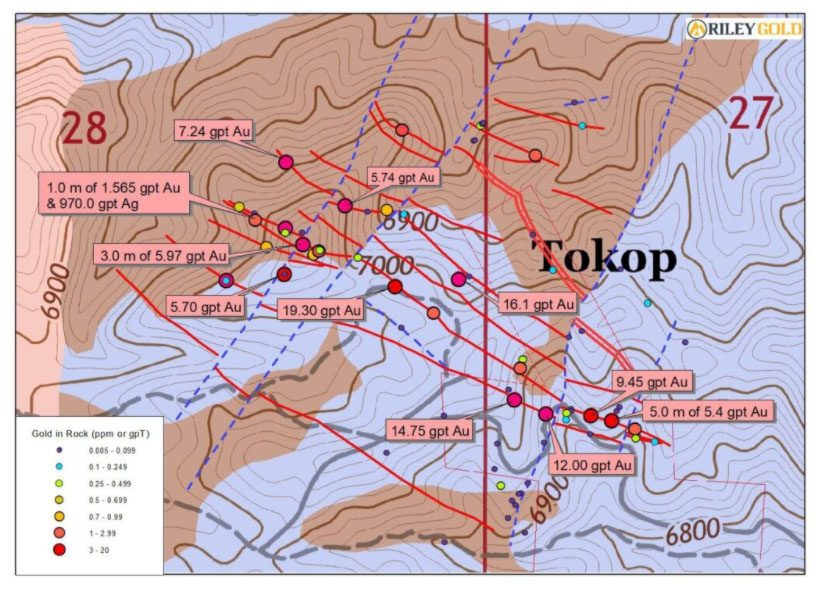

Exploration targets on the Mercedes property

Notable producers in the area include Alamos Gold's 3 Moz Mulatos gold mine, Agnico's 1 Moz La India gold mine, and Minera Alamos' Santana and Santa Rosa projects.

Another project that Magna is exploring is San Judas, which comprises two contiguous claims within the municipality of Trincheras, Sonora. This property is at the southern end of the Caborca orogenic gold belt or Sonora-Mojave Megashear, a trend known to host several orogenic and related intrusive gold-bearing deposits.

San Judas location map

There are several large open-pit heap leach gold operations within the Caborca belt, including Magna's San Francisco property. Others are La Herradura, Soledad-Dipolos and Nochebuena (Fresnillo), Cerro Colorado (Gold Group), El Chanate (Alamos Gold), and La Choya (Hecla Mining).

The combined gold reserves and resources identified within the trend to date total in excess of 10 million ounces, but this figure could be doubled (~20 million ounces) according to the current exploration results.

Silver Portfolio

In addition to these gold assets, Magna has also assembled a portfolio of silver exploration properties in northern Mexico, led by the recently acquired Margarita silver project in Chihuahua state.

Margarita is located within the prolific Sierra Madre Gold Belt that hosts numerous multimillion-ounce gold-silver deposits. The property lies 15 km northwest on strike with Sunshine Silver Corp.'s Los Gatos mine.

Location of the Margarita project

The mineralization at Margarita represents a low-intermediate sulphidation epithermal Ag-Pb-Zn system. There are 7 km of multiple outcropping veins inside the property, and only one of them has been drilled. Channel sampling in the past has returned values ranging from 100 to 900 g/t Ag.

In February, exploration activities began on the project, where the company has taken 5,097 meters of HQ drill core from 35 drill holes acquired from the project's previous owner and plans to re-log these drill cores. It will also re-sample the vein and vein extensions, and compile sections based on drilling in 2018-2019.

Field work at Margarita is scheduled to begin soon, which will be used to plan a drill campaign for Q3 2021.

Elsewhere, Magna is also planning work programs on its two other early-stage silver properties: La Pima and Los Muertos.

On the La Pima property, located 24 km northwest of Magna's San Francisco mine, a second phase of exploration comprising 2,000 meters of drilling is planned along silver breccias hosted in limestone, targeting the source of a supergene enrichment halo at depth that has shown high-grade silver values on surface and an enrichment zone near surface.

The drill program, also expected to commence in Q3, will be focused on exploring continuity at depth and the source of the silver mineralization encountered to date. During phase 1 drilling, Magna completed a total of 1,719 meters in nine core holes. The target is a high-grade silver in replacement deposits hosted in sedimentary rocks.

At Los Muertos, which lies 25 km southeast of Argonaut's operating La Colorada mine, the next steps on this property will comprise soil and rock chip sampling, geology mapping and an IP geophysical survey to support an initial 2,000-meter drill program that is planned for later this year.

Conclusion

With a handful of intriguing gold-silver assets in its portfolio, Magna Gold is on the verge of leading the next line of mid-tier precious metals producers in Mexico, a premier gold and silver mining jurisdiction.

Its primary asset, the past-producing San Francisco mine, already has more than one million gold ounces in the ground, making it a potential game-changer for the company. Once reopened, the San Francisco mine would become a dual open-pit and underground operation, which will further lower costs and increase the company's cash balance.

Speaking of cash, Magna President and CEO Arturo Bonillas says his company does not like to engage in debts, but rather prefers to build projects with their own generated cash. Cash flows are currently at $20–$25 million, which gives the company ample capital to grow its projects.

I'll repeat myself—Magna Gold is on the verge of leading the next line of mid-tier precious metals producers in Mexico. Cash flows are currently at $20–$25 million, which gives the company ample capital to grow its projects. Shares Outstanding are just 89.4 million. When was the last time you read something like that?

Never.

Please have a hard look at the following share structure chart.

Commenting on San Francisco, the company's prized asset, Bonillas says: "We bought the asset at a very good price, and we are turning it around without any external money. The mission here is to generate and unlock tremendous value on the property with our own sources, which we are successfully doing."

But the work doesn't stop at San Francisco; there is more gold production coming in the pipeline. Another asset that is being fast-tracked to production is the Mercedes project.

"The idea at Mercedes is to start mining by Q2 2021, extract and produce 20,000 ounces—which are the ones in the resource—and generate approximately $20 million, because the cash cost and production cost at Mercedes are quite low," Bonillas adds.

This type of high-growth potential hasn't gone unnoticed in the market. Within the span of one year, Magna's stock has increased by over 200% since the beginning of 2020. IMO, it's only getting started.

Magna Gold Corp.

TSX.V:MGR, OTCQB:MGLQF

Cdn$0.97, 2021.04.07

Shares Outstanding 89.4m

Market cap Cdn$89.4m

Magna Gold Corp.website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard (Rick) Mills, AheadoftheHerd.com, lives on a 160-acre farm in northern British Columbia. Richard's articles have been published on over 400 websites, including: Wall Street Journal, USA Today, National Post, Lewrockwell, Montreal Gazette, Vancouver Sun, CBSnews, Huffington Post, Beforeitsnews, Londonthenews, Wealthwire, Calgary Herald, Forbes, Dallas News, SGT report, Vantagewire, India Times, Ninemsn, Ib times, Businessweek, Hong Kong Herald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Read what other experts are saying about:

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF). MGR is a paid advertiser on his site aheadoftheherd.com.

Disclosures:

1) Rick Mills: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Magna Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Magna Gold is an advertiser on Ahead of the Herd. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer above.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Magna Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Magna Gold, companies mentioned in this article.

Charts and graphics provided by the author.