Maurice Jackson: Joining us for a conversation is Dr. John-Mark Staude, the CEO of Riverside Resources Inc. (RRI:TSX.V; RVSDF:OTCQB).

It's always a pleasure to speak with you, sir. Riverside Resources has some updates for shareholders on the Cecilia Gold-Silver Project. Before we go on site, Dr. Staude, please introduce us to Riverside Resources and the opportunity the company presents to the market.

Dr. John-Mark Staude: Riverside is a prospect generator. We have projects in Canada and in Mexico, as well as royalties in the United States. By being a shareholder in Riverside Resources you're exposed to the upside, where partners are drilling on projects we own in many different locations, thus many chances for a big win.

Maurice Jackson: Dr. Staude, take us to Sonora, Mexico, and get us acquainted with the Cecilia Gold-Silver Project.

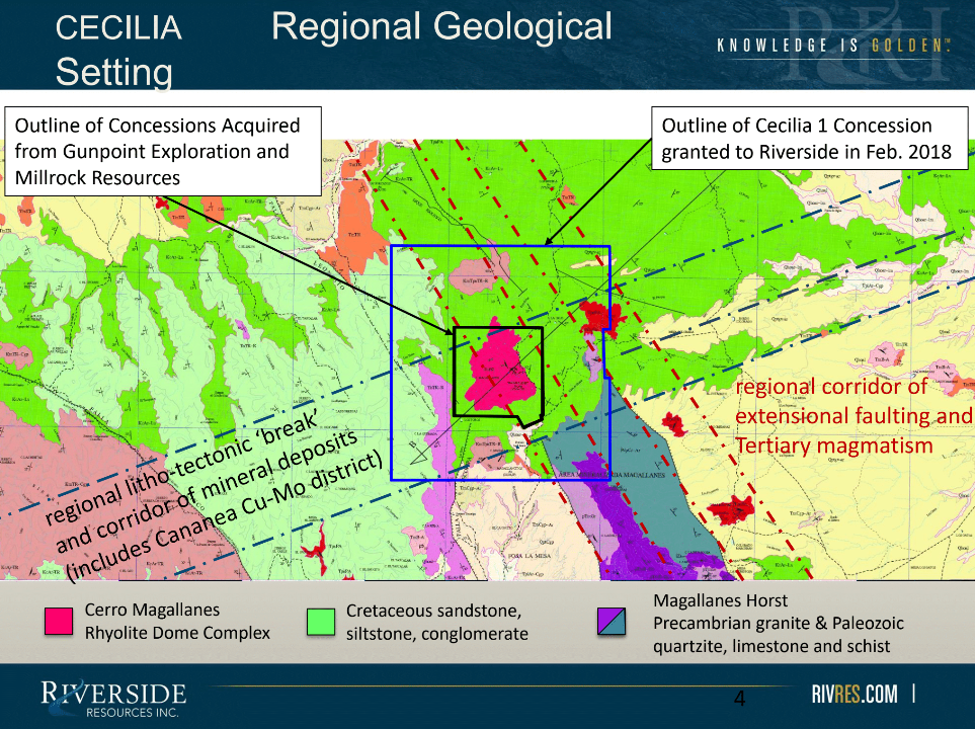

Dr. John-Mark Staude: The Cecilia Project is in the northwest corner of Mexico in the mining state of Sonora, near the border of the United States. It is in a great location. Our project is immediately to the east of one of Mexico's largest mining complexes, Cananea, which has operated copper mining for over a hundred years. To the north of us is Bisbee, in Arizona, that's been mined for over a hundred years. Douglas, to the northeast of us, has been active for over a hundred years.

So right around these different mines, we have the Cecilia Project. And we'll look in detail as we drill the geologic center. The rhyolite dome complex is the key target area that we have at the Cecilia Project.

Maurice Jackson: Riverside has recently conducted two successful drilling targets. Let's look at each one respectively, beginning with the North Breccia. What is special here, and why is this significant for shareholders?

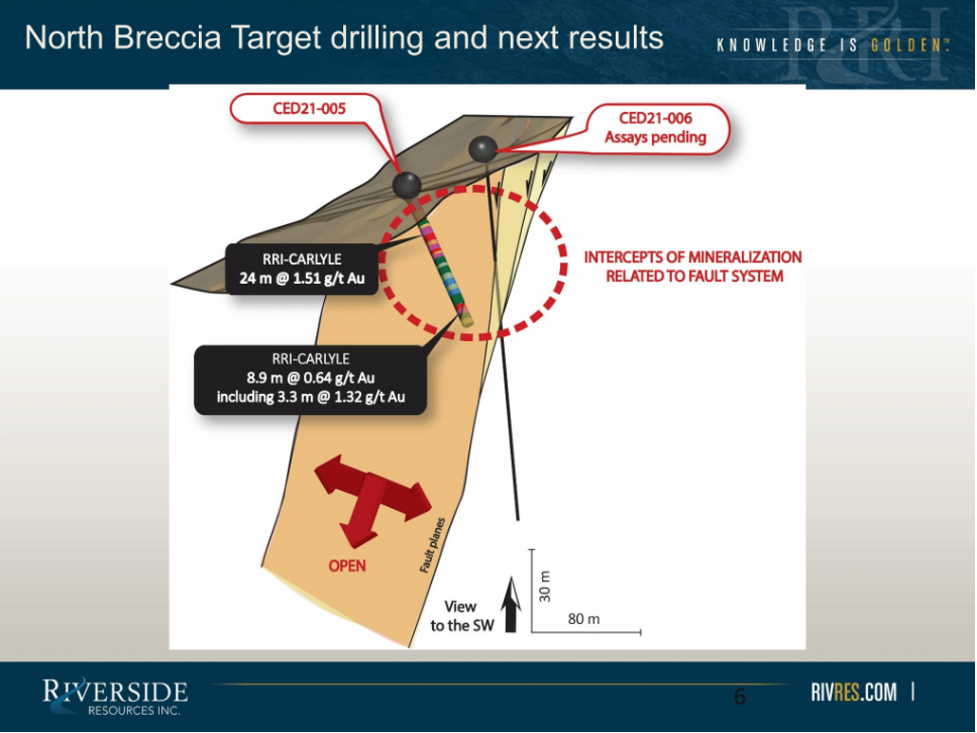

Dr. John-Mark Staude: The North Breccia, which is the red area, is the large dome. Readers will note the blue lines are major structures and red lines are major structures. You could say X marks the spot, where these two Xs go together on the edge of the dome on the North Breccia. The reason this is important is we have potential for tonnage. We have potential for grade. We have the potential for large discoveries. Thus, it's a really exciting project we've drilled into.

The North Breccia comes up along the margin of the dome system, which is where Riverside is drilling. We are specifically excited about hole number 5, which discovered gold at 24 meters, of 1.51 g/t gold near the surface. This is excellent for Riverside, working with our partner, Carlisle Commodities Corp., which is funding the program. Riverside is the owner of the project and the operator doing the exploration.

We also look forward to the next press release, with the assays coming for hole 6 that we show in a diagram. These structural zones—this is the type of thing we like to see. This is the feeder zone that makes large mines, significant operations, in Sonora, Mexico—things like the Las Chispas mine, where we see SilverCrest Metals Inc. (SIL:TSX.V; SILV:NYSE.American) or the mine at Mercedes, where we see Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A) mining. Thus, we're very excited for Riverside to be moving ahead with this target and this drilling that we just have now.

Maurice Jackson: Dr. Staude, in reference to the pending assays, do we have a time frame for those?

Dr. John-Mark Staude: We do. We hope to have them in the next two to three weeks for the next results. They're at the lab. The labs are backed up a bit because it's such a busy time. It's excellent right now, the mineral exploration, and we see there's a good chance for us to have another good hit and coming up from hole 6.

Maurice Jackson: And one more question here for you before we leave the North Breccia Target. What's the span difference between holes 5 and 6?

Dr. John-Mark Staude: The span difference here is 30 meters vertical and 60 meters along strike. So we can see that it's a nice cross-section right at the surface. Plus, it's wide open. These aren't deep holes. This isn't complicated at all. This is right near the surface gold mineralization that's open, so we can follow it further in later drilling.

Maurice Jackson: Let's visit the San Jose, which is the second target area. What can you share with us about the results thus far?

Dr. John-Mark Staude: San Jose is immediately to the west of the drilling that we were talking about in hole 5 and hole 6 over here at the North Breccia. About 500 meters up the mountain, up on the top of the ridge, the San Jose target is going north-south, where we have drilled three holes, 1, 2 and 3—and also the La Cueva target 4. All four of these holes are hitting gold mineralization. We're excited to see this as a second target area at the Cecilia Project.

Readers should note, we're at the top of a rhyolite dome. And what we can see here in the colors are the different intercepts where we've followed up surface gold, and now in drill holes as well. Exciting to have two different zones at the Cecilia Project coming through with gold mineralization now.

Maurice Jackson: As we leave the Cecilia, what additional activity does Riverside have planned for this year? And what can shareholders expect in reference to news flow as well?

Dr. John-Mark Staude: You know, we have good experience working in Mexico, and we're so excited for the work continuing at Cecilia. We'll have the second results and we look forward to continuing at Cecilia.

We also have work going in our Los Cuarantes project, and we'll have news flow coming there. Our big programs going with BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK). We have at least five different areas working on copper. We'll have news flow coming from that.

We also announced the deal in Canada and expect to see news flow in the next month about financing and progressing on our project there—not financing of Riverside, but with our partner, moving ahead on drilling on the assets that Riverside has vended in and keeps a royalty on. So we have lots of news coming in the next three months for Riverside.

Maurice Jackson: Let's look at some numbers before we close. Dr. Staude, please give us an update on the capital structure.

Dr. John-Mark Staude: Riverside continues to have a very careful, tight capital structure. Having operated for over 13 years, we have 71 million shares out. We have no warrants. We're tightly structured, really poised for a big upside.

Maurice Jackson: Dr. Staude, for someone listening that wants to learn more about Riverside resources, please share the contact details.

Dr. John-Mark Staude: Please visit www.rivres.com.

Maurice Jackson: Dr. Staude, always a pleasure to speak with you. Wishing you and Riverside Resources the absolute best, sir.

And a reminder, I'm a licensed broker for Miles Franklin Precious Metals Investments, where we provide unlimited options to expand your precious metals portfolio, from physical delivery, offshore depositories and precious metals IRAs. Call me directly at (855) 505-1900 or you may email Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Riverside Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Riverside Resources. is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.