In an April 6 research note, analyst Phil Skolnick reported that Eight Capital initiated coverage on Royal Helium Ltd. (RHC:TSX.V) with a Buy rating and CA$1.85 per share target price. In comparison, the company is trading today at about CA$0.84 per share.

Skolnick presented the reasons why this helium company is an attractive investment.

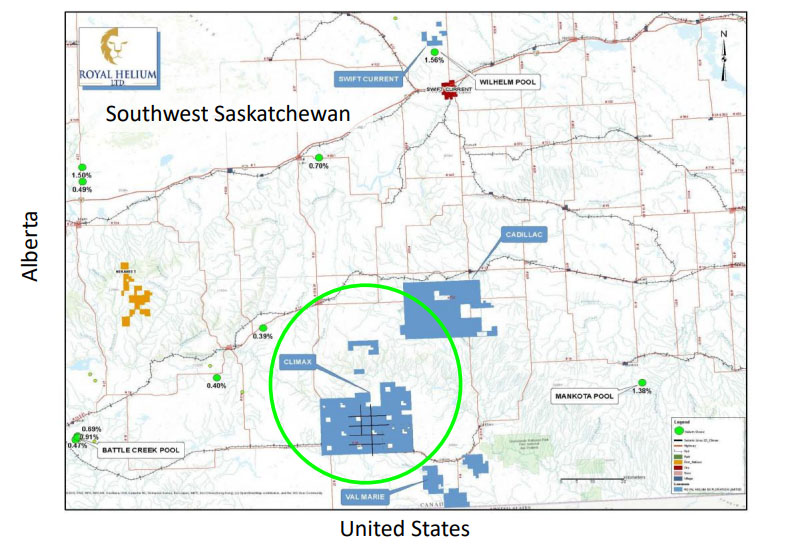

For one, Royal Helium owns a large land package with numerous leases throughout southern Saskatchewan, a helium producing region. The company has permits and leases on 205,417 hectares (205,417 ha) of the total 400,000 ha of prospective helium land it owns there. Also, it has applied for permits and leases for the remaining 164,068 ha.

Two, Royal Helium could have a large resource of high quality helium there. Needing helium yields greater than 0.3% to be economically viable, the company plans to only target wells with helium yields of 0.8%–1.2%. Its goal is to prove up 30 structures that it estimates contain a total of 1–2 trillion cubic feet of raw inert gas, primarily nitrogen along with 0.3% helium.

"This is a deep Precambrian helium play where there is abundant well and seismic data in the region," Skolnick noted.

Three, the prospect of Royal Helium appraising and developing its wells is low risk. Already, Royal Helium knows where the areas are that contain high helium concentrations, based on well production test data. Primarily, the wells are vertical and don't require fracking. According to Royal Helium, well costs are about $1.5 million, and the company can reach commercial production rapidly, in six months' time, for $2 million. The wells' reserve life index is about 10 years, and helium levels tend to remain stable throughout that period.

"Our internal estimates demonstrate the strong economics of these wells, which pave a path towards a free cash flow generating business model once commercial development of the asset is in place," wrote Skolnick.

Four, Royal Helium has "skin in the game" as 20% of the company is insider owned.

The helium company has a handful of potential stock-moving events on the horizon, which Skolnick listed. One is test results on Royal Helium's first three wells that are testing the central part of the Climax land block. If results are positive, the company will launch a drill program.

Another possible catalyst is the company procuring an offtake agreement. The anticipated report, expected around mid-2021, from Sproule Associates, evaluating the prospective helium resource of the first three Climax wells, is a third. Finally, Royal Helium could announce plans to construct a multigeneration facility to monetize its nitrogen and carbon dioxide gases.

In his report, Skolnick also reviewed the current macroeconomic factors affecting the helium market. He addressed future helium supply and demand.

As for demand, last year COVID-19 hurt demand. Looking forward, however, demand is expected to increase. Eight Capital forecasts, in its base case, that helium demand will continue to outpace supply until 2025 and, thus, sustaining high helium prices, Skolnick relayed. However, should demand turn out to be 10% higher than Eight Capital estimates, then supply will not be sufficient to meet demand all the way through 2030 and perhaps beyond.

Starting in the near term, demand associated with cryogenics, semiconductors and optical fibers specifically is expected to rise, driven in large part by the global computer chip shortage. The effect of this should be higher helium prices. Also, the space exploration and quantum computing industries should boost demand. The global push to add and improve infrastructure should result in demand growth for welding-related helium. The nuclear energy industry also needs helium to cool down the cores of its small-scale reactors.

On the supply side, Skolnick highlighted that western Canada, which has the fifth largest helium resource globally, can be a major player, and in particular can meet the helium need of the U.S., the world's largest consumer. Canada as a locale for helium production is favorable, given it is a friendly jurisdiction, it has a full supply chain being developed, it can capitalize on existing infrastructure and services, and its helium is associated with nitrogen that can be safely released into the air. In contrast, the helium supply in the United States is tied to methane that cannot be released into the atmosphere.

For this and other reasons, Skolnick indicated, Canada is not at risk of the U.S. usurping its market share. Other factors supporting this are that helium production in the U.S. tends to be associated with other operations, not production just for production's sake. Also, the areas of helium concentration in the U.S. tend to be in shallower, less pressurized and smaller sized fields than in Canada.

Skolnick pointed out in the North American helium industry America mirrors those of natural gas liquids and liquefied natural gas. There are two types of producers. One sends its helium to third-party purification plants, where the purity of the gas is determined. The other itself separates the various gas and capitalizes monetarily on all of them; such production is being established in Canada. In both cases, a third party ships the helium.

"As Canada's helium upstream industry continues to grow, we expect further vertical integration by helium producers as well as midstream hub solutions that will facilitate offshore exports and provide opportunities for natural gas producers to capture and monetize helium molecules that are currently being emitted into the atmosphere," Skolnick added.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Royal Helium Ltd. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Royal Helium Ltd. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Royal Helium Ltd., a company mentioned in this article.

Disclosures from Eight Capital, Royal Helium Ltd., Initiating Coverage, April 6, 2021

Conflicts of Interest: Eight Capital has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research and other businesses. The compensation of each Research Analyst/Associate involved in the preparation of this research report is based competitively upon several criteria, including performance assessment criteria, the quality of research and the value of the services they provide to clients of Eight Capital. The Research Analyst compensation pool includes revenues from several sources, including sales, trading and investment banking. Research analysts and associates do not receive compensation based upon revenues from specific investment banking transactions.

Eight Capital generally restricts any research analyst/associate and any member of his or her household from executing trades in the securities of a company that such research analyst covers, with limited exception.

Research Analyst Certification

Each Research Analyst and/or Associate who is involved in the preparation of this research report hereby certifies that:

• the views and recommendations expressed herein accurately reflect his/her personal views about any and all of the securities or issuers that are the subject matter of this research report;

• his/her compensation is not and will not be directly related to the specific recommendations or views expressed by the Research Analyst in this research report;

• they have not affected a trade in a security of any class of the issuer whether directly or indirectly through derivatives within the 30-day period prior to the publication of this research report;

• they have not distributed or discussed this Research Report to/with the issuer, investment banking at Eight Capital or any other third party except for the sole purpose of verifying factual information; and

• they are unaware of any other potential conflicts of interest.

The Research Analyst involved in the preparation of this research report does not have any authority whatsoever (actual, implied or apparent) to act on behalf of any issuer mentioned in this research report.

Company Specific Disclosures: Eight Capital and/or its affiliated companies have provided investment banking services to Royal Helium Ltd. in the past 12 months.