Maurice Jackson: Joining us for conversation is Stephen Gill, the chairman of the Board of Directors for Nevada Copper Corp. (NCU:TSX; NEVDF:OTC).

A pleasure to have you join us today to get us up to date on the latest developments for Nevada Copper. Before we begin, Mr. Gill, please introduce us to Nevada Copper and the opportunity the company presents to the market.

Stephen Gill: Nevada Copper is an emerging copper producer. We've just brought online the first new source of copper supply in the U.S. in well over a decade and has the only permitted construction-ready second project (open pit) that exists in North America today.

So when you look at the copper market, I think everyone's seen the recent moves in the copper price. The focus on the real shortage of copper supply. When you dig a little deeper to how that comes about, what you see is there are no projects of any scale, or permitted projects in the Western Hemisphere, particularly in North America in the U.S. that are ready to go.

Nevada Copper owns the Pumpkin Hollow Copper Project, which hosts both an underground mine and open pit. We are bringing the underground mine online, and currently ramping up production, and behind the underground mine we have a large, fully permitted open pit behind it; it's a unique company today in the copper market.

Also we have a very different profile in terms of ESG metrics, given we use dry stack tailings so never have issues, as you see in the mining industry, with tailings pond problems. Therefore, we won't have challenges with regards to tailings. We will have a very low carbon footprint given that our grid power comes from solar and natural gas with Nevada Energy.

Maurice Jackson: Now, the company also has a four-leg approach to growth. Can you share that with us?

Stephen Gill: Nevada Copper employs a strategy with four key strategic objectives. Number one is near-term production, which you have from the underground mine, which is ramping up now. We plan to see that go to steady-state in the near term, in the coming months, and then that underground mine is expandable and extendable. So the mine life will get bigger from known resources we can talk to a little bit later. And the production will get higher from expansion capacity in the mill and the underground shaft.

Leg two is the permitted open pit. That's a large project, we'll be able to produce up to about 100,000 tons of copper per annum. We have done recently engineering to bring down the capital cost because of project economics. We've got further work to do on getting to the ultimate scale of that project. The last drill program that was done in 2018 showed that the mineralization extends far beyond what was previously understood and outside of the existing pit shell. So that project again will get bigger, and will get the IRR [internal rate of return] to improve. And then ultimately, the construction decision for that second project.

The third leg is the property itself. We have a very large footprint in terms of our land package on the eastern side of an area called Yerington in Nevada, which is a rare copper district in the U.S. It had historical production in the 1970s and '80s, and it has really been underexplored since then. We've consolidated the eastern part of that district and have got multiple exploration targets that are well-defined extensions to the underground mine that I mentioned: extension to the open-pit mine, separate targets called Teddy Boy, Black Mountain, Mountain View and a potentially large porphyry target.

So we have a follow-up plan to continue to do that exploration and prove up the additional resources that would extend that operational life. So between those first three legs, you've got an underground mine with a current mine life of approximately 15 years potentially going to 25 years, and expanding in production. You've got an open pit with a mine life of around 25 years, that we still haven't got to the full extent of how big that will ultimately be. And then you've got a property that has multiple other sources of copper feed that we think we'll be able to operate for generations.

And then the final leg, the fourth leg of that strategy, is to continue to build our strategic position in Yerington. We control the key infrastructure in that district. We have the only permitted operating base, we're able to operate up to 70,000 tons per day of ore. We have a large area for storing dry stack tailings. We have power infrastructure, water infrastructure. In that Yerington district is nearly 40,000,000,000 pounds of copper being identified across around 10 different deposits.

Our view is that the long-distance future for that district is to be operated as a district itself, with a central processing hub, and multiple sources of ore feeds feeding into that processing hub. So those are the four key legs of the strategy that they're all moving in parallel.

Maurice Jackson: Mr. Gill, that's a very compelling value proposition. After ending last year on a positive note, can you comment on the delays that set the company back on its production schedule; have these issues been resolved?

Stephen Gill: Yes. We put out a release in early February to clarify some delays that had happened in January and February. So maybe where I should start, post-COVID, we started the milling operations in August of last year. We've been producing copper ever since, a steady increase in volumes. We completed at Christmas time the main shaft, which is the key piece of infrastructure, the key milestone for the ramp-up of the underground mine. As we complete the main shaft, we can now hoist the full capacity, the full design capacity, of ore out of the mine and into the mill, allowing hoisting rates to go from around 1,400 tons per day to over 5,000 tons per day.

So that was completed Christmas. In late January, early February, there were some commissioning items in the shaft that caused some delayed time for building those hoisting rates, but since that time we've run the main shaft, the full system, over 5,000 tons per day on a shift basis. We've run it well over 3,000 tons per day on individual days, which is where we plan to be at this point in the ramp-up. In addition, Nevada Copper has run the mill at 5,000 tons per day. We've seen development rates increase in multiples over recent weeks and months. And we've had some of the follow-on key steps for that ramp-up completed as well, including electrical infrastructure and ventilation.

And so where you stand today, the mobile fleet is in place. The shaft is complete and commissioned and ramped up. The electrical infrastructure is all in place and we're steadily ramping up development rates. And with that, ore milling rates month on month. The key limiting factor or the guiding factor for the speed of that ramp-up is the sequential installation of additional ventilation capacity as we get further and further into the mine. This being a new mine, as you go deeper into the mining zones you have to continue to build out your ventilation capacity ahead of yourself. And we anticipate a steady-state (production) to occur not long after the middle of the year.

Maurice Jackson: Nevada Copper is currently producing copper concentrate. How's the processing mill performing and are there any delays there?

Stephen Gill: The mill has been performing well and has performed consistently. As I mentioned, we've run it up to its full 5,000 ton per day design. At this point of the ramp-up, we're not running at that level on average week on week, but we've proven we can run-up to the full design capacity. We're achieving recoveries well over 90%. We're producing on spec concentrate, the expected concentrate grades. We've been shipping and selling that concentrate for months, as I mentioned.

The mill is performing well and proving itself for the task at hand. The key step over these next few months will be to see increasing volumes, average monthly and quarterly volumes, as we increase the ore feed to the mill. So we will see that average copper production increase as we build towards the steady-state point.

Maurice Jackson: Moving forward into 2021, what is the expected news flow in the coming months?

Stephen Gill: There is a lot to happen this year, particularly, I think very well after COVID last year, it was good to have got through that milestone on the shaft and be ramping up. And so you've got several milestones on the underground, and then also on the broader properties back to the multiple prongs to our corporate strategy.

On the underground, investor can expect increasing volumes. We expect to see sequential operations updates that will let people know as we access different areas to mine, as we're accessing different stoping zones, as we see grades lifting, as we see milling rates and copper production rates lifting. And we expect to see that sequential increases month to month.

So you got those to look out for. As a way to look further ahead of yourself, you'll see updates on the installation of the key ventilation steps, which is part of that ramp up. Then further in the future on the underground, there'll be updates on the study work around expansion potential and the extensions to the mine itself, to the mineral resource itself. There will be updates on the open pit.

We released the Pre-Feasibility Study (PFS) a couple of years ago now. We've been doing work on the project since that time. We've analyzed ore hardness. We've done analysis on the dry stack tailings deposition approach, which includes some significant savings. We're working with a group on a solar power option for the open pit and looking at the open pit scale. When we did that PFS, it was based on a low copper price environment. So we've gone for a very conservative approach, which optimizes the pits and the project scale around $2.50 copper. We're sitting here today at $4 copper with a very constructive environment going forward.

And when you look at scaling options for the size of the pit and the expansion of the pit, you see very large uplifts in NPV and IRR. For example, the PFS goes from 37,000 tons per day to 70,000 tons per day production in six years after the startup. If you do that simultaneously, you see about potentially see a large increase in the NPV just from that one change that is already engineered.

And so the study work will carry on with the open pit. There'll be updates on how that will get bigger and higher IRR, and there's also follow-up drilling to continue to do the infill drilling from the 2018 drill program that I'd mentioned has already extended the ore body beyond the pit. So we need to do the infilling there, update our resource and reserve for a larger, higher-grade resource reserve, and then put out an updated study on the open pit.

So it's a lot there, a lot of information. And then on the border of property, we've got the follow-up drilling and service exploration to add multiple targets that I'd mentioned, Black Mountain, Mountain View, the Teddy Boy Porphyry, the Teddy Boy Oxides, and IOCG.

So there's a lot of follow-up information. So if you put that now in order, you've got ramp-up catalysts that will come fairly frequently on the underground as we build up to steady state. You've got a steady-state production itself, which I think is a big milestone. And then particularly in the second half of the year, a lot to come in terms of showing the true potential or the true value of the broader property. What the open-pit really will look like in terms of its true scale and its true profitability and what the drilling will show us on the targets that have brownfield targets we've already defined more broadly on the property. So a pretty full year.

Maurice Jackson: Sounds exciting, sir. Action packed. I know shareholders such as myself are looking forward to the next press release. And before we get into some numbers, let's look at some milestones here. Would you cover some of the recent milestones that the company is exceptionally proud of?

Stephen Gill: So we completed construction... So let me take a step back a couple of years. Let's not forget we've built, constructed, ramped up, or ramping up the first copper mine in the U.S. in well over a decade. And that's happened also at a time where several other potential properties have frankly moved backward on their permitting process. And so you achieve that in a time when no one else in North America has got close to advancing a copper mine.

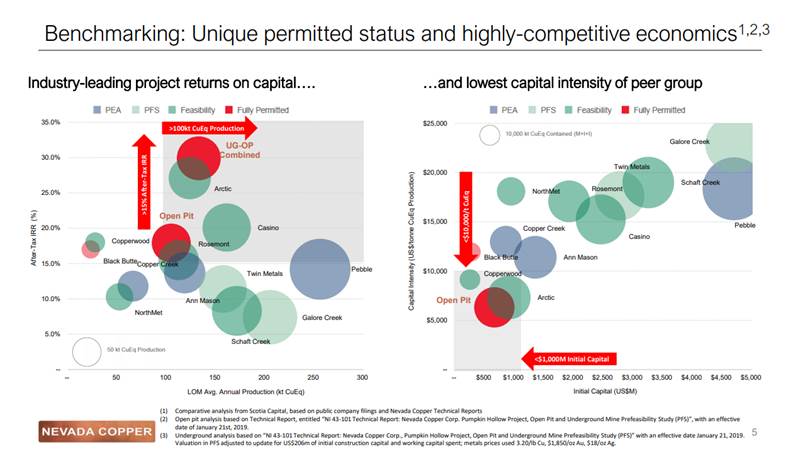

We really can't overstate how unique that is. The same on the open pit, we re-engineered the open pit from very large upfront capital to such a very low upfront capital. When you look at benchmarking, this is the lowest capital intensity project and highest IRR in North America, we have the most capital intensity and most outright capital of any unbuilt copper mine in North America today.

What we have defined in the PFS is in itself, I think quite an achievement. It's easy for that to be forgotten and overlooked. That study was released in 2019, and rightly since that time, the sole focus has been on the ramp-up of the underground. And I think what I'd hope to see is as people gain confidence in the ramp-up with the sequential releases, you're going to suddenly see the value coming back into the share price for that open pit, or the open pit at $3.20 copper at nearly a $900,000,000 NPV.

And as I've mentioned, we've already done the re-engineering work to increase the scale of the open pit, which as it becomes public, we would hope to see the NPV increase substantially at $3 copper, and very, very substantially at current prices. You can see in the corporate presentation, I think the existing study numbers in terms of leverage the copper price, at today's copper price, you've got about $2,500,000 of net asset value before the additional factors that I've spoken about.

So we very proud of the underground having been completed, put in motion, copper producing and revenue being generated. Proud of the open-pit being engineered already to what it is, and what we have in the pipeline as it were, it's still to come on the open pit, which people will be pleased to see. And also then on the third leg, we're proud of having quietly consolidated a pretty exceptional land package that's again, unmatched in North America or most good jurisdictions for copper, in terms of the size of that land package and the prospectivity of the targets we have in addition to the underground, the open- pit. So I think these are the key recent milestones to recap.

Maurice Jackson: Looking at numbers, Mr. Gill, please share the capital structure for Nevada Copper?

Stephen Gill: Nevada Copper has quite a significant share count today as a plan already announced that it's going to take a rollback at the AGM in May. The market cap today is a little over $300,000,000 Canadian, it's worth comparing that back to the net asset value we spoke about. And so, at USD$4 copper that is an approximate $2,500,000 NPV, based on the projects as they stand today. So we're looking at around a C$3,000,000,000 Net Present Value in studies that people can go and look at and compare at current copper prices (Nevada Copper) at a $300,000,000 Canadian dollar market cap.

On the balance sheet, you've got a $130,000,000 project finance facility from KFW, which is the German development bank. KFW is an excellent partner in the project. The development bank with German export credit, they're extremely diligent. So I think that's a good stamp of approval for them to have got involved, to begin with, at an extremely low cost. The (finance) facility is 10 years and Libor +1.5% interest rate.

So it's the type of project finance you really want on large long-life assets like this. There's a working capital facility from the off-taker that's partially drawn. And there's a standby facility from the largest shareholder to access for additional capital to kind of underpin the ramp-up.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

Stephen Gill: It may be a quality problem to have, but yeah, the copper market is moving up very rapidly. I think if you look at the analysis, there's a lot of reasons to believe that the copper prices are just early on, on a move up, and will be staying for a long time. When you look at copper assets, because of the permitting issues, because of the long lead times, copper cycles tend to be long and sticky.

And so, I'd love to be further on from where we are today on particularly the open pit and some of the development options. We had to take a hiatus from that last year given COVID. And I think we've done a lot of that with the underground already, and a lot with the PFS released on the open pit. We lost some time last year, and so a lot of these catalysts we talked about that are still to come this year, we would have liked to have done it last year. That would have been great to have done that with a year's lead time before copper's price has started moving up. But I say it's a quality problem to have, wanting to have more time without the spotlight of copper prices moving.

Maurice Jackson: Last question. What did I forget to ask?

Stephen Gill: So maybe, I think probably the ESG factors of the company. I think it's increasingly important today and it's easy to overlook or to downplay, particularly in the materials sector. We've talked about the production coming online. We've talked about the growth. These industrial assets and how you conduct yourself from an ESG perspective is really important in terms of the license to operate.

And frankly, the elements of our assets from an ESG point of view, are probably in large part what helps separate us from all the other copper projects that have been unable to get permitted and move forward in the last 10 years. So just to kind of recap some of those, this is a very low water consumption project that has water management issues, that's been a key focus. We draw grid power currently from Nevada Energy, which has a very low scope to carbon footprint given the source of that power is natural gas and solar, so Nevada Energy is a very good source of good power. That's also reflecting our very low power costs at five cents a kilowatt-hour.

I mentioned we advanced on study work around the solar option. We have this large land package that also allows us to put in place solar that further reduces carbon footprint. It further reduces our operating costs so it's a win-win. We've got a specific focus on diversity within the workforce and the Board, and a focus on community engagement. We're in the U.S. so you're never going to have the issues that we see constantly coming up in the Congo in Africa and in Southeast Asia, which again, back to the importance of this and the copper market today, you've got a shortage of copper, and you can see in our presentation, you've got over half of the copper supply globally coming from non-first tier jurisdictions, and about 40% of it coming from outright difficult jurisdictions.

You have Africa, Southeast Asia, Indonesia and Mongolia. What little growth we have is coming out of Mongolia and Indonesia, and you do project forwards to 2030, what we see materializing is an even more risky supply brace, given that there are such a shortage of, again, North American copper projects.

So that, just by virtue of where we are and having the permits in place, sets you apart from most other sources of copper. And then within what we can control waste management, emissions, and again, community and diversity are key, such that you've got frankly a green source of copper, which you're seeing become more and more important.

Maurice Jackson: Mr. Gill, if investors wish to learn more about Nevada Copper, please share the contact details?

Stephen Gill: www.nevadacopper.com.

Maurice Jackson: Mr. Gill, it's been a pleasure speaking with you. Wishing you and Nevada Copper the absolute best, sir.

And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide: Mining Insights and Bullion Sales, subscription is free.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Nevada Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Nevada Copper is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.