The latest Meridian news release shows an impressive hint of the mineralized potential of the Cabaçal VMS Copper-Gold Project in Brazil, at which Meridian Mining UK S (MNO:TSX.V) last year signed an option agreement for a 100% ownership.

Meridian announced the roll-out of its field program following the granting of an environmental permit for drilling in March, and mobilized two drill rigs and a geophysical team to commence a 10,000-meter diamond drilling program. One of the initial focus areas was in the southern sector of the deposit defined as the Southern Copper Zone (SCZ), where historical drilling suggests the presence of high grade NW-SE trending alteration pipe hosting copper-gold-silver mineralization.

Diamond drill holes CD-003 and CD-004, both targeting the SCZ, intercepted significant mineralization, as was illustrated by portable XRF readings of the cores. An impressive highlight returned a reading of 13.21% copper, 34g/t gold, 29g/t silver and 1.08% zinc (see picture above). The example provides a provisional point-source reading of mineralization within the higher-grade zone, with the grades being consistent with expectations from the historical drill result. According to management, such readings provide a useful confirmation of sulphide metal associations identified by eye. Actual assays from a lab are of course required to properly quantify the intercepts, and these are expected later in April.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

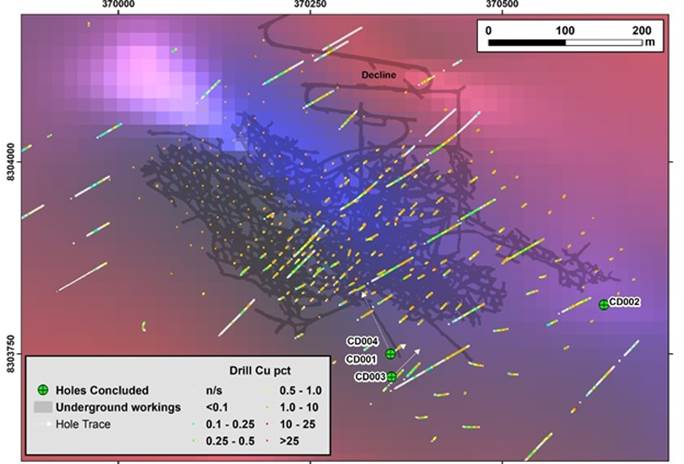

Zooming in a bit further on the drill holes, CD-003 was targeted as an infill hole between historical hole JUSPD 596, which intersected 15m @ 5.2g/t Cu, 2.66g/t Au, and 9.54 g/t Ag, and adjacent holes to the south that intersected broad packages of mineralization. As a reminder, JUSPD 596 can be seen here:

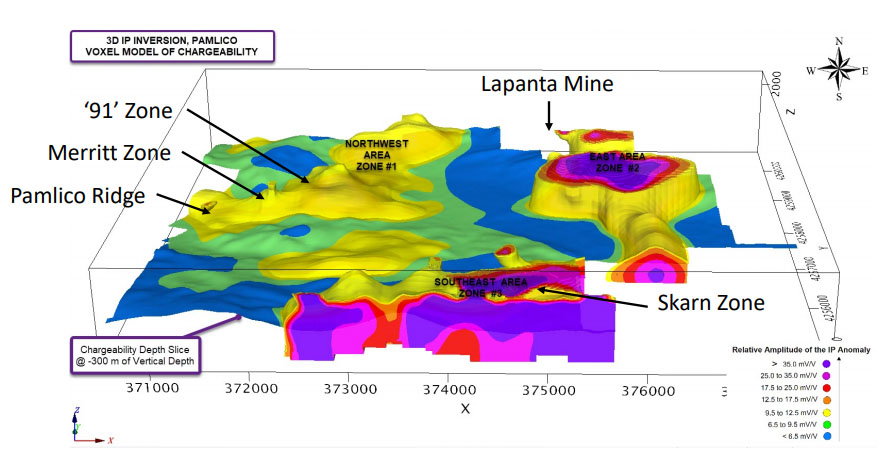

Location of historical Cabaçal drill holes with significant results at beyond the limits of underground development, viewed to the north‐east.

CD-004 was set up to target a position projecting about 20m south of the limit of historical workings. The hole was drilled from the location of the historical drill pad of JUSPD 596, and as part of a fan (a fan means a series of holes drilled from a common platform on different trajectories, with holes directed in this case to the NW and NE). CD-004 was drilled in the vicinity of historical drill hole JUSPD482, which intersected 13.4m @ 5.50% Cu, 1.31g/t Au, and 24.72g/t Ag. The two holes targeted positions about 85 meters apart along the NW-SE trending mineralization corridor.

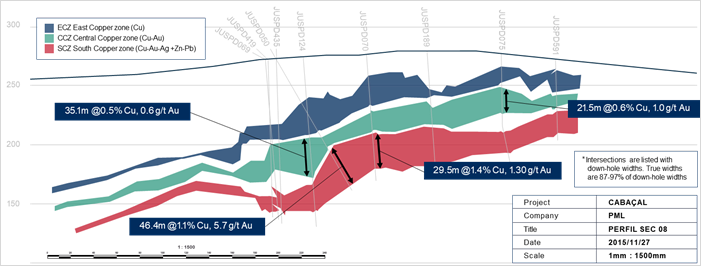

The geologists of Meridian identified a breccia to stringer sulphide zone of 11.4m length from 156.9m to 168.3m depth for hole CD-003, and this zone is expected to generate the higher-grade results after assaying. For hole CD-004 this is a likewise zone of 13.1m length from 151.3m to 164.4m depth. Both holes have a longer disseminated sulphide mineralization zone starting at 46 to 54.8m depth, continuing to depths of 168.3 and 164.4m respectively. According to CEO Adrian McArthur, this breccia to stringer zone is more commonly located at key stratigraphic contacts (in this case directly above the acid volcanic footwall ("TAC") horizon). The disseminated sulphide has been historically defined as a series of broader stacked sheets, examples of which are illustrated in this cross section:

Cross section of historical drilling looking northwest

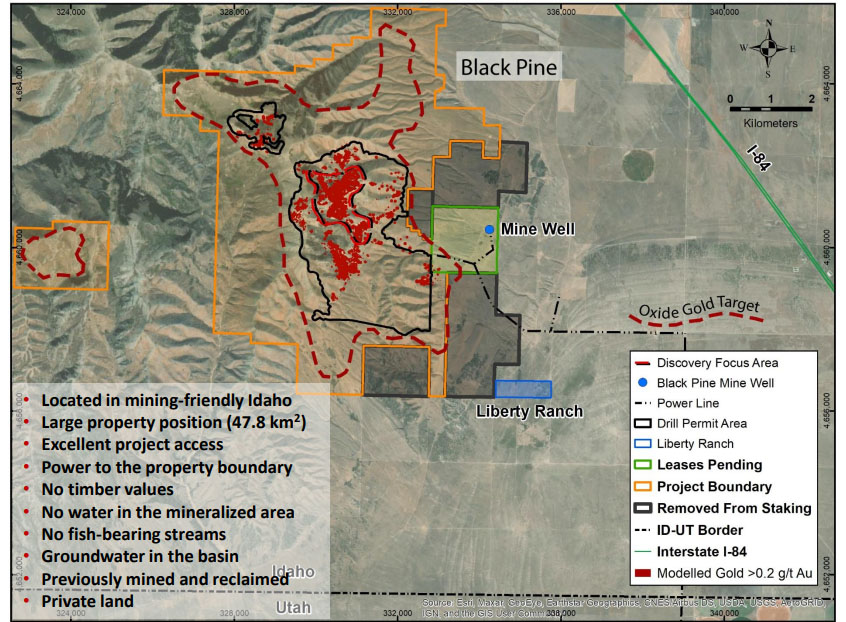

Earlier holes CD-001 and CD-002 were drilled in advance, with CD-001 targeting to simply twin JUSPD 596, and CD-002 targeting shallow high grade copper gold mineralization of the Eastern Copper Zone. Assays of these two holes are also expected later in April. The locations of the four drill holes can be seen on this map, which is also showing historical mine workings and examples of historical drilling, projected on a VTEM image in the background with blue representing more conductive zones, in order to provide context:

In the meantime, surface EM surveys have commenced to characterize the geophysical response associated with the Cabaçal Mine, together with borehole EM surveys. Electromagnetic surveys detect anomalies associated with sulphides—the more connected the sulphide assemblage, the stronger the response. Results of both surveys are expected later this month.

CEO McArthur is obviously pleased with the ongoing progress, as he stated:

"The two new holes confirms the full mine sequence stratigraphy in the Southern Copper Zone, with the sulphide rich basal layer intact. The mineralization style seen in sulphide-rich basal layer corresponds to the characteristics of the target corridor identified in the 1990 Mason and Kerr study, which interpreted the position as part of a major NW-SE trending alteration pipe of higher grade copper-gold-silver mineralization. Additional drilling geophysics will be undertaken to trace the extent of this position towards the historical workings and consider extensional projections to the south east. The wide package of disseminated mineralization is consistent with our expectations. The ongoing program will continue to test both the broad envelope on mineralization and more discrete high-grade trends in working towards a 43-101 resource update and development studies."

The concept of a major alteration pipe of copper-gold-silver mineralization sounds interesting. I wondered why Mason and Kerr reached this interpretation, what kind of strike length we could be looking at, why McArthur thinks the mineralization is consistent with their thesis, and how McArthur thinks why and how he should try to verify the Mason/Kerr thesis. He stated that the Mason and Kerr study was undertaken in 1990 to identify targets requiring follow-up drilling. This particular corridor has been defined over a 100m strike length, but its southern extensions are poorly defined, with the map showing the drill density rapidly becoming wide-spaced with increasing distance from the historical workings. The drill program coupled with surface and down-hole geophysics will provide vectors to the areas of greater sulphide concentrations within the broader halo of disseminated and stringer mineralization.

The current drilling is part of a 60 to 70 hole drill program for 10,000 meters, of which 30 holes are twinning holes, in order to verify the 21.7Mt historical resource estimate. This 10,000-meter program is expected to be completed by the end of Q3, 2021, and management is targeting a maiden NI 43-101 compliant resource estimate by Q4, 2021. In addition to this, management is also working on verification of a 600-hole historical data base from BP/Rio Tinto, in advance of the resource update.

Conclusion

The sulphide intersections and pXRF readings seem to indicate that Meridian Mining could have a pretty attractive project at the right time in the metal price cycle. As drilling and surveys are underway now, expect lots of news flow the coming months. It will be very interesting to see the assay results at the end of this month, combined with a nice set of sections and drill collar maps, and on top of this hopefully interesting EM survey results, to indicate the potential district scale opportunity targeted by management. So far things are looking very promising for Meridian Mining.

Top: CD-003: Southern Copper Zone, Trays 47-48; 157.27 - 164.40m. Zone of stringer sulphides and quartz veining approaching sulphide breccia zone. Bottom: CD-004: Southern Copper Zone, Trays 45-56; 153.96 - 161.68m. Zone of sulphide breccia and quartz veining.

I hope you will find this article interesting and useful and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor and has a long position in this stock. Meridian Mining is a sponsoring company.All facts are to be checked by the reader. For more information go to www.meridianmining.co and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.