Maurice Jackson: Joining us for conversation is Todd Hilditch, the CEO of Riley Gold Corp. (RLYG:TSX.V; RLYGF:OTCQB).

Pleasure speaking to you to share the opportunity before us in Riley Gold. Before we delve into company specifics, please introduce us to Riley Gold and the opportunity the company presents to the market.

Todd Hilditch: Riley's an early-stage company and we've been around for all of about six months. We've built the company around the people, the projects and the ability to finance. All of our team, whether it be at a management level or a director-level, have had success in building companies and ultimately either selling them or taking them to production. So we're excited about Riley going forward.

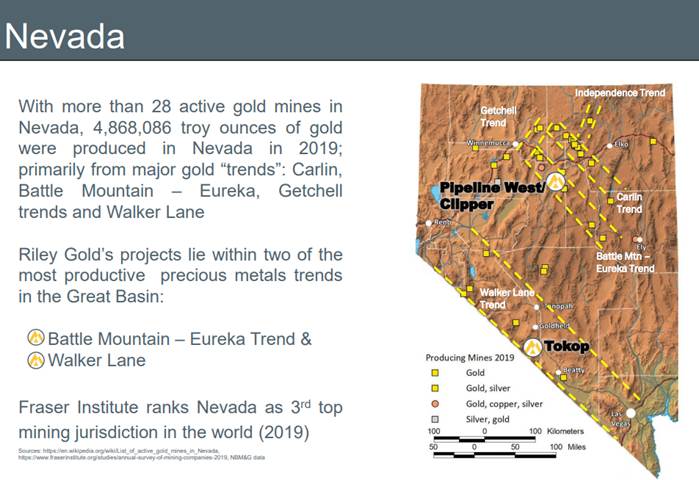

Maurice Jackson: Riley Gold presents several virtues to the market that merit speculators' attention. Let's introduce your property bank, which is strategically located in elephant country, in an absolute top jurisdiction for exploration and mining. Sir, take us to Nevada and get us acquainted with your projects.

Todd Hilditch: You're absolutely right. Nevada is an unbelievable jurisdiction for not only the exploration because of its gold endowment, but also for other opportunities that have not been discovered. The state itself produces give or take about 30 mines in the state, producing about 5 million ounces of gold per year.

We wanted to go to an area that has been tried, tested and true, and we decided to stick with Nevada, which is where our experience is. Our two projects are, as you say, the Pipeline West Clipper Project is definitely in elephant country up in some of the major trends. And we also have a second project that we're very excited about, Tokop.

Maurice Jackson: As a testament to the management's business and geological acumen, provide us with the historical context and share how Riley Gold acquired his projects.

Todd Hilditch: What we've learned over years and years you, cannot place a value on experience and relationships, but they are paramount to success. We were fortunate enough to decide to go for our two projects because of introductions and long-standing relationships that I've had for 20 years in the state, everything from geological to legal, to permitting, etc. So we took an opportunity to look at the big picture when we were deciding what we wanted to bring into Riley. Our first notion was to find some ounces, give us some shoulders, to begin with, but we also recognized that in the state of mining, the three stages are exploration, development and production.

And we felt that if we were going to be in one of the toughest sectors in the world, in terms of risk-reward, we decided to go at the very beginning of the lifecycle, which is where most investors and shareholders would get the biggest kick and that is finding the gold and the exploration side. Riley Gold decided on our two projects came to fruition through years of ongoing relationships. So for us, it's all about friends, family and forging ongoing relationships to add value for our shareholders.

Maurice Jackson: Well, now that we have some background on the projects, let's go onsite. Sir, take us to Southern Nevada and introduce us to the company's flagship Tokop Gold Project.

Todd Hilditch: Allow me let take a step back before I introduce the Tokop Gold Project. We are extremely excited about our geologist who leads our technical efforts, Charles Sulfrian; he and I have been working together for about 18 years and he is excited about the Tokop Gold Project. We expect to be drilling in the early part of April. This project came to us as a result of some work almost 10 years ago with a company that changed direction for lots of reasons. And this asset was on their balance sheet and when we were introduced to it, we were immediately excited because it had some historical drill holes but not enough to move it forward at the current time. And when we look at some of the drill results and sample results along with the size of the property it was akin to give us a real excitement level.

And in literally six months, we've gone from dating the project, getting to know the Tokop aggressively, including just adding a technical director or advisory committee member, I should say, who has experience with this type of a deposit (Press Release). The Tokop is our main focus at the moment. We've got some samples still to come, we've got drilling to come and we expect reasonably good results out the gate. It's a shear hosted vein-type deposit which we can see on surface. So with that in play, we'll be able to get a much better handle on our development post this for the first drill program.

Maurice Jackson: I see that there's a comparison with Fort Knox; is there something you can share with us there?

Todd Hilditch: That is correct, we do see similarities in the style of the mineralization, shear hosted veins at surface, and it's been certainly tested at Fort Knox but Double Gulch and Eagle as well with Victoria Gold. And as you mentioned, Fort Knox, which was Kinross, in fact, the gentleman that we have brought on the advisory committee this morning has worked on both of those projects. So it's not the typical geology that you would see in a Nevada project. It's something a little bit more akin to those two projects up in Alaska, but all of the signatures are there. So we're looking to prove that to be a good opportunity for us.

Maurice Jackson: Exploration is a research and development exercise; I'm interested in hearing how Riley Gold arrived at this thesis, which has given the company confidence on the upside and making additional discoveries and increasing shareholder value. Please walk us through the genetic model and then the exploration model.

Todd Hilditch: Well, it's interesting the genetic model is similar to what I've mentioned, where you get to a project certainly there hasn't been enough drilling to identify a resource. You get to a project, you look for the signatures, something that a geologist can see a little twinkle in his eye and say, "Okay, hang on, I see an opportunity because of this." And it's through that genetic opportunity, which is where I believe shareholders get their biggest upside is on the exploration and the finding of gold and silver. So it's through that genetic process that it leads to development and then to production. In this particular situation, our guys are very excited about the opportunity because of the signature that they see. And so with that in mind, we're going to move forward, it's not like we have a model that's different than any of the other juniors.

You do as much due diligence on sampling, on geophysics, on work to identify where your drill program would start. And then sometimes you call it a Hail Mary, sometimes you call it the best-educated guess, that you'd take all that information and dump it into a model. Charlie Sulfrian has worked 22, 23 years with Barrick. Has 40 plus years of experience, he's been everything from a Chief Chemist at Barrick to Chief Geologist. So we place a lot of faith in Charlie's experience as well as Dick Sillitoe who came to the project along with Ted Wilton, who we've added today. And you just do as much homework as you can and then you drill in the best-educated spots. And with that, it leads to the second iteration, third iteration of drilling.

Maurice Jackson: With regards to the historical resource, how will Riley Gold move forward with achieving a NI 43-101 resource and in what category?

Todd Hilditch: Well, we're in too early of a stage for that at this point; there have only been 20 drill holes. Riley Gold be doubling the total drill holes. This is one of those systems where it's not going to take hundreds upon hundreds of holes of drilling before you can identify a resource in an envelope. This is a near-surface, shear-hosted vein set and it shouldn't be too much of a stretch for us in a reasonably decent time. I can't identify that to you today, but it's not going to be three, four years out before we could put a resource together; it'll be much sooner than that. I would hope in the next 12 to 18 months.

That would come in most likely the form of a Measured and Indicated and Inferred resource and the interesting thing about these systems and all systems, what you see at surface is not what you're after, it's what's below and what event brought that gold to surface or within an area that you've drilled and you've found it. It didn't come from the sky, so we've got to find out how it came there, the plumbing system, if you will. So it'll all depend on all of those factors before we could put a resource together, but that's our goal.

Maurice Jackson: Leaving the Tokop Gold Project, sir, please introduce us to the second compelling project, the Pipeline West/Clipper Project.

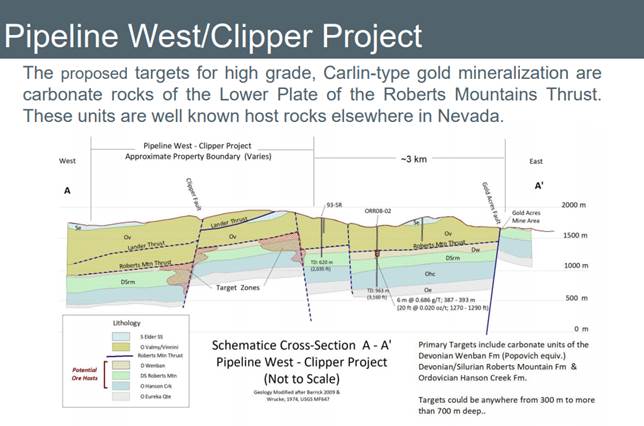

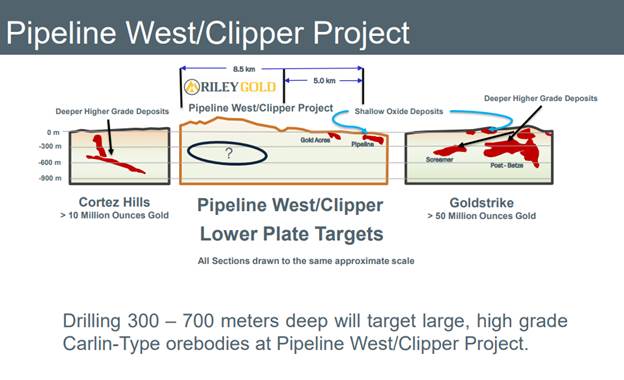

Todd Hilditch: Now we're talking elephant country when we are discussing the Pipeline West Clipper Gold Project. Nevada Mines, which is the joint venture between Newmont and Barrick, has quite a complex out there with Cortez, four miles of numerous other deposits that make part of this endowment of gold. I think there are 40 million-plus ounces of past production and reserve resources that are in this area.

There are lots of opportunities that we still think exist. Our project is off to the west by about five kilometers, give or take. And there has not been in our opinion enough work on the project, which is one of the reasons why we picked it up through a relationship as well. And trying to identify an opportunity to get into the same type of geological formation as our neighbors. Recently, Barrick, announced that they feel that there's great opportunity out in this area from Robertson south down through the Cortez Mining Complex, and we are on the peripheral to that. So I think that probably excited a lot of junior companies and we're certainly excited about ours.

Maurice Jackson: Can you walk us through the genetic and exploration model, please?

Todd Hilditch: This one's a little tougher to nail down at this given point, except for the fact that with Barrick in production on the eastern edges to where we're located, they've produced from a formation called the Wenban. There's another company off to our northwest, Ridge Line Minerals, who we have a lot of respect for, they've tapped into the Wenban. We sort of sit between the two of them so our expectations are the same host rock that's being produced is in our land makes a part of it. And it would be our goal to find that. To date, there hasn't been enough drilling beyond 250 meters or 700 or 800 feet, if you will, on our project and that's one of the goals. Genetically let's find and then focus on where we want to have that initial drill program.

And that would be through not as much soil sampling is up there as maybe some geophysics and then the nail down an opportunity and drill holes as to where to try to prove our model. To be open and honest, we're not going to get to this project until we've gotten knee deeper, waist-deep into Tokop in our drilling. At this point, we're focusing on getting the Tokop drilling going and then Charlie and his team will then have an opportunity to move up, hopefully in the late spring-summer when there's no snow up in that area to start the process.

Maurice Jackson: Now, before we leave the project sites, what type of activity is currently being conducted, and what are the plans respectively for each in 2021?

Todd Hilditch: For both projects? Well, we've got drilling at Tokop, and then out here at Pipeline, it'll begin with some initial data review. We've already started that obviously; we've had the project for about six months. But it'll be more of filtering information, which's important, in terms of helping us to identify a drill program. So there'll be a lot of desktop work and then fieldwork and then Charlie's team will identify the next steps. That's a little earlier stage upon the profile at this point for us.

Maurice Jackson: Leaving the project site, let's discuss some important topics germane to the projects. Are your projects 100% owned or do they have any earning options or within your reversionary interests?

Todd Hilditch: It's a great question and one that every CEO wrestles with, our projects are 100% under option to us. My feeling over the last 20 years in this industry and I'm not saying it's the right one, a lot of people have great success in having a joint venture model. Our opinion all the way along has been this is a difficult sector. I mean, you're trying to find little yellow stuff, gold or silver, hundreds of feet or thousands of feet below the surface. If we're able with our people to identify good locations, if we're able to have good projects and we're able to fund these projects because of the three-legged stool of people, projects and money, I don't necessarily want to share that upside. I'll go if we're wrong and we're not successful, which in this industry the odds are tough. We've had success, fortunately, in the past. But I don't necessarily want to share that love, that risk if you will. So we own them 100% and or within at least to option, purchase them 100%. And until that model changes I'm going to stick with it; it works for us.

Maurice Jackson: We're going to get into some numbers later in this discussion, but from a capital expenditure standpoint, how is infrastructure on your projects?

Todd Hilditch: Infrastructure is good. We are in Nevada, you've got lots of undulations of geography and there are some locations in the state that some may not ever get drilled just due to topography. We're in good shape at the Tokop location. I would argue that to date we haven't identified all the drill holes we're going to want to put in. But to date, we've been successful at getting permitted for about 95% of what we wanted. So that's very good and very good access, whether it be through Tonopah and or Beatty. And then up at Pipeline West/Clipper, similarly, you've got good access to Barrick off to our eastside. There are lots of infrastructure, no hindrances to get onto the project, very accessible.

Maurice Jackson: I think you just alluded to it, you're fully permitted or you said 95%, is that correct?

Todd Hilditch: No, we're fully permitted for the work that we're about to do at Tokop; we've received our BLM [Bureau of Land Management] approval on our notice level drilling. We have a combination of private and public land at Tokop. So from a standpoint of getting permitting, it's usually about a two-week process and we successfully received that. That allowed us to start the movement to getting drill rigs out there in about a week, a week and a half.

Maurice Jackson: Is the ultimate goal for Riley Gold to build a mine or arbitrage?

Todd Hilditch: That's the end-all question. So every single junior, which we include ourselves in that grouping, will tell you that the intent is to build a mine. That's a very difficult thing and a very expensive thing. I'm happy to say and particularly with the group of folks we have involved with us that our goal today is 100% stick exactly what I just said. I mean, we will take this far enough down the line that if we make a decision to go to production, touch wood. And if we're lucky enough to find enough ounces, we have the ability through some of our directors from a permitting standpoint, William Lamb has taken a project through to production in a different sector.

But we have the ability and I think we have the financial capability and supporters to be able to support that mode. Typically though, you're going to get to a point where somebody bigger, if you're successful, will come along and tap you on the shoulder. And we're open to that concept, because if it's good for the shareholders, which would 100% vote, if someone came along and said, "You've done a great job, now get out of our way we want to take this to production." We would look at it 100% and ultimately the shareholders have that decision.

Maurice Jackson: We've discussed the good; let's address the bad. What can go wrong and what are your action plans to mitigate that wrong?

Todd Hilditch: Well, at this stage we're just getting going. There are difficulties, a drill as an example, if you've got watered out on a particular drill or the drilling conditions were difficult, the rocks didn't agree with the drill bit. Those things are certainly out of our control. Those would be bad, but certainly, things that we could work around or the nasties, if you will. That said, the real only issues that we have today would relate to if the gold markets pulled back to a point where funding was difficult. All of these forward-looking statements, that could be a problem. I mean, other jurisdictions worldwide certainly have those issues with governmental interference, etc. But we don't have that issue down in the United States and or in Nevada. So I'm not skirting your question, I'm just suggesting that at this point, the negatives that we could encounter, the real big hindrances, we don't have in front of us yet. And it would relate more to markets, gold price ability to finance, ability to get drill rigs, those are the kinds of things.

Maurice Jackson: Fair enough. Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Hilditch, please introduce us to your board of directors and management team and what skill sets do they bring to Riley Gold?

Todd Hilditch: Well, we've been very careful from day one with the inception of Riley, not necessarily knowing exactly which direction we were going to take the company at the onset. We now have a much clearer picture on the exploration side. But we have a set of individuals that I believe tick all of the boxes of different experiences, starting with William Lamb, who's our chairman. He's got 25 plus years in the mining sector background metallurgist, has had an amazing and successful track record. Worked with the Lundin Group of Companies, was the CEO of Lucara Diamonds. Was involved and has responsibility and finding some of the largest diamonds that have ever been found in the world in Africa. So he's got a great world of experience crossing from technical, but also onto the market side and raising capital.

We've got Bryan McKenzie who has been with me forever. He's a CFO, he's been with me in all of my previous companies, which we can get to in a minute. Have a great experience from a financial standpoint.

Cyndi Laval, an attorney at Gowlings WLG Partners. Also very well seasoned securities attorney who has great successes and is very well respected. So she would round out a legal side.

Richard DeLong, who is a permitting expert, has worked with the majors and worked with groups such as our size; I've worked with Richard in the past. So we've got a permitting angle that we've got covered off. So we've done I think a great job of rounding out our board and folks that are going to be helping us going forward.

Maurice Jackson: Who is Todd Hilditch and what makes him qualified for the task at hand?

Todd Hilditch: That's a loaded question. For the last 20, 25 years, I've been involved in the mining sector and the public company sector. Again, the mining space is very difficult, one of the things that I'm very fortunate to say is we've had successes in every one of the companies that we have put together. And I'm not saying they're all home runs, they're not all triples, they're not all doubles but the good news is our sector, if you could find a project, we've had success in lithium in the early days in 2010, we sold out to the world's largest. Our company at the time was Salares Lithium. I started a company that was involved in nickel, Sama Resources, which is still ongoing in Côte d'Ivoire. We've had other successes in the uranium space.

So we haven't only been gold, but we've had a smattering of really good sectors and opportunities that have turned into or are turning into something. I'd like to say that if I bring anything to the table whatsoever, I mean, it's the smart folks that are working with us that they'll take this company to better success. But we've stuck with it, we do what we say we're going to do, we're prudent with our money. We do as much homework as we can and if I'm leading that process and trying to steer in some directions, maybe that's part of what I do. But I just like to think that the market would be supportive of us because of the successes we've had in the past. I'm fortunate to be surrounded by a team of professionals, each with a proven pedigree of success. And it's the shared past successes that gives confidence that we will deliver to our shareholders.

Maurice Jackson: How about boots on the ground? Who do you have on your technical team?

Todd Hilditch: Charlie Sulfrian would lead that. Charlie, as I mentioned, has spent 23 years with Barrick, another 15 years with Western States Minerals Corp. He was involved early stage in some of the sampling, this led to the discovery of eventually what's now Goldstrike. So from a technical background, he leads, he's hired members of his team to work with. We do rely in particular with adding a technical advisory committee member today, Ted Wilton. We've done our homework with regards to talking with Dr. Dick Sillitoe, who is a world renowned geologist and certainly knows this type of system. We've had numerous Zoom and calls with him and we believe that he feels there's a great opportunity here. So from a technical standpoint, led by Charlie but supported by me.

Maurice Jackson: Let's get into some numbers. Sir, please provide us with the capital structure for Riley Gold.

Todd Hilditch: This is probably one of the more proud elements of our infancy. We have 25 million shares issued out, fully diluted, which would include another 10 million, is made up of warrants at 40 cents and a small amount of options. What we're going to do to be 35 million, we have kept that in check specifically to grow the company and adding value. In the situation that we're in now if we have some success, we may be able to get those warrants exercised within our group. And the good news is we were able to do our property transactions without issuing a single share of stock. So that's helpful, we're not worried about selling in the market and all that type of thing and so we're in good shape on the structure.

Maurice Jackson: You said that modestly, but I want to make sure everyone fully understands here, give us the fully diluted again one more time.

Todd Hilditch: 35 million, fully diluted.

Maurice Jackson: That's amazing.

Todd Hilditch: Only 25 million issued and outstanding at this very moment.

Maurice Jackson: It just doesn't get better than that.

Todd Hilditch: The group that made up the private placement that we did in October, there are of all the folks that are involved, there's maybe only five or six people of that new shareholder group that I haven't been involved with over the last 10 years, five years, three years, two years of doing business with them. So it's a unique scenario, and I'm very happy that the folks that make up that shareholder group have supported me. I would hope that the only reason why they continue to support is that, again, we do what we say we're going to do, we're prudent with our money.

Everything doesn't work out, but you've got to be straight up and honest with folks and say, "Hey, we're going to drill for gold and you know what? It's hard to find it but if we do, we're going to be successful. If we don't, we'll pivot and do everything we can to make sure that we can try to keep your investment as a whole as we can." So I think that's one of the reasons why we have the success of such a tight structure.

Maurice Jackson: You alluded to it but how much cash and cash equivalents do you have?

Todd Hilditch: We raised $3 million; once we took care of a lot of the project payments and getting the infrastructure up and running, we're a little over $2 million, which is plenty for our first initial drill program. We're using core only at Tokop. With success we will raise either through the exercise of warrants or potentially in the market, that's to be determined, additional capital. Once we get a better handle on what we're seeing, that's the opportunity to raise more capital.

Maurice Jackson: What is your burn rate?

Todd Hilditch: That's a little tricky too because we're just building out our team especially down in Nevada but I would guess on a regular year, once we're up and settled in, our corporate burn rate would be approximately $450,000 Canadian per annum. And if you include the Nevada team and group, which may grow, it won't shrink but it may grow. I would argue if you include that, we're probably in the $600,000 to $700,000 range. But that still to be determined.

Maurice Jackson: How much debt do you have?

Todd Hilditch: Zero.

Maurice Jackson: And who are the major shareholders?

Todd Hilditch: Well, management is about 20% so we have skin in the game. We do have two institutions that I'm proud that they took a toehold in our private placement, Extract Capital, as well as Paul Stephens with Stephens Investment Management, both groups have supported the junior and bigger space, medium-term and larger companies. So we've got great toehold positions there. And then the remainder would be in high-net-worth along with friends and family that have been with us for a long time.

Maurice Jackson: What is the float?

Todd Hilditch: That's a good question. In theory, it's everything but the 20% the management owns so that would take you in 18 million share type thing, 17 million shares. I don't believe that to be a real float, I think the folks that are supporting us are long term. You've noticed that since we became public and went through the four-month hold of trying to trade it up to 60 cents on not only a few shares which shouldn't have really been there. But since we've come back, I don't know, there's maybe been a few 100,000, maybe quarter of a million shares sold in the last couple of months since our four-month restrictions have come off. So, that's a pretty good indication that we've got pretty sticky investors if only 200,000 of 15 million have come up.

Maurice Jackson: That’s a good vote of confidence from shareholders.

Todd Hilditch: So the float, it's a hard question to answer because in theory it's everybody else is floating but in practicality, I think it's much tighter than that.

Maurice Jackson: Are there any redundant assets on the books that we should know about?

Todd Hilditch: None, these are our only two for now.

Maurice Jackson: Are there any change of control fees? And if yes, what is the compensation?

Todd Hilditch: Not at this point but if the management agreements do get put in place they would be industry standard, probably in the 18 months to 24 months range if and when instituted.

Maurice Jackson: Is management charging a consultant fee for any services?

Todd Hilditch: All of our management run off of consultancy. So within that G&A or burn rate, everything from our senior management team through our geological team, for a lot of reasons we run it through consultancy versus employment.

Maurice Jackson: In the closing multilayered question, what is the next unanswered question for Riley Gold? When can we expect a response and what determines success?

Todd Hilditch: Well, we've alluded to some of those. The reality is the drill bit is the truth serum and for us, we're in a position where that truth serum is starting in a couple of weeks, the early part of April for drilling. I would expect and I'm guessing here the labs have been tremendously under the stress of work and a little bit slower than I think most of us in our sector would like. But we're in a position that we'll probably get the first set of drill results out, I'm guessing—and this is a forward-looking statement—100% would be sometime in probably June, maybe May, late May, but early June. So those are the things that don't keep me up at night, it is what it is. We'll get the drilling down, we'll get it to the lab and then we'll get it to the market. It's pretty straightforward, there's nothing that keeps me up at night worrying about Riley or the going forward period. Having two teenage boys and is that's what keeps me up at night, not Riley.

Maurice Jackson: All right, last question, sir. And that is what did I forget to ask?

Todd Hilditch: I think if I were to maybe say, and I alluded to that on a comment, we're not necessarily going to stop at Tokop and Pipeline/West and Clipper. If there's an opportunity that comes along that is a bigger picture and would add value to our company in an acquisition of property or otherwise, we would look at that. It's still premature I think for us to be thinking about 6, 12 months down the road, just due to what's in front of us at the current moment. But that would be probably the only thing we didn't touch on and it's tough to talk to without a little bit more time, energy and information.

Maurice Jackson: Mr. Hilditch, if somebody wants to learn more about Riley Gold, please share the contact information.

Todd Hilditch: The website address is rileygoldcorp.com. I may be reached be at thilditch@rileygoldcorp.com and my direct contact number at the office is (604) 443-3831. Happy to talk to anybody about our company, the people; we're an open book and encourage any calls.

Maurice Jackson: Mr. Hilditch, it's been a pleasure speaking with you today. Wishing you and Riley Gold, the absolute best, sir.

And as a reminder, I am licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium and rhodium, to offshore depositories and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Riley Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riley Gold, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.