Sports betting is set to surge this month on the back of college basketball's March Madness tournament. Across the U.S., states with newly-legal markets recently helped to push monthly wagers on sporting events past $4 billion for the first time ever.

Additionally, several markets that could handle hundreds of millions of dollars in bets per month are pushing ahead with legalization measures. New York and Georgia, for example are racing against the clock to deregulate mobile and online sports betting before their legislative sessions end at the end of this month.

Related ETFs and Stocks: Roundhill Sports Betting & iGaming ETF (BETZ), Penn National Gaming, Inc. (PENN), DraftKings Inc. (DKNG)

Sports betting has now been legalized in 25 states (plus Washington DC), with 21 of those markets being fully operational.

Despite a few key states seeing a pullback in total bets handled in February, new entrants pushed the total sports betting handle in the U.S. over the $4 billion mark for the first time in history. February was the fourth straight month that the entire U.S. industry set a new record.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on March 25.

Wall Street is broadly enthusiastic about sports wagering companies. As Casino.org notes, brick-and-mortar sportsbooks are low-margin enterprises, while online operators face lower fixed costs and much greater ease of access.

In a recent note to clients, Goldman Sachs wrote, "We expect a combination of favorable legislation and consumer adoption to drive growth in U.S. online sports betting and internet gambling from $900 million/$1.5 billion markets today to $39 billion/$14 billion in 2033, equating to 40%/27% CAGRs for over a decade."

March Madness Sets up a Betting Surge

The outlook for sports betting faces a completely different outlook in 2021 than it did in the early part of 2020. This time last year, MRP was covering the NBA's announcement that they would be suspending their ongoing season due to the outbreak of COVID-19 on the American mainland. The NCAA followed up with an even bigger shock, outright cancelling college basketball's "March Madness" national tournament.

Thankfully, this year's tournament is in full swing with no significant COVID-related issues to speak of.

March Madness has become a staple of American sporting, as well as sports gambling, due to the notorious unpredictability of outcomes in nearly every game. The betting angle has been amplified by the popularity of filling out a March Madness bracket, an attempt to predict the winners of every single game in the tournament. 17.2 million brackets were entered into ESPN's 2019 Tournament Challenge alone, along with billions of dollars wagered each year during tournament time.

While the number of Americans placing bets this year — 47 million — is expected to stay flat from 2019, wagers are expected to break the 2019 record of $8.5 billion.

Since 13 new legal sports betting markets have opened up since the 2019 tournament, Forbes notes that the number of people betting online this year is up more than 200% from 2019. Per the American Gaming Association, about 18 million people will bet online, versus just 8 million will betting in-person.

Mixed Results in February Betting

As MRP wrote last month, sports betting only begun operations in Michigan for the final 10 days of January, but the data was staggering, as the state's online sportsbooks handled a whopping $115.2 million in the short period.

In February, the first full month of legal sports betting in the state, Michigan posted the largest full opening month for any online sports betting state, topping $300 million in handle. Per Gambling.com, FanDuel, DraftKings, Barstool and BetMGM accounted for 92% of the total online sports handle. In total, the Wolverine State now has 11 active online operators.

Illinois's sports betting handle reached a record $581.6m in January, the seventh consecutive month of growth for the state's betting business. Barstool Sportsbook, owned by Penn National Gaming, will likely help that spate of wagers increase further, launching in the state just ahead of March Madness.

Though the top state market for sports betting, New Jersey, saw a pullback in handle, it was not unexpected. With two to three fewer calendar days to work with, one less weekend for bettors to wager, and the end of football season, WSN.com reports the total handle was $743 million, down 22.5% from January's $958.7 million, but up 50.1% from February 2020's total handle of $494.8 million. That discontinued a mark of three straight months with $900 million or more in sports wagering handle.

New York, Connecticut, and Georgia Legalization on Deck

Though New Jersey has long benefitted from New York's slow action on mobile an online sports betting, that could be about to change.

With overwhelming majorities in the New York Senate and Assembly, each house advanced a multi-operator mobile sports betting framework within their budget bills this month with votes of 43-20 and 106-43, respectively. New York State Assemblyman and Racing and Wagering Chair J. Gary Pretlow said in an interview this week that New York mobile sports betting legalization is expected to have the support of NY Governor Andrew Cuomo by the time the new fiscal year (FY) starts April 1.

The Assembly proposal would allow the state to license 14 mobile skins among casinos in the state, where in-person commercial sports betting is already legal, with two skins per commercial and tribal casino. As MRP wrote last month, a skin represents an online license worth $12 million. Per Action Network, DraftKings has already partnered with del Lago Resort, FanDuel has partnered with Tioga Downs & Casinos, and, along with Barstool, BetRivers partnered with Rivers Casino & Resort.

To New York's east, Connecticut might be right behind them on the sports betting front. Governor Ned Lamont's HB 6451, the key bill that represents the state's gaming compact agreement, was greenlighted by the Joint Public Safety and Security Committee this week. Should the bills become law, Connecticut would become the third state behind Michigan and Pennsylvania to legalize mobile, online sports betting and iGaming in one fell swoop.

Mashantucket Pequot tribal Chairman Rodney Butler has said he expects sportsbooks to be able to take bets by the 2021 NFL season. His tribe's casino has already partnered with DraftKings in anticipation of legalization. As SportsHandle.com writes, FanDuel and other major operators will try to find a way into the market, but options will be limited since partnerships have already been inked by participating parties.

Down South, in Georgia, the state's House Economic Development and Tourism Committee passed both Senate Resolution 135 and Senate Bill 142 on Tuesday. Each of those pieces of legislation aim to legalize sports betting in Georgia. According to Legal Sports Report, the legislature is trying to move quickly to beat the clock, as the Georgia legislative session ends at the conclusion of March.

SR 135 specifically amends the Georgia Constitution to explicitly allow for GA sports betting. SB 142 legalizes online sports betting to be operated by the Georgia Lottery Corporation. The bill would license at least six online operators. According to The Georgia Professional Sports Integrity Alliance, close to $1.5 billion is illegally wagered on sports in the Peach State, and a good portion of that represents potential tax revenue that's essentially being lost.

Due to rapidly rising revenues, the deregulatory incentive facing many cash-strapped states, and an ongoing technological evolution that has put betting right at gamblers' fingertips, MRP is re-affirming our LONG Sports Betting theme.

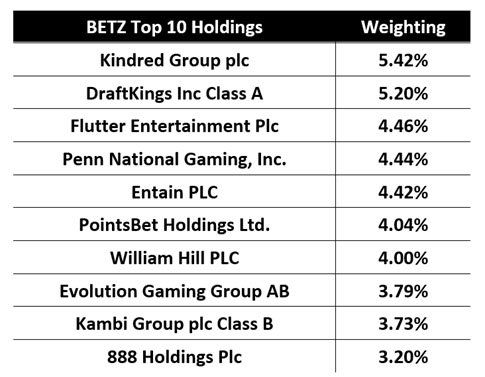

The Roundhill Sports Betting & iGaming ETF (BETZ), launched last June, marks the first exchange fund dedicated to the fast-growing sports wagering and internet casino markets, is an innovative way for investors to play the boom in sports betting.

Since the inception of our theme on November 30, 2020, BETZ has returned +32%, more than quadrupling the S&P 500's gain of just +7% over the same period.

Originally published March 25, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.