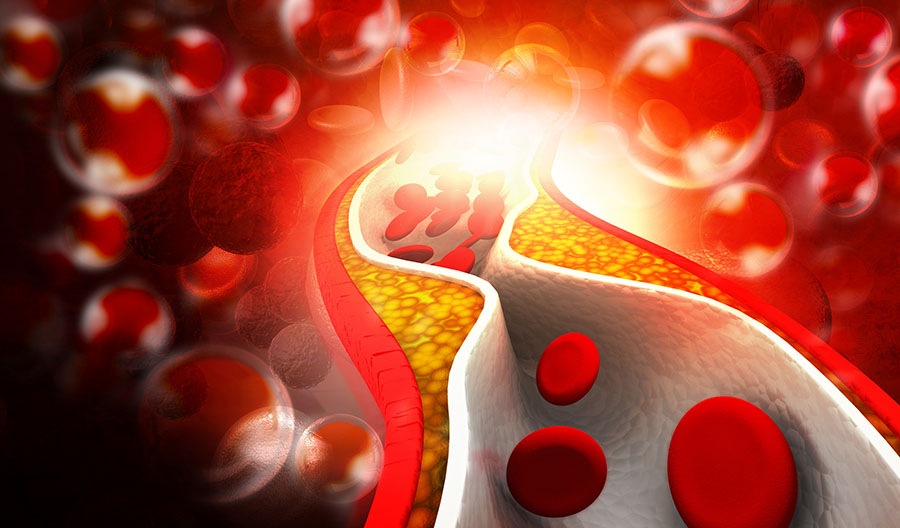

Medical device company Shockwave Medical Inc. (SWAV:NASDAQ), which is focused on developing a system of tools that utilize Intravascular Lithotripsy (IVL) to treat severely calcified cardiovascular disease, today announced "a preliminary forecast revenue range for the first quarter 2021, ahead of its participation in the Wells Fargo MedTech R&D Spotlight Call Series held earlier today."

Shockwave Medical's President and CEO Doug Godshall stated, "We are pleased by the encouraging performance in the first quarter and, in particular, with the excellent reception of our newly-launched C2 Coronary IVL product in the United States...I commend our team on their extraordinary preparation and execution of the launch of C2 and am so grateful for the collaborative partnership we have with our customers. The entire Shockwave Medical organization remains focused on our mission to deliver life changing products to patients suffering from calcified arterial disease."

The company highlighted the activities surrounding the launch of its C2 System which was approved by the U.S. Food and Drug Administration (FDA) in February for use in calcified de-novo coronary arteries prior to implanting a stent.

The firm indicated that since gaining FDA approval, its territory managers have secured an average of a little more than 1.5 accounts in the U.S. per month, which is in line with its strategy of rolling out the product in an organized and sustainable manner. Shockwave noted that in parallel to the rollout, peripheral revenue in the U.S. has continued to grow sequentially month-over-month in Q1/21.

The company noted that thus far the performance of the C2 System has been on par with the results experienced in international markets.

Shockwave advised that to date more than 120 customers in the U.S. have purchased the C2 Launch Kit and that the orders typically average around 6 C2 units each. The company noted that already about half of the U.S. clients that have initiated launch of the C2 System have completed the launch activities and are now able to use IVL independently.

The firm noted in addition that "five live cases utilizing C2 in U.S. centers have been performed in conjunction with the recent Cardiovascular Research Technologies (CRT) and Scottsdale Interventional Forum (SIF) Conferences."

The company provided some limited preliminary financial data and reported that it expects revenue of $31-32 million in Q1/21, which would represent an increase of 104-111% over Q1/20. The firm noted that the estimates are preliminary and unaudited and thus are subject to adjustment.

Shockwave Medical is a medical device company based in Santa Clara, Calif., that is focused on the development and commercialization of transformative products, tools and approaches in treating calcified cardiovascular disease. The company stated that its goal is to create a new standard of minimally invasive care for the interventional treatment of atherosclerotic cardiovascular disease. The firm noted that its technology employs its "differentiated and proprietary local delivery of sonic pressure waves for the treatment of calcified plaque, which the company refers to as Intravascular Lithotripsy (IVL)."

Shockwave Medical started the day with a market capitalization of around $3.6 billion with approximately 34.8 million shares outstanding and a short interest of about 6.6%. SWAV shares opened nearly 12% higher today at $115.00 (+$12.02, +11.67%) over yesterday's $102.98 closing price. The stock has traded today between $113.53 to $122.31 per share and is closed at $122.89 (+$19.91, +19.33%).

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.