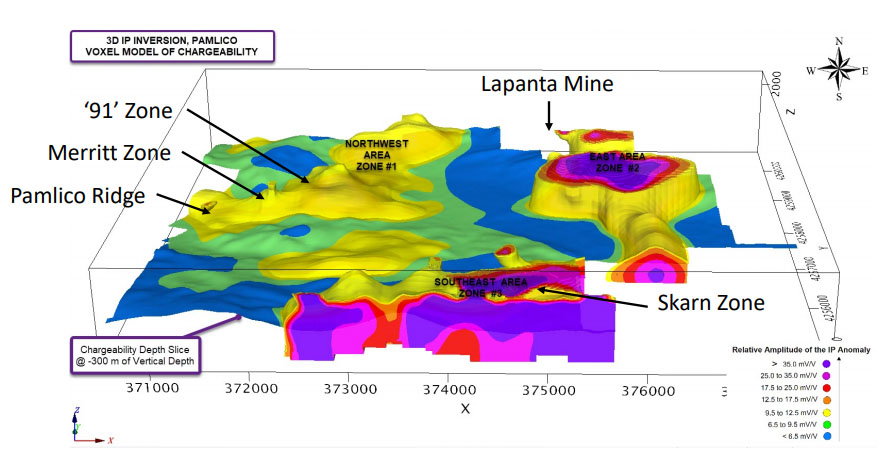

In a March 24 research note, Noble Capital Markets Inc. senior research analyst Mark Reichman discusses Newrange Gold Corp. (NRG:TSX.V; NRGOF:OTCQB) after the company announced "the completion and interpretation of an expanded Induced Polarization (IP) geophysical survey on the Pamlico Project in Nevada."

The report indicated that the total scope of the IP survey work carried out at Pamlico exceeds 76.5-line kilometers and encompasses the entire property and noted that results from the latest 56.35-line kilometers surveyed were instrumental in not only further delineating and extending known anomalies, but also aided in the identification of previously unrecognized structural anomalies, the analyst noted.

Based upon the IP survey data, Newrange Gold was able to significantly enlarge the Pamlico project area and has staked out large amounts of additional land in three areas where anomalous chargeability was detected, Reichman noted.

The three new zones, called the Northwest, East and Southeast areas, are all two to three kilometers in size and all intrude on the property boundary. "Collectively, they reflect a district-scale opportunity extending approximately five kilometers east to west and more than six kilometers north to south," the analyst wrote.

The bulk of Newrange's past drill work has been conducted in the Norwest Area. The firm plans to complete additional reverse circulation (RC) drilling at the recently discovered Merritt Zone to better define close to surface mineralization and to determine the potential for an open pit mine there. The company also plans for at least 2,500 meters of drilling in a minimum of five five new holes at Merritt to target deep chargeability anomalies.

The analyst commented, "Newrange has made significant progress with its exploration and drilling program at Pamlico." From late May 2020 through March 1, 2021, Newrange completed 9,044 meters of drilling in 74 RC holes. Reichman noted that the recent discovery of high-grade mineralization near-surface at Merritt appears to strongly support the views of Newrange's management that "multiple high-grade zones surrounded by halos of lower grade material exist over a much broader area" than previously thought.

Noble Capital Markets commented that a multi-million ounce resource may be in the making at Pamlico.

Noble Capital Markets rates Newrange Gold as an Outperform with a target price of US$0.20 per share versus its current share price of approximately US$0.12.

Read what other experts are saying about:

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Newrange Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newrange Gold, a company mentioned in this article.

Disclosures for Noble Capital Markets, Newrange Gold Corp, March 24, 2021

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the "Company") covered by the Noble Research Division and referred to in this research report.

The Company in this report is a participant in the Company Sponsored Research Program ("CSRP"); Noble receives compensation from the Company for such participation. No part of the CSRP compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed by the analyst in this research report.

The Company has attended Noble investor conference(s) in the last 12 months. Noble has arranged non-deal roadshow(s) with investors in the last 12 months.

Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) within the next 3 months.

Noble is not a market maker in the Company.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis. Named WSJ 'Best on the Street' Analyst and Forbes/StarMine's "Best Brokerage Analyst." FINRA licenses 7, 24, 63, 87.

RESEARCH ANALYST CERTIFICATION

Independence Of View:

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation:

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or research report.

Ownership and Material Conflicts of Interest:

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.