In early January, I decided that the extra pounds I was carrying around was a definitive mortality check for any sexagenarian lucky enough to be in generally good health, but sufficiently slovenly and undisciplined to allow such to happen. So, with great and good intentions in mind, I decided to try to do something about it and set out on a journey of intermittent fasting and additional exercise, with very interesting results.

The first and most obvious change was the absence of any form of alcohol in January and February, and once the purple alligators and screaming banshees stopped coming out of the walls and ceilings, day-to-day living returned to normal. Thirty-one pounds later, dungarees that refused to fit and belt buckles that would explode into shards of lethal metal are no longer sources of frustration (and danger).

But the one activity that I now cannot do without is my 3-kilometer walk up and down the hills surrounding the lovely Scugog swamp. Some days I take two of these walks and some days (like today) it is in the rain and wind. But whether it is the cows grazing or the crows squawking, there is always something fascinating and invariably thought-provoking.

The picture you see above is a newly renovated barn carried out by two young lads, perhaps in their late twenties, who removed all of the old, dilapidated wood and replaced it within three days. Walking by them this week, I shouted out, "Looking good!" to which they replied with big smiles, "Did you bring this nice weather along with you today?" I turned to my walking partner (who is way better-looking than me, although that it is not difficult) and said, "Look at those hard-working young guys earning an honest living." Two Millennial males happy to have work, out in the fresh air, zero sense of entitlement, zero expectation of outside "assistance," and zero reliance on government handouts. Hard to imagine in this day and age.

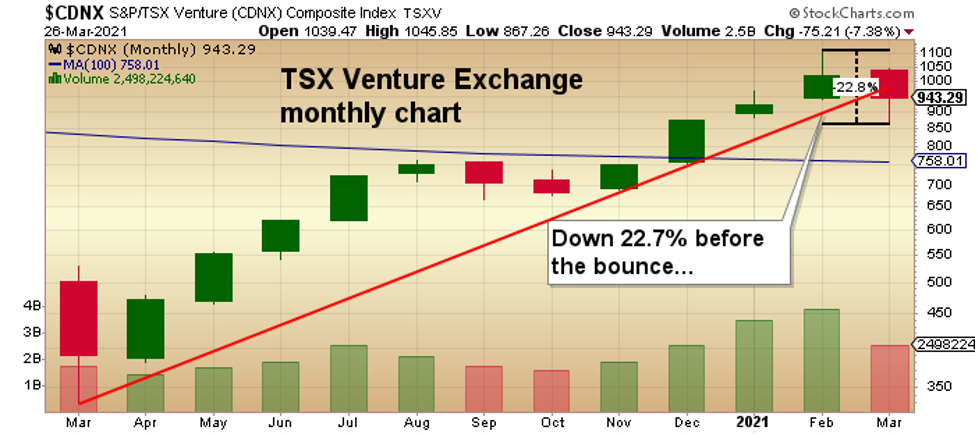

Another week has gone by and I am thanking the High Heavens that this miserable month of March is almost over. Back in February, the TSX Venture Exchange was ripping along at over 1,100, and just as everyone was beginning to talk about a return to the 2011 highs above 2,400, along came the pre-PDAC "creep," and then the post-PDAC "sprint," as investors bolted for the exits with terminal ferocity.

Alas, this too shall pass, but it is with great interest that I note the performance of copper year to date, which is suffering remarkably less pain than both gold and silver. It is also instructive to see just how 2021 is shaping up for gold and silver bulls—of which I am one. But it is one thing to be a gold and silver bull, and quite another to be a gold and silver bug.

The title of my service was changed from "Gold and Gold Miners Advisory" to "GGM Advisory" because I did not want to give people the impression that I am a gold bug, because I am most definitely not. There are times (such as last August) when I exit positions taken during sharp selloffs (such as the COVID crash of March 2020), because when the "crazies" are out, you have to step aside. In fact, one item pounced upon by the "bugs" was Warren Buffett buying Barrick Gold Corp., but that was anything but bullish because I must have seen that news release tweeted out 500,000 times in five days, which told me that if a gold hater like Buffett is a buyer of GOLD:US, then sentiment must have been "frothy," to say the least.

Another major difference between the philosophies of the gold bug versus the gold bull is the recent "#SilverSqueeze Movement," which went viral back in February. Not to be outdone by the lunacy of trying to grapple with the bullion bank bullies as happened last month, what has surfaced is the latest "conspiracy theory," which the #Silversqueeze Community is now launching into the Twitterverse and Instagram and Facebook (and everywhere they think someone has a stock account). It all revolves around the "Perth Mint," where (it is alleged) that "allocated gold" has disappeared or been comingled with "unallocated gold," leaving Perth Mint customers high and dry in being able to access their private gold stashes.

I am continually left aghast at how this is anything new in the zoo, when the world knows full well that the central bank gold holdings have been hypothecated many times over, and yet they continue to hold it on the books at par value and in quantities that have never been audited nor verified. As a gold bull, I learned years and years ago to discount these kinds of rumors—not necessarily that they are untrue, but that relative to the U.S. dollar-denominated price of gold (which governs the prices of gold and silver equities), they are meaningless.

As the infamous J.P. Morgan once said, "Gold is money—everything else is credit." And it is credit (and the destruction thereof) that is going to determine how many ounces of gold and silver it will take to buy a home in Ajax, Ontario. Incidentally, the average price for a detached home in working-class Ajax is over CA$900,000, which, at today's ridiculous prices, is 458.92 ounces of gold or 31,620 ounces of silver. (In normal times, it would take less than 100 ounces of gold and less than 6,000 ounces of silver.) The way a gold bull views his holdings is not how many Canadian dollars it is worth, but rather how many houses in Ajax it will buy, and at what point he should trade his gold for a home in Ajax.

In a similar fashion, I am a copper bull, but certainly nothing resembling a copper bug, because copper represents a commodity linked to global demand and supply. While current conditions suggest that prices (especially in U.S. dollar terms) are headed higher, I will let the charts determine whether or not I want to own it. As it stands, the price of copper is currently in a textbook uptrend, with a letter-perfect 30o angle of ascent, with all moving averages perfectly aligned within the uptrend.

Now, I have a great many friends around the globe who are gold bugs, and while I tease them and flick ashes on their carpets from time to time, they know what I believe the ultimate outcome will be when the Day of Fiscal and Monetary Reckoning arrives (and it will not revolve around crypto or "Modern Monetary Theory"). They know that J.P. Morgan was correct and that is precisely why he made that statement. Bankers are bankers, and when you look back upon the history of financial folly, you need to look no further Baron von Rothschild, who said: "Let me control a nation's currency and I care not who makes the laws."

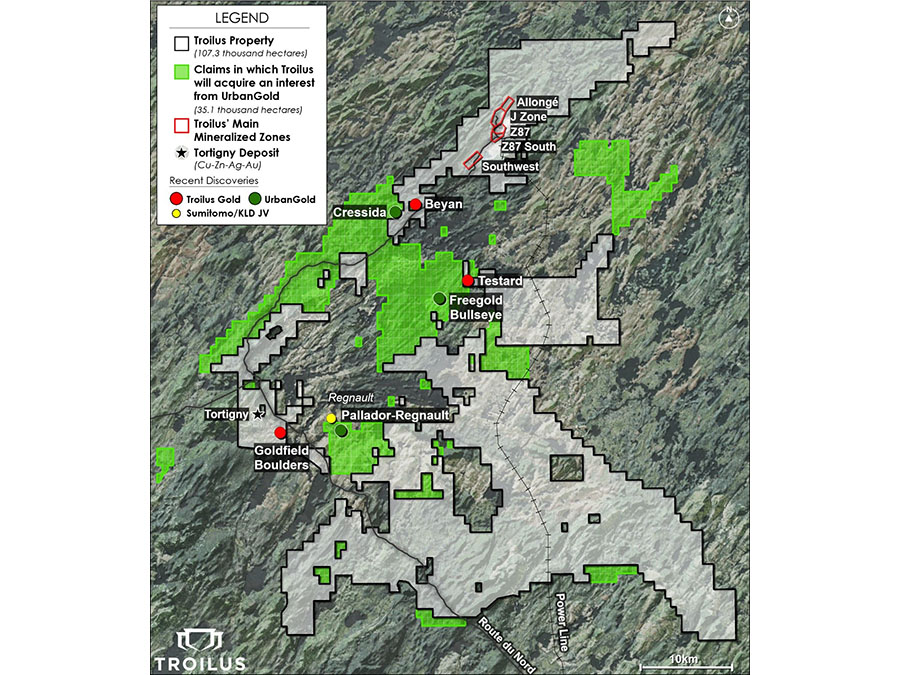

However, when it comes to the near-term need to generate income, flexibility reigns paramount in the implementation of wealth preservation, which is why I bring to your attention these tiny little micro-cap jewels like Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Norseman Silver Ltd. (NOC:TSX.V). Norseman is a silver deal that delivered as a "qualifying transaction" a property called Cariboo in late 2020. As I am wont to do, I dug deep on Cariboo and downloaded their technical report on sedar.com, and discovered that it is situated deep in the heart of British Columbia "porphyry country," where porphyry copper-gold-silver deposits run rampant. Here is a snippet from that report:

"Initial discoveries of copper and silver mineralization were found to be high grade" was sufficient for me to call the property vendor and ask him a few probative questions, to which he offered complimentary responses and added excitement. To me, it is apparent that the Cariboo project might just be a copper-silver porphyry deposit, which would fit nicely into my bullish perspective on the red metal.

Both Getchell Gold Corp. and Norseman Silver Inc. comprise major allocations in the GGMA 2021 Portfolio and have since the late summer of 2020. Like Norseman, Getchell also has exposure to copper through its Star Point/Star South projects, which are going to be drilled later this year. This grants me optionality and flexibility in the event that the electric metal story gathers momentum.

Of course, the risks to owning any industrial metal lie in the return of global growth and robust trade, which have been anemic since the lockdowns. Since the wizards in government are slowly discovering that pestilence is not a preferable fate to starvation, it looks increasingly evident that economies will be allowed to function normally, allowing the human immune system to function as it has so successfully down through the ages. However, that old expression of "a penny late and a dollar short" immediately springs to mind.

There is no such word as "rurality" in the dictionary, but please trust me when I tell you that there is, indeed, such a word in my heart. I grew up in a small town called Malton, as in the international airport in Toronto (formerly "Malton Airport"). That was a wonderful place to grow up and get into all kinds of trouble, but where the cops raised their families with zero police presence because the mothers were the only police that were required. In the 1950s, Malton was a rural setting, with farmer's fields surrounding the town and the Canadian National rail line cutting through it only to service the aircraft factories like AVRO and De Havilland. The main drinking place was the Malton Legion, which also served as the bingo hall and the after-work pub for all the workers in the factories. There were tons of fistfights and tons of arguments, but never were there shootings and never were there knife fights, because the arguments and the fistfights were just one more excuse to got to the Malton Legion to "sort things out"—which always happened without fail, thanks to the mothers that absolutely ruled the town. "Rurality" rules.

Originally published March 26, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold, Norseman Silver. My company has a financial relationship with the following companies referred to in this article: Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold and Norseman Silver, companies mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Charts and graphics provided by the author.