This week Fed Reserve Chair Jerome Powell spoke at the "Innovation Summit" hosted by the Bank for International Settlements.

During his talk, he dissed Bitcoin and cryptocurrencies saying they were "…highly volatile and therefore not really useful stores of value, and they're not backed by anything."

OK, let me get this straight.

At its latest FOMC meeting the Fed promised near-zero interest with no rate hikes until 2023, and its $120 billion monthly asset purchases see no sign of abating.

In the past year, the Fed has unleashed the largest multi-trillion-dollar quantitative easing fiat money campaign the world's ever seen. And that's saying a lot after its reaction to the 2008 financial crisis.

Where is this "money" coming from? These are trillions of currency units "not backed by anything," which Powell himself wants to see lose value through higher inflation.

The COVID-19 pandemic has changed our world. Many of the existing structural problems, like easy money policies, record high corporate and personal debts, and national debts and deficits have ballooned to historical levels.

Trying to dial back these measures will prove not only futile, but likely impossible.

And this places gold in a perfect "sweet spot" to gain more favor, and continue on its historic bull run.

Gold Turnaround

It's true gold has backed off from its new all time high of $2,067 to around $1,730 today. That's about 19% below. Essentially, it's a textbook correction.

Even after that, gold is still 44% higher than it was in late 2018.

But let's look at a timeline of what happened a year ago for some perspective.

On Wednesday, March 11, 2020, the WHO declared COVID-19 a pandemic. Gold was at $1,640, near its then recent high of $1,690.

By early Monday, March 16th, under shock and panic, gold temporarily touched $1,450, then quickly regained $1,500.

The Federal Reserve had held multiple emergency meetings to that point in March as stock markets crashed.

On March 19th, President Trump announced details of a historic $1 trillion economic package. Congress was asked for $500 billion for direct payments to taxpayers. Stimulus checks of $1,200 per person were, in effect, economist Milton Friedman's theoretical "Helicopter Money" tool, popularized by Ben Bernanke in 2002.

"Helicopter Money" was no longer just "theory." It had moved from the lab to the real world.

On March 23rd, the Fed pledged a slew of programs to help markets function more smoothly. It promised unlimited quantitative easing through its asset purchase program. The Fed even moved, for the first time ever, into buying corporate bonds from primary and secondary markets through ETFs.

As well, the Fed also pledged $300 billion for main street business, the Term Asset-Backed Loan Facility, and to purchase agency commercial mortgage-backed securities.

This was, in effect, the start of QE Infinity.

So I ask, what do you expect of inflation?

Inflation "Baked in the Cake"

According to the U.S. Bureau of Labor Statistics, the CPI for All Urban Consumers was up 1.7% over the last 12 months. I say hogwash.

The most basic staples like food, building supplies and energy have been soaring.

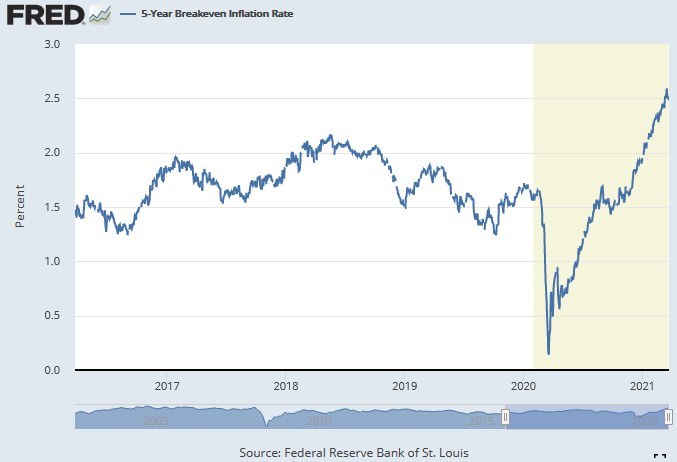

Which explains the more realistic rising inflation expectations.

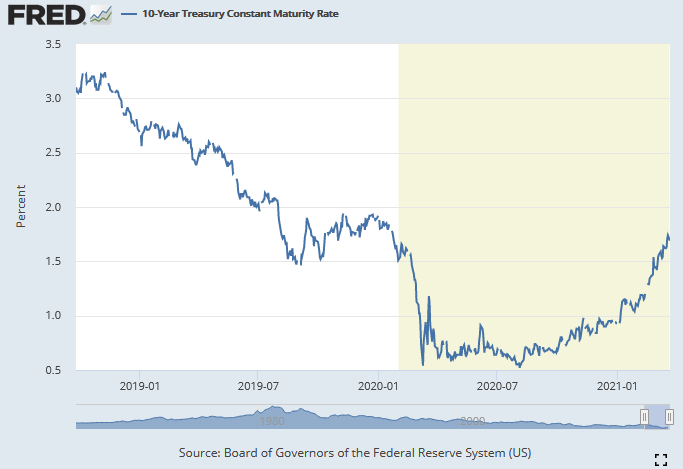

Which in turn explains why the 10-year Treasury Yield has soared of late.

This has dented not just gold, but also stocks of all stripes. Meanwhile, the U.S. dollar has risen along with yields.

So, as much as Powell may jawbone about resisting initiating a policy of Yield Curve Control, those limits may soon be tested.

Remember, right now these rates are competing with and therefore pressuring gold. I expect to see either a leveling off of longer-term rates, or a Fed reaction to cap them if deemed necessary.

That would likely cause renewed dollar weakness and a return to falling real negative interest rates. And this could be a catalyst to launch gold higher, potentially setting new all-time record highs.

As Jeff Clark of Goldsilver.com recently pointed out, there are multiple instances of large inflation spikes over very short time periods.

Once gold gets a whiff of this kind of action, it will likely be a major catalyst triggering a huge rally.

The Dow Jones Industrial Average took eight months to reclaim its pre-March crash highs. Gold took just one month, then soared to a new all-time nominal high.

Investors should be preparing now for the inflationary effects of an abating pandemic and the release of massive pent-up demand on a majority of economic sectors.

In the Gold Resource Investor newsletter, I provide my outlook on which stocks offer the best prospects as this bull market progresses. I recently added a low-risk, deep value gold royalty company to the portfolio that I believe has exceptional potential to outperform its peers in the next 12 months.

Right now, gold is simply pausing as we work through rising inflation expectations, and the implications that brings.

Odds strongly favor gold being much higher 12 months from now. This is the time to position in gold and gold stocks.

--Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.