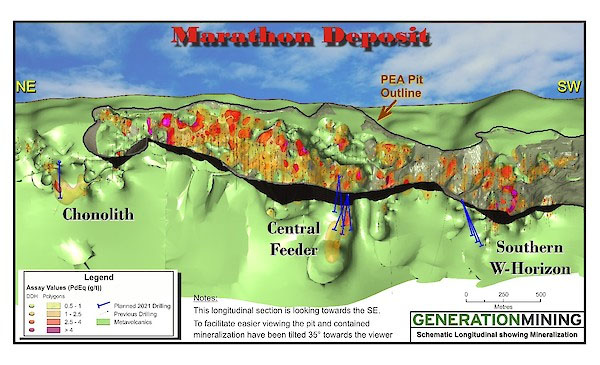

In a news release, Generation Mining Ltd. (GENM:TSX; GENMF:OTCQB; 9GN:FSE) announced the results of a feasibility study on its Marathon asset in Ontario, Canada.

"This study confirms that the Marathon palladium and copper project is a substantial mining project that is expected to provide a very robust return on investment," President and CEO Jamie Levy said in the release. "We expect the palladium supply in particular to remain in deficit for the foreseeable future as Europe, China and other regions roll out tougher emissions standards."

The study calculates an after-tax internal rate of return (IRR) of 29.7% and a net present value at a 6% discount (NPV6%) of CA$1.07 billion. These figures are based on long-term metals prices of US$1,725 per ounce for palladium and US$3.20 per pound for copper. Payback is estimated to be 2.3 years.

When using current spot metal prices (US$2,395 per ounce for palladium and US$3.99 a pound for copper), the study shows an after-tax IRR of 47%, an NPV6% of CA$2.02 billion and a payback period of 1.5 years.

Initial capex is estimated to be CA$665 million net of equipment financing. Average life-of-mine cash costs are an estimated US$687 per palladium equivalent ounce2 (Pd eq oz2). All-in sustaining costs are calculated at US$809 per Pd eq oz2.

The study forecasts quantities of payable metals at 1.9 million ounces of palladium and 467 million pounds of copper, along with 537,000 ounces of platinum, 151,000 ounces of gold and 2.8 million ounces of silver.

"With the consensus outlook for palladium and copper strong for the next decade," commented Executive Chairman Kerry Knoll, "this is a project whose time has come. With little new PGM mine capacity being scheduled to come on stream over the next few years, Gen Mining plans to advance the environmental approval process, detailed engineering and mine financing during the remainder of 2021. We anticipate being able to begin construction next year subject to permitting approvals and financing arrangements."

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Generation Mining. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.