For several months, investors in Sassy Resources Corp. (SASY:CSE; SSRYF:OTCQB) have been waiting for all the drill results from the sizable, 100%-owned, flagship Foremore project in the Eskay Camp, at the heart of the Golden Triangle, in northwestern British Columbia. Eleven of 17 holes have been reported, along with highlights of more than 1,000 samples.

Nicobat to be spun-out for shares in exciting new battery metals play

As we were waiting, shareholders were advised to watch for news on non-core asset Nicobat and for possible acquisitions outside the Golden Triangle. Well, that news arrived last week. Sassy is close to monetizing Nicobat by optioning it (for shares and a multi-year work commitment) to a private Canadian battery metals junior.

That company plans to list on the CSE in coming months. Management remains optimistic about the prospects for battery metals, and Sassy would hold a meaningful position in this prospective play. Sassy's team has executed very well in its short history as a public company.

While the Nicobat news is very good, the more exciting development is that Sassy has formed a wholly owned subsidiary, Gander Gold Corp. (GGC) to pursue opportunities in the province of Newfoundland and Labrador (NF). CEO Mark Scott has started in NF by optioning eight promising claim blocks from Vulcan Minerals.

NF is one of the most exciting exploration districts in Canada. It's the focus of a mini gold rush. Much of the action is in the Central Newfoundland Gold Belt, a large region stretching across the island, ~250 km in length. For centuries NF was mined for base metals, but it was not until much more recently that gold became a primary target.

Sassy enters mini gold rush in Newfoundland, still at early stage

In the 1980s Noranda did a lot of drilling all over NF, but in many cases (reportedly) did not bother assaying for gold! As New Found Gold's (NFG) corporate presentation explains, "the Fosterville epizonal high-grade model was not understood at that time."

GGC will enable Sassy to pursue options to generate shareholder value through meaningful project diversification outside of the Eskay Camp, with minimal shareholder dilution. NF offers under-explored opportunities, high-grade gold/silver plus base metal potential, relatively low-cost drilling and the ability to explore year-round.

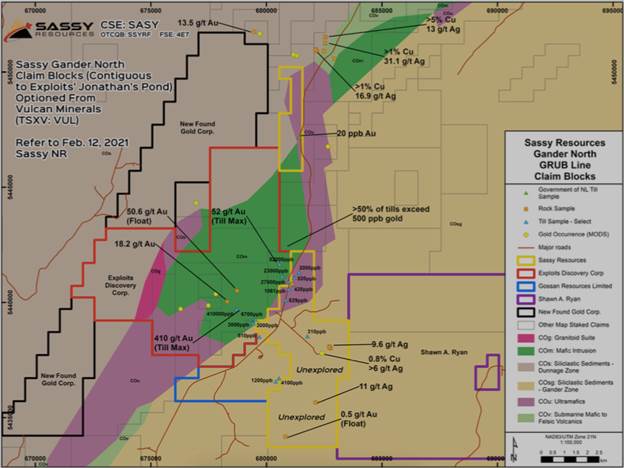

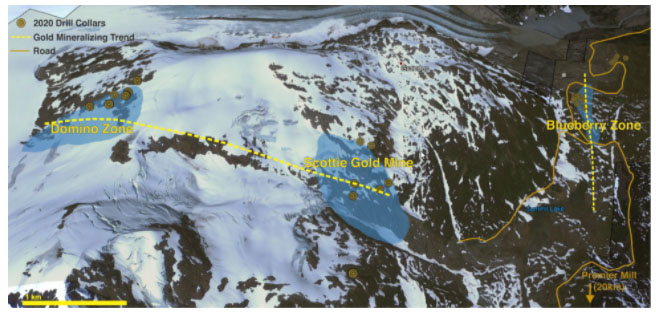

Management plans to mobilize to execute reconnaissance/orientation diamond drilling on drill-ready targets at Gander East this Spring. Gander East adjoins Jonathan's Pond, where some of the highest grade till anomalies ever discovered in NF (up to 410 g/t Au!) were found. That mineralization trends onto parts of Sassy's optioned property. Sassy now controls the closest claim block to NFG's new Eastern Pond discovery.

Exploration programs this year will cover the rest of that property, plus the other seven blocks—plus any new properties added to the portfolio in coming months—with airborne geophysical surveys and pattern soil/till sampling and prospecting over the 2021 field season.

Although not mentioned in the press release, it seems reasonable to wonder if one day GGC might be spun out into its own publicly traded vehicle. Perhaps not anytime soon, and not without some exploration successes, but something to think about.

Mark Scott, President and CEO, commented:

"We've taken some creative, forward-looking steps aimed at year-long value creation with Sassy establishing a major foothold in the prolific Eskay and Newfoundland mineral districts during transformational periods for each region. The Gander Gold subsidiary gives us various attractive options to leverage success for our shareholders."

Sassy entered into an option agreement with Vulcan Minerals to acquire a 100% interest in eight claim blocks, (624 claims, 156 sq. km) including the drill-ready Gander North, a compelling target intersected by a major regional fault zone (the GRUB Line) ~15 km northeast of NFG's tremendous new discovery—the Keats zone of its Queensway project.

NF stars Marathon Gold and New Found Gold leading the way….

In late 2019, NFG hit 93 g/t Au over 19 meters and has had many other high and very-high-grade intercepts since then. Eight rigs are now turning as part of a 200,000 meter grid drill program. NFG's Keats zone is one of the most significant discoveries in Canada of the past 20 years. (NFG market cap = $500 million, pre-maiden resource). 200,000 meters will focus a lot of attention on NF!

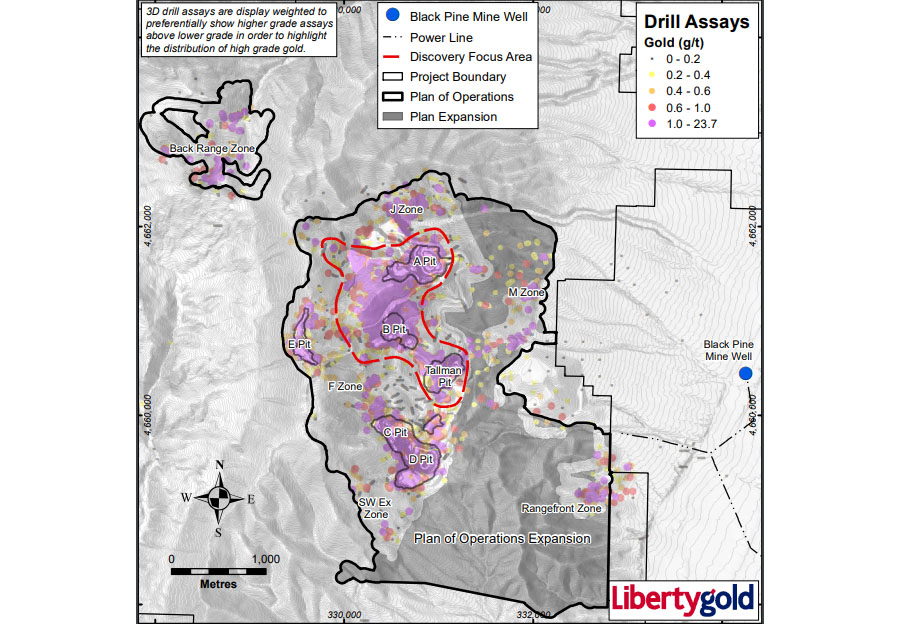

NFG's Queensway project ranks among the top five pre-maiden resource projects in Canada, along with projects owned by Great Bear Resources in the high-grade Red Lake mining district in Ontario (GBR market cap = $800 million) and Eskay Mining's (ESK) 50,000+ hectares near the center of the Golden Triangle in B.C. (ESK market cap = $375 million).

Since NFG's discovery, a better understanding of the Gander Gold Belt's blue-sky potential is emerging, making Sassy's untested Gander North and its other claim blocks highly prospective. Near Gander North's western and northern boundaries, there are some extremely high gold-in-till anomalies.

Over a 4-year period, Sassy will pay $400,000 in cash to Vulcan, incur $2 million in exploration expenditures and issue 2.5 million shares. Vulcan will retain a 3.0% NSR on the entire 624 claims, of which Sassy can repurchase 1.5% for $2 million plus 500,000 shares.

Marathon Gold has an enterprise value (EV) {market cap + debt – cash} of ~C$560 million. Its single project, at PFS-stage, is in central NF. The Valentine project is expected to reach production within three years. At US$1,550/oz. gold, the after-tax NPV(5%) of the 12-year mine = C$671 million/[48.8% internal rate of return].

The AISC = US$739/oz (bottom quartile). An NPV of C$671M million is 2.5x the project's upfront cap-ex of C$272 million, making it one of the best in North America, which is why Marathon enjoys a premium valuation; EV/NAV = 0.83x.

Sassys Gander Gold subsidiary alone could be worth $20 million+

There are no majors or mid-tier gold producers in Newfoundland. However, I would not be surprised to see Marathon and New Found Gold acquired. After that, there are roughly three dozen juniors with gold prospects in NF, ~12 of which have market caps between $20-40 million, one ~$55 million.

If management can deliver good drill results, I think it's reasonable to think that Sassy's NF properties and exploration activities, (the assets held in GGC), could support a $20 million+ valuation. Given Sassy's tight capital structure, a $20 million valuation for GGC alone would be worth ~$0.50 per Sassy share. Sassy's shares are currently at $0.54.

And, if Sassy can conduct multiple drill programs that hit attractive grades, with multi-meter interval widths, then a valuation north of $25-30 million would be possible. Having said that, it might be necessary for Sassy to spin out GGC for its value to be more fully recognized by the market.

There's more news to come from Sassy in NF. Management continues to review possible farm-ins and acquisitions of exciting properties/projects under attractive deal terms. And exploration/prospecting will be starting this spring, with the goal of identifying drill targets for 2H 2021.

The copper price soaring is great news for Sassy Resources!

Finally, with the #copper price soaring, late last week breaching $4.00/lb for the first time in nine years, readers are reminded that Sassy's flagship Foremore project has considerable copper showings that warrant further exploration. Copper is now at $4.15/lb, a 9.5 year high. I asked CEO Scott about Sassy's Cu prospects, he provided the following quote,

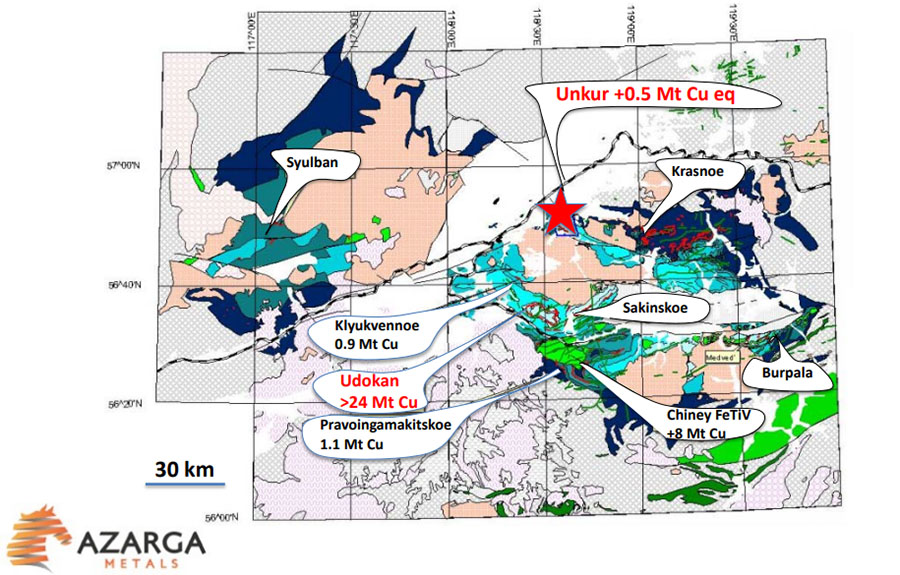

"There's significant copper potential at the Foremore project, including along the >5 km More Creek VMS Corridor, and on several potentially multi-km long lineaments in the Hanging Valley. In 2019, the Heather showing produced a grab sample containing 21.4% Cu. The province of Newfoundland and Labrador has a long history of Cu and Zn exploration and production.

We will certainly be sampling for these metals as we explore our new holdings there. Most of the properties we have optioned have some form of anomalous Cu soil / till / lake-sediment / stream-sediment / outcrop samples, together with known gold / pathfinder occurrences and favorable structural environments."

Conclusion

An investment in Sassy Resources (TSX-V: SASY) / (OTCQB: SSRYF) gives investors exposure to two potentially world-class, gold-silver projects. Both have copper kickers. Both are in safe, prolific jurisdictions. Both have high-grade potential. Both are sizable footprints (Foremore = 14,600 sq. km / Gander Gold Corp. 15,600 sq. km to start, expected to grow).

Management, led by CEO Mark Scott, is top tier, especially for a company with an EV of just C$20 million. The pullback in the gold price from >$2,060 oz. in early August 2020 to about $1,810/oz. today has caused many top-quality gold juniors to trade 40%–60% lower from their 52-week highs.

At $0.54/share, Sassy is down 56%. Freegold Ventures and Fury Gold Mines are each down 63%, producers OceanaGold Corp. and Victoria Gold are down 53% and 44%. So, Sassy is not alone in this junior market sell-off. There are likely some very attractive buy the dip opportunities this month.

Readers are encouraged to dig deeper into the Sassy Resources story, review recent press releases, and watch for upcoming news on both the NF strategy and the flagship Foremore project. With copper, zinc, silver, nickel and cobalt up between 45%–68% from a year ago, it makes no sense for Sassy shares to be down so much from a high of $1.24.

At current levels, the company's EV is just $20 million. This valuation could be a very good entry point for readers with an appetite for high risk/high potential reward investments.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Resources was an advertiser on [ER] and Peter Epstein owned shares & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sassy Resources, a company mentioned in this article.