In a Feb. 9 research report, Stifel analyst Ian Parkinson reported that Troilus Gold Corp. (TLG:TSX; CHXMF:OTCQB) is continuing to focus on ounces that count at its Troilus project and that strategy is proving effective.

Also of note, Troilus Gold stock, now trading below its peers, Parkinson noted, at about CA$1.13 per share, has threebagger potential. Stifel's $4 per share target price on the exploration firm indicates this.

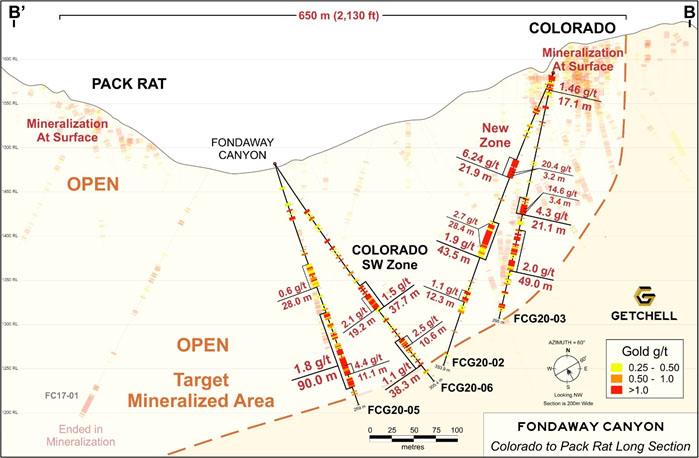

The analyst provided the highlights of the recent drill results from Troilus Gold's Southwest zone, which bode well for the Troilus project overall. At year-end 2020, the Canadian company had drilled 8,500 meters (8,500m) in Southwest and delineated a total resource there of 580,000 ounces of gold equivalent (Au eq).

New results come from hole TLG-ZSW20-203 that was placed 75m to the north of the pit shell outlined in the 2020 preliminary economic assessment (PEA). The hole's notable assays included 1.2 grams per ton gold equivalent (1.2 g/t Au eq) over 16m and 6.66 g/t Au eq over 3m.

Significantly, hole -203 extended known mineralization and also intersected mineralization 100m below the bottom of the pit.

"The drill results released today will widen the pit without increasing the strip, effectively increasing ounces per vertical meter and pushing out the underground portion of the PEA," thereby improving the overall project economics, Parkinson wrote.

Stifel has a Buy rating on Troilus Gold.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.