In a Feb. 9 research note, Noble Capital Markets analyst Mark Reichman reported that Newrange Gold Corp. (NRG:TSX.V; NRGOF:OTC) is advancing two of its projects, North Birch in Ontario and Pamlico in Nevada.

"With Newrange getting closer to understanding the potential source of gold mineralization for the Pamlico District and laying the groundwork for drilling at North Birch, we believe this year's exploration and drilling programs could accelerate the company's development and provide significant catalysts for the stock," Reichman commented.

He described the exploration work the Vancouver-based exploration firm has going at both properties and what it aims to achieve from the efforts.

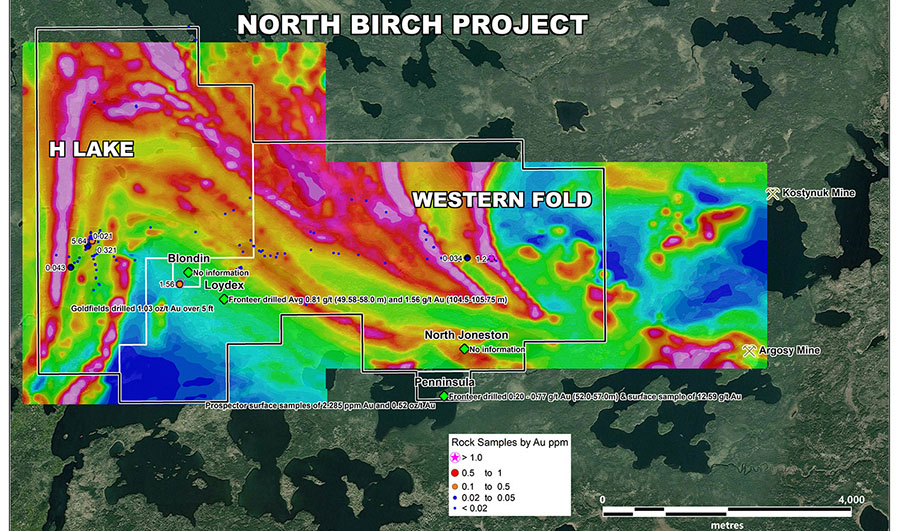

At North Birch in Canada, Newrange is preparing for an induced polarization (IP) geophysical survey to commence in about 10 to 14 days. The primary survey target is an 8 kilometer (8 km), undrilled area that is part of a folded iron formation.

That area "extends 2 km along strike into the high-grade Argosy gold mine which closed in 1952," Reichman noted. "There are multiple showings in the rocks to the south of the main target horizon."

The objective of the survey is to help Newrange delineate areas of sulphide enrichment and thereby identify targets for diamond drilling to follow. The company still needs to receive the necessary drill permits but indicated drilling could begin as early as April.

Also, Reichman relayed, Newrange exercised its option to acquire the H Lake property, 3,830 acres adjacent to the western part of North Birch. Both properties cover part of the same folded iron formation as the Western Fold property. Together, North Birch, H Lake and Western Fold span 9,514 acres and encompass the entire folded iron formation.

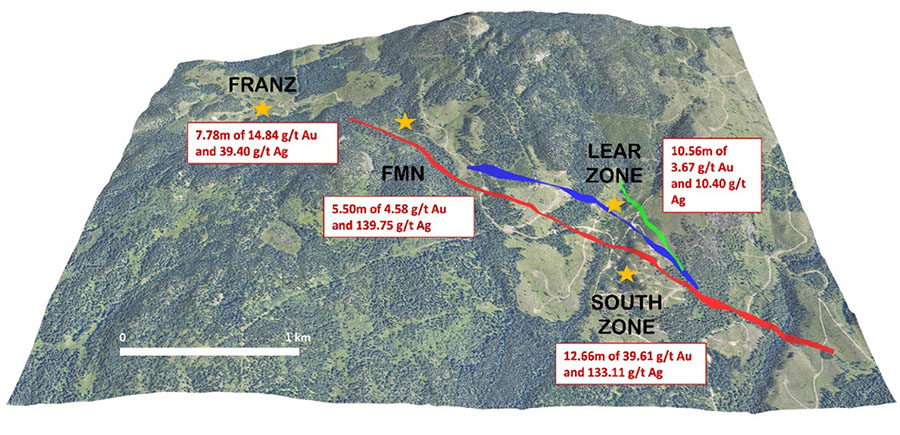

As for its Nevada project, Pamlico, Newrange is conducting an IP geophysical survey there, too, to obtain clarification of two anomalies. One is 1,000 meters wide by 1,000-plus meters long, which the company suspects was caused by a sulfide-rich skarn system. The other anomaly is located about 3.8 km to the southeast of the first and is smaller.

"The survey will help management to better interpret the geological environment and improve targeting for an upcoming diamond drilling program," Reichman wrote.

Noble Capital has an Outperform rating and a $0.20 per share target price on Newrange Gold, the stock of which is now trading at about $0.11 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: ?????. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ?????, a company mentioned in this article.