The views expressed in the following article are solely that of its author, Peter Epstein. Any commentary by Mr. Epstein about potential mining activities or resource size are his opinions alone. All $ figures are C$, unless indicated otherwise. "Au" = gold, "Ag" = silver.

Blue Lagoon Resources (CSE: BLLG) / (OTCQB: BLAGF) recently announced its fall 2020 prospecting results, and importantly, the addition of a second drill rig to its largest ever 20,000+ meter program on the 18,935-hectare, Dome Mountain Gold-Silver project, (15 known high-grade vein systems, 20 km geological strike), 50 minutes from the storied mining town of Smithers, B.C.

The company has other meaningful assets, including the 100%-owned, 7,120 hectare Pellaire (Gold) and 4,810 hectare Big Onion (porphyry copper) projects. More on those later, as Dome Mountain is the main focus.

Over $100M (in today's $) spent exploring just 10% of the Dome project…

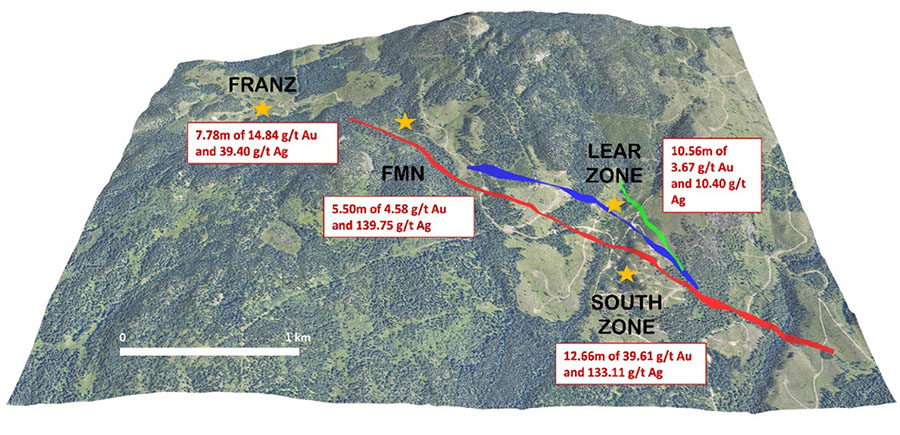

In today's dollars, over $100 million has been invested into exploration and development by serious companies including Noranda and Timmins. In 1987 Noranda outlined a resource of ~20k tonnes at 23.6 g/t gold ("Au") [not NI 43-101 compliant], at the Forks target. That's just one of 15 known vein systems on the property. Forks is ~500 meters south of the company's existing resource of ~190k Au E. oz, at a weighted average grade of ~10.1 g/t.

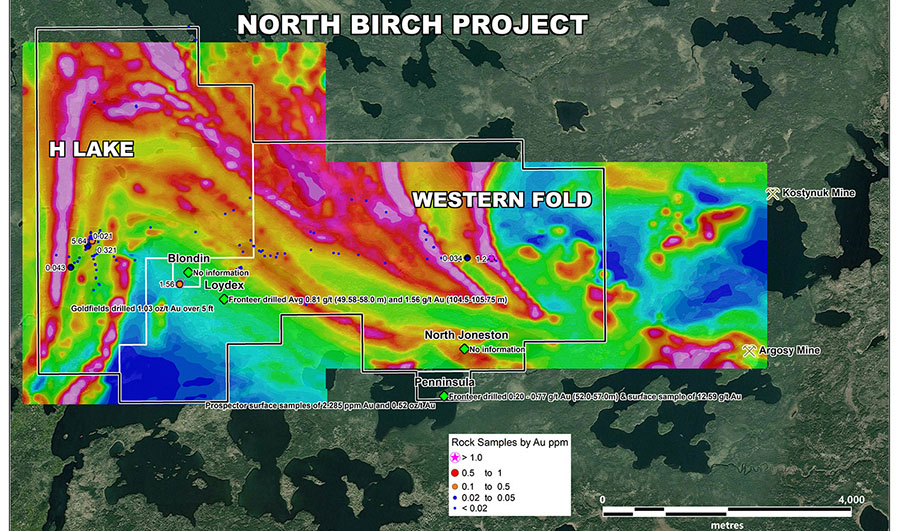

Amazingly, decades of investment was directed at chasing the Boulder Vein system across just ~10% of the recently enlarged Dome Mountain project. Recently, for the first time, a property-wide airborne geophysics program was flown.

Five very attractive targets were readily identified, but the technical team is still analyzing the data and believes there's probably a dozen or more.

Later this year, Dome Mountain could have line-of-sight to a high-grade resource approaching a million gold equivalent ounces. And, there would still be substantial blue-sky potential across the other 14 high-grade vein systems on the 18,935 ha footprint.

Consider this exclusive quote by CEO Rana Vig:

"Our approach to drilling the Dome property is two-fold. Firstly, from data we have, there's a high degree of confidence that we can grow the resource on the Boulder Vein system by more than five times by following up on 2016 drilling, and drilling a known 800-meter extension to the west. That, and expanding upon the limited drilling done at depth — which is known to be high-grade...

…Secondly, we will chase substantial blue-sky potential by drilling some of the 15 known high-grade gold-silver vein systems, especially new targets recently identified by the first ever property-wide airborne survey. Regarding our ongoing drill program — visually we can see we're hitting mineralization, but we won't get any assays back until early March."

As Mr. Vig points out, the area around the Boulder Vein system remains open at depth. Last year, hole DM-20-139 (drilled to ~600 m depth), intersected 3.1 m of 18.6 g/t Au Eq. from 335.5 to 338.6 m.

Most historical holes were half (or less) as deep. Finally, the resource was calculated with a 3.42 g/t gold cut-off grade. Lowering the cut-off (due to the higher Au/Ag prices) would increase the number of ounces.

HIGHLIGHTS OF NEW ROCK SAMPLE DATA

Booked ounces are especially valuable at Dome Mountain because management can potentially start exploiting them by year-end. Blue Lagoon holds both an Environmental Management Act Permit, and a Mining Permit that, (with routine amendments and modest capital outlay in coming months), will allow for a 75k tonne/year operation. Neither permit has an expiration date. Dome Mountain could be the very next gold-silver mining operation in B.C.

CEO Vig believes this year will be another strong one for gold and silver prices. Many analysts see gold at $2,000–$2,400/oz. and silver at $34–$42/oz. in 2021-22. Yet, even at today's price of ~$1,862/oz., Blue Lagoon is in fantastic shape—with an Enterprise Value ("EV") {market cap + debt – cash} of $36 million and >$5 million in cash.

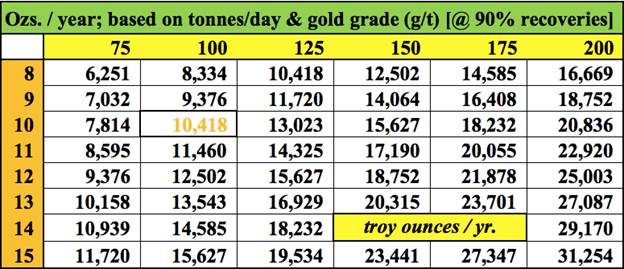

The chart below shows scenarios ranging from mining 75 to 200 tonnes/day at [Au Eq.] grades of 8 to 15 g/t. A run-rate of 9–12k oz/year could be achieved this year. By 1Q or 2Q 2022, management plans to have ramped up from 100 to 200 tpd. Depending on grade, that could mean a run-rate of 18–25k oz/year.

If achieved, millions of dollars in cash flow (after a profit split with B.C. mill owner and junior miner Nicola Mining), would fund a lot of exploration and development, while mitigating the need for private placements.

Small-scale production from Dome Mountain could start within a year!

I assumed a 90% mill recovery rate for both gold and silver. However, in 2016, 5,700 tonnes of Dome Mountain ore was processed through Nicola's Mill. The average grade was 9 g/t gold equivalent. The gold recovery was 95%, silver about 85%. Since then, Nicola has reportedly improved its silver recovery to ~88–89% for mineralization like that found at Dome Mountain.

The 9 g/t bulk sample from 2016 compares to a reported 43,900 tonnes mined at 12 g/t, in the early 1990s. The project hosts roughly four ounces of silver for each ounce of gold.

Drilling is underway at Dome Mountain (20,000+ m) and will continue into the spring. Initial results are expected in early March. The technical team likes what they're seeing, but grades cannot be estimated, we have to wait for assays.

A second drill rig has been deployed to follow-up on high-grade results in hole DM-20-114, which hit 107 g/t Au + 278 g/t Ag over 1.4 m (incl. 165.3 g/t Au + 398 g/t Ag over 0.7 m) at a depth of 69 m. That's 1.4 m of 110.8 g/t Au Eq. found at <80 m depth, one of many near-surface, bonanza-grade intercepts found over the decades.

I believe Dome Mountain alone is worth well more than Blue Lagoon's entire EV—especially if/when new discoveries are made. Dome is the type of project, (possibly large-scale, very high-grade, near-surface resource, with good regional infrastructure, in a great jurisdiction) that should attract mid-tier and major gold-silver producers.

Pellaire and Big Onion: two other meaningful and valuable projects

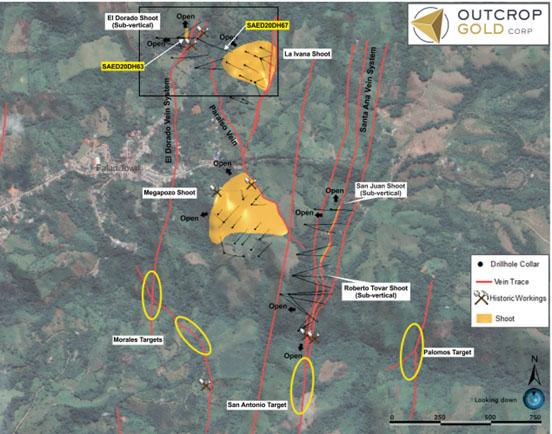

As great as the flagship Dome Mountain project is, two of the company's other assets are quite compelling as well. The 100%-owned, 7,120 hectare Pellaire Gold project is 220 km due north of Vancouver. It contains at least 10 narrow high-grade, gold-bearing vein systems that outcrop at surface at an elevation of ~2,500 meters.

The camp and mill site are below at an elevation of ~1,690 meters. The project has ~1,300 meters of narrow underground workings from five historical surface adits. None of the underground workings is currently accessible.

Importantly, there's ~24,000 tonnes of stockpiled material at Pellaire, (not waste or tailings, but ore) at an estimated grade of 5.5 g/t gold. This is a fairly straightforward, multimillion dollar cash flow opportunity (over a 5-6 month period) expected to start this summer.

For a variety of reasons, management believes there's a chance that the 5.5 g/t grade assumption is too conservative, which could add a few million dollars to the operation. Cash from toll-milling the stockpile will be directed towards exploring the property's high-grade vein systems.

According to prior studies, Pellaire's metallurgy looks quite promising. For instance, a report by Ash Associates, in Oct. 1995 asserted,

"At the time of deposition, the mineralization of the Pellaire veins included significant sulfides and tellurides…. in this particular case — the sulfides and tellurides have been almost entirely leached out…. The absence of sulfides is an advantage, since high gold recoveries and low reagent usage tend to result from situations like this…."

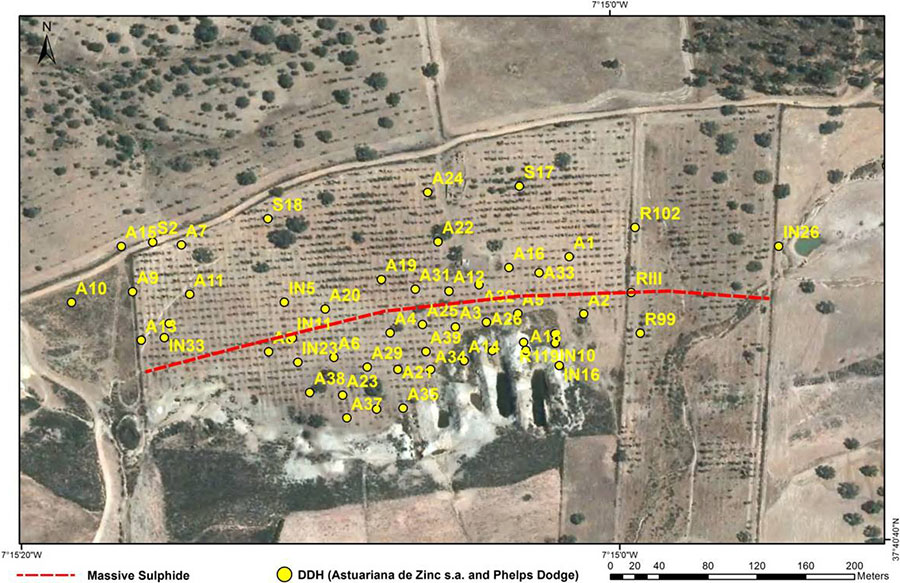

The 4,810 hectare Big Onion project has had 313 holes / 45,477 m drilled into it and has a historical (non NI 43-101 compliant) resource of >700M lb of copper (combined, Indicated + Inferred) at a grade of about 0.30% (+ some molybdenum). There are two large targets ready to drill.

Management believes there's tremendous blue-sky potential to greatly expand the dimensions of the deposit, possibly up to 1 billion tonnes in this copper porphyry target. The historical resource is ~90M tonnes.

If the deposit is found to be much larger, (subject to more drilling) a higher cut-off grade could be used to demonstrate a fairly high grade (by porphyry-style standards) and fairly large (multi-billion pound) copper system.

Big Onion is very close to Dome Mountain. Management is working on many aspects of the two properties at the same time, saving time and money. As a promising copper porphyry target, Big Onion could attract companies that might not otherwise be interested in Blue Lagoon's gold-silver heavy assets.

Copper offers excellent diversification from the company's gold-silver focus. Copper is the best green energy / high-tech / battery metal, the only metal that benefits from growth in 1) renewable energy, 2) city-scale infrastructure builds and grid deployments, and 3) the EV revolution. Simply put, copper is absolutely crucial to global efforts to decarbonize the planet.

Conclusion

With Blue Lagoon, investors get three bites at the junior mining apple. This is a company with a strong management / technical team, and over $5 million in cash. Its flagship project Dome Mountain could have line-of-sight to 1 million high-grade gold equivalent ounces before too long. In my opinion, this alone in B.C., Canada, would be worth perhaps twice the company's current Enterprise Value.

If there is a million ounces, as management envisions, that would mean the team's understanding of structure and geology is sound, and that the project has good continuity—which could lead to a multi-million ounce, high-grade gold-silver deposit in 2022. Remember, it would cost over $100 million and take several years to replicate what has been done.

Both Pellaire and Big Onion are strong enough projects to be spun out into new entities. In my opinion, each could support market caps in the ten(s) of millions. Combined, Dome Mountain, Pellaire and Big Onion are worth A LOT more than Blue Lagoon Resources' (CSE: BLLG) / (OTCQB: BLAGF) current valuation.

Blue Lagoon shares traded as high as $2.11 in early 2020, BEFORE management acquired Dome Mountain, and before a major move higher in gold and silver prices! There's tremendous upside potential if management can execute on its plans this year.

{please watch short video clip on the Dome Mountain project}

The Company will evaluate a production decision once all permit requirements are in place. Any production decision in advance of obtaining a Feasibility Study, including mineral reserves demonstrating economic and technical viability of the project, is associated with increased uncertainty and risk of failure.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research[ER], (together, [ER]) about Blue Lagoon Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Blue Lagoon Resources was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.