As Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) was sidelined for most of last year due to COVID-19, its exploration programs were basically halted. The project that first got underway again was the Tierra Dorada Gold project in Paraguay. The story on this project is a testament to the strong network of Golden Arrow in Latin America. When CEO Joe Grosso talked to officials in Paraguay somewhere in 2019, they told him to take a look at some of their projects, and talk to local geologists. So he did, and these geologists identified numerous projects, ready for staking. In the end, two claim blocks totaling 64k hectares were staked.

Some of the projects weren't standard, as they consisted of mineralized outcrops on farmland, with cattle grazing on it. According to VP Exploration Brian McEwen, this resulted in fencing their trenches and drill locations, as otherwise the cows might fall into holes that needed to be excavated around outcrops for example.

Commencing in August 2020, the company has completed a shallow diamond drill program and its first induced polarization (IP) geophysical program at this project in December 2020, at a priority target zone called Alvaro.

All properties are road accessible, and with good infrastructure, including power to the projects. The company started working on Alvaro in 2019, and completed extensive sampling and trenching, returning positive results, up to 143 g/t.

San Miguel has seen earlier exploration by among others Yamana, and returned the following highlights from historical drilling: 6.1m @ 1.12 g/t Au from 12m, 3.05m @ 2.87 g/t Au from 20m, 4.57m @ 1.72 g/t Au from 9m, and 3.05m @ 1.35g/t Au from 27.5m. Itayuru and Cerro Pero have seen sampling results up to 7g/t Au.

Golden Arrow Resources was able to start drilling and complete an IP and resistivity survey at Alvaro relatively quickly, as it had the exploration permit in hand, and brought all IP equipment over there from Argentina. The conditions to do so were very strict according to McEwen, only shallow holes were allowed as the company was granted a prospective permit first that meant the maximum depth of drill holes could only be 20 meters.

This came in handy, as extensive soil and vegetation would have made prospecting and trenching more difficult, as it has done before in the recent past (2019). To be more specific, the current prospecting permit in the Alvaro area allows drill holes up to 20 meters in depth. The goal of this first program was to follow and characterize the high-grade mineralized quartz vein structures right below the surface and confirm potential continuity of mineralization in these veins.

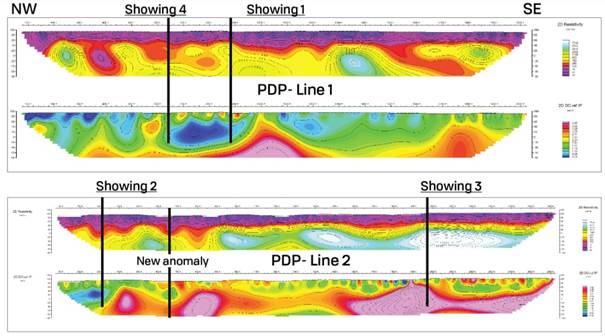

The geophysical surveys were designed to detect and delineate veins, hydrothermal alteration, faults and lithologic contacts below the 2 to 6 meters of soil and saprolite cover. As can be seen in the maps above and below, the chargeable highs and magnetic lows have a district scale profile.

The drill program tested four IP survey showings, with 41 drill holes totaling 550 meters. Half the holes returned intercepts greater than 0.5 g/t Au, which is very good for hit ratio. The average core recovery for the entire program was 74%, which is pretty low. According to McEwen, this was caused by the rock being extremely weathered. Highlights of this program were DHTD18 returning 0.5m @143.5g/t Au from 3m, and DHTD35 returning 3.16m @11.8g/t Au from 1.7m.

These shallow holes just scratched the surface of the IP chargeable trends, trends which continue below the 140-meter depth of the survey.

The company is now planning a second, more detailed, drilling program to both test the new geophysical anomalies and to step-out holes around the best intercepts reported in this news release. A minimum of 2,000 meters of drilling is expected to be started by the end of the first quarter of 2021. The company has applied for a full exploration permit to allow deeper drilling. If those permits are in place, holes will have a planned depth of approximately 100 meters. If the permit is delayed for any reason, the company will likely continue with drill shallow holes up to 20 meters.

As Paraguay virtually is unknown for exploration in the mining industry, I asked McEwen why not much exploration took place in this country. According to him it is likely a result of government policy that didn't support mining, lack of exposure of the geology and investors in the past. But things have changed over there, and Golden Arrow Resources has met with minimum resistance, and more cooperation.

Besides Paraguay, Golden Arrow Resources has projects in Chile and Argentina, and it is looking to JV projects in its portfolio, mostly in the high Andes. These projects are at high altitude, which means slow progress, because of limited field seasons. These projects are typically costly and therefore management aims at the support of large companies. Brian McEwen is talking to major companies and getting a lot of interest, as the projects have strategic locations.

With regards to Chile, Golden Arrow's Rosales Copper project is situated in the Atacama Region, in a prolific mining region that, besides some of the largest and richest lithium brine deposits globally, also hosts multiple large precious and base metal mines. Large mineral deposit types in the area include iron-oxide copper gold (Candalaria, Mantos Verde), porphyry copper-gold (Inca del Oro), epithermal gold-silver (El Peñon, Guanaco) and Maricunga gold deposits (Cerro Casale-Caspiche, Refugio, Marte, Maricunga).

Based on solid sampling results (up to 5% Cu), the company applied for all of the surrounding concessions that are available. Golden Arrow has just commenced a phase 1 exploration program that includes detailed mapping, sampling and trenching, as well as ground magnetics and IP/resistivity geophysical surveys. For now, mapping and sampling is underway, and the environmental work for the full exploration permit for trenching and drilling has been submitted. McEwen assumes the permit could probably be granted in February, and trenching and geophysics will probably start very soon after this.

Drilling will likely start at the beginning of Q2. According to McEwen, there could be porphyries at depth, but for now they are looking at near surface stockwork concepts, as there are 50–60 meter thick bands of high-grade mineralization, with oxidized copper. They are targeting a minimum of 50 Mt @1%Cu for now, and they are already talking to groups that do processing, which seems to be a household concept in Chile.

The current exploration budget for Rosales is C$150k, and a drilling budget hasn't been defined yet. Such a first drill program would be RC, according to McEwen, and likely a small program. The drilling costs are reasonable, as they are estimated at C$200/m for diamond drilling.

With regards to the projects in Argentina, Golden Arrow's Flecha de Oro project is currently the most important one in Argentina, and the company has two other prospective properties in Rio Negro. As a reminder, the following numbers from Flecha de Oro came from trenching so far:

- 24.0 g/t Au over 2m

- 18.0 g/t Au over 0.7m including visible gold

- 13.09 g/t Au over 5m

- 99 g/t Ag and 2.8% Cu over 0.2m

- 129 g/t Ag, 3.5% Cu and 0.2% Bi over 1.2m

The current ongoing exploration program commenced on December 7, 2020, and is focusing on the Puzzle property, where gold mineralization has been identified in a large quartz vein and adjacent quartz stockwork zone within a corridor over 6.5 kilometers in length and more than 150 meters in width. The trenching program is planned to include approximately 18 trenches totaling 2,500 meters, excavated across the vein corridor along 6.2 kilometers of strike length, to delineate targets for a potential 2021 drilling program. Drilling permits have been applied for; according to McEwen this could take 1–2 months to be granted, hopefully not longer, he said. Golden Arrow Resources has completed a ground magnetic survey on its priority Puzzle target, and the planned trenches are indicated on the map below:

The program will likely last until the end of January, and results are expected in February. The plan will then be to move this crew to the La Esperanza target and continue the trenching program there.

With three exploration projects ongoing in three different countries, a lot of news flow can be expected from Golden Arrow Resources. Having a pile of cash in the treasury, the company should be able to complete a lot of drilling, and hopefully they will find something substantial.

The company still has 675k shares of SSR Mining (SSRM.TO); this equity being worth C$14.72 million at the moment (Jan 26, 2020, share price C$21.81), after having sold 570k shares of the original 1,245,580 shares received from SSR Mining as part compensation for the sale of the 25% interest in the Puna operation. Golden Arrow has about C$12 million in cash at the moment, and is fully funded for its 2021 and 2022 exploration programs. Keep in mind the current market cap is C$20.77 million, which is less than the SSR shares and cash (C$26.72 million), and assigning no value to the various projects.

Golden Arrow has been sideranging since the summer of 2020, but recovered from the March 2020 COVID-19 crash, as can be seen here:

Share price GRG.V; 1 year time frame (Source tmxmoney.com)

There are two distinct reasons for this: precious metals prices went up considerably during the summer of last year, and the 10% buy-back program that was initiated in March 2020 probably did its share as well. According to management, the buy-back program has been completed in Q3, and with a new logo and three different exploration programs ongoing, Golden Arrow Resources seems ready to add another successful exploration chapter for the Grosso Group.

Conclusion

It has been all about COVID-19 in 2020, and Golden Arrow Resources is relieved to see the imposed restrictions loosening up in Latin America. Its exploration programs were ramped up again as soon as the regulators allowed it at the end of last year, and fortunately its program in Paraguay could start even earlier, producing nice results with near surface diamond drilling. As management was happy with the outcome, they decided to plan a drill program that goes to a depth of about 100 meters, and submitted the necessary paperwork for the drill permits. These are expected in February/March, and drilling will commence shortly afterwards. The same situation goes for the Puzzle target on its Flecha de Oro gold project in Argentina and on its Rosales copper project in Chile. With the significant treasury, there is no need to go to the markets anytime soon. For a junior that is trading at 78% of its cash value, it seems investors have an interesting opportunity to invest in a pretty derisked, undervalued and experienced explorer with three chances for success.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.