- Copper is on a bullish tear: More upside in 2021 in all metals

- China is a massive buyer: A reason the U.S. is next

- Nevada Copper: A strong management team with solid financing

- Proven and probable reserves in the U.S. with the potential for more

- An emerging producer: Risk-reward and the value proposition favors lots of upside

Finding value in the stock market is a challenge these days. At the end of 2019, Tesla Inc. (TSLA:NASDAQ) shares were trading at a split-adjust level of below $90 per share. On Dec. 18, they were at $695. Returns like that are hard to come by; they require taking a fair amount of risk. Elon Musk had more than his share of detractors in late 2019. In 2020, they became very quiet.

As we move into 2021, we are hopeful the global pandemic will fade into our rearview mirror. Vaccines that create herd immunity to the virus are already becoming available. However, the economic legacy of a tidal wave of liquidity and tsunami of stimulus will remain a reminder of the costly coronavirus.

The 2008 global financial crisis was a far different event than the 2020 pandemic. However, central banks and governments employed the same financial tools. The only difference was in 2020 the levels were much higher. In 2008, the U.S. Treasury borrowed a record $530 billion to fund the stimulus. In May 2020, the Treasury borrowed $3 trillion. The inflationary liquidity and stimulus ignited a secular rally in the raw materials asset class.

From 2008 through 2011, copper's price exploded from $1.2475 to $4.6495 per pound. The price rose by over 3.7 times. In March 2020, the price of copper dropped to a low of $2.0595. If history repeats, the target for the red metal could be much higher than the 2011 record peak. Nevada Copper Corp. (NCU:TSX; NEVDF:OTC) is an emerging mid-tier copper producer that could provide incredible returns in a rising copper market.

Copper is on a bullish tear: More upside in 2021 in all metals

In 1988, the copper price rose to a record high of $1.6085 per pound in the futures market. It was not until 2005 that the red metal made a higher high.

Source: CQG

The long-term quarterly chart highlights the ascent of copper. The nonferrous metal has made higher lows since 2001. Technically, copper looks poised to reach a new all-time peak over the coming years. Price momentum and relative strength indicators point to a bullish trend as we move into 2021. After moving to a higher low in March, copper has posted gains over the past three consecutive quarters and has broken out to the upside.

Source: CQG

The monthly chart illustrates price gains in nine of the past ten months. The next level of technical resistance stands at the 2012 peak, at just below $4 per pound, a gateway to the record high at $4.6495 from 2011. Central bank and government monetary and fiscal policies are rocket fuel for the red metal and many other commodities, as they weigh on fiat currencies' purchasing power.

The London Metals Exchange (LME) is the leading trading venue for copper and other base metals.

Source: LME/Kitco

The chart shows that copper inventories on the LME are closer to the lows than the highs over the past five years. At below 106,000 tons as of Jan. 6, the low level of stockpiles is an indication that the fundamental equation is tight and favors the upside for the red metal.

China is a massive buyer: A reason the U.S. is next

China is the demand side of the equation for copper and many other commodities. With 1.4 billion people and the world's second-leading economy, the Chinese require massive copper inflows for infrastructure building each year.

The global pandemic has caused the U.S. economy to falter. The high level of unemployment is a substantial challenge for the incoming Biden administration. Meanwhile, there is bipartisan support for an infrastructure rebuilding program that would make jobs available and repair the crumbling roads, bridges, tunnels, airports, government buildings, schools and other infrastructure parts over the coming years. An infrastructure package would increase U.S. demand for copper and other construction materials.

Meanwhile, we are likely to see demand for copper increase at a time when the expanding money supply is already pushing the price higher, creating an almost perfect bullish storm for the base metal.

Nevada Copper: A strong management team with solid financing

In the mining business, experienced management is critical for success. Glencore International Plc (GLEN:LSE) is one of the leading commodity producers and trading companies in the world. Nevada Copper's CEO, Mike Ciricillo, was the former head of global copper assets at Glencore. Pala Investments is a company dedicated to value creation in the mining sector. Nevada Copper's chairman, Stephen Gill, is a managing partner at Pala. Tom Albanese, the company's leading independent director, is the former CEO of Vedanta Resources Plc (VED:LSE), one of the world's leading diversified natural resource companies, with operations in India, South Africa, Namibia and Australia. The company is a producer of oil, gas, zinc, lead, silver, copper, iron ore, steel and aluminum. He was also Rio Tinto Plc's (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) CEO. Rio Tinto is a global leader in raw materials production with a market cap of over$95 billion.

Nevada Copper has an all-star team at its helm. The company can finance through a senior debt facility at a low rate of interest backed by the German government. Management has arranged for off-take agreements for its copper concentrates.

Proven and probable reserves in the U.S., with the potential for more

Nevada Copper owns mining properties and rights in the U.S, in a region ranked in the top three in mining jurisdictions by the Fraser Institute in 2019. The Canadian Institute is a think tank that researches natural resources and other areas that impact Canadians' quality of life.

The company has mineral resources of six and one-half billion pounds of copper, including underground and open pit measured and indicated resources.

The desert climate and local typography in Nevada are optimal for efficient and eco-friendly mining. The company uses a dry-stack method for tailings, which achieves a high percentage of recycled water and no tailings dam requirement.

Nevada Copper has strong support from the local community and all levels of Nevada's state government for its projects and is fully permitted. It is the first producer in the area since 1978 with a large copper inventory in the earth's crust. And, Nevada Copper has the only processing permit in the district.

Meanwhile, the underground mine is currently in production, with commercial output targeted mid-year of 2021. The company has a net present value of $421 million in post-tax revenues at $3.50 per pound, which does not include the pre-production open pit project. The copper price is already above that level. With over 13 years of remaining mine life, the project has another 680 million pounds of inferred resource available.

The next phase of projected output will come from the open pit, fully permitted for production with five billion pounds of copper, measured and indicated. The net present value of this reserve is approximately $1.2 billion, post-tax at $3.50 per pound.

Additionally, Nevada Copper is exploring for metals on over 16,000 acres in the region. The company's current market cap of $150 million makes for a compelling value proposition.

On Jan. 6, the company announced a steady increase in performance from its Pumpkin Hollow underground project. The CEO, Mike Ciricillo, commented: "The team continues to improve the performance both at the mine and processing plant, evidenced by the operational metrics for December. Most importantly, they have done it safely. In addition, the commissioning of the main hoist system is progressing well, with the shaft reaching its full production speed further enabling the ramp-up to our goal of 5,000 tpd of hoisted material. We are well on our way to show the potential of the Pumpkin Hollow Underground Project."

The company also announced it closed the previous announcement amendment to its existing senior credit facility on Dec. 30, 2020. The amendment included a $15 million increase in the loan amount and a deferral of $26 million of planned debt service until 2023. Nevada Copper drew down the fill $15 million on Dec. 30, 2020. The full details of the latest new can be accessed via this link.

An emerging producer: Risk-reward and the value proposition favors lots of upside

Emerging producers carry lots of risk in the world of commodities. However, the reward is always a function of risk in all markets. An experienced management team with a top-notch pedigree, production permits in a copper-rich area in Nevada, in the politically stable United States, and the prospects for a rising copper price make Nevada Copper a company to put on your investment radar.

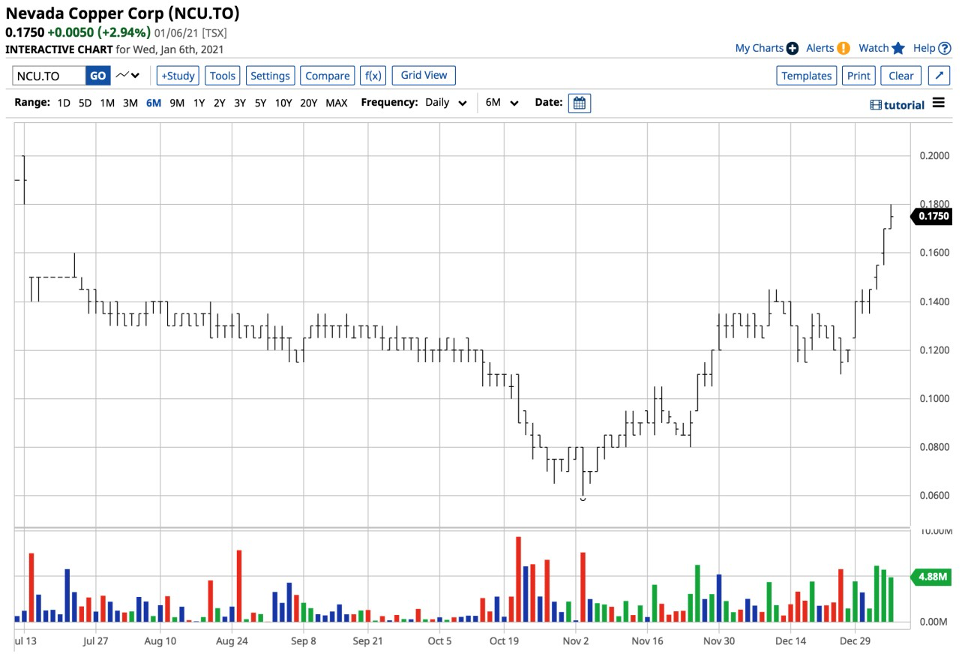

Source: Barchart

Since November 2, the stock has traded from a low of $0.05 to a high of $0.133 per share on Jan. 6. NEVDF, the U.S. OTC shares, has a market cap of $192.14 million and trades an average of over one million shares each day. At $0.133 on Jan.6, NEVDF is a company that could offer incredible growth over the coming years. A rising copper price in a world where demand is increasing will support more production.

There is always lots of risk in stocks that trade for pennies. However, NEVDF/NCU.TO is a company that could be trading for dollars as the prospects for the red metal look bright.

It is always challenging to identify companies that can experience explosive growth. A reward is always a function of risk. Nevada Copper could be one of those diamonds in the rough in the mining business for 2021 and beyond.

Andrew Hecht is a commodities trader and analyst with over forty years of experience. He began his career at Philipp Brothers, the world's leading merchant physical commodities trading company, in the 1970s through the 1990s. He spent two decades with Philipp Brothers working in the commodities division, Salomon Brothers division, and at Phibro Energy. Hecht ran trading, sales, and marketing in a wide range of commodity products. He subsequently worked with banks, hedge funds, and institutions trading commodities and managing risk. The business took him around the globe to assist producers and consumers. Hecht has taught at the university level and writes prolifically on commodities for many portals. He has been one of the top-rated and followed contributors at Seeking Alpha over the past years. He is a partner at Bubba Trading and continues to analyze markets, teaching traders and investors via his newsletters, articles and seminars.

[NLINSERT]Disclosure:

1) Andrew Hecht: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Nevada Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Nevada Copper. Nevada Copper is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.