Magna Gold Corp. (MGR:TSX.V; MGLQF:OTCQB) is a relatively new company—it only began trading on the TSX Venture exchange in June 2019—but has quickly moved to optimize and restart operations at the San Francisco Gold Mine in Sonora, Mexico, that it acquired in May 2020, and it has been acquiring additional projects.

Magna Gold's CEO Arturo Bonillas is no stranger to the company's flagship San Francisco Mine. He co-founded Timmins Gold Corp., which acquired the project in 2005 from Geomaque, then drilled it, produced a feasibility study, built the processing facility—which originally had a 10,000 tonne per day (tpd) capacity that was expanded to 20,000 tpd—and operated the mine.

Bonillas left Timmins Gold in 2017, and the San Francisco Mine ran into operational challenges. "We have the same team we had back in Timmins days who were responsible for the mine's initial success," Bonillas told Streetwise Reports. "This is a very particular ore body. It doesn't have a meaty metallurgy. However, we have resolved the issues and the mine is very profitable, reaching heap-leach recoveries of over 70%, which is not common. The most important thing is the human capital, people are back being creative."

"Our primary strength is in our team of highly experienced mining professionals. We have a proven track record of developing properties in Mexico from discovery to production on budget and on time," Bonillas added.

The San Francisco Mine has a Measured and Indicated resource of 1.43 million ounces of gold, and plans further exploration on the 41,000 hectare property. The company expects to complete 30,000 meters of drilling by March 2021 and has stated that it aims to increase the mineral reserves by at least 200,000 ounces of gold with that drilling.

"Magna's goal is to unlock the inherent value of San Francisco through an aggressive yet disciplined program of drilling and mine optimization that will establish a mine generating cash flow that can be re-invested into the property to support future growth," the company stated. From May 6 through October 31, 2020, Magna has sold 14,810 ounces of gold from the San Francisco Mine, generating revenues of US$27 million.

Magna has also begun underground production at San Francisco.

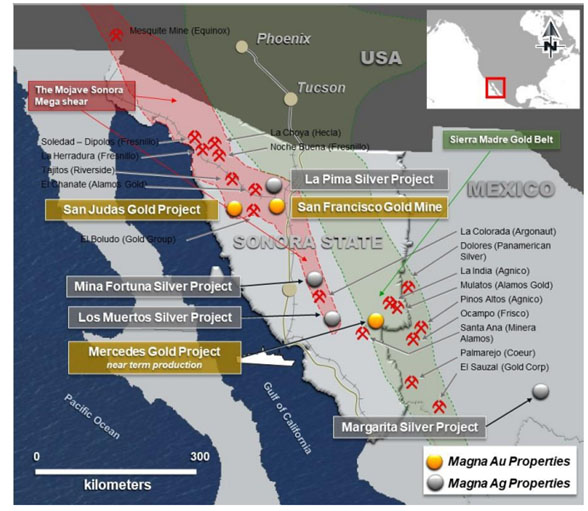

The company has been exploring its other projects and just released results from its nine-hole, 1,719-meter, phase 1 drill program at La Pima silver project, also located in Sonora, just 24 km from the San Francisco Mine. "La Pima is an early-stage silver target with an excellent surface target of historical mine workings and outcrops," the company stated. Drilling homed in on areas that geophysical surveys found promising.

Drill highlights include 302.73 g/t silver equivalent over 1.30 meters and 246.40 g/t silver equivalent over 1.45 meters.

"Magna is encouraged by these drill results and a second round of drilling is currently being planned to commence the first quarter of 2021," Bonillas said. The company intends to drill 2,000 meters in a follow-up program designed "to test additional areas of alteration and to test the assays received at depth."

In addition, the company is continuing to explore the Mercedes project located in Sierra Madre Occidental province. Drilling at the end of 2019 confirmed near-surface gold and silver mineralization along 300 meters of La Lamosa Ridge. "We are designing a small operation there, and we are finalizing a PEA [preliminary economic assessment] study to make a production decision there next year," Bonillas said.

Another project, San Judas, is an early-stage exploration property in Sonora. Samples on the property have returned assays ranging from 0.5 g/t gold to 26.0 g/t, "outlining a broad area—5 km by 2 km—of structurally controlled gold mineralization. We have the potential here another San Francisco Mine type of deposit," Bonillas noted.

In November, Magna acquired the Margarita silver project in the state of Chihuahua. "The property features 7 km of outcropping veins, but only one vein has been drilled," Bonillas noted. Channel sampling has returned assays from 100 g/t silver to 900 g/t silver. "We plan to initiate drilling shortly and put out a maiden resource estimate on the project," Bonillas explained, "and then produce a preliminary economic assessment and prefeasibility study."

With both gold and silver properties, the company is developing its strategy and has stated that it may consider forming a standalone silver company.

Magna Gold has 89.4 million shares outstanding, 94.96 million fully diluted. Insiders own 8% and institutional ownership constitutes 45%. Major shareholders include Eric Sprott, U.S. Global Funds, Delbrook Capital, Medalist Capital and Adrian Day Asset Management.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Magna Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Magna Gold, a company mentioned in this article.