As this is being penned, I am seated in my den just after 7 a.m. looking out into the pitch darkness of an early December morn and the only light is a reflection off the cool waters of the lovely swamp Lake Scugog emanating from the bustling metropolis known as Port Perry. I can hear the distant rumbling of cars and trucks all along the causeway on their way to destinations that have surely changed from what and where they were one year ago.

With warranted affection, it gives me great hope in watching my fellow small-town citizens carrying on with pre-Christmas traditions, decorating the eaves with festive lights and animated front-lawn symbols that go back centuries. The will to survive and spit in the eye of the current public health crisis (which is rapidly morphing into a civil obedience crisis) gives me time to reflect upon the events of the past year. In case you haven't noticed, in the blink of an eye, 2020 will soon be gone, and to this I say, "Good riddance!"

Furthering that sentiment, I normally take the first week of December to conduct a self-audit of the year in review, largely because by this time there is not a great deal one can do to enhance one's portfolio performance. You have either had a good year or you have had a bad year, and with markets winding down into mid-month, volumes and volatility are going to be significantly reduced and trading opportunities disappearing up the proverbial chimney.

This year I am faced with a dichotomy of emotion caused by the two opposing human emotions of pride and guilt. On the one hand, I see fear and suffering everywhere around me and it bothers me, not because of the impact of the virus but more by the cacophony of messages being delivered to the masses by the fear-mongering media and vote-searching political masters. On the other hand, I see financial media and their money-managing conspirators popping corks and taking victory laps as the Dow Jones moves through 30,000, with its morbid intent being to convince everyone that "this too shall pass," and that "the stock market is sending us a positive message."

Sadly, as a former member of the financial industry and as a person that makes his living in the financial arena, I should be happy looking at the P&L (profit and loss statement) of my portfolio performance in 2020. It has been the best year that I have had since 2010, having ridden the precious metals for most of that decade. Alas and instead, the pride one deserves for a job well done is replaced with the pall of guilt, because being a gold and silver advocate and being rewarded for years of patience is in some way a disparaging comment on the current plight of the average citizen. There is not a day that goes by where someone or something in the mainstream media doesn't lob a ten-pound cannonball across the bow of the HMS Gold and Silver, suggesting either Bitcoin or Tesla as having been "a better place to be."

Needless to say, on Aug 6 of this year, the gold and silver legionnaires were all taking well-earned victory laps, as gold and silver were absolutely crushing it, outperforming the blue chips and the tech sector by a wide margin. In fact, of particular annoyance and, in fact, dire concern to the Wall Street mavens was that the blazing performance of the gold and silver stocks were converting tech buyers into gold and silver buyers, and since Wall Street can't charge fees when a gold or silver buyer makes a purchase, that cash disappears from the banking system forever. That, my friends, is where the most nefarious mission of 2020 was carried out with such skill and aplomb that books will certainly be written about it. I call it "Mission Recapture."

The chart from the beginning of 2020 until Aug. 6 is a gold bug's most erotic dream. It has the precious metals perched deservedly on the magnificent throne of "top performers," impishly thumbing their noses at those "stupid stockroaches" and "Bitcoin buffoons." Then, some time after it was revealed that infamous gold-hater Warren Buffett had bought US$500 million worth of Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), the bow-taking, nose-rubbing gold bugs found themselves under a sudden and very stealthy siege.

While most of us have been calling the period from Aug. 6 to Nov. 30 a "correction," I would add a word to that and rather refer to it as an "orchestrated correction," and one fully financed by the U.S. Treasury through its "Working Group on Capital Markets."

With global growth in full retreat and the CAPE (cyclically adjusted price/earnings) ratio higher than any other time in history, the Wall Street intelligentsia used taxpayer credit lines to goose the NASDAQ to nosebleed levels and a move the S&P within 4% of gold. With some nineteen trading sessions left in calendar 2020, the banco-politico cartel should be lighting up those Cohibas in full celebration of a "job well done" and the sign "Mission Accomplished" should be hanging off every Wall Street lamppost. The execution of "Mission Recapture" has been one for the ages; its blatancy matched only by its boldness; its criminality matched only by its deceit.

With 2020 on its last decrepit legs, it will surely be marked in history as the year in which the U.S. Fed and the U.S. Treasury merged into one entity, neither one independent, both serial counterfeiters. No longer is there any need for the Fed chairperson to pronounce any intention of resisting political pressure from either a sitting president or any member of the legislative bodies. The Year of Our Lord 2020 was the year that a third mandate was added, giving further substance to the reason that the Creature from Jekyll Island came into being.

On top of "maximum full employment" and "price stability," the third mandate is now "stock market uptrend integrity." I hear that a fourth mandate is under review and falls under the category of "bubble maintenance," because while they have been doing it since the 1987 Crash, it has never been made official.

I have been cautious on the senior and junior gold miners for most of the second half of 2020 and only turned bullish last weekend, as November was grinding to a close, marking the worst monthly performance for gold since 2017. However, I elected to move to an "overweight" position in that tiny jurisdiction within the precious metals equity realm characterized as "developer/explorer."

There are a number of reasons for making this move but my primary incentive was safety. But wait a minute, you say, as you list the following reasons that they are not safe, such as illiquidity, volatility, small (or no) resource base (ounces), no production, and no discovery (yet).

I would counter back that it is for those reasons that the large professional investors, which includes the hedge and mutual funds, avoided these names back in the summer when they were blindly inhaling anything that had in its name either "gold" or "silver." The Eldorados (ELD:TSX; EGO:NYSE) and Yamanas (YRI:TSX; AUY:NYSE; YAU:LSE) were bid up into the clouds by confused and desperate money mavens that were freaked out by the pandemic, but more by the monetary and fiscal insanity vaguely meant to represent "relief," when all it really turned out to be was yet another Wall Street taxpayer gift.

These huge investment pools, for the first time ever, found themselves long a bunch of brand-new but relatively miniscule (compared to technology or the FANGS) companies, but instead of outperforming their peers with these money-printing hedges, they looked at their performances at the end of September and found that all those NASDAQ stocks they sold in the summer were screaming higher (thank you, Jerome Powell) while the precious metals positions (that we supposed to be no-brainers) were suddenly down 20%.

So, since these leviathan loot lifters were never shown the Getchell Golds (GTCH:CSE) or Norseman Silvers (NOC:TSX.V) of the world, when November turned into a precious metals rout, the senior and junior gold stocks got smoked in varying degrees of regurgitant revenge. Overboard they went, looks of anger and disgust permeating boardrooms around Wall and Bay Streets.

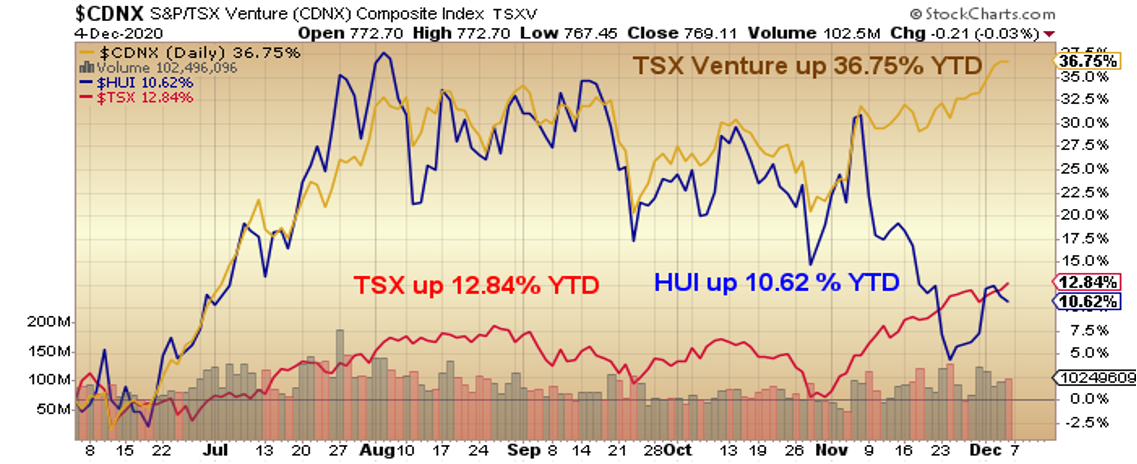

Happily, or more appropriately, less sadly, the junior developers and explorers dominate the TSX Venture Exchange, and while the TSX.V has more technology and cryptocurrency issues than twenty years ago, the index is strongly correlated to commodities, with the two major ones being gold and silver. This next chart proves my point, and rationalizes how owning the quality developer/explorers was actually a move to safety as opposed to increasing risk. The TSX Venture Exchange outperformed the HUI by a threefold margin and the TSX by 2.5 times (which is huge if you are a money manager).

I designed the GGMA 2020 Portfolio in late 2019, long before the pandemic arrived, and the two core positions were Getchell Gold Corp. and Aftermath Silver Ltd. (AAG:TSX.V). Other names include Norseman Silver Ltd. (up 500% year to date [YTD]), Megastar Development Corp. (MDV:TSX.V; MSTXF:OTC; M5QN:FSE) (up 107% YTD) and Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB) (unchanged YTD). (To be fully transparent, I do have one clanger uranium stock, down 37%, as well.) Call it "luck" or call it "tactical brilliance," but however one cuts it, hiding out in the micro-cap developer/explorer names has worked well in the second half of 2020.

But what has me excited is that the really fun part of the precious metals cycle is just about to begin.

Every secular bull market in gold and silver has in its DNA multiple corrections along the way to Mania Land. 2020 saw the distant shorelines of Mania Land in the summer, when the generalist fund managers came pouring over the walls and into the precious metals. It wasn't pretty in July, when the DSI soared north of 90, but as frothy as some people thought it got, it was modest compared to the 2002–2011 bull. But it was absolutely nothing—a minor, almost imperceptible blip on the mania radar screen—compared to the late 1970s, which saw astronomical rates of return and equal measure of madness and greed. In fact, it was the precious metals bull from the Jimmy Carter years that served as the embryonic gestation period for the term "Never confuse bull markets with brains!"

The next chart is a perfect graphic for demonstrating how the developer/explorers have performed.

You know, sometimes I find myself caught in a nostalgia trap and find it nearly impossible to conceal the excitement that was forged into my subconscious mind over forty years ago. I also constantly imagine all of the sniggering millennials and Gen Xers rolling their eyes at that "old guy tellin' war stories from a hundred years ago." When Nixon abandoned the gold standard in 1971, he put an immediate stop to the practice of foreign treasuries (like France) taking gold in place of dollars every time a T-bond reached its maturity date. What followed was a nine-year bull market but one with a major correction right in the middle. A move from $35 to over $850 per ounce in the decade left an indelible impression on my investment psyche, so when you hear someone compare this period of time to the "Stagflation Seventies," you better find out whether they were in the capital markets back then. The year 2020 has similarities to the 1971 event, but in terms of magnitude, there is zero comparison. The money printed from late 2019 (Fed REPO actions/COVID relief) until now has been many orders of magnitude—as in twenty geometric progressions—greater than at any other time in history. You can take the costs of WWI and WWII, and add the two Gulf Wars, and it is still a drop in the bucket when you consider that the greatest helicopter drop is just ahead of us in 2021.

This serial debasement of the U.S. greenback has left little doubt as to its reserve currency status looking beyond next year. The Zimbabwe-esque behavior of the stewards of the American currency has rendered it undeserving of the title "safe haven" asset.

Already in 2020, and in the middle of a severe economic slowdown with nonexistent money velocity to spur demand-pull inflation, an Acapulco cliff dive in purchasing power is forcing the U.S. dollar-denominated price of copper to its highest price since 2013. Interestingly, the first-time copper traded through US$3.50/lb. was in 2006, but that was all demand-pull because China had decided to build out their entire country, which required historic amounts of cement, timber and copper. There is no such excuse in 2020, other than the rejection of U.S. dollars as suitable mediums of exchange.

To all of those new generation thinkers and investors out there, I will gladly apologize for the repetitiveness of the "stories," but I will not apologize for the repetitiveness of the "message." We are entering into a period of time to be earmarked in future history books as "The Great Inflation," the era in which those in control decided to vaporize the purchasing power of fiat currency the world over. Just as it happened in ancient Rome, and 1921–23 Germany, and 1990s Zimbabwe, and Venezuela and Turkey in 2020, citizens having faith in paper money whose worth is determined by "fiat" ("a formal authorization or proposition; a decree") are about to find savings and retirement pools and inheritances vaporized by the self-interested actions of the banco-politico elite. They needed an excuse to set the dominos tumbling, and they got it in the form a global pandemic, and it matters not from whence COVID-19 came, it was the crisis they needed, and they most certainly did not let it go to waste.

So, as the year 2020 drifts out to sea, be it known that the most important phase of the precious metals bull market lies ahead of us. But this time, I think that it won't be a generational debate pitting Telsa against Toyota, or Bitcoin versus gold. As this orchestrated demolition of the global currency system gathers momentum, all citizens, regardless of race, sex, color or age, will come to a sudden realization that owning physical gold and silver is as necessary as house or medical insurance, and rightfully a place in the hierarchy of needs.

I will have the 2021 Forecast Issue ready by New Year's Day, but I am sure you all have the message. The golden bull is back.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold, Megastar Development, Norseman Silver, Aftermath Silver and Goldcliff Resources. My company has a financial relationship with the following companies referred to in this article: Getchell Gold, Megastar Development, Norseman Silver, Aftermath Silver and Goldcliff Resources. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Goldcliff Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, Getchell Gold, Norseman Silver, Megastar Development and Goldcliff Resources, companies mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.